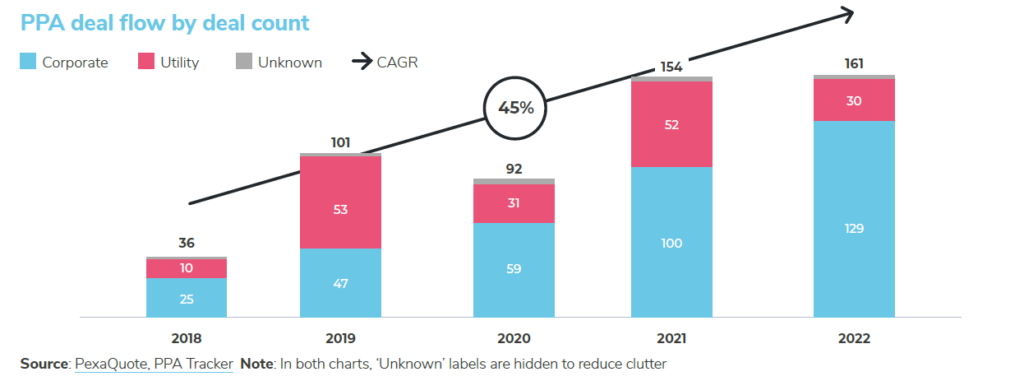

More power purchase agreements (PPA) were signed last year compared to 2021, although contracted PPA volumes dropped by more than 20%, according to the European PPA Market Outlook 2023 conducted by Pexapark.

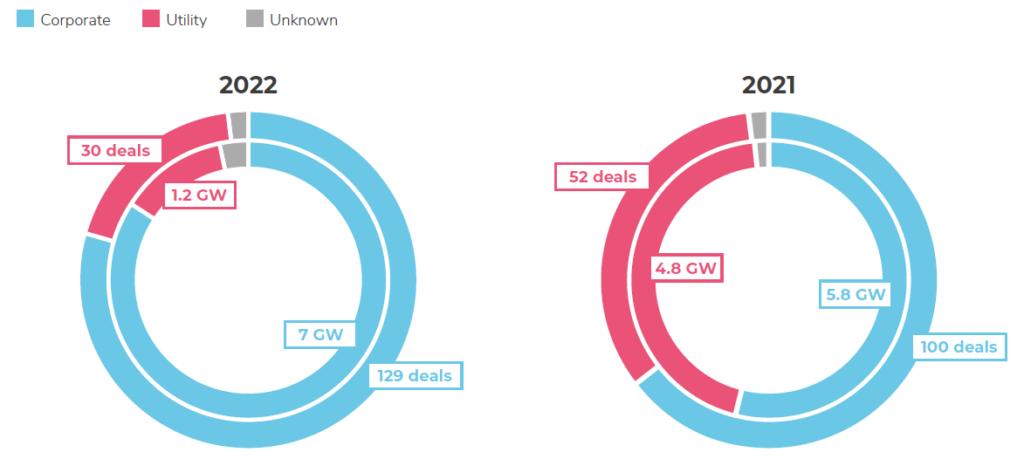

In 2022, the total number of PPA deals in Europe increased by 4.5%, with at least 161 deals compared to 154 the year before. But the disclosed contracted volumes last year were only 8.4GW, a 21% decrease with respect to 10.7GW in 2021.

Unlock unlimited access for 12 whole months of distinctive global analysis

Photovoltaics International is now included.

- Regular insight and analysis of the industry’s biggest developments

- In-depth interviews with the industry’s leading figures

- Unlimited digital access to the PV Tech Power journal catalogue

- Unlimited digital access to the Photovoltaics International journal catalogue

- Access to more than 1,000 technical papers

- Discounts on Solar Media’s portfolio of events, in-person and virtual

Or continue reading this article for free

Corporate PPAs accounted for 80% of the deal count (129 out of 161) and 83% of contracted volumes (7GW out of 8.4GW). Corporate disclosed contracted volumes increased by 20.7% last year to 7GW from 5.8GW in 2021. In terms of deal count, it was up by 29%, with 129 deals after 100 in 2021.

Pexapark believed that hedging against rising and volatile prices were one of the reasons for such corporate PPA activities. Instead of sourcing power for the near future, corporates tended to spread the high front-year costs by signing long-term PPAs.

“By historical standards, market observers would state that a volatile and high pricing environment is not ideal for deal making, but 2022 was different. (As) short-term futures contracts reached punishingly high levels, this meant that many procurement managers had to take the drastic step to safeguard cashflow liquidity and production costs by jumping into long-term contracts,” the company stated.

