In brief: The current global economic slowdown is causing many industries to struggle, including the PC market, which saw shipments fall 28% during the holiday season. AMD felt this effect in its graphics and client PC segments during Q4 last year, but it believes things will improve after the current quarter. Overall, though, 2022 was a record-breaker for Lisa Su's company.

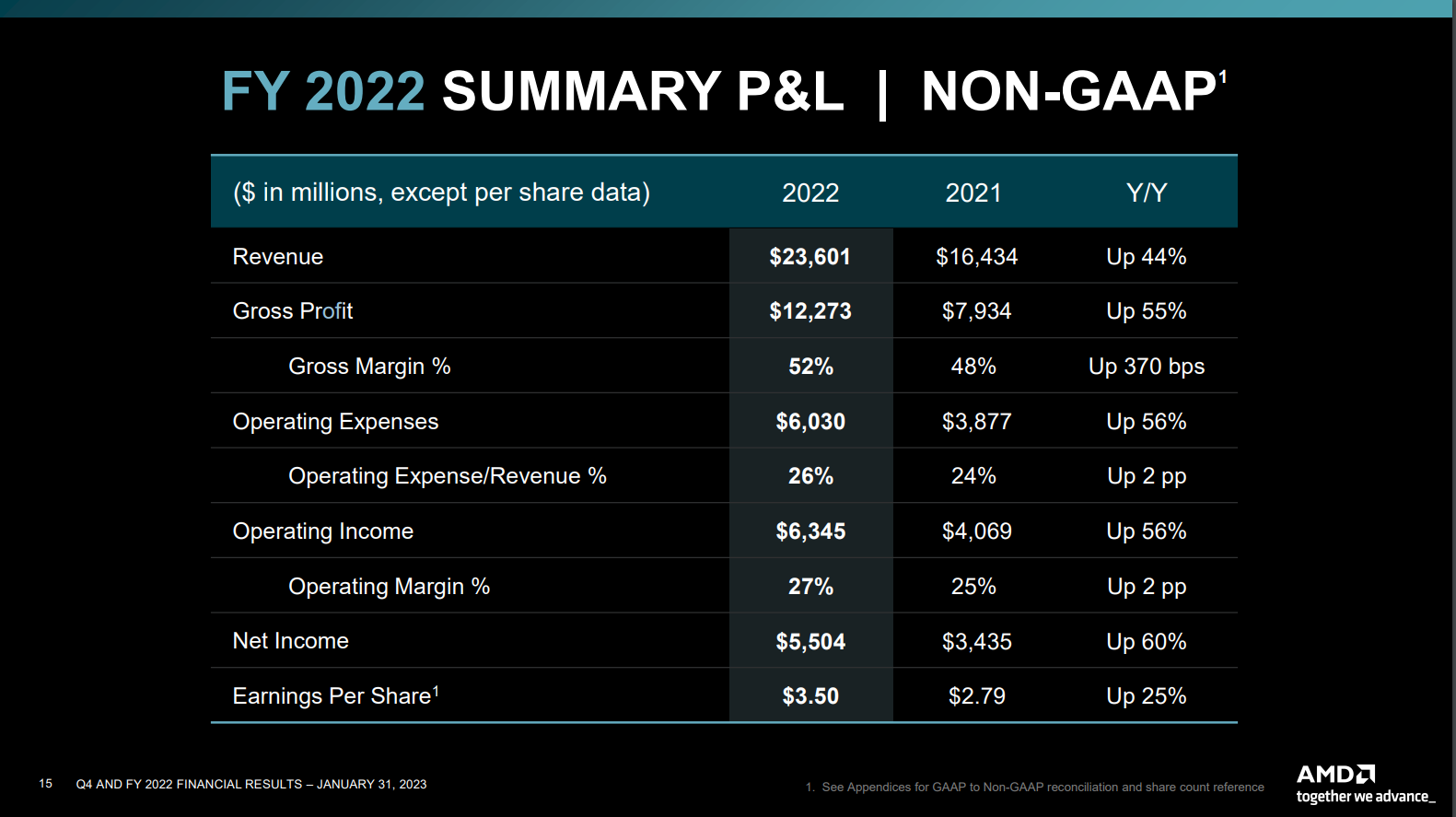

AMD's financial results for the fourth quarter and full year show an all-time revenue high across the whole of 2022 thanks to strong performances in its Data Center (Epyc processors) and Embedded divisions. The company generated $23.601 billion last year, a 44% increase from the $16.434 billion it earned in 2021.

