United Way in Montgomery County will again be a Volunteer Income Tax Assistance program site for the 2023 tax season.

In collaboration with United Way of Greater Lafayette, the VITA program will offer free tax preparation and e-filing services to individuals and families with an annual household income at or below $73,000; persons with disabilities; and those who are older than 60 years of age.

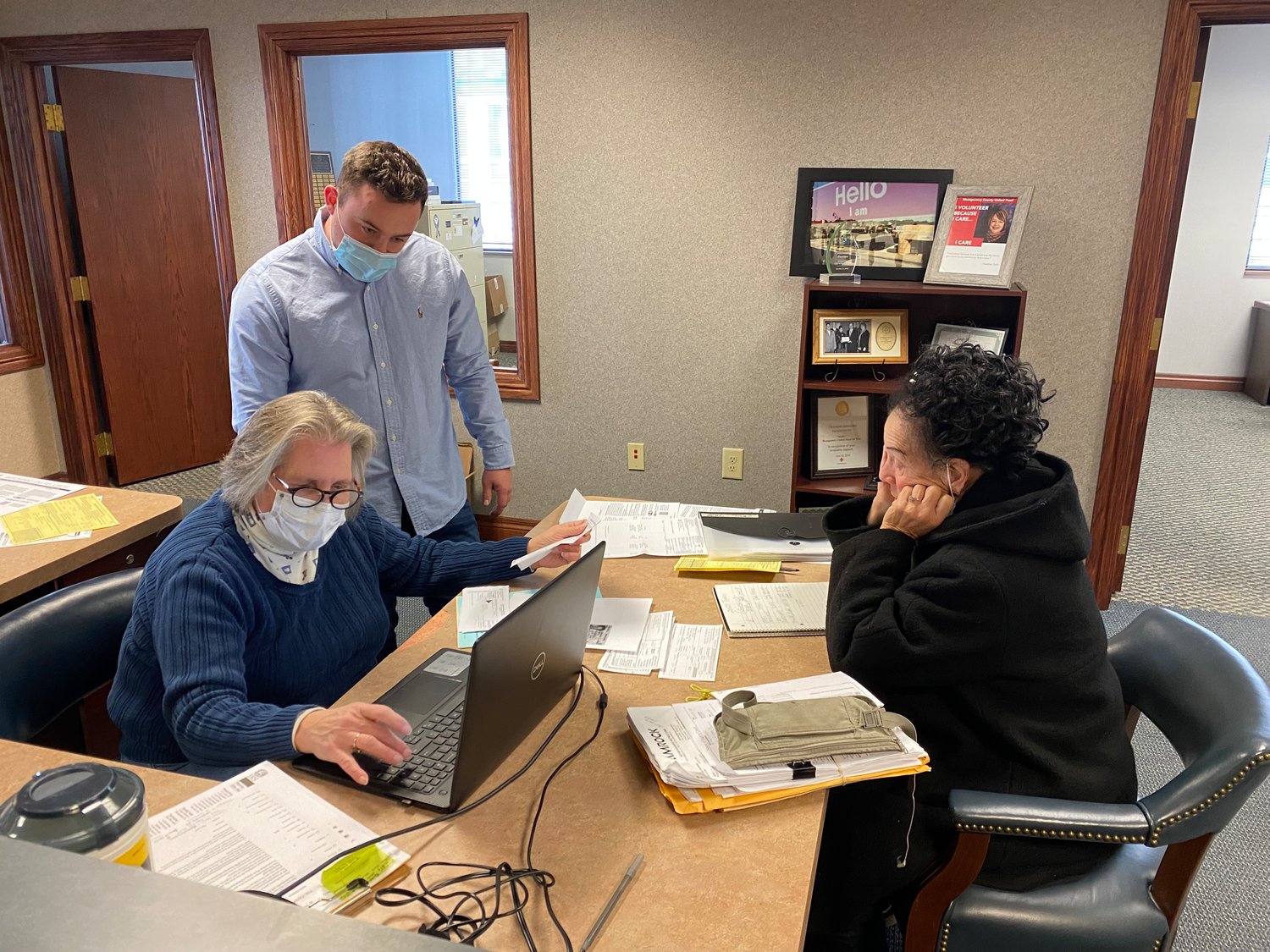

VITA tax preparers are certified by the IRS to ensure that clients receive all eligible Earned Income Tax Credits (EITC) and Child Tax Credits. In addition, clients save money by not having to pay fees associated with tax preparation.

Through the VITA program, United Way will help hard-working individuals and families in our community take advantage of their tax dollars and reinvest their returns back into Montgomery County. Many clients will use their tax refunds to pay bills, add to their savings accounts, purchase homes, and make home or car repairs.

In-person appointments are required and can be scheduled by visiting www.uwmontgomery.org or by calling our appointment line at 765-362-5484. Appointments will take place at the United Way in Montgomery County office at 221 E. Main St. on the second floor of the First Financial Bank. Site hours are 9 a.m. to 1 p.m. Monday, Wednesday and Friday from and noon to 4 p.m. Tuesday. Limited Saturday appointments are available 9 a.m. to noon Feb. 18, March 11 and April 1.

Volunteers are vital to maximize the number of clients that can be served. No tax or accounting experience required. If you are interested in assisting with the United Way in Montgomery County VITA site, contact Gina Haile at 765-362-5484 or gina@uwmontgomery.org.