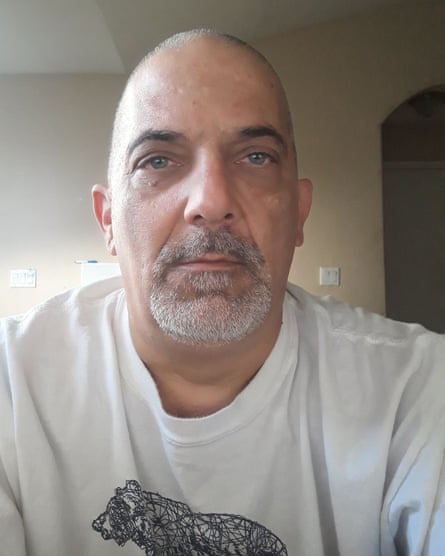

Andrew Amuso, a single father of a seven-year-old child in Phoenix, Arizona, has lived in the same apartment for eight years.

Before the Covid-19 pandemic, his rent was about $900 a month. Last year, it was increased by $276 a month to $1,176 a month, and he has received a lease renewal this year with another large increase, to $1,585.65 a month.

“It’s greed, pure, unadulterated greed. If you saw my place, you would be shocked that I’m going to be paying over $1,500 a month,” said Amos. “When I asked why they’re raising the rent, they said it’s because they can. And they’re right. They can. Because in Arizona there’s no laws protecting renters.”

Despite the significant rent hikes he has received over the past two years, his apartment has remained unchanged. His roof has been leaking for two years whenever it rains and the property management company he rents from has ignored his constant requests to repair the problem.

“I’ve had to cut back on groceries, I can’t do extracurricular activities, and I don’t have a car right now. When my rent increased last year, I had a high car payment and had to give the car back and was hit with a garnishment,” added Amos.

The last of the pandemic rental assistance relief is running out in many states as rent prices have soared across the US, forcing many renters to relocate, take on greater financial burdens to pay rent, or face eviction if they are unable to pay.

The median monthly asking rent in the US increased 17% to $1,940 in March 2022 compared with one year ago, according to an analysis by RedFin. Several metro areas have experienced rent hikes of more than 30%, with more than 20% of renters in many of these areas behind on rent payments.

Shanti Singh, legislative director of the California-based non-profit Tenants Together, explained that rent prices were soaring around the US due a variety of factors, including inflation, some metro area rental prices bouncing back after lulls in the beginning of the pandemic, a widespread lack of affordable housing around the US. She said there were also political factors, as the US moves on as though the Covid-19 pandemic is over, even though millions of renters are still experiencing its economic impacts.

“We need rent control. There’s no justifiable reason for any landlord to increase the rent on a tenant that dramatically except for profit,” said Singh.

She argued that rental relief assistance was inadequate to fully address the scale of the economic burdens of renters around the US, and was issued to landlords without conditions, with many landlords still evicting tenants or using rent hikes as a tactic to do so throughout the pandemic.

“We really didn’t do a great job as a country in taking responsibility and caring about renters, we were just like – landlords, get your money back, no strings attached, and it’s almost like we care even less now. We just expect every renter to have completely recovered,” Singh said.

Angela VanDusen of Auburn, Washington, received a $400 rent increase this year on an apartment she has lived in for five years, raising her rent from $1,295 a month to $1,695 a month. She noted the apartment had not been renovated at all and frequently needed repairs, and she often had to ask several times before they are fixed.

“I’m currently working while my fiance is unemployed dealing with health issues, but now needs to find work as soon as possible so we can prepare for the increase,” said VanDusen. “We had exhausted our savings over the past few months to keep up, and this increase will make it fairly impossible to build that back up in the near future.”

According to data analyzed from the US Census Bureau’s household pulse survey, 13.4% of renters in the US are at least one month behind on their rent and more than 5.5 million renters have expressed they are not confident in their ability to pay next month’s rent. Between 1985 and 2020, median US rental prices increased 149%, compared with an overall median income increase of just 35% in the same period.

Black and Hispanic renters have been disproportionately affected, with 19.9% of Black renters in the US and 15.5% of Hispanic renters reporting they are behind on their rent payments. Many who are in arrears have either applied for rental assistance and were denied or are still awaiting a response, or have received some assistance, but are still behind on rent.

Dawn Kearney, a grandmother raising two grandchildren on her own in Las Vegas, Nevada, received a lease renewal this year with a $400 rent increase on a house she has lived in for the past nine years.

“This definitely puts a financial strain on us as a family. We have no choice but to pay it,” said Kearney, whose rent is now $1,695 a month. “It’s obvious if I don’t pay it, they will get somebody else in here to pay for it and the cost of moving and trying to find another place is just astronomical right now.”

One Las Vegas resident reported a rent increase of $6,400 a month, from $1,495 a month. In recent weeks, several individuals have made viral videos on TikTok reporting large rent hikes and the impacts of having to either move back in with parents or take on the financial burden of greater rent.

As rental prices are soaring, evictions of tenants have begun to return to pre-pandemic levels in many US cities. In response, several cities have enacted programs to provide legal counsel for renters facing eviction and several cities are pushing for rent control measures and expanding tenant rights.

Rent control measures exist in Washington DC, New York, New Jersey, California and Maryland, while proposals to add or expand rent control measures have been introduced in Arizona, Florida, Hawaii, Illinois, Kentucky, New Jersey, New York, Washington and Massachusetts.

In New York, housing advocates are pushing for a Good Cause anti-eviction bill that would also grant tenants legal rights to fight unreasonable rent increases, as rent hikes can often be used as a tactic to evict tenants. The bill has received a surge of support in response to the dramatic rent increases tenants are experiencing around New York.

“It’s a combination of a housing shortage and real price gouging that are leading to a dramatic housing crisis for tenants and it’s impacting tenants on a variety of income levels,” said Cea Weaver, campaign coordinator with the tenants group Housing Justice For All. “In many cases, their rent increases are not justified by any increase in costs, but in fact, justified by gentrification or changing neighborhood conditions that basically is a landlord wanting to cash in.”