Child Tax Credit Update: What is IRS Letter 6419?

Commitment to Our Readers

GOBankingRates' editorial team is committed to bringing you unbiased reviews and information. We use data-driven methodologies to evaluate financial products and services - our reviews and ratings are not influenced by advertisers. You can read more about our editorial guidelines and our products and services review methodology.

20 Years

Helping You Live Richer

Reviewed

by Experts

Trusted by

Millions of Readers

Families who received advance monthly payments of the child tax credit last year will need to pay special attention to forms in the mail specific to your tax filing for the child tax credit.

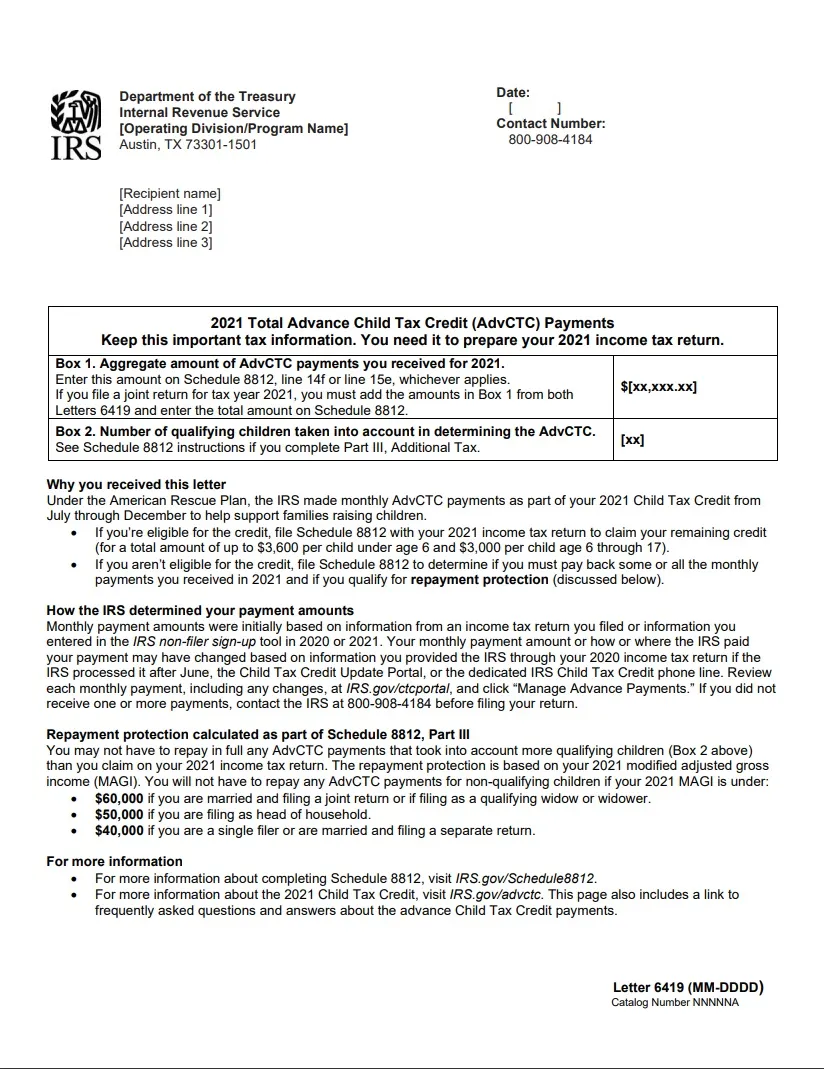

Every household that received advance payments of the child tax credit in 2021 will receive Letter 6419 Advance Child Tax Credit Reconciliation from the IRS soon, if they have not already received it. You will need this letter to do your taxes this year if you received any money in 2021 from the child tax credit.

It is imperative that those who received child tax credit funds in 2021 file a tax return — even if they normally do not file — and compare the amount of money they received in the credit with the amount they qualify to claim for 2021. Child tax credit advance payments were paid out to you based on your 2020 and 2019 tax returns, meaning that if your income increased in 2021 and surpassed the income threshold, it’s likely you will need to pay some or all of the credit back once your 2021 income is officially used in your new tax return. You will use Letter 6419 in order to do this, so make sure you do not throw it out.

Here’s what it looks like for reference:

If you did not receive any advance payments last year, you can claim the full amount of the benefit this year on your tax return. This also includes families who do not normally file taxes or make enough money to file taxes. This specific benefit is fully refundable, meaning that you will not have to pay it back as long as you do not exceed the income limitations or your eligible children do not age out during the qualifying period.

Starting today, you can file your return for 2021 to receive your benefit. Those who make under $73,000 per year can actually have their taxes done for free using the IRS Free-Filer Program online.

More from GOBankingRates:

Written by

Written by