The value of cryptocurrencies has exploded over the past two years with big names like Bitcoin and Ethereum doing well, and altcoins like Solana and Dogecoin returning many multiples for investors. But the volatile nature of cryptocurrency and its uncertain future mean that it might not be an appropriate investment for everyone, even if it has a lot of disruptive potential.

If you want exposure to cryptocurrency, but not the hassle of owning cryptocurrency itself, Apple (AAPL -0.57%), Block (SQ -1.97%), and Coinbase Global (COIN 2.01%) may be great ways to play the market and provide downside protection for your investment.

Image source: Getty Images.

1. Apple as an infrastructure play

Arguably, the biggest thing holding cryptocurrencies back today is the lack of accessibility on mobile devices. Users can trade cryptocurrency on a number of platforms, but many crypto wallets don't have mobile apps, and neither Alphabet, which makes Android, nor Apple have easy integrations into their mobile operating systems.

Since non-fungible tokens (NFTs) are held in crypto wallets and NFT gated websites rely on crypto wallets, this is really holding the industry back. But the crypto industry isn't responding by building new smartphones; it's waiting on smartphone companies to update their software and policies.

This shows just how entrenched products like the iPhone are in the market. These devices are now infrastructure in the digital economy. Just like a restauranteur assumes that people will be able to get to their restaurant on roads, and electricity will be provided by a utility, the smartphone is just an assumed piece of technology for crypto.

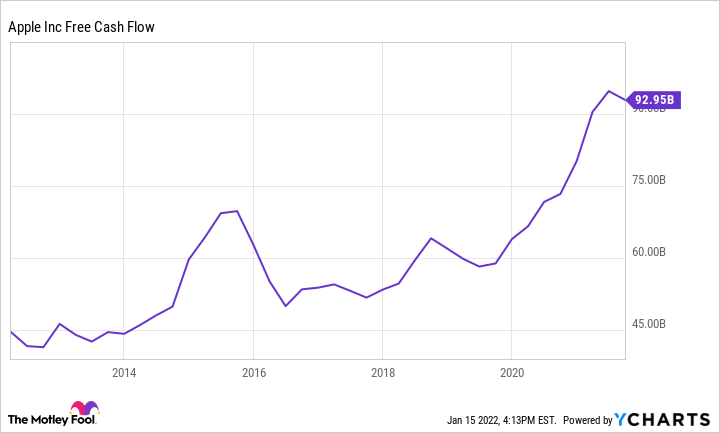

I think that dynamic will allow Apple to grow its user base, raise prices, and steadily increase free cash flow. And this was already one of the world's best cash flow machines.

AAPL free cash flow. Data by YCharts.

2. Block as an option to pay with Bitcoin

Block is a company that's been dabbling in cryptocurrency for years but is only now starting to make it a big part of its business. The Cash App's Bitcoin trading accounted for $1.81 billion in revenue in the third quarter alone, although that doesn't generate much margin for Block.

Where cryptocurrency gets more exciting for Block is its use as a medium for competing transactions, potentially cutting Visa (V -0.48%) and Mastercard (MA -1.19%) out of the equation over time. Transactions could be verified instantly for a fraction of the current price, all on a cryptocurrency infrastructure.

We don't know if that's what TBD54566975 (Block's Bitcoin project) is working on, but the company is clearly building some kind of infrastructure layer for Bitcoin. Whether it's crypto trading on the Cash App, crypto transactions on Square, or something unknown from TBD54566975, I think Block will be a big player in crypto for a long time.

3. Coinbase as the trading platform

Coinbase is already a giant in cryptocurrency trading. And given the regulatory requirements in place today, I don't see that changing. The company is already connected to millions of customers' bank accounts and crypto wallets, effectively building a crypto brokerage platform that's incredibly profitable.

COIN revenue (TTM). Data by YCharts. TTM = trailing 12 months.

We also know that Coinbase will soon be launching an NFT marketplace, which CEO Brian Armstrong thinks could be bigger than the crypto trading business. If that's true, this stock is incredibly cheap at about 20 times earnings.

I see Coinbase as something of an infrastructure play in cryptocurrency, like Apple. It's not going to be the place where the most innovation takes place, but it's an entrenched leader at the gateway to cryptocurrency for users. That's a valuable position, and I think it'll drive growth for decades.

Take the volatility out of cryptocurrencies

These three companies are steady, profitable businesses that aren't nearly as volatile as cryptocurrencies. But they have exposure to that market and could grow as crypto does, so they're great stocks if you want to avoid betting on a single cryptocurrency.