Grainger Plc (GB:GRI) is a leading rental housing company in the UK with a huge portfolio of private rental homes – and there’s several signs it could be a good bet for the longer term.

The company recently reported strong rental market conditions for the second half of 2022.

It also stated that occupancy levels remain over 98%, and it expects solid financial results ahead. Grainger aims to double in size in coming years and is well-supported by its business model, balance sheet, and secured pipeline of rental homes.

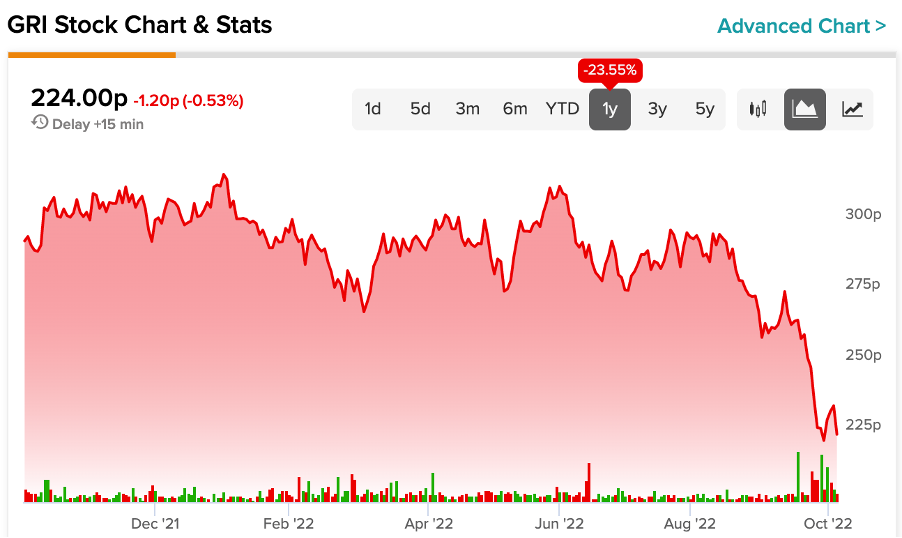

Grainger’s stock has gone through a lot of ups and downs in the last year and has been trading down by 23.5%. However, the company’s fundamentals are solid, and this will generally reflect in future share price movements.

Moreover, the current downfall creates a more attractive buying opportunity for the long term.

The upside

Last month, Grainger announced its trading update before its annual results due in November 2022. The company enjoyed a strong rental performance and posted total like-for-like rental growth of 4.5% during the first 11 months of the year.

Due to favourable rental market conditions, the company’s occupancy remained at a record high of 98%. The shortage of available rented homes in the UK is likely to continue in the future, which will lead to robust top-line growth for the company.

The company’s pipeline of another 10,000 purpose-built rental homes will further drive the rental income in the next financial year. Its pipeline is also fully secured, which makes it more confident in its outlook.

Chief Executive Helen Gordon commented, “Despite the buoyant rental market, we are very mindful of the financial challenges facing many individuals. We are therefore taking a responsible approach to rental increases, ensuring affordability for our customers remains a central consideration and balancing rent increases with retention.”

Does Grainger pay a dividend?

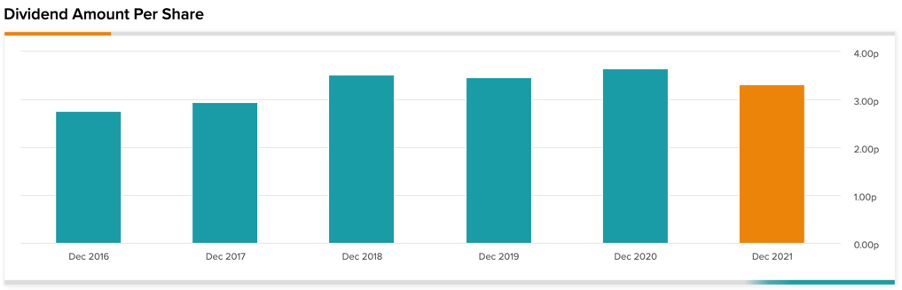

The company has been a consistent dividend payer for more than 10 years now. It has a policy of distributing 50% of net rental income as dividends divided between interim and final.

Grainger’s dividend yield of 2.3% is in sync with industry standards, and it remains committed to sharing profits with its shareholders.

In its half-yearly results announced in May 2022, the company announced an interim dividend of 2.08p per share. This was 14% higher than the last year’s interim dividend of 1.83p.

Grainger share price forecast

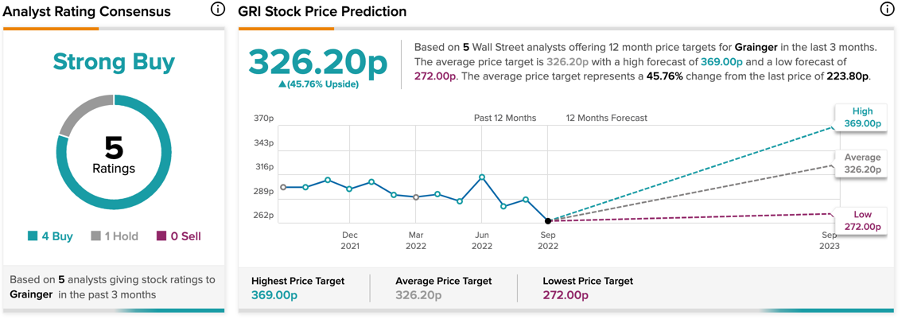

TipRanks rates Grainger stock as a Strong Buy, with four Buy and one Hold recommendations.

The GRI price target is 326.2p, which represents a 45.7% upside to the current price level.

Conclusion

Overall, the company has a lot of positive features. It is investing heavily in its business and is in a strong position to benefit from the UK private rental market.

Hopefully, it is just a matter of time until the share prices move in tandem with the earnings.