Exporting LNG during Winter Storm Uri proved disastrous

Editor’s note: This is the first article in a four-part series revealing how the exportation of natural gas adversely affected Texans during Winter Storm Uri, how this situation could have been prevented, and what policy changes are needed to avoid a similar disaster in the future.

Everyone who lived in Texas during Winter Storm Uri has a story to tell about how people suffered during that horrific storm in February 2021.

Hundreds of thousands of Texans performed in large and small ways to help people and save lives. Firefighters worked double and triple shifts. Many first responders worked out of buildings without electricity, water, or heat for significant periods of time.

To this day, many people blame those who ran electric utilities for the disaster. But here again, there were instances of extraordinary dedication. At one of the region’s coal plants, workers shoveled frozen piles of coal by hand. Line workers scaled poles in West Texas amidst ice, snow, and record-breaking cold temperatures, working 16-hour shifts. In Austin, these 16-hour shifts lasted for eight days in a row. Some power plant operators had to physically break ice at the power plant’s water supply inlets to keep the generators operating. Energy traders responsible for purchasing fuel supplies slept by their desks.

Good Samaritans used their four-wheel-drive vehicles to pull countless cars out of the snow or provide desperate people with food or essential transportation. Some restaurants opened to feed people for free. The Travis County Democratic Party used its phone bank to contact area seniors to check on their welfare.

Despite the collective best efforts of this veritable army, if a system of incompetence sets up to an entire society to fail, there will never be enough heroes to compensate.

Much of the misery, death and destruction inflicted on Texans by Winter Storm Uri could have been avoided. For even as the storm was raging enormous quantities of Texas natural gas—fuel that could have provided relief for more than half of the Texas residences that lost electric power during the emergency—was being shipped around the world as liquified natural gas (LNG).

What is LNG?

LNG is condensed gas that has been chilled to 259 degrees below zero Fahrenheit to compress it to 1/610th of its volume in the gaseous state. This makes it profitable for gas-rich nations (such as the United States, Trinidad, and Australia) to transport it in some of the largest seagoing vessels in the world and sell to gas-poor nations (such as China, Japan, South Korea, Turkey and the United Kingdom).

Natural gas is typically transported from producers to customers via land or ocean pipelines. Indeed, in the United States, almost all gas production is transported through pipeline systems. U.S. producers also send exports to Mexico and Canada via pipelines. But once a certain distance is exceeded (about 3,200 miles for a land pipeline and about 1,250 miles for an ocean pipeline) shipping is often more economical. In fact, about 13 percent of all natural gas produced in 2020 was shipped as LNG.

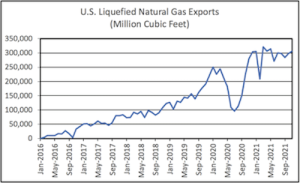

Since 2011, more than $62 billion has been invested in LNG export infrastructure in the United States. The lower 48 states produced virtually no LNG until 2016 but in 2021, more than 10 percent of U.S. natural gas production was exported, a staggering five-year growth rate. The U.S. Energy Information Administration projects that by the end of this year, the United States will have more LNG export production capacity than any other country in the world.

The conflict between domestic gas needs during emergencies and foreign LNG exports is already a problem. And it’s going to get worse. Another $19.3 billion has been invested in LNG plants under construction in Texas and Louisiana. When completed those plants will boost existing U.S. export capacity by 39 percent by 2025.

In addition, an LNG export facility under construction on the Baja California Peninsula in Mexico will be supplied largely by U.S. natural gas pipelines. This plant when completed will bypass shipping via the Panama Canal and could raise U.S. export capacity by another few percent.

Gulf Coast dominates LNG exports

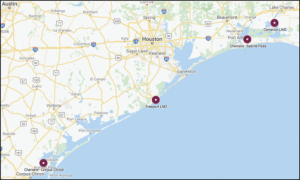

There are currently six export facilities in the United States that produce and ship LNG. Four of them—representing 90 percent of this country’s capacity—are either in Texas or very near it.

Two are located inside the Lone Star state: Cheniere-Corpus Christi LNG, and Freeport LNG (on the coast in Brazoria County). Together these two plants produce about 37 percent of the total U.S capacity.

A third plant, Cheniere-Sabine Pass LNG, is just across the Texas-Sabine River border in Louisiana. The plant produces 35 percent of U.S. LNG export capacity.

A fourth plant, Cameron LNG, is located in Louisiana, about 23 miles due east of Orange, Texas and produces 18 percent of U.S. capacity.

The shipping manifests

In a rational world, one would think that in an emergency, exports would be preempted to provide for critical domestic supply. But this did not occur during Winter Storm Uri.

The state’s primary electric grid crashed catastrophically about 1:20am February 15th. But ERCOT (Electric Reliability Council of Texas) grid operators acknowledged the state was in trouble as early as February 9th. That’s when it received notice that natural gas supply restrictions to some of its power plants would begin affecting the grid February 10th.

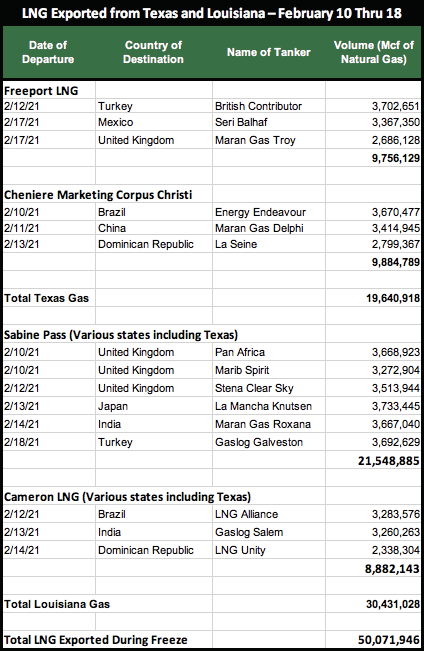

Using February 10th as a benchmark to when great caution should have been exercised in marshaling emergency fuel supplies, and February 17th when the worst part of the emergency ended, the daily manifests of LNG shipments shows huge quantities of natural gas were exported to other countries.

