Affiliate links on Android Authority may earn us a commission. Learn more.

10 best credit score apps for Android to check your credit now

Your credit score is very important. Businesses use it when issuing credit cards. You need a decent one to get good rates on a house. Even some jobs require a good credit score. Luckily, there are plenty of ways to check out your credit, and often for free. You probably know a few of these already. For example, Credit Karma is on our list and it’s one of the most popular free credit score apps. You have other options too. Here are the best credit score apps for Android.

Please note, this list is for our US readers. Each country handles this kind of stuff differently and the services below may not work outside of the US.

The best credit score apps for Android

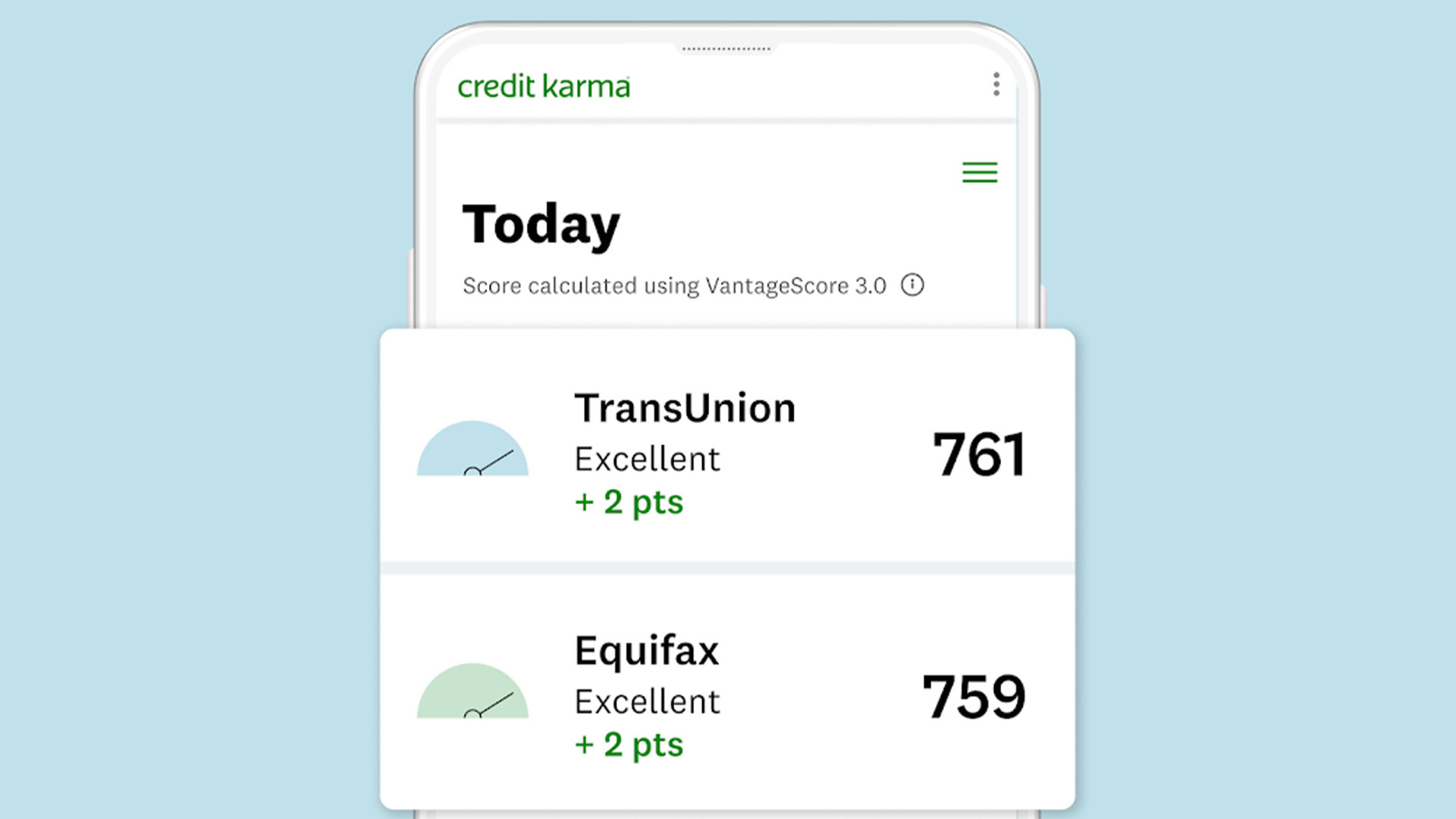

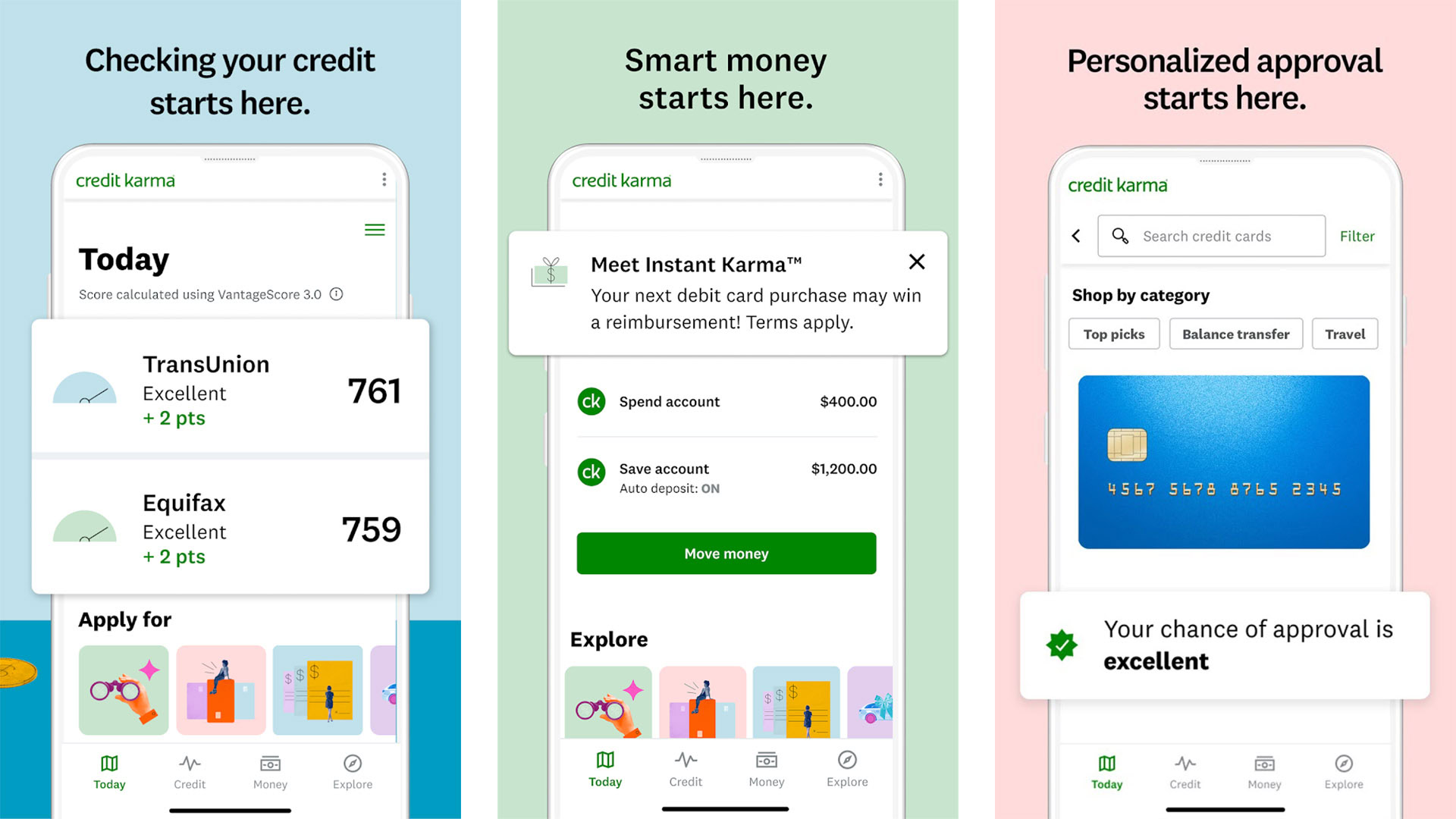

Credit Karma

Price: Free

Credit Karma is one of the most recognizable names in this space. You sign up, log in, and see your credit reports. It gets the basics right and you can see things like your open accounts and how much money you owe.

