Thanks to a months-long shakeout, the crypto market experienced one of the most drastic drawdowns in its history in 2022. But questions are arising about when (if?) major cryptocurrencies will recover.

The global crypto market capitalization, which makes up the total value of all crypto assets (including stablecoins and tokens), has fallen roughly 64% from $2.2 trillion to about $797 billion year to date, according to CoinMarketCap data. The two largest cryptocurrencies by market cap, bitcoin and ether, have fallen 64% and 67%, respectively, during the same time frame.

With a loss of more than half their value, one could argue that these cryptocurrencies can’t recover. But when you zoom out and look at the overall picture, things aren’t that bad for bitcoin and ether, despite what transpired this year.

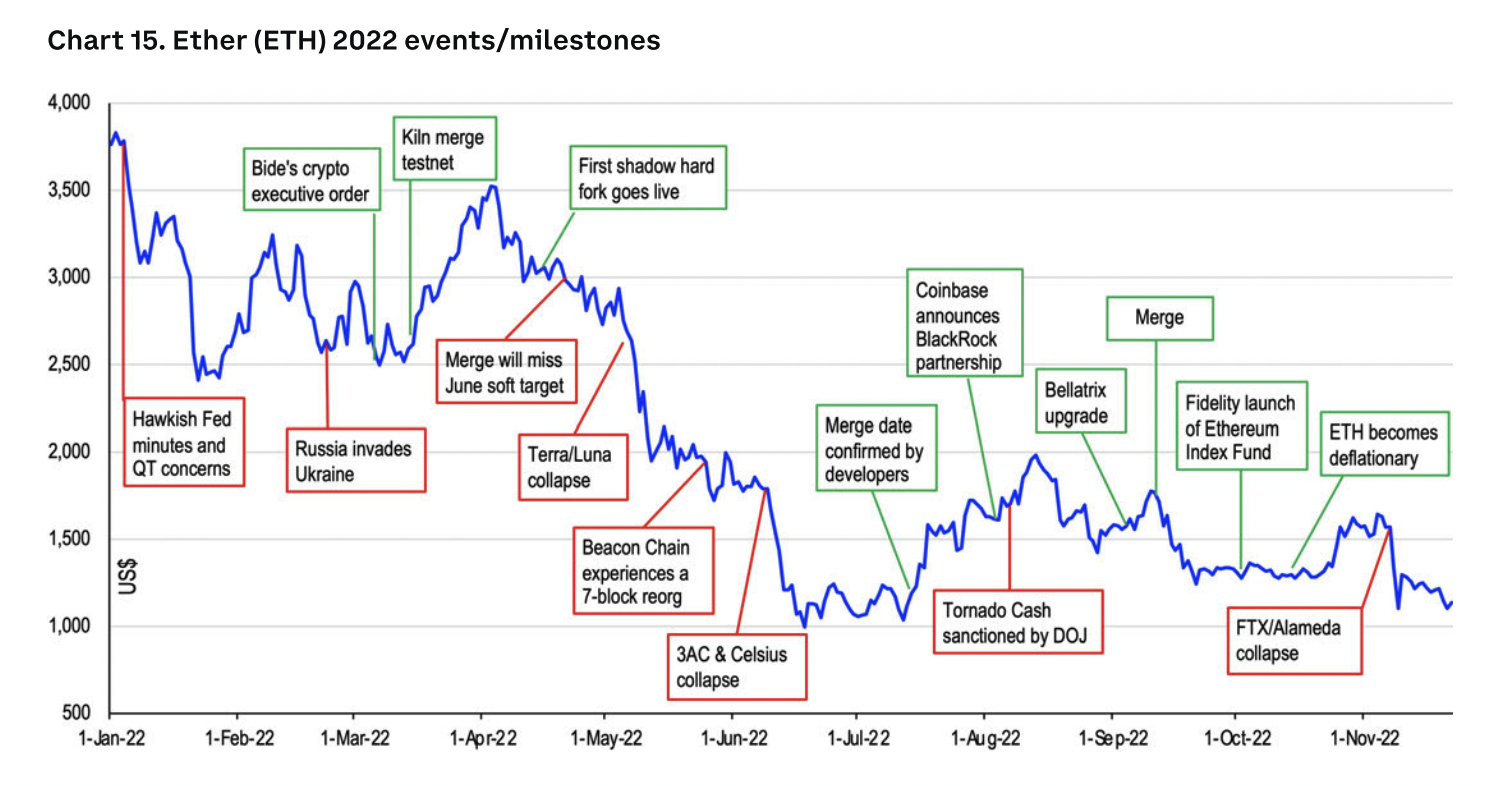

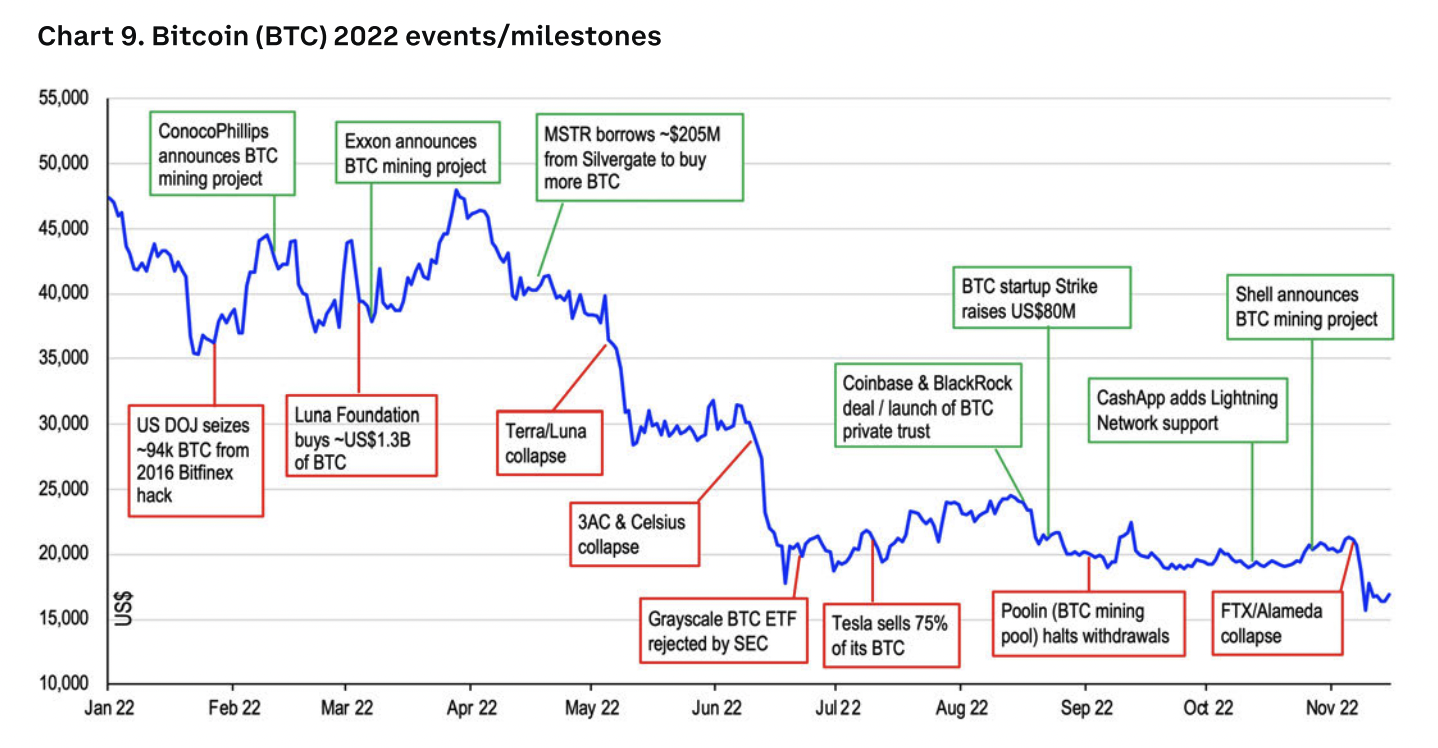

Let’s look at how significant crypto and global events from this year affected the two biggest cryptocurrencies.