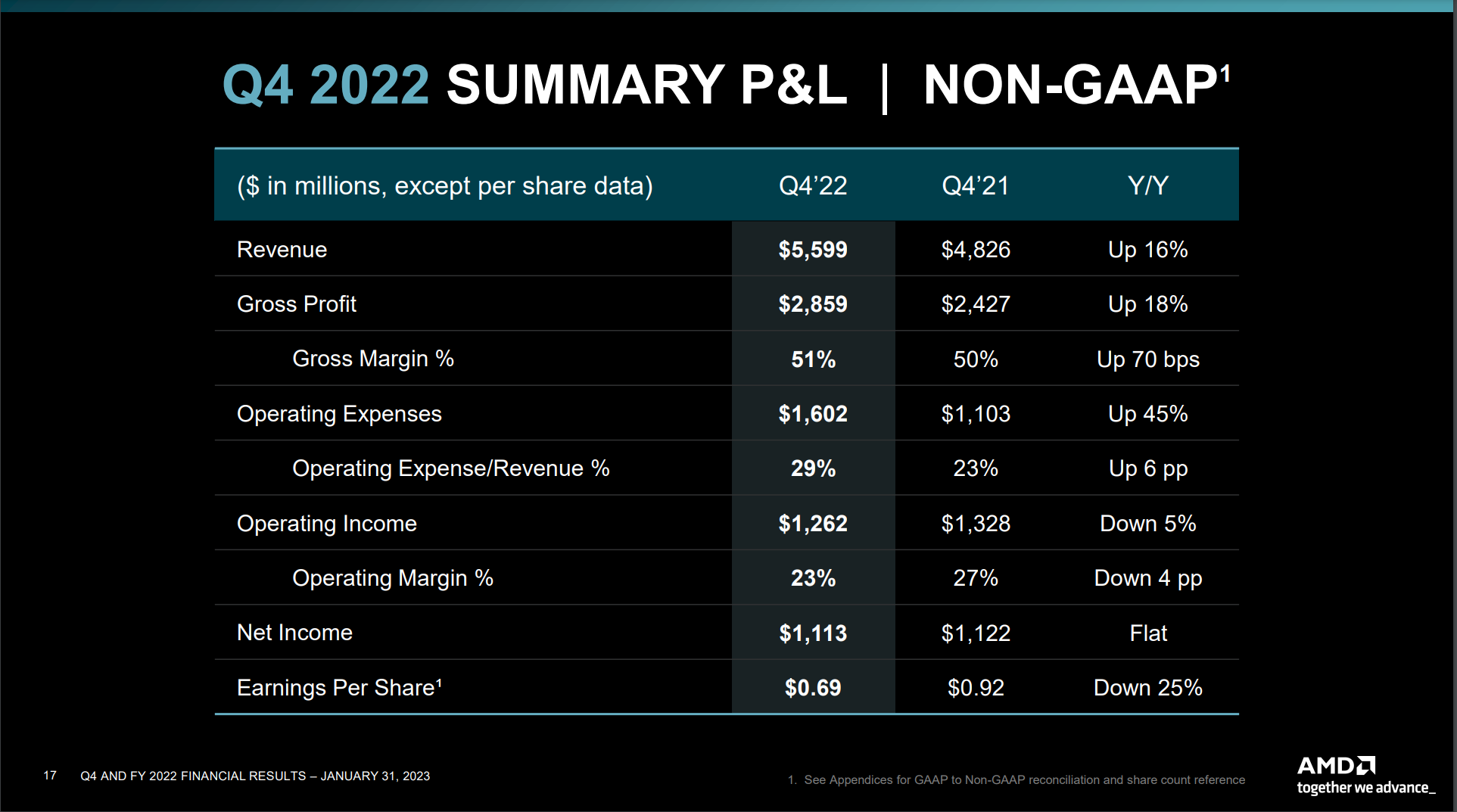

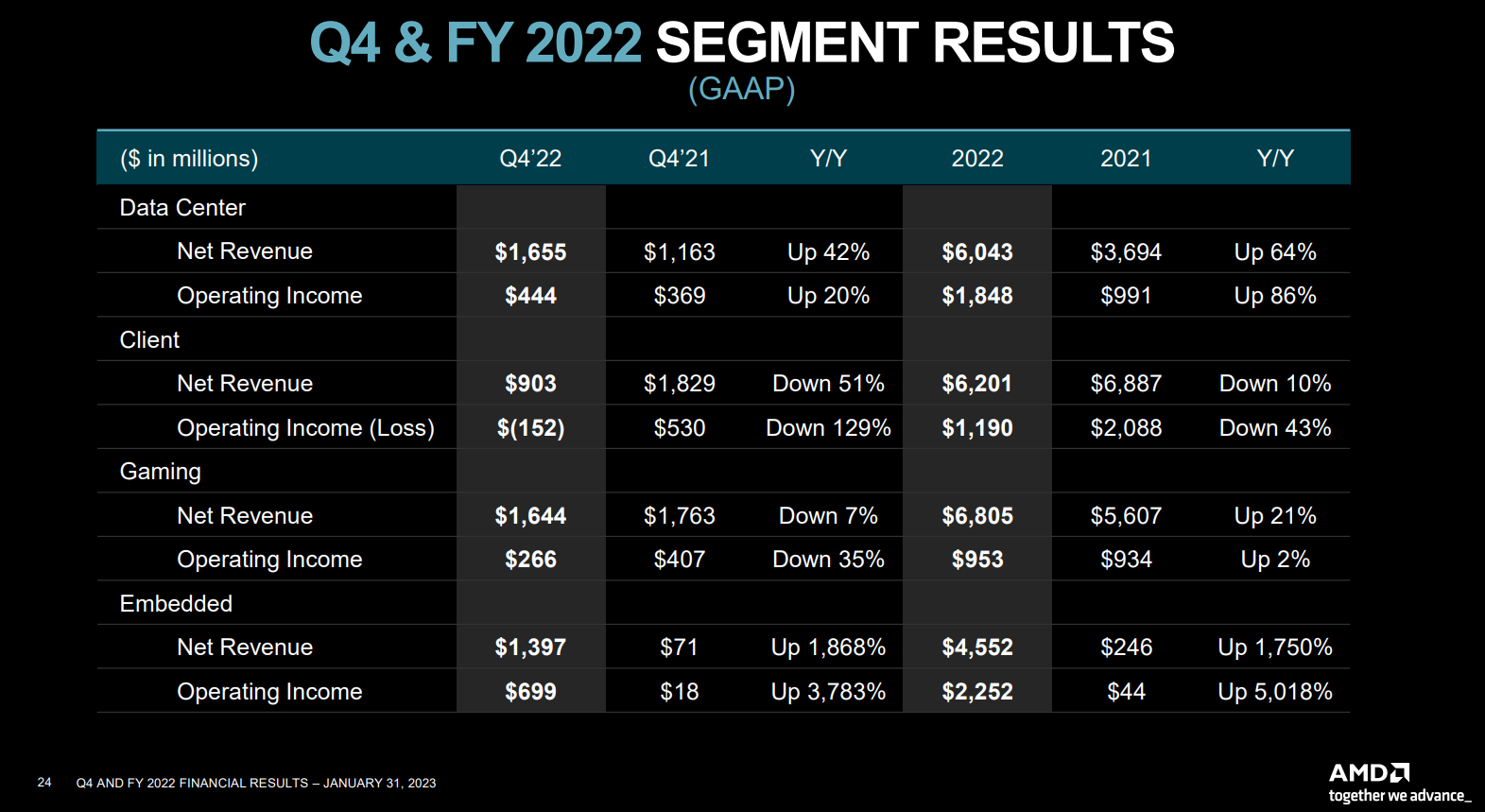

It wasn't such a rosy picture during Q4 2022, though. Revenue was up 16% to $5.6 billion, but net income was down 98% from $974 million in Q4 2021 to $21 million, though AMD says most of that was due to the Xilinx acquisition. Revenue from client processors fell 51%, and gaming GPU revenue was down 7%. AMD made an operating loss in the fourth quarter of $149 million.

"2022 was a strong year for AMD as we delivered best-in-class growth and record revenue despite the weak PC environment in the second half of the year," said AMD CEO Dr. Lisa Su. "We accelerated our data center momentum and closed our strategic acquisition of Xilinx, significantly diversifying our business and strengthening our financial model. Although the demand environment is mixed, we are confident in our ability to gain market share in 2023 and deliver long-term growth based on our differentiated product portfolio."

While AMD's data center segment brought in the most net revenue during Q4, it was the Embedded division that really stood out, especially when it came to operating income; Embedded made up more than half of AMD's total profit during the fourth quarter. It seems the acquisition of Xlinx was a shrewd move on team red's part.

IDC says global shipments of traditional PCs slid to 67.2 million units in the fourth quarter of 2022, down 28.1% versus the same period in 2021, while Gartner says shipments hit their the biggest slump since the mid-1990s. AMD expects revenue of around $5.3 billion during the current quarter (ending March 31), down about 10% YoY, and it believes client and gaming revenue will continue to drop next quarter. However, Su did appear confident that the landscape will improve across the rest of year. "The first quarter should be the bottom for us in PCs," said AMD's boss.