Downgrading vs. Canceling Your Credit Card: Which Is Best for You?

Commitment to Our Readers

GOBankingRates' editorial team is committed to bringing you unbiased reviews and information. We use data-driven methodologies to evaluate financial products and services - our reviews and ratings are not influenced by advertisers. You can read more about our editorial guidelines and our products and services review methodology.

20 Years

Helping You Live Richer

Reviewed

by Experts

Trusted by

Millions of Readers

Credit cards can be a tricky business. They’re tempting to use but come with the risk of overspending or accruing more debt than you can easily pay off, which can lead to mountains of additional interest.

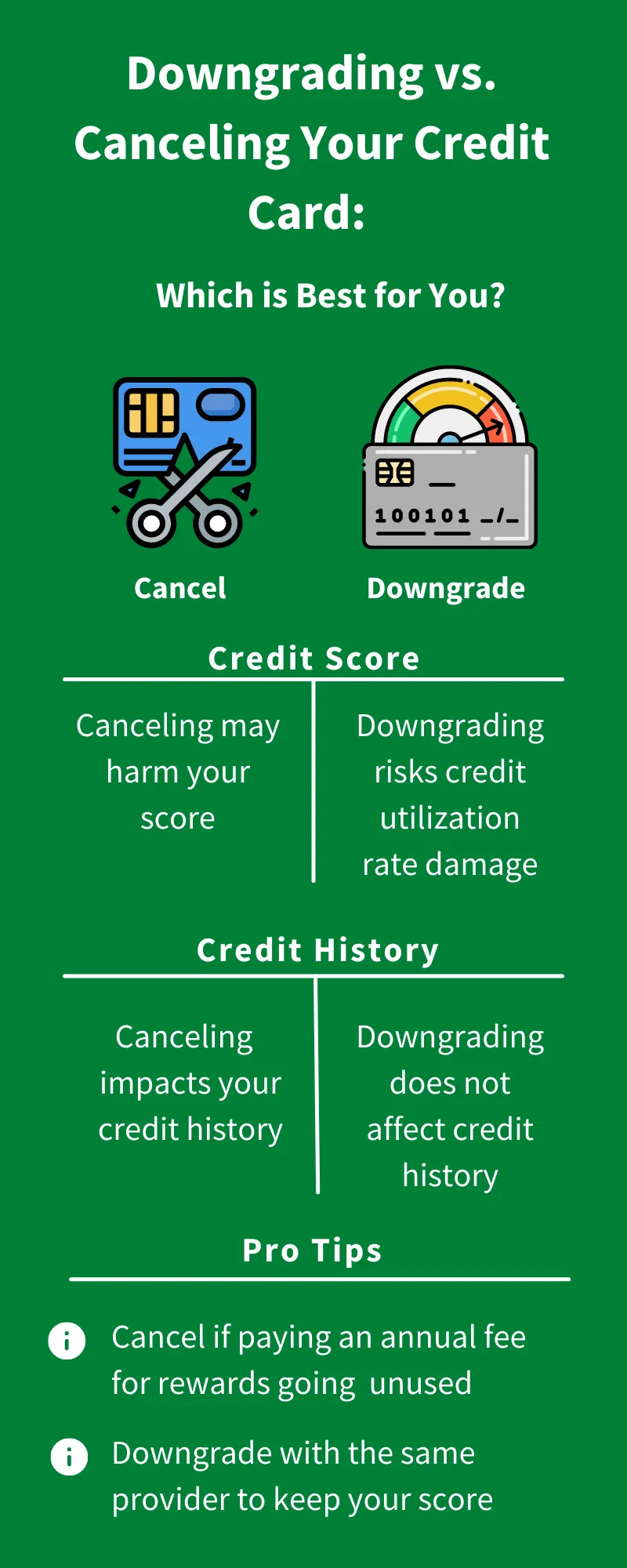

But is canceling the best plan, in a world where your credit score is so intimately tied to using credit cards? Experts offer recommendations for whether you should cancel or downgrade a credit card.

Canceling affects your credit score

Canceling a credit card can have an impact on your credit card because when you have more credit, it helps your credit utilization ratio. When you cancel a card, that will drop how much credit you have available to use.

Downgrading and canceling may both affect your credit utilization rate

Downgrading may also affect your credit utilization rate, said Todd Christensen, author of “Everyday Money for Everyday People” and a financial counselor with DebtReductionServices.org.

“Canceling a card means the balance becomes your credit limit in the eyes of the credit scoring models,” he said.

Also, when you cancel a credit card, “any balance left on the account makes it look like the account is maxed out.”

Canceling impacts your credit history

Additionally, age matters when it comes to credit, said Andrew Lokenauth, CEO of Fluent in Finance.

“The average age of your existing credit accounts for 15% of your credit score,” he said. “The longer your credit card history, the better for your credit score. So, by closing a credit card that has been open for a long time, you can reduce the average age of the accounts on your credit report, which can cause your credit score to drop.”

Lower the limit on your card

Instead of canceling a credit card, you can lower its limit, which helps your credit, said Alex Baker, CEO of Survey Examiner. “You’ll also keep its credit line. Having more credit accessible can help you maintain a lower credit utilization ratio.”

Plus, this way you have the benefit of not requiring a credit check. New applications trigger a hard credit inquiry, lowering your credit score.

“A new credit account also reduces your credit account age,” Baker said. “You can avoid both issues by downgrading a card.”

Downgrade with the same credit provider

Shaun Heng, a vice president at CoinMarketCap, recommends downgrading with the credit card provider you already have.

“By doing this, you can avoid the hit your credit score will take by canceling one card and applying for a new one with a different provider,” Heng said. “Importantly, downgrading to a card from the same provider means your credit line remains open, which is really important to maintaining your credit score — especially if you’ve been holding that card for a long time.”

Keep in mind, however, that most card providers don’t allow downgrades within the first 12 months of opening an account.

Cancel if you can’t control your spending

Of course, there are times when even the hit to your credit score may be worth canceling, said Chloe Choe, owner of Off Hour Hustle.

“Canceling a credit card can be beneficial if you have trouble paying your bills on time or controlling your spending habits,” Choe said. “If it’s difficult to keep track of your spending, it might be better to resort to a debit card or cash to spend what you only have.”

Cancel a travel credit card you don’t use

Another time you might want to consider canceling a card is if you’re paying a $450 annual fee for a top-grade travel rewards card but are not traveling much anymore or for the foreseeable future, in the wake of COVID-19, said Cyndie Martini, CEO of Member Access Processing, the nation’s largest aggregator of Visa card services to credit unions.

“(Then) it makes sense to churn to a new card that has a lower or no annual fee but does feature other rewards, such as cash back, that you can use,” Martini said. “The other thing to consider about travel rewards is that airlines are currently canceling record numbers of flights. This severely limits the seats available to purchase with reward points.”

‘Not the end of the world’

Unless you’re engaging in any major financial moves, such as buying a home or car, or applying for a loan, canceling a card is “not the end of the world,” said John Garner, CEO of Card Curator, a credit card rewards optimization company.

“As a matter of fact, the credit filing on your credit card stays on your credit report for six years after cancellation, and it continues to build credit throughout that time,” Garner said. “After six years, it will be removed from your credit report, and it will negatively impact your credit score then. However, people’s credit scores are very dynamic, so one credit card rolling off after six years doesn’t have as much of an impact as one thinks.”

More From GOBankingRates

Written by

Written by  Edited by

Edited by