Link: Apply now for the Capital One Spark Cash Plus (Rates & Fees)

Last year, I got approved for the Capital One Spark Cash Plus (review) and was instantly approved, even though I got approved for the Capital One Venture X Rewards Credit Card (review) (Rates & Fees) just a couple of months prior to that. I wanted to recap my experience applying, especially given the great welcome bonus that the card is currently offering.

In this post:

Why you should apply for the Capital One Spark Cash Plus

The Capital One Spark Cash Plus is offering a welcome bonus where you can earn a one-time cash bonus of $1,200 once you spend $30,000 in the first 3 months.

Admittedly that’s a big spending requirement. Keep in mind that cash back earned on the card can be converted into Capital One miles, at the rate of one cent per mile. I value Capital One miles at 1.7 cents each (thanks to all the ways to redeem them), so that makes the card much more lucrative.

It’s not just the welcome bonus that’s great, but this is also just a generally very lucrative card. The card offers a flat 2% cash back with no limits and no foreign transaction fees, making this one of the best cards for everyday spending, and one of my favorite business cards.

While the card has a $150 annual fee (Rates & Fees), the card offers an additional $150 cash back when you spend $150,000 on the card in an anniversary year, so it’s especially rewarding for big spenders. Think of the card as offering a refund of the annual fee for big spenders.

My experience applying for the Capital One Spark Cash Plus

I found the process of applying for the Capital One Spark Cash Plus to be pretty straightforward, though of course an instant approval always helps with my perception of application processes. 😉

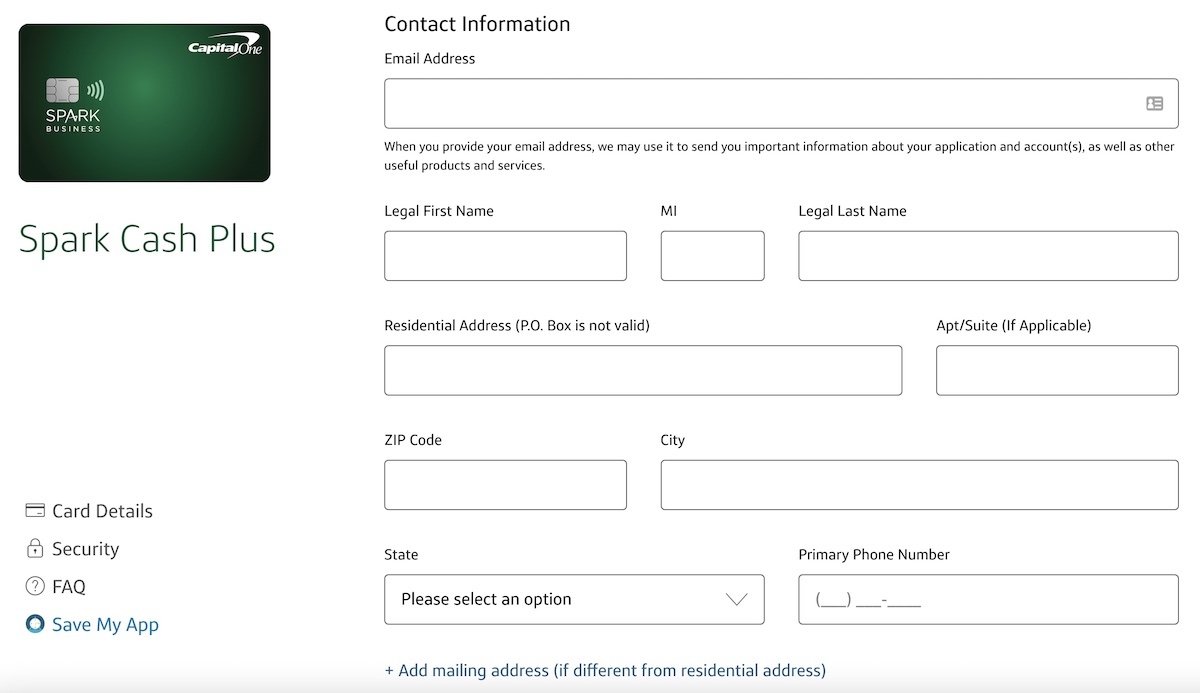

The application consisted of four parts. The first part just asked for personal contact details.

