A spouse has received support for wanting their husband to share some of the six-figure windfall he inherited after his mom died a few years ago, claiming he hasn't spent a cent.

They shared their grievance to Mumsnet under username BerylFeatures, as they explained their husband inherited a large amount after his mom passed away.

They said: "DH's mum died a couple of years ago and he got £100,000 ($126,174) inheritance.

"As far as I'm aware he's got it in his bank account and not spent any of it.

"We're not short of money but we're not well off either."

They didn't have high expectations for the cash, but admitted: "I was expecting him to at least take us on holiday but he hasn't mentioned it.

"If you received an inheritance would you share it with your family?"

The post, which can be read here, has amassed more than 170 replies since being shared on Thursday, as people thought the husband should share some of the money.

OverByYer thought: "That's so mean. DH inherited about £40k ($50,469) last year and I tried to persuade him to spend it on himself—nice car, watch etc and he just wouldn't. We've just bought a static caravan with the money and he is thrilled as it means the whole family get to enjoy it. Will your DH even discuss it?"

If you received an inheritance would you share it with your family?"

Shoxfordian asked: "Have you spoken to him about it? Surely you should be planning it together and deciding together—doesn't sound as though you're a team."

Girlmom21 reckoned: "Maybe he's still deciding what he wants to do. I'd invest that—especially if I was mortgage free."

DockOTheBay commented: "If either of us inherited that it would go in a joint account. He is stupid to not at least be investing some of it, just letting it sit in an account. Have you asked him what he's planning to do with it?"

Mally100 reckoned: "Yanbu, the fact he hasn't touched it is odd. Maybe he is still processing his mum's death and just blocked out everything including the money."

GarlandsinGreece remarked: "Absolutely bizarre. All money in our household is house money and shared."

GreeboIsMySpiritAnimal wrote: "Oof, that's a bit tight of him. DH got a much smaller inheritance from his grandma a few years ago and it went on a family holiday and our kitchen extension."

And BashfulClam added: "When my husband inherits it will be his. His parents worked hard for that for him. If he wishes to pay off our mortgage or put it all on black at the casino then It's not up to me. it would be nice if it benefited us both but it's entirely his."

Although Rwalker pointed out: "Chances are he'd sooner have his mum than money. Inheritance can be a poison chalice and enjoying something that has only come to you through a death sometimes just seems wrong. Unless your living hand to mouth I'd leave it. To start asking about spending it just seems grabby and insensitive."

To which BerylFeatures replied: "This is exactly how I feel. I keep waiting for him to bring it up but he doesn't and I don't want to look grabby."

