Meta Platforms (NASDAQ: META) and Netflix (NASDAQ: NFLX) are two FAANG stocks that seem so different. Meta’s a social-media company, while Netflix is a video streamer that’s in the business of binge-worthy video content. Over the next few years, these two unlikely competitors could clash in the realm of ads as both firms gear up to go above and beyond their original areas of expertise. Let’s use TipRanks’ Comparison Tool to evaluate these two evolving FAANG plays to see which is the better bet for investors.

Meta and Netflix Stocks Aren’t So Different

Meta is setting its sights on the metaverse while continuing to embrace video-based forms of social media with Reels. Meanwhile, Netflix quietly rolled out its social-media-like “Fast Laughs” clips feature. Indeed, Meta is inching into video, while Netflix has shown it’s open to embedding social-media aspects in its app. Such moves suggest Meta and Netflix are poised to become more similar in time as they look to outgrow their original businesses.

Looking into the distant future, the similarities between the two firms could grow further.

Meta seeks to be a leader in the metaverse (virtual-reality world). Undoubtedly, virtual reality is a hot topic when it comes to gaming. That’s a major reason why Meta placed a big bet on game platform Crayta, which could help Meta pick its game up (pardon the pun!).

Netflix has also embraced video gaming by adding a wide roster of mobile games for free to its subscribers. Reportedly, the company is also seeking to make its own game studio. Netflix CEO Reed Hastings is not playing games (again, sorry for the pun) when it comes to Netflix’s video-game expansion.

Meta Platforms (META)

Meta is ready to go all-in on its metaverse efforts. While it may seem like Meta is 10 or 15 years early to the party, I do think Meta’s new vision and deep pockets could bring the mainstream metaverse closer than many expect. Indeed, dipping a toe into the metaverse waters would be prudent but would limit a firm’s ability to become a force to be reckoned with.

Right or wrong, Meta is swinging for the fences. With high reward potential comes elevated risk. Regardless, I think CEO Mark Zuckerberg is smart to reinvest his ample cash flows into futuristic initiatives rather than just seeking to return capital to shareholders in the form of a dividend, as social-media apps face slowed growth.

The main social-media feature for Meta over the near-term future lies in Reels. Thus far, Meta has done a sound job of replicating the success of TikTok. With such an extensive network, Meta can easily showcase the hottest new social-media features to its users.

It’s this network alone that makes Meta a more durable social-media company that many give it credit for. Further, the firm has a moat surrounding its older, Baby Boomer user base, who are less likely to be tempted by the hottest new trends and platforms in the social space!

Apart from Reels, Meta really needs to continue investing in its gaming capabilities. Indeed, it will be tough to be a metaverse frontrunner without a few gaming studios in the books. Perhaps it’s time that Meta went on a gaming acquisition spree or followed in the footsteps of Netflix by creating a game studio for itself.

What is the Price Target for Meta Stock?

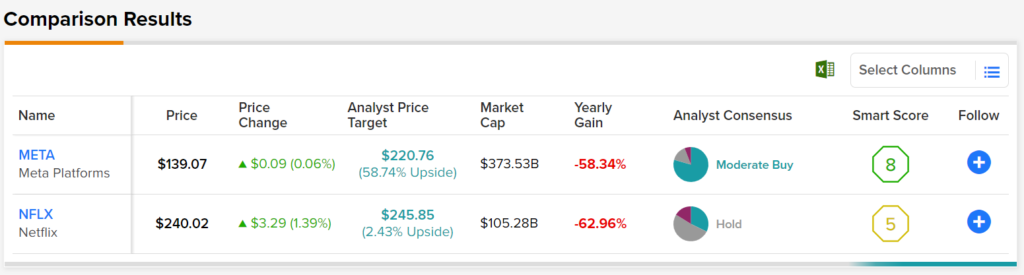

Wall Street loves Meta, with a “Moderate Buy” consensus rating based on 27 Buys, five Holds, and two Sells assigned in the past three months. The average META stock price target is $220.76, which suggests 58.7% upside over the year ahead. That’s a solid gain for the misunderstood stock.

Netflix (NFLX)

Netflix’s gaming ambitions are clear, but skeptical analysts will note that the firm is a tad late to the party. Arguably, Meta is also late to the gaming party versus other FAANG companies. In any case, Netflix is looking to make up for lost time, as it looks to offer more entertainment options for subscribers while embracing ads to make its services available to more consumers.

In prior pieces, I noted that very few Netflix subscribers were playing the games. As Netflix continues investing in high-quality titles, I think it’s just a matter of time before Netflix becomes as much of a gaming company as it is a video streamer.

With a cheaper ad-based tier, Netflix is essentially allowing budget-conscious consumers to get more for less. Recently, Netflix was hit was a slew of upgrades over the ad-based model.

I think such upgrades are warranted. Netflix is a premium entertainment service that could cut into the ad businesses of other low-cost (or free) forms of entertainment like social media.

What is the Prediction for Netflix Stock?

Wall Street is muted on Netflix, with a “Hold” rating based on 10 Buys, 16 Holds, and five Sells assigned in the past three months. The average NFLX stock price target of $245.85 implies a meager 2.4% return. Indeed, there’s a lot of uncertainty as Netflix pulls the curtain on an ad-based tier while it continues making a deeper dive into gaming.

Conclusion: Wall Street Expects More from META Stock

Netflix and Meta are entertainment companies that will be fighting for limited consumer engagement. As both firms pursue gaming, while Netflix enters the ad business, look for both companies to duke it out. At this juncture, Wall Street favors Meta over Netflix. I’m inclined to agree. Meta’s a far cheaper bet here.