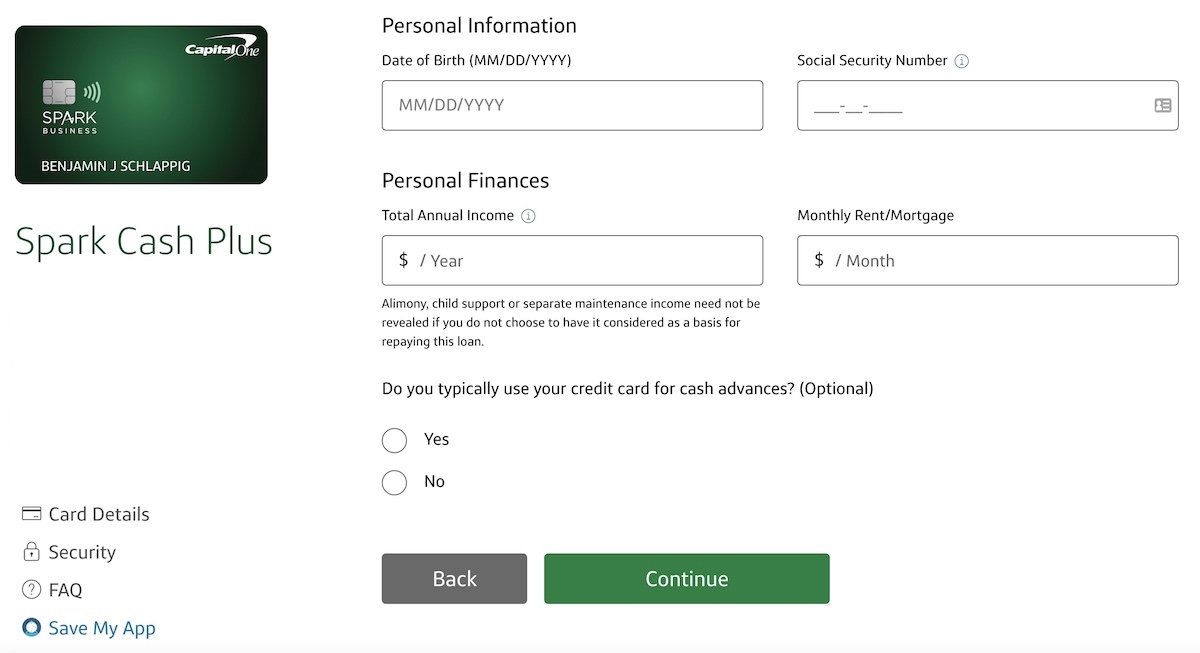

The second part asked for more personal information, including my date of birth, social security number, income, monthly rent or mortgage, etc.