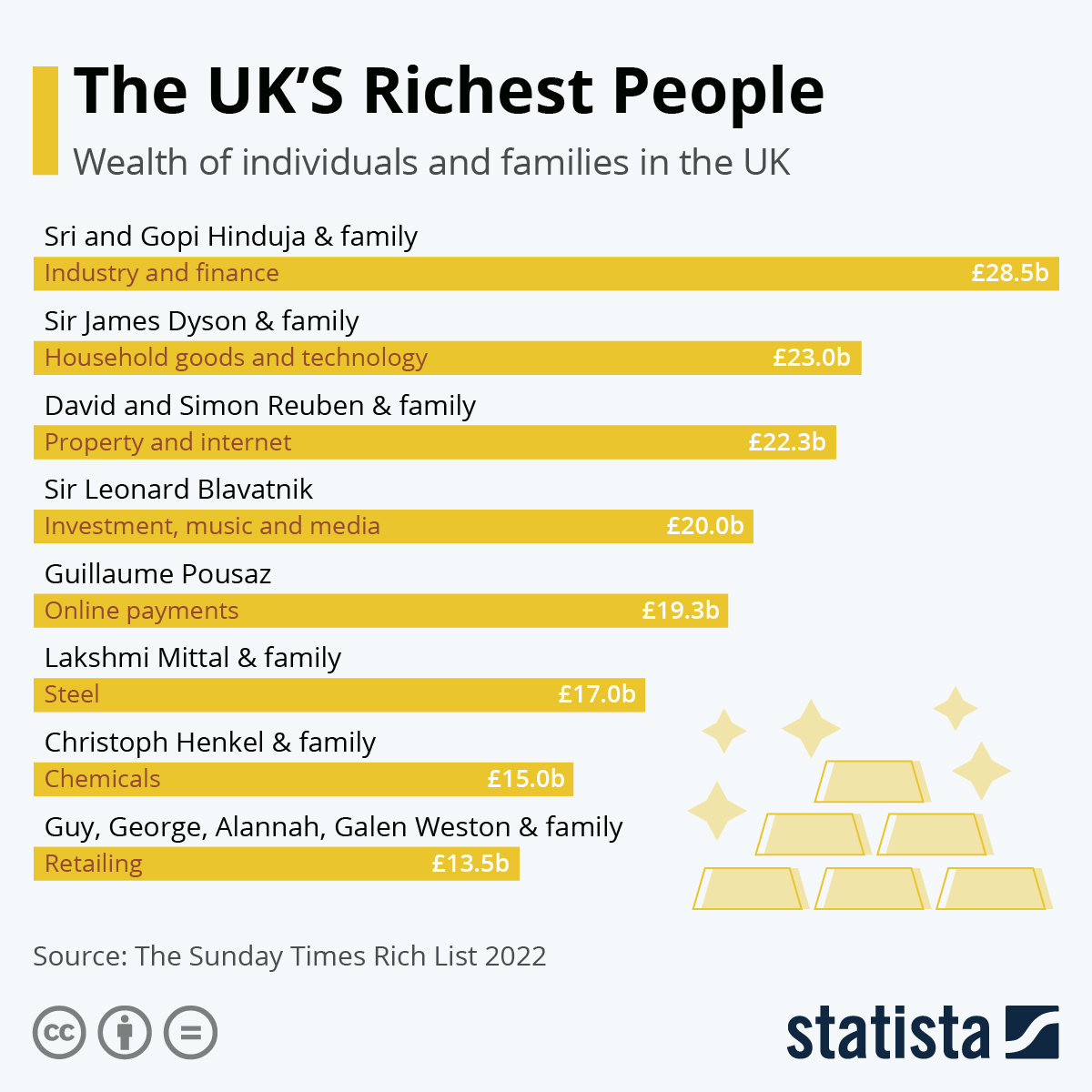

In the U.K., where the couple are thought to be based, inheritance is subject to 40 per cent tax on any estate—including property, money and possessions—over £325,000 ($410,070.)

The chart below, provided by Statista, shows the U.K's richest people.

You will find more infographics at Statista

You will find more infographics at StatistaThe government explained: "If you give away your home to your children (including adopted, foster or stepchildren) or grandchildren your threshold can increase to £500,000.

"If you're married or in a civil partnership and your estate is worth less than your threshold, any unused threshold can be added to your partner's threshold when you die. This means their threshold can be as much as £1 million."

Explaining if a person has claim to a spouse's inheritance, Citizens Advice said: "You are entitled to acquire and to hold any land, property, savings or investments in your own right during marriage. The same is true for your partner."

Although they noted: "However, if the marriage breaks down, any property owned by you or your partner will be taken into account when arriving at a financial settlement on divorce. This could include property you owned before you were married."

Do you have a similar monetary dilemma? Let us know via life@newsweek.com. We can ask experts for advice, and your story could be featured on Newsweek.

Uncommon Knowledge

Newsweek is committed to challenging conventional wisdom and finding connections in the search for common ground.

Newsweek is committed to challenging conventional wisdom and finding connections in the search for common ground.

About the writer

Rebecca Flood is Newsweek's Audience Editor (Trends) and joined in 2021 as a senior reporter.

Rebecca specializes in lifestyle and viral ... Read more

To read how Newsweek uses AI as a newsroom tool, Click here.