Salem unemployment trends through November 2021 (Pamela Ferrara/Special to Salem Reporter)

The Salem area unemployment rate inched down to 4.1 percent in November, falling for the sixth month in a row. This translates into 8,700 people unemployed in Marion and Polk counties, which make up the Salem Metropolitan Statistical Area.

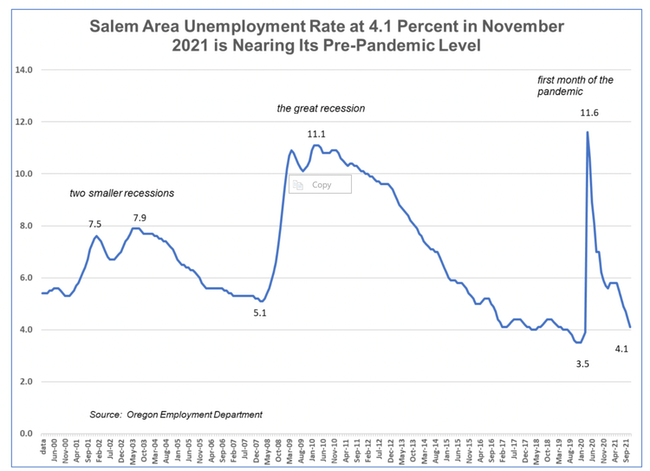

It took only 21 months for the unemployment rate to decline from double digits in April of 2020 to 4% in November of 2021 – just one of the many unusual aspects of the pandemic downturn.

We’ll examine more unusual aspects of recent unemployment history next. But first, let’s define the unemployment rate, as it is often misunderstood.

The unemployment rate is the number of people unemployed divided by the number of people in the labor force and expressed as a percentage. If a person is not working, and is looking for work, they are considered unemployed. Those working, and those not working and looking for work, added together, make up the labor force.

The unemployment rate is arrived at by means of a survey. Each month, surveyors of the federal Bureau of Labor Statistics question members of approximately 60,000 households around the country regarding their work status. The unemployment rate is estimated from the responses.

The unemployment rate is not a measure of those collecting unemployment insurance. Young people who are looking for a job for the first time, or someone who’s been employed before, hasn’t looked for a job in a while, and decides to look for one, are both considered unemployed. In neither instance would the job seeker collect unemployment.

However, in times of high unemployment, such as at the beginning of the pandemic, and during the great recession of 2008, a larger percentage of the unemployed collect unemployment than at times of low unemployment. This is because most of the unemployed were laid off from a job, and were eligible to collect unemployment.

Another unusual aspect of the pandemic downturn is the fact that it took just one month for the Salem area unemployment rate to leap from 3.6% to 13.2%. During the great recession, in contrast, the unemployment rate took 25 months to increase from 5.1% to 11.3% (see graph).

Another dramatic contrast is the fact that since April of 2020, the unemployment rate has taken only 21 months to come back down to nearly pre-pandemic levels. In the great recession, the rate took seven years to recover to pre-recession levels.

Next, we’ll look at some unusual aspects of industry unemployment rates in the U.S. during the pandemic. We use U.S. information because industry unemployment rates are estimated from a monthly survey of businesses. In both Oregon and the Salem area, the number of businesses in the survey sample are too small to produce a reliable estimate. However, the Salem area’s industry make-up is similar to that of the U.S. So, we can assume that Salem’s industry unemployment rates were similar.

Leisure and hospitality workers were hit hardest in the early months of the pandemic (Pamela Ferrara/Special to Salem Reporter)

Leisure and hospitality workers were hit hardest in the early months of the pandemic (Pamela Ferrara/Special to Salem Reporter)

Unemployment in the first month of the pandemic was uniquely concentrated in service industries where employees had extensive public contact, not surprisingly (see table above). What might be surprising is how concentrated in only a handful of industries unemployment was. The leisure and hospitality industry experienced an unemployment rate of nearly 40%, as many of the industry’s businesses were completely shut down.

The other services industry, which includes hair and nail salons, repair and maintenance businesses, pet grooming and the like, also experienced business closures and ran up an unemployment rate of 23% in April of 2020. The wholesale and retail trade unemployment rate was in double digits, as many retail establishments curtailed numbers of customers and laid off staff at the beginning of the pandemic.

The private education and health services industry also experienced nearly 11% unemployment, as doctors and dentists’ offices cut back on routine patient care and laid off staff. Industries with little public contact, or those which could do business remotely, such as financial activities (banks, insurance companies and the like) experienced some unemployment, but it was minimal compared to the three industries discussed above.

The other services and education and health services industries have recovered, with unemployment rates in November 2021 hovering around the average of 4.1%. However, leisure and hospitality was still experiencing unemployment at nearly twice the average rate, 7.5%.

Unemployment rates remain lower for people with more education, though they’ve fallen across the board (Pamela Ferrara/Special to Salem Reporter)

Unemployment rates remain lower for people with more education, though they’ve fallen across the board (Pamela Ferrara/Special to Salem Reporter)

Some aspects of unemployment in the pandemic downturn were not unusual. For example, unemployment rates by educational attainment displayed the same pattern as they have for decades. The highest unemployment rates were for those attaining less than high school, and the lowest for those attaining bachelors’ degrees or higher (see table above).

In times of high unemployment, large numbers of the unemployed are “long-term” unemployed, defined as being unemployed for 27 weeks or more. The pandemic downturn was no exception. This is a problem for labor markets, and for those unemployed, because the longer a person is unemployed, the more difficult it becomes to find a job.

Finally, the pandemic downturn and the great recession are similar in that unemployed Oregonians received billions of dollars in additional unemployment benefits from the federal government. The CARES Act, passed by Congress at the beginning of the pandemic, allowed states to extend benefits to those previously not eligible, such as the self-employed.

Oregon used the expanded definition of benefit eligibility, and 12 billion dollars in federal aid came to Oregonians. A large chunk of it was in the form of expanded unemployment benefits.

During the great recession federal unemployment extensions lengthened the maximum number of weeks to draw unemployment insurance in Oregon to 99 weeks, 72 weeks longer than usual. This amounted to several billion dollars in federal aid.

In both downturns, the extra income allowed many families to survive, pay bills and buy groceries. The economy would have been in far worse shape without it.

We may see the unemployment rate dip below four percent in the Salem area soon. The U.S. rate dipped below 4% in December, and Oregon and the Salem area usually follows suit.

However, the new Covid surge may cause a temporary set-back to the declining rate – we’ll have to wait and see.

Pam Ferrara of the Willamette Workforce Partnership continues a regular column examining local economic issues. She may be contacted at [email protected].

JUST THE FACTS, FOR SALEM – We report on your community with care and depth, fairness and accuracy. Get local news that matters to you. Subscribe to Salem Reporter starting at $5 a month. Click I want to subscribe!