CryptoSlate Wrapped Daily: South Korean authorities fail to follow through on Do Kwon aide’s arrest; EU puts more crypto sanctions on Russia

CryptoSlate Wrapped Daily: South Korean authorities fail to follow through on Do Kwon aide’s arrest; EU puts more crypto sanctions on Russia CryptoSlate Wrapped Daily: South Korean authorities fail to follow through on Do Kwon aide’s arrest; EU puts more crypto sanctions on Russia

Michael Saylor gave 0.03 BTC away through the Lightning Network, Ethereum active users increased by 36% last quarter, and much more in this edition of CryptoSlate Wrapped Daily.

Cover art/illustration via CryptoSlate. Image includes combined content which may include AI-generated content.

The biggest news in the cryptosphere for Oct.6 includes the arrest and release of Do Kwon’s aide, the EU’s crypto sanctions on Russia, and 0.03 Bitcoin distributed to three winners by Michael Saylor through the Lightning Network.

CryptoSlate Top Stories

South Korea tightens circle on Do Kwon, arrests his aide

Terraform Labs founder Do Kwon’s aide Yoo Mo became the first person to be arrested in the ongoing Terra-Luna investigation. Mo was the Head of General Affairs at Terraform Labs and got arrested on Oct. 6, one day after South Korean authorities released an arrest warrant on Oct. 5.

In the meantime, South Korea issued a separate warrant requesting Kwon to hand in his passport within 14 days. If he fails to do so, his passport will be invalidated by the authorities.

South Korean court dismisses arrest warrant for Do Kwon’s aide

Nearly 12 hours after Mo’s arrest, local news sources reported that a South Korean District Court has denied the arrest warrant against Mo. The initial arrest warrant wanted Mo handcuffed for violating the Capital Market Act.

However, the deciding Judge Jin-Pyo argued that LUNA hadn’t been classified as a security, which meant that Mo may not have violated the Capital Market Act.

EU narrows Russia’s options further with crypto sanctions

The European Union (EU) announced a new set of sanctions that banned all crypto asset wallets, accounts, or custody services belonging to Russian users.

Previous sanctions allowed the above services to operate if they held funds lower than €10,000.

Saylor gives away BTC via lightning network

Michael Saylor sent 0.03 Bitcoin (BTC)in sats to three winners of his Lightning meme contest using Lightning Network.

The correct answer is Yes, and I will make three more transactions of 1,000,000 sats each to the 3 posters of the most liked #Lightning⚡️ memes in the comments below. https://t.co/qXZ90q4Ly9

— Michael Saylor⚡️ (@saylor) October 4, 2022

The contest ended on Oct. 5, and Twitter users ShireHODL, NEEDcreations, and publordhodl received 1 billion sats each.