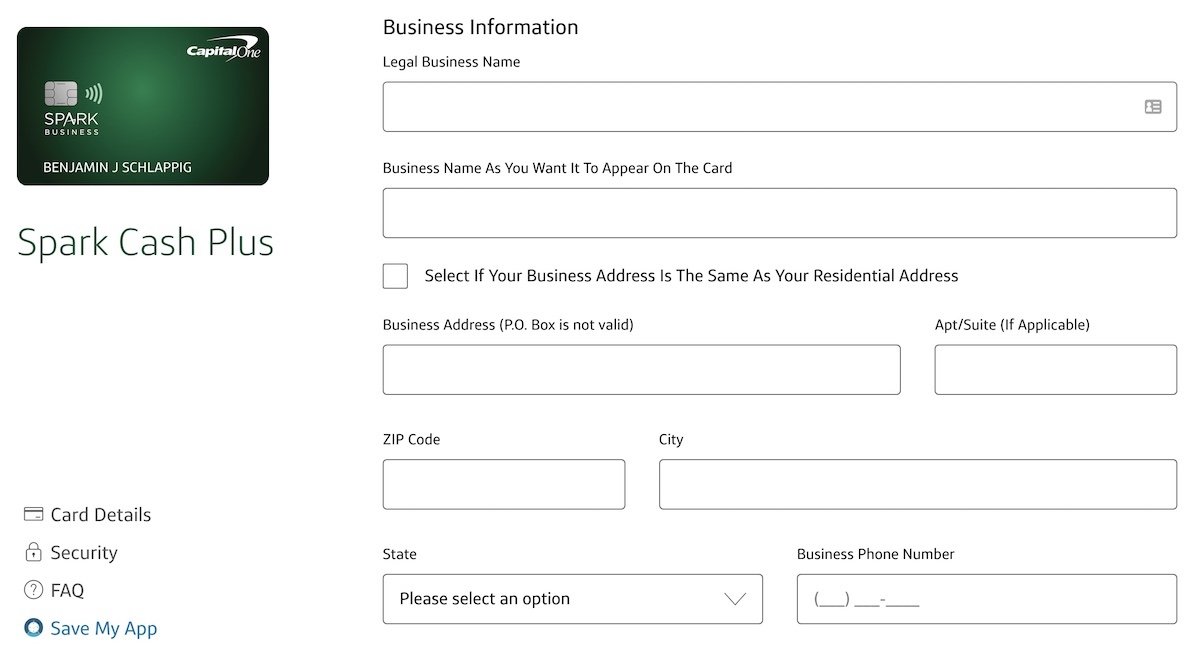

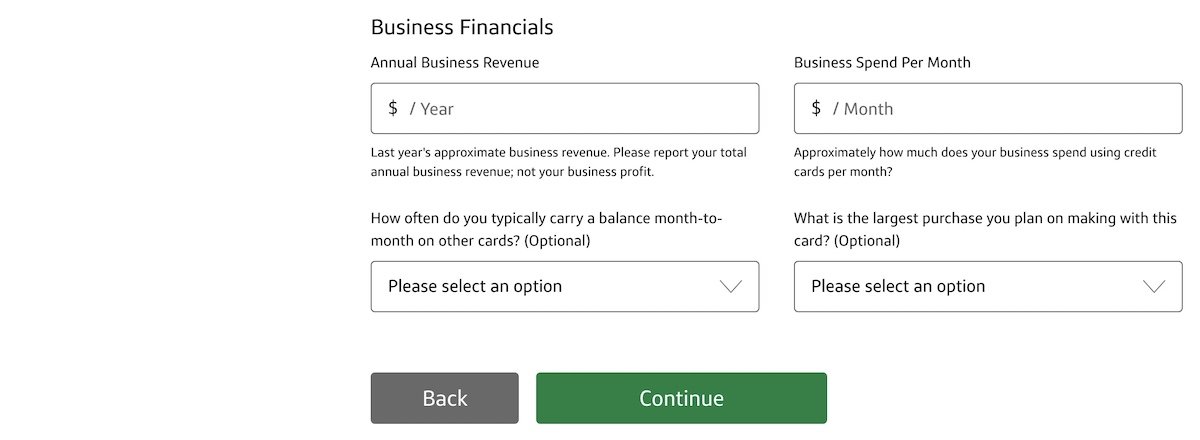

The third part asked for my basic business information, including the business address, business revenue, anticipated spending, etc.

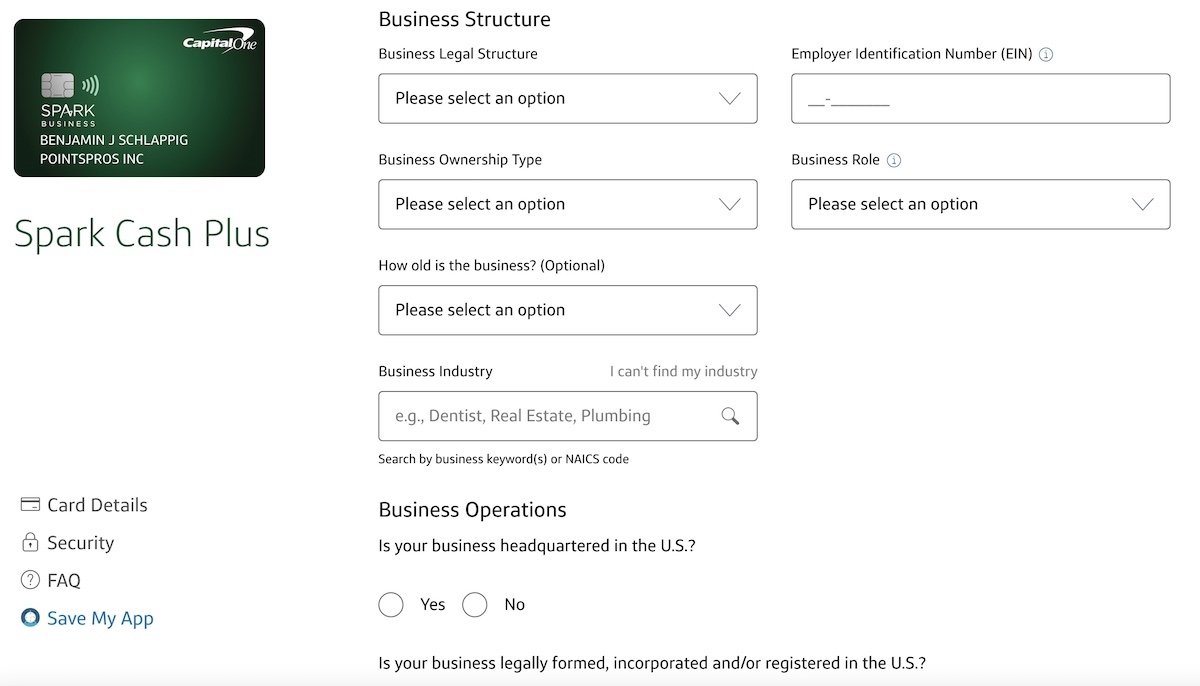

Then the fourth part asked for more information about my business structure, and my role in the company.

