Are You Eligible For Inflation Relief Payments?

Commitment to Our Readers

GOBankingRates' editorial team is committed to bringing you unbiased reviews and information. We use data-driven methodologies to evaluate financial products and services - our reviews and ratings are not influenced by advertisers. You can read more about our editorial guidelines and our products and services review methodology.

20 Years

Helping You Live Richer

Reviewed

by Experts

Trusted by

Millions of Readers

This year has been difficult financially for many Americans, with the cost of gas, groceries and just about everything else rising amid inflation. If you’ve felt the pinch in 2022, you probably also have dreamed of tapping your bank’s app on your phone and seeing your balance increase by a few hundred dollars, unexpectedly.

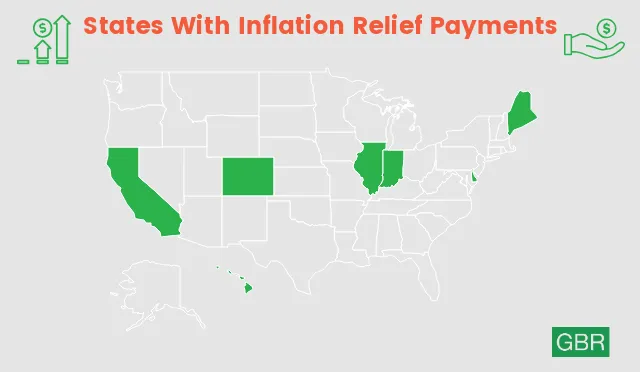

But if you live in one of 16 states, that actually could — or already did — happen to you this year. Certain states are giving inflation-relief payments to those who meet specific criteria, and the best part of it is you don’t have to do anything outside the ordinary to get this free money. It will just appear, either as a direct deposit or as a paper check in your mailbox. How do you know if your state is on the list to send out money this month and through the end of the year? Read on for an update about free money.

California

Californians will receive financial relief through the Middle Class Tax Refund program. This is a one-time payment of up to $1,050, depending on your income and family situation. According to the state Franchise Tax Board, your eligibility is determined by whether you:

- Filed your 2020 tax return by Oct. 15, 2021

- Met the California adjusted gross income limits specified by the state

- Weren’t eligible to be claimed by someone else in the 2020 tax year

- Lived in California for six months or more in 2020

- Live in California when payment is issued

If you are eligible for a payment, you will receive it between October and January. Visit the Franchise Tax Board website to estimate how much you might receive.

Colorado

The state has started sending out checks through the Colorado Cash Back Bill, giving taxpayers $750 for individual filers and $1,500 for joint filers. Colorado Cash Back is a one-time refund of state revenue from the state fiscal year 2021-22.

To be eligible, taxpayers must:

- Have been at least 18 on or before Dec. 31, 2021

- Lived in the state for all of 2021

- Filed a state income tax return for the 2021 income tax year or applied for a Property Tax/Rent/Heat Credit (PTC) Rebate

As long as you filed your state tax return by June 30, you should have your check by Sept. 30. If you file by the October 2022 extended deadline, you should receive your payment by Jan. 31, 2023.

Delaware

The 2022 Delaware Relief Rebate Program provides a one-time direct payment of $300 per adult (18 and over) in the state, giving them help coping with higher gas and food prices.

To be eligible, residents must have filed their 2021 state personal tax refund by the due date. Checks are being mailed out throughout the summer.

Hawaii

Under the state’s Act 115, Hawaii is continuing to issue checks of $100 to $300 per person, based on filing status and income. Amount to be paid is based on information from 2021 tax returns.

Illinois

The state is expected to begin issuing tax rebates the week of Sept. 12. Individuals who earned less than $200,000 last year will receive a $50 rebate; couples filing jointly will receive $100 if they earned less than $400,000.

Indiana

The Hoosier State is in the process of distributing checks to residents under its automatic taxpayer refund law. In all, taxpayers with an individual filing status will receive $325, double that for couples filing jointly. The printing and mailing of checks is expected to continue through early October.

Maine

An estimated 858,000 Maine residents will receive $850 relief checks each, or $1,700 for a married couple filing jointly. To be eligible, full-year Maine residents must file 2021 income tax returns by Oct. 31, 2022. Taxpayers must not be claimed by anyone else as a dependent and must have a federal adjusted gross income of less than $100,000 if filing single, $150,000 if filing as a head of household and $200,000 for couples filing jointly.

More From GOBankingRates

Written by

Written by  Edited by

Edited by