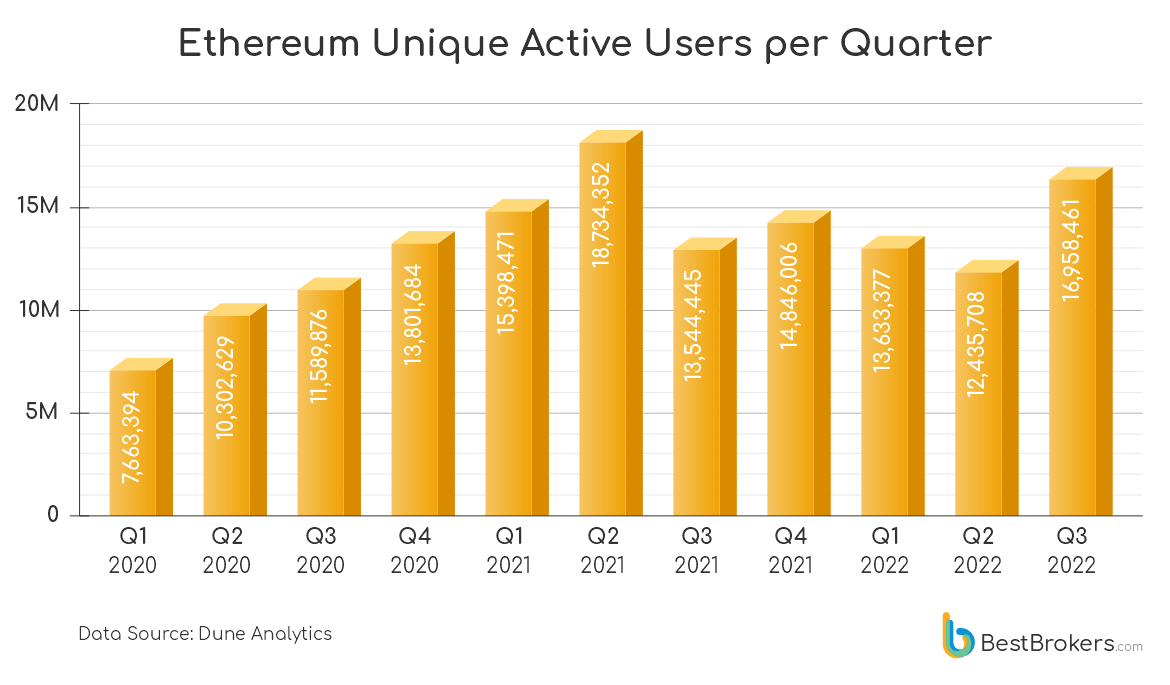

Number of active Ethereum users increased 36% in Q3 despite bear market

Ethereum (ETH) gained more than 4.5 million new active users during the third quarter of 2022, as the data from Dune Analytics indicates. This increase equates to a 36% growth in the active user base.

Ethereum active users have recorded a steady decrease since the fourth quarter of 2022. Some analysts claimed that his sudden increase could signify that the crypto market is returning to its positive trend.

Decentraland has just 30 daily active users despite billion dollar market cap – DappRadar data

According to data from DappRadar, Decentraland only has 30 daily active users despite its $1.2 billion valuation.

Decentraland’s native token MANA has a daily volume of $121 million with a market cap of $1.31 billion.

Ripple slams SEC for opposing amicus briefs, XRP up 3.6%

The Securities and Exchange Commission (SEC) got publicly criticized by Ripple over its opposing standing to the amicus briefs filed by I-Remit and TapJets. The “slam” was publicized on Twitter by the defense lawyer James Filan.

Following this, Ripple’s native token XRP recorded an increase of 3.6% over the last 24 hours.

Marathon Digital invested over $30 million in bankrupt Compute North

Bitcoin mining company Marathon Digital revealed its investments. The firm said it invested $10 million in convertible preferred stock and another $21.3 million in unsecured senior promissory notes in Compute North.

The announcement also disclosed that Marathon held 10,670 Bitcoins, which roughly equates to $207.3 million at the current prices.

Tuttle Capital files Inverse ETFs to trade against Jim Cramer’s recommendations

Tuttle Capital filed two ETFs to invest at the opposite position of any stocks recommended by the Mad Money host Jim Cramer.

Jim Cramer is known for his contradicting investment strategy, which often proved him wrong in crypto. The most recent example came in July when Cramer said he was selling all his Bitcoin after the market cap fell below $1 trillion. He said Bitcoin had no real value. Bitcoin responded to that by spiking fast and gaining 17% at the end of the month.

Despite Tornado Cash fiasco, Bitcoin SV launches ‘Blacklist Manager’ tool

Bitcoin SV (BSV) launched a new tool called “Blacklist Manager” that enables miners to freeze tokens.

Even though the topic of sanctions is hot after the OFAC’s ban on Tornado Cash, Bitcoin SV claims that Blacklish Manager can be used to freeze lost or stolen tokens or to “comply with court orders.”

Calls mount for Louisiana state to buy Bitcoin following BlackRock divestment

Louisiana State announced pulling around $794 million from BlackRock in relation to Environmental, Social, and Governance (ESG) principles. Upon the announcement, Bitcoin maximalists called for the State Treasury to buy Bitcoin.