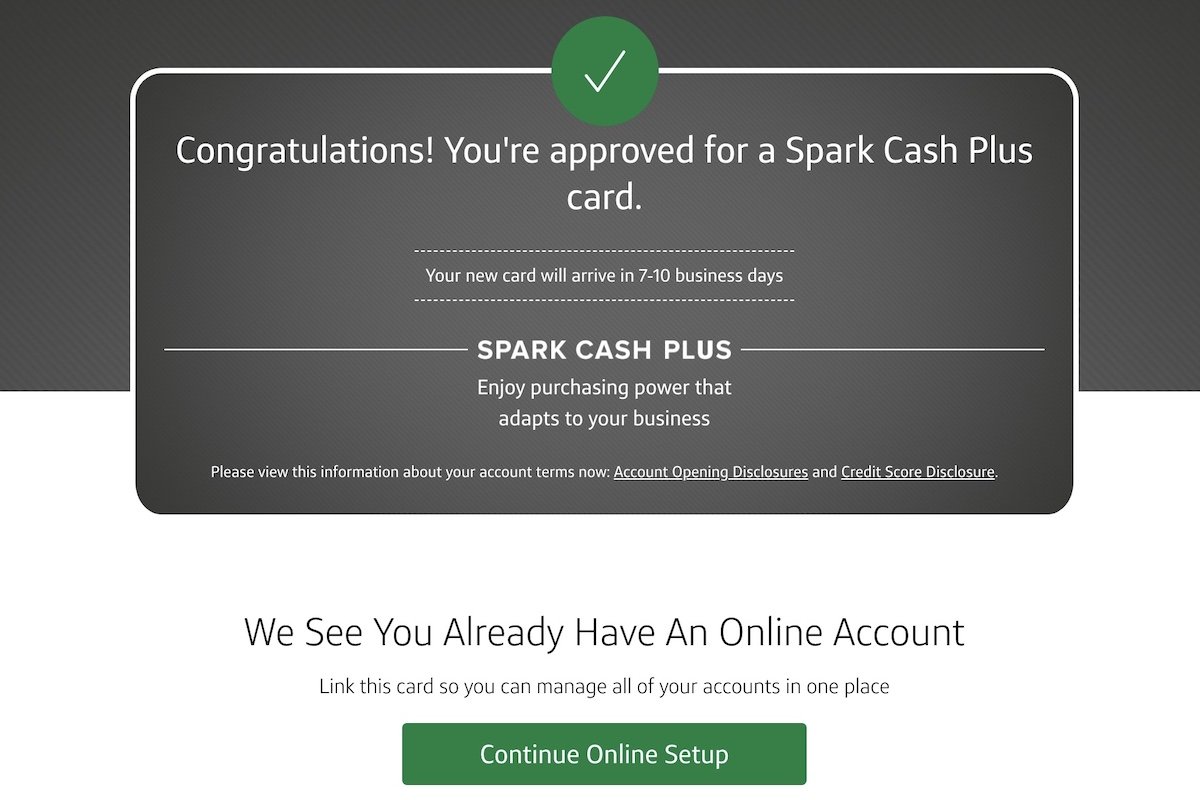

Then there were a couple of pages of disclosures, and a summary of my application. I then hit submit, and received an instant approval, which you can’t beat!

Since the Capital One Spark Cash Plus is a charge card, there’s no pre-set spending limit, and as a result there was no credit limit listed on the page. I could then immediately link my new card to my existing Capital One online account, so that I could start managing my account.

What are Capital One’s application restrictions?

Anecdotally, Capital One has very few consistent application restrictions. There have been some rumored guidelines, but I think my application disproves both of them (and this is corroborated by reports from others):

- Some suggest that you can only be approved for one Capital One card every six months; I was approved for the Capital One Spark Cash Plus after being approved for the Capital One Venture X just over two months earlier

- Some suggest that you can only have two Capital One cards at a time; personally, I have four Capital One cards

Perhaps one noteworthy distinction here is that the Capital One Spark Cash Plus is a charge card and not a credit card, so it’s possible that may impact this. Regardless, my experience so far suggests that the Capital One Spark Cash Plus might not be so hard to be approved for, even if you recently got the Capital One Venture X.

Bottom line

The Capital One Spark Cash Plus has a generous welcome bonus, which can be converted into Capital One miles as well, in conjunction with another card. While the spending requirement is significant, picking up this card could be well worth it for anyone who is looking for a business card and can pull off the spending.

Hopefully this is a useful data point for anyone who is interested in this card, but also recently picked up the Capital One Venture X.

If you applied for the Capital One Spark Cash Plus, what was your experience like?

This doesn't count towards 5/24 right?

@ Miles -- Yep, correct.