There are a host of other services like a tax filing function as well as credit card stuff. We don’t necessarily recommend any of that, but the core functionality is very helpful. You can also use this to monitor your credit and do so some other stuff.

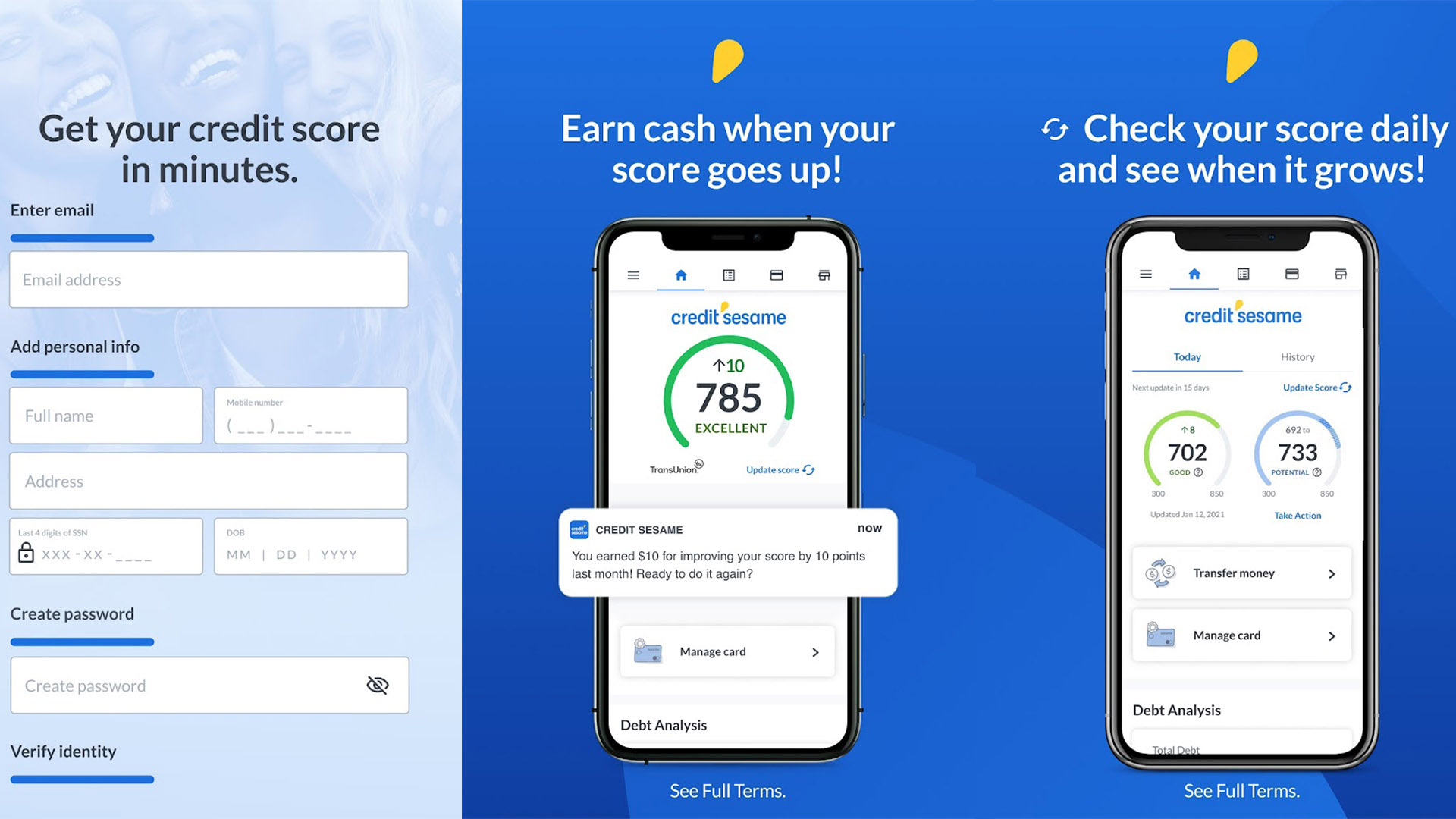

Credit Sesame

Price: Free / $9.95-$19.95 per month

Credit Sesame is a lot like Credit Karma. It shows your credit score, open accounts, and all of that. It then remains free by offering you a bunch of stuff like credit cards or cashback offers. The free part of it is useful for basic credit monitoring. The subscription options add some other stuff like daily credit scores, monthly reports, and other power-user features.