Prominent names joined the pressure as well. A leader at the Canadian Association of Community Health Centres, Scott A. Wolfe, tweeted his support and said:

“Put 1-5% of that in Bitcoin, for the people of Louisiana and future generations!“

SEC staff reportedly unhappy with Gensler over Kim Kardashian’ publicity stunt’

SEC’s enforcement staff are reportedly uncomfortable with the media attention Chairman Gary Gensler attracted with the fining of Kim Kardashian.

SEC staff said Gensler violated protocol with his “publicity stunt” regarding the situation.

Research Highlight

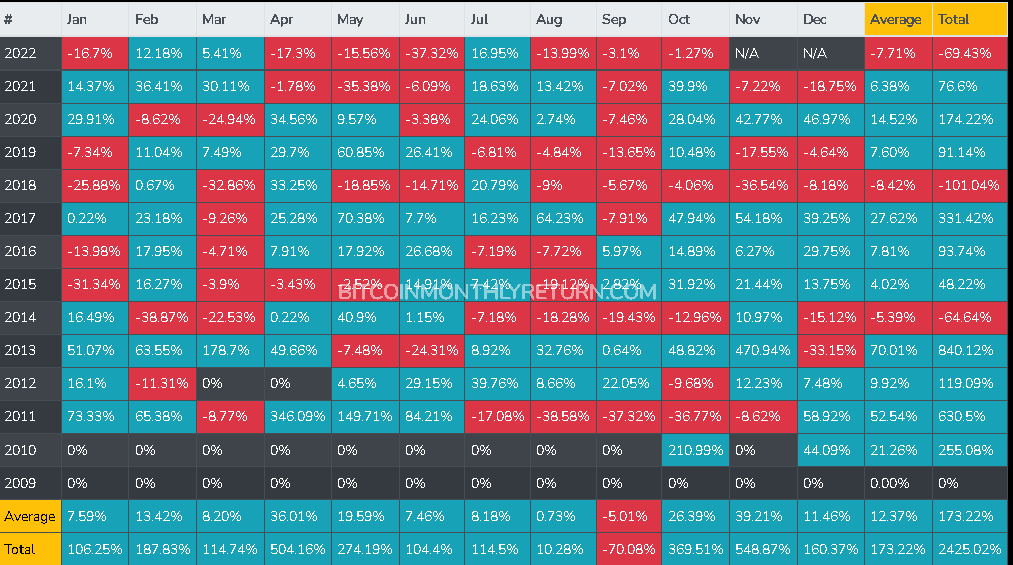

Research: After September bloodbath, historically bullish Q4 could ease the pain

Crypto history showed that September bloodbaths are a recurring theme for the crypto markets and are followed by a haling spike during the fourth quarter.

September 2022 was particularly bloody for Bitcoin. For the first time since 2016, it failed to close the month in the green.

October, however, has been showing signs that history could repeat itself and follow the bloody September with a positive uptrend in the crypto markets throughout the fourth quarter.

Bitcoin’s monthly average for October closes at 26.39%, which marks the second-best month in Bitcoin’s history.

News from around the Cryptoverse

South Korean watchdog reiterates support for crypto protections

The Chairman of South Korea’s Financial Services Commission (FSC) spoke publicly on Oct. 6 to reiterate the institution’s support for blockchain technology and user protections, according to Yahoo Finance.

Crypto Market

Bitcoin (BTC) recorded a decrease of 0.59 % to fall to $20,035 in the last 24 hours, while Ethereum (ETH) spiked by 0.56% to be traded at $1,358.

Biggest Gainers (24h)

- Casper (CSPR): + 18.24%

- Ravencoin (RVN): +4.86%

- Trust Wallet Token (TWT): +4.51%

Biggest Losers (24h)

- Helium (HNT): -9.32%

- Bitcoin Cash (BCH): -2.77%

- Chainlink (LINK): -2.41%