Spain had the highest volume and number of deals for the fourth year in a row, with more than 3.2GW of disclosed capacity across 31 deals. A total of 1.8GW, equivalent to about 80% of contracted volumes in MW, came from two deals as aluminium company Alcoa was ready to restart its San Ciprián smelter, including a 924MW onshore wind PPA with Greenalia and 906.3MW onshore wind projects with Endesa.

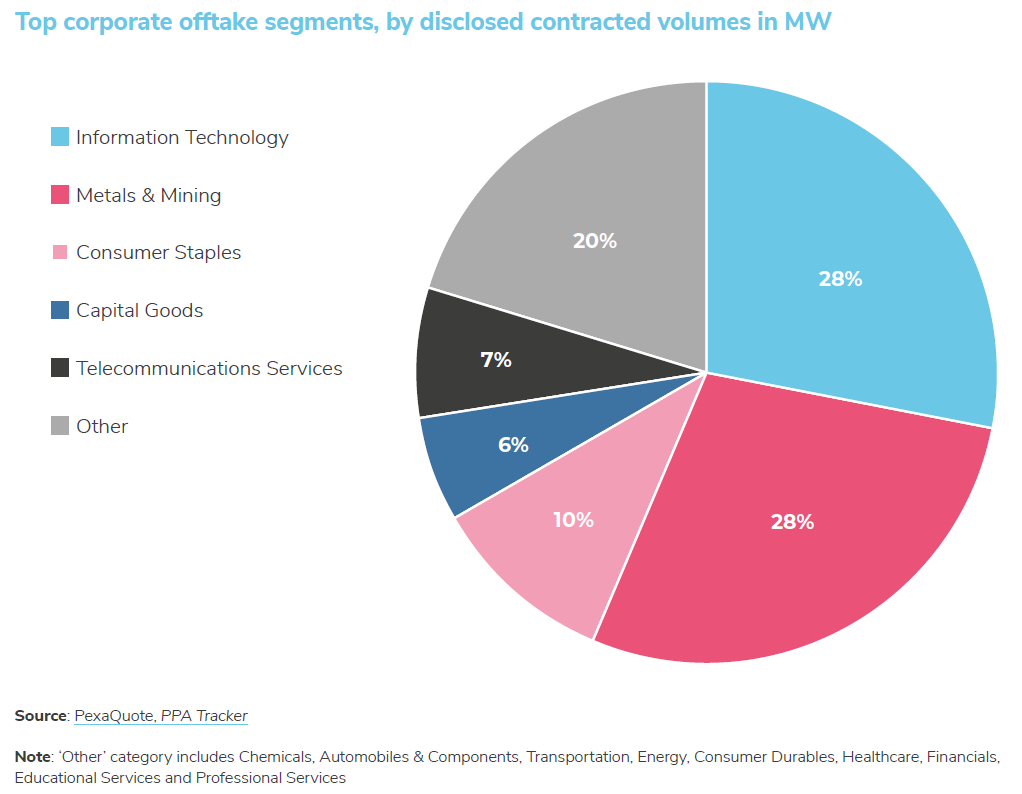

The information technology industry procured the most volumes among other corporate segments, bringing home more than 1.97GW across 14 deals, equivalent to 28% of the total disclosed contracted volumes in MW.

The metals and mining industry came “extremely close” with disclosed contracted volumes of 1.95GW across 19 deals. Notable businesses in this segment included Alcoa, Umicore, Cemex and Salzgitter.

Extreme backwardation also led to price disparity between short- and long-term PPAs. This was the result of contracts for deliveries in the near term that started getting priced significantly higher compared to longer term ones. The phenomenon created a strong interest among power producers to opt for short-term hedges instead of the usually sought long-term PPAs.

“2022 was a year of ‘shock therapy’ for renewables investors. For those who were caught out by the market conditions, and equally for those who weren’t, the turmoil made it necessary to better understand and manage energy risks,” said Maritina Kanellakopoulou, senior insights analyst at Pexapark.

Looking forward, Pexapark offered three top predictions for 2023. First, the popularisation of short-term PPAs would continue with volatility expected to remain above historic levels, while it could take longer than 2023 to rebuild trading liquidity for longer dated products.

Second, project owners, utilities and corporates will join forces to leverage their strengths and competencies. Corporates could take long-term price risk, while utilities and project owners can provide the more sophisticated trading and risk services to guarantee supply.

Lastly, co-location and flexibility will be on the rise. “We see an increasing trend among our clients where they wish to maximise the value they can bring to the system via their grid connection. Having a grid connection which is utilised only 20-30% of the 8,760 hours of the year is encouraging project developers to pursue co-location with other flexible technologies such as storage,” said Brian Knowles, director of storage and flexibility at Pexapark.