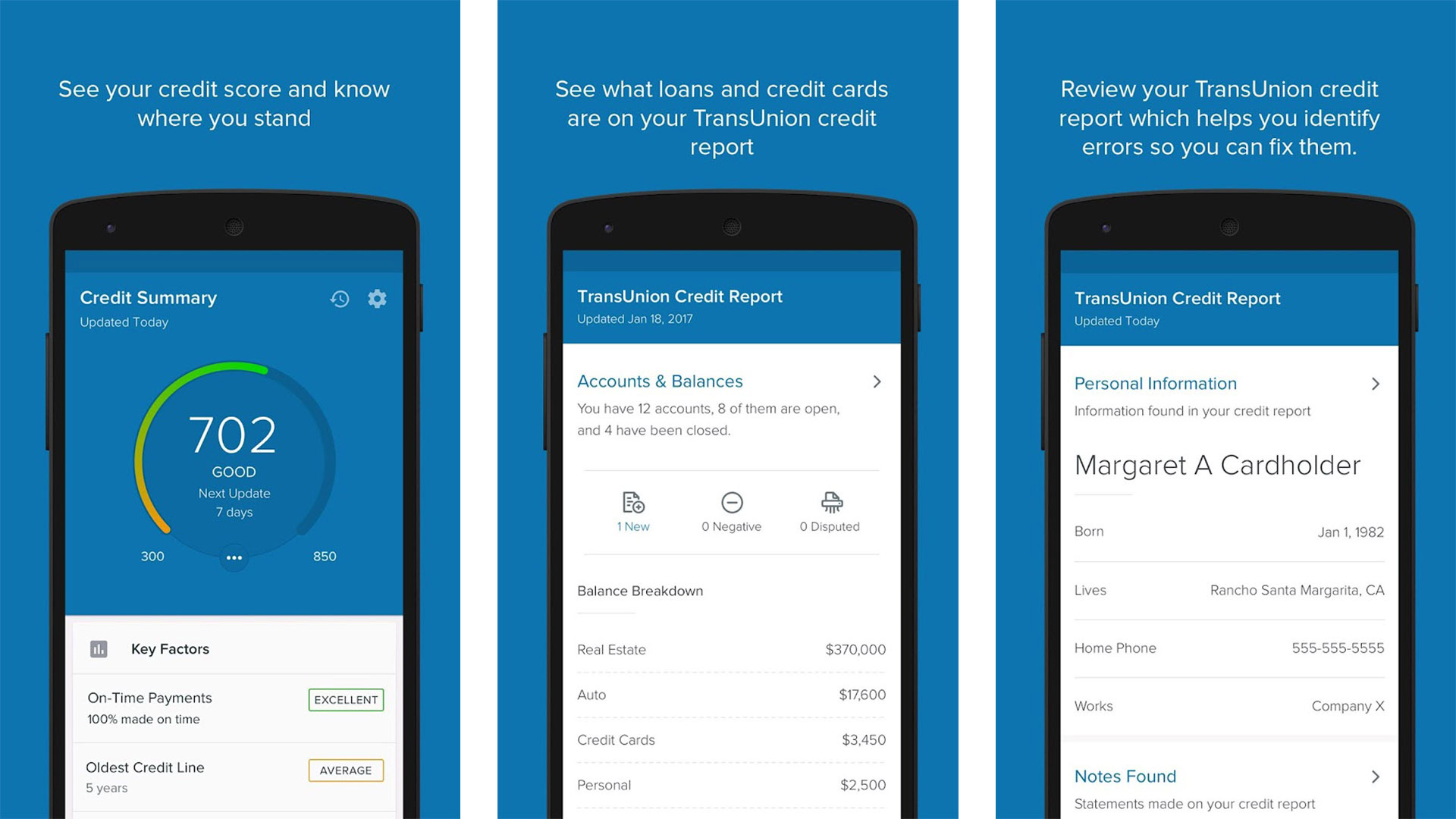

CreditWise from Capital One

Price: Free

CreditWise by Capital One is a free app offered by the credit card company. Anybody can use it, even if you don’t have a Capital One credit card. It offers free weekly TransUnion credit scores. You can also review your credit report from TransUnion to see your various accounts. Some other features include a credit simulator to see how your decisions affect your score and alerts for various nefarious things, like if your social security number ends up on the dark web. It’s pretty great for a free service.

Experian Credit Report

Price: Free / $9.99-$19.99 per month

All three of the major credit bureaus are on the Play Store, but Experian is the only one that has a decent mobile app. The app gives you a free credit report along with your FICO score whenever you want. It also helps you improve your credit by adding in things like paying your bills and utilities.

Some other features include alerts when your credit changes, updates to your credit score (every 30 days), and more. There are subscription services, and you’ll need one to do anything other than the most basic stuff.