According to records from the U.S. Department of Energy, between February 10th and February 18th the two Texas LNG ports shipped more than 19.6 billion cubic feet of natural gas to Brazil, China, the Dominican Republic, Mexico, Turkey, and the United Kingdom. (Even though the 18th was outside of the time period for the worst part of the Texas crisis, the time required to liquefy this fuel makes the date relevant to the emergency.)

Chenier-Sabine Pass LNG exported more than 21.5 billion cubic feet of gas to India, Japan, Turkey, and the United Kingdom during this critical time.

Cameron LNG exported 8.9 billion cubic feet of gas to Brazil, India, and the Dominican Republic during the Texas crisis.

Had this exported LNG been available for fuel-starved Texas power plants, they could have generated enough electricity to serve more than half of the residential customers who suffered through blackouts during Winter Storm Uri.

Fracking changed everything

In the first decade of the 21st century, things looked bleak for U.S. energy consumers. Experts said fossil-fuel extraction in the United States had reached “peak gas” and “peak oil,” meaning more than half of reserves had been depleted and extracting the balance of these fossil resources was expected to be increasingly more expensive.

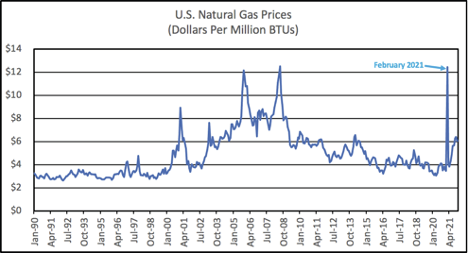

Despite U.S. natural gas consumption staying basically flat between 2000 and 2009, delivered prices were up 116 percent compared to the previous decade. At one point, prices soared as high as $12.48 per thousand cubic feet (during July 2008), compared to the 1990’s decade average of $3.11.

While many residents struggled to pay their bills, industries related to petrochemicals began closing, moving, or downsizing. Chemical industry employment declined by 19 percent between 2000 and 2010, from 988,000 to 796,000. Likewise, the number of plastic industry employees declined 34 percent, from 956,000 to 627,000. This was in no small way due to the rising price of U.S. natural gas, which made chemical production in nations with cheaper gas and oil more competitive.

Back then, investing in LNG imports was seen by the U.S. gas industry as a key to maintaining supplies. They predicted the need for a $100 billion investment in LNG import infrastructure by 2010. There were predictions that by 2016 imported LNG would provide the energy equivalent of somewhere between 14 percent and 28 percent of the previous decade’s domestic gas consumption.

But in about 2008, fracking—a method of extracting fossil fuels from deep underground by injecting high-pressure solutions of water, chemicals and sand into shale deposits—began to boost U.S. gas supplies markedly. In 2011, fracking started boosting domestic oil production as well. Fracking made obsolete the dire predictions linked to peak gas and peak oil based on older drilling techniques.

United States suddenly an exporter

Scarcity pricing vanished. Gas costs plummeted. There was so much supply that new domestic chemical and plastics factories were built in this country, adding new jobs. In fact, there was so much supply that the U.S. LNG industry turned the spigot around.

The Freeport, Cameron, and Cheniere-Sabine Pass terminals were originally built as import facilities, but the owners realized that the gold rush was now in exports.

U.S. LNG exports are now vigorously competing against domestic natural gas prices, sometimes driving them higher. A November 2021 Wall Street Journal article revealed that electric utilities in the Pacific Northwest, the Midwest, and New England were all facing rising fuel costs because of competing exports. That was the third time that LNG-induced price increases in U.S. natural gas had occurred since exports began in 2016.

This conflict between domestic gas prices and foreign gas sales is not a uniquely American problem. Australia, currently the world’s largest LNG exporter (until the United States claims the title within the next year) has experienced massive domestic natural gas price increases because of how much it exports. The country is seriously considering the bizarre solution of building domestic LNG import terminals to solve supply constraints brought about by its export terminals.

Few Americans, however, would have predicted that LNG exports might actually endanger the public’s well-being with acute shortages of natural gas. Due to poor planning, lax or non-existent regulation, and lack of common sense, they now have.

This is the first in a four-part series on how Texas exported fuel that could have been used for emergency supplies during the brutal freeze of February 2021. I hope you will be interested in Part 2: The St. Valentine’s week massacre.

Trust indicators: Paul Robbins is an environmental activist and consumer advocate who has lived in Austin for five decades. He is editor of the Austin Environmental Directory, a sourcebook of environmental issues, products, services, and organizations in Central Texas. The publication has been offered free to the public since 1995, and can be accessed free online.

Trust indicators: Paul Robbins is an environmental activist and consumer advocate who has lived in Austin for five decades. He is editor of the Austin Environmental Directory, a sourcebook of environmental issues, products, services, and organizations in Central Texas. The publication has been offered free to the public since 1995, and can be accessed free online.

Thanks to Tony Switzer and Sarah Campbell for reviewing this story, and Ken Martin for editing.