SOUTH JERSEY (KYW Newsradio) — Three men have been charged with market manipulation in a bizarre stock scheme involving a small deli in Paulsboro, New Jersey.

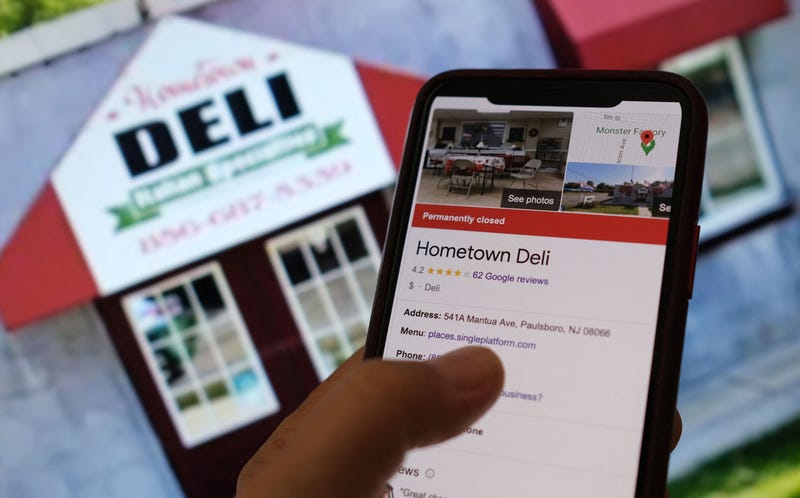

The now-closed delicatessen, called Your Hometown Deli, had less than $40,000 in sales when it was being valued as a corporation worth up to $100 million due to share manipulation.

Authorities say it was acquired by the trio so they could form an umbrella company and then coordinate stock trades to create a false impression of supply and demand, setting themselves up for huge stock profits.

The plan began with the formation of Hometown International in 2014, with the goal of creating a reverse merger — a transaction in which an existing public company merges with a private operating one, allowing them to sell shares at a high amount.

This, however, was unbeknownst to the local deli owners, who partnered with one of the defendants to open the store the same year.

State prosecutors say the defendants’ scheme inflated Hometown International’s stock by 939%. The defendants also had another company called E-Waste Corp., which was inflated by 19,900%.

According to the U.S. Attorney’s Office of New Jersey, 63-year-old James Patten and 80-year-old Peter Coker Sr., both from North Carolina, have been arrested. The latter’s son, 53-year-old Peter Coker Jr., remains at large in Hong Kong.

All three face significant jail time if convicted of securities fraud and related charges. Just the counts of securities fraud and manipulation of securities prices each carry a maximum sentence of 20 years and a $5 million fine.

The SEC announced its own separate charges against the trio.