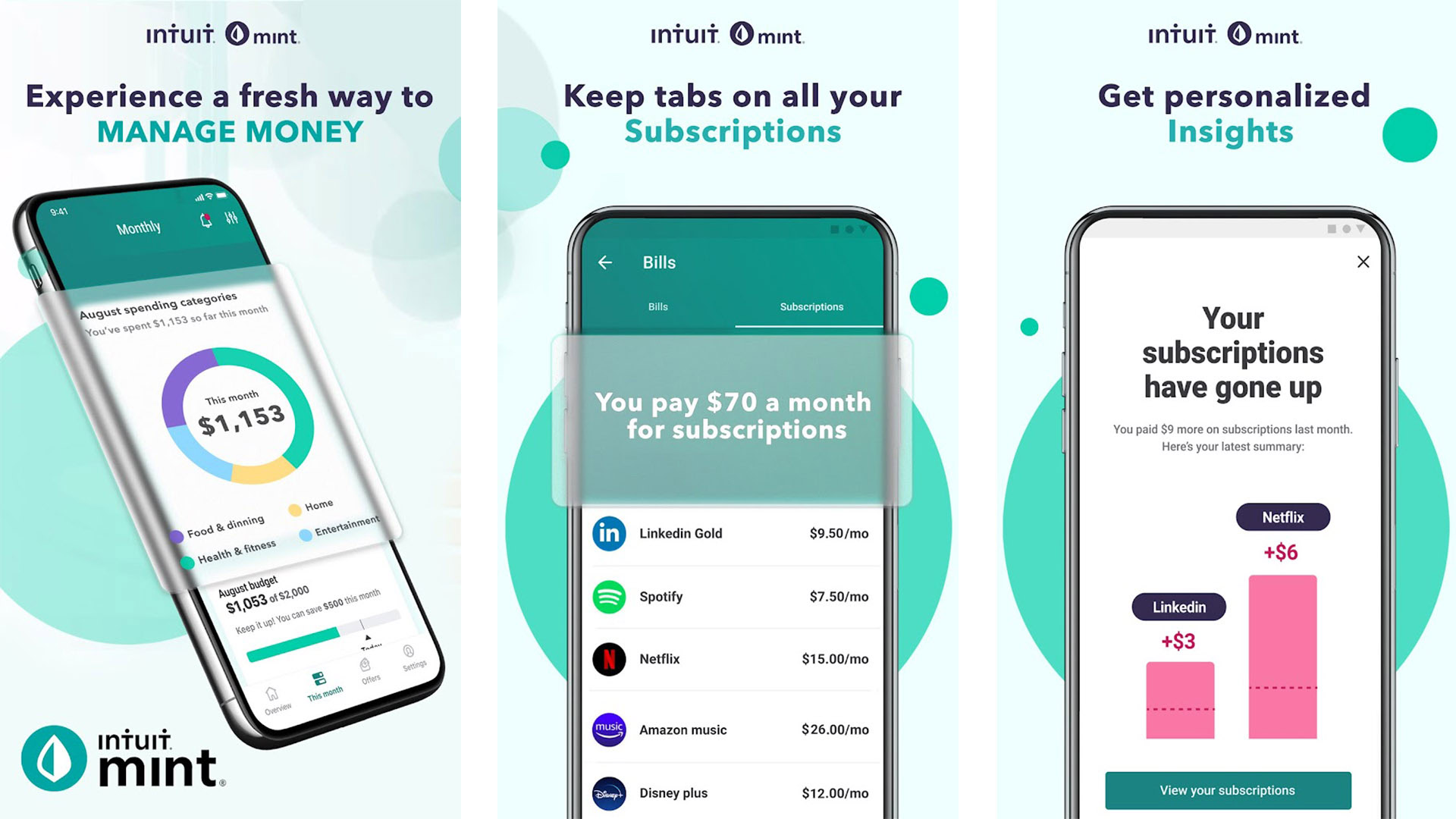

Mint

Price: Free

Mint is one of the most popular budgeting apps on mobile. Its primary focus is helping you manage your money more effectively. It does this with a wide range of features, like spending graphics, a budget tool, etc. However, one of the many features of the app is the ability to pull your credit score so you can see what you’re dealing with.

It won’t deliver alerts if your credit score changes, but it’s a nice one-two punch for people who want to manage their money better and watch their credit score go up.

MyFICO

Price: Free trial / $19.95-$39.95 per month

MyFICO is a premium service that lets you check your FICO score whenever you want. Several companies do credit scores, but an outsized percentage of lenders use your FICO score. It’ll also show you different FICO scores depending on the type of purchase. Thus, your mortgage FICO may be different than if you were going for an auto loan.

The app also includes various reports, insights, alerts, and even graphics to help you see your FICO score over time and ways you can improve it. The only downside is that although you get a free trial, a subscription is required after the trial period ends.

NerdWallet

Price: Free

NerdWallet is very similar to Mint. It’s a money management app with a bunch of tools to help you save money, spend less, and manage your money better. One of those functions includes the pulling of your credit score so you can see it go up or down over time.

NerdWallet also sends you notifications when your credit score changes, shows you articles about how credit scores work, and gives you advice on how to build better credit. It’s definitely not perfect, especially for super niche things like having multiple accounts at the same bank, but otherwise, it’s decent.

WalletHub

Price: Free

WalletHub is another direct competitor to companies like Credit Karma or Credit Sesame. It pulls your credit score and claims to update it every day. You can also monitor your credit 24/7 and set up alerts for various activities — and there is a debt payoff plan function where it helps you build a plan to pay off existing debt.

It services credit card ads as a source of income, but otherwise, the app is entirely free to use. Some people have reported login bugs, but most people don’t seem to have them. It’s quite good and competes favorably with the others.