Image Credits: Coinbase (opens in a new window)

When the Terra/LUNA ecosystem collapsed in early May, within about six weeks, over a billion dollars of the total crypto market cap was wiped out, dropping from about $1.8 trillion to about $820 billion, data shows. Comparing against the largest cryptocurrencies again, bitcoin and ether both fell over 50% in that period.

Just focusing on that event, the decline looks (and, fair enough, was) brutal.

Yet, since that big drop, both bitcoin and ether have held in the same range, even after FTX, one of the largest crypto exchanges, collapsed last month and filed for Chapter 11 bankruptcy.

“Within crypto, we expect digital asset selection will transition towards higher-quality names like bitcoin and ether based on factors like sustainable tokenomics, the maturity of respective ecosystems, and relative market liquidity,” Coinbase’s 2023 Crypto Market Outlook report stated.

When you combine crypto’s bigger drop earlier this year with the global macroeconomic reset, it begins to paint a picture of resilience for the two largest tokens in the digital asset space.

“Bitcoin’s resilience amid major stress suggests its long-term success is not dependent on any centralized entity either pumping or dumping it,” Coinbase researchers said in the report. The value proposition for bitcoin has “only strengthened this year,” too, as sovereign currencies globally have shown signs of stress and central banks continue to struggle with policy credibility, they added.

“For as long as a Bitcoin 100-week moving average could be calculated, the crypto has never been at a deeper discount than at the end of November,” Mike McGlone, senior macro strategist at Bloomberg Intelligence, said in a “2023 Cryptos Outlook” report. “The collapse of FTX and other crypto firms is a good reason, but it’s from similar ashes that bull markets typically emerge.”

This is not implying that all cryptocurrencies will maintain similar, if any, support. Take Solana, for example, which is down a whopping 94% year to date and hit single-digit prices for the first time in almost two years earlier this week.

Ever since FTX’s demise, Solana has been spiraling for a number of reasons, including top NFT projects leaving its blockchain and one of its most prominent backers being the now-disgraced former FTX CEO Sam Bankman-Fried. Solely looking at numbers, Solana’s future appears uncertain — it dropped from being the fifth-largest cryptocurrency in early November to 18th place as of today, according to CoinMarketCap data.

Amid the chaos, though, Solana co-founders see this downturn as an opportunity for their team to continue building and ignore the market madness.

“It’s just a time of immense fear, but there’s immense opportunity,” Raj Gokal, co-founder of Solana, said to TechCrunch earlier this month. “There’s a lot of signal and a lot of noise.”

The baseline focus for Solana-centric developers and users is to “look at the hard times as a great opportunity to just jump in, in a contrarian way, and build for that next market cycle,” Gokal said at the time.

The bear market can provide additional pressure on cryptocurrency markets and break current support levels for bitcoin and ether, but some industry analysts view these breaks as extreme discounts and opportunities.

“Bitcoin may drop to what would be a substantial discount around $10,000, but within the elongated upward trajectory could revisit $40,000 resistance,” McGlone stated earlier this month.

As for the second-largest cryptocurrency, Ethereum may have a bullish scenario amid slumping global markets and outperform both bitcoin and equities, McGlone added. “Plenty can go wrong with new technology, but we see maturation with an enduring downward slope in incremental supply that — if the rules of economics apply — are positive for the No. 2 crypto.”

The most significant concern for crypto players is an obvious one: Perhaps the market won’t jump back up next year. But believers and some market analysts think it will.