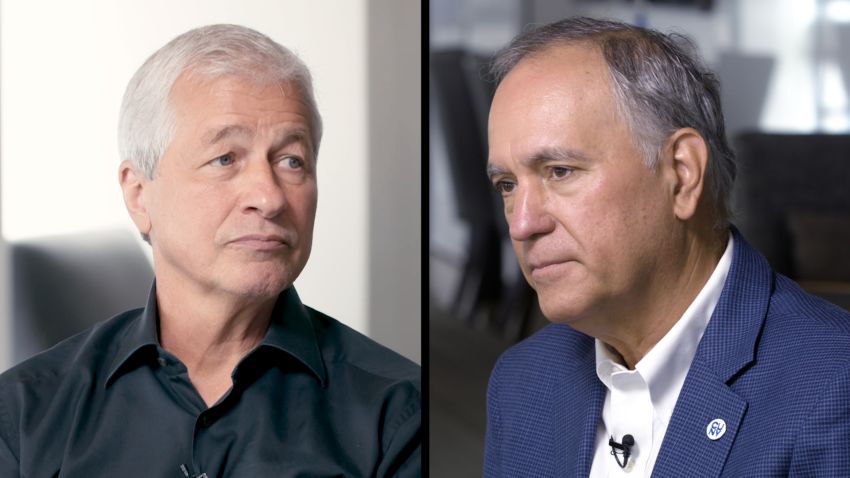

JPMorgan Chase CEO Jamie Dimon said Wednesday that the Federal Reserve should have moved sooner to raise interest rates and conceded the odds do not favor taming inflation without sparking a recession.

“We’re a little late but remember two years ago we had 15% unemployment and no vaccine. People should take a deep breath and give them a chance,” Dimon told Bloomberg TV. “The sooner they move the better.”

The JPMorgan (JPM) CEO added that the federal government needs to focus on national security in the wake of the war in Ukraine.

“The Cold War is back,” Dimon said. “Global energy is precarious…If oil goes to $185 that’s a huge problem for people and we should do everything we can today. We need to pump more oil and gas.”

The good news is Dimon says the US economy is “very strong” right now and consumers are in “great shape.”

Asked if he’s worried about the Fed starting a recession, Dimon said, “Of course.”

Dimon sees just a one in three chance that the Fed can engineer a “soft landing,” where inflation is brought under control and the economic expansion continues.

He sees the same odds for a “mild recession” that spans six to nine months, adding that there’s “a chance it’s going to be much harder than that.”

The Fed is “going to try to slow the economy enough so that 8% [inflation] starts to come down over time. I wish them the best,” Dimon said.