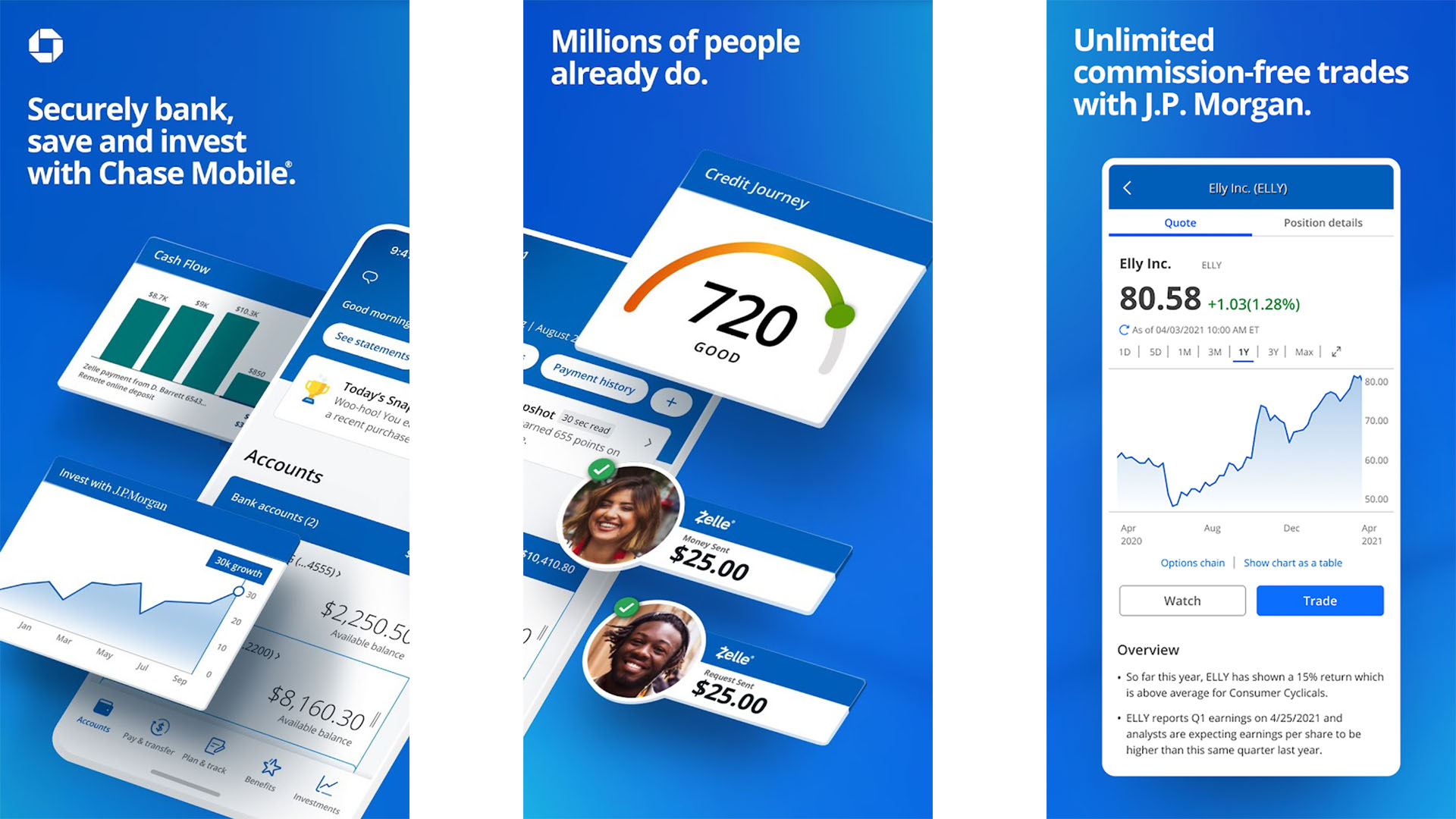

Some banking apps do it

Price: Free

Some banking apps and most credit card companies offer free credit scores. Some examples include Capital One (listed above), Chase, Bank of America, Citibank, many credit unions, and more. You simply need to get a hold of your bank’s customer service to find out if yours offers it and how to access everything. In most cases, it’s pretty easy and updates regularly so you can keep track of your accounts and your credit score in the same place.

FTC’s official website

Price: Free

The FTC says you’re entitled to one free copy of your credit report every 12 months. Obviously, you can get it more often than that through other means, but this is still an option. It’s especially good for people who don’t want to sign up for a whole service that emails or pesters them all the time. At the button below, you can go to the FTC’s website, where you can find out how to get your credit report for free.

If we missed any great credit score apps, tell us about them in the comments. You can also click here to check out our latest Android app and game lists.