52-Week Money Challenge: Save $1,378 in a Year

Commitment to Our Readers

GOBankingRates' editorial team is committed to bringing you unbiased reviews and information. We use data-driven methodologies to evaluate financial products and services - our reviews and ratings are not influenced by advertisers. You can read more about our editorial guidelines and our products and services review methodology.

20 Years

Helping You Live Richer

Reviewed

by Experts

Trusted by

Millions of Readers

How much money do you think you could save in a full year, week by week? Without a strategy, plans to boost savings are at risk of falling through. The 52-week savings challenge is easy, motivating and you can start the plan at any week of the year.

What Is the 52-Week Money Challenge?

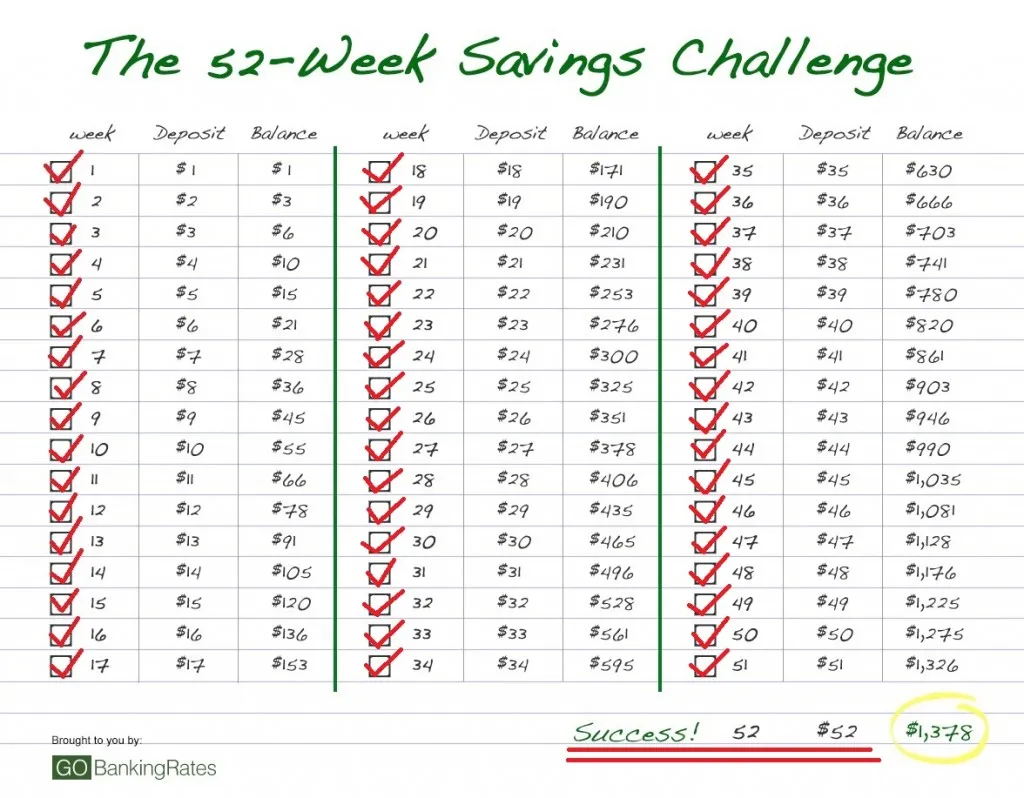

The purpose of the 52-week money challenge is to save $1,378 in 52 weeks by matching the amount of money you set aside with the number of each week. For example, in week one you set aside $1, in week two you set aside $2, in week three you set aside $3 and so on. You continue saving according to the corresponding week number until you reach $1,378.

You can reach your $1,378 annual savings goal in different ways. The challenge’s flexibility allows you to increase or decrease your savings amount each week. You can even skip weeks and save more in subsequent weeks if you need to. As long as you end up with $1,378 at the end of 52 weeks, you’ve succeeded.

How To Get Started

You can participate in the 52-week savings challenge by downloading a printable chart to keep track of your savings or registering to use an online 52-week money challenge form. The printable chart is a PDF that you use as a trackable reference.

You can customize the online form according to your preferences. Here are the parameters that you can adjust.

- Start date

- Savings mode — increasing, reverse or constant

- Challenge length — 52 weeks or 12 weeks

- Multiplier — between 1 and 10

After putting in your parameters on the form, you can generate your customized 52-week money challenge chart and even print it if you’d like.

Why the 52-Week Savings Challenge Works

Initiating a habit of saving can sometimes feel like an uphill battle. The beauty of the 52-week savings challenge lies in its uncomplicated approach, making it an attractive strategy for anyone looking to boost their savings at any point throughout the year. The concept is easy — save the amount of money equivalent to the number of the week that is on the calendar. No advanced math skills are required.

The real strength of the 52-week challenge is its adaptability. Unlike specific New Year’s resolutions, this challenge doesn’t confine you to start only at the beginning of the year. You can embark on this savings journey anytime, offering a flexible path to cultivating better financial habits without waiting for a specific date.

How To Stay Motivated

How can you stay motivated to successfully complete the 52-week savings challenge?

Here’s some tips:

- Decide if this financial challenge is for you. Saving $1 the first week may be easy, but consider what your financial situation might be on week 52.

- Decide where you will save your money. You could use an envelope system, but a more practical method is to open a separate savings account to manually or directly deposit your weekly savings into the account. Your money might even earn a little interest.

- Create a purpose for your saving — a savings goal — perhaps a vacation, a birthday party or a college tuition payment.

- Let your friends and family members know about your challenge. They can help hold you accountable and keep you motivated to reach your financial goal of saving $1,378 in 52 weeks.

How To Adjust Along the Way

You’ve set your start date, have your bank account or your envelopes set up and printed your savings chart. Now, it’s time to decide how you want to start your 52-week money challenge.

For many, spending spikes at various times throughout the year, such as during holiday seasons or around special occasions like birthdays. To accommodate for this, consider the reverse savings method, where you save larger amounts at the start of your challenge and gradually decrease the amount week by week. This strategy ensures you save the bulk of your funds when your budget is less strained, allowing for a smoother saving journey regardless of what pops up.

Good To Know

If you’re concerned about whether you’ll be able to save enough on the 52-week savings challenge, think about reducing some of your weekly expenses. This will help you develop healthier spending habits and live within your budget.

FAQ

Here are the answers to some of the most frequently asked questions about saving money.- How much money do you save with the 52-week money challenge?

- If you are diligent every week, you could have $1,378 by the end of the challenge.

- What is the 52-week money challenge?

- The 52-week money challenge is a simple and effective way to save money over a year. Each week, you save an amount corresponding to the week number, starting with $1 in week one and ending with $52 in week 52, totaling $1,378 saved by year-end.

- How can you save $10,000 in six months?

- To save $10,000 in six months, you need to save approximately $1,667 per month. This requires a detailed budget, cutting unnecessary expenses, increasing your income through side gigs and sticking to your savings goal rigorously.

- What is the 100-envelope in 52 weeks challenge?

- The 100-envelope challenge is a variation of the 52-week money challenge. Instead of weeks, you use 100 envelopes, each labeled with a number from $1 to $100. Each week, randomly pick two envelopes and save the amount written on them. This accelerates the saving process, allowing for more significant savings in less time.

- What is the save $5,000 in three months challenge?

- To save $5,000 in three months, you need to save approximately $1,667 each month. Start by reviewing and adjusting your budget to cut unnecessary expenses, seek additional income sources and prioritize your savings by setting up automatic transfers to a dedicated savings account.

The article above was refined via automated technology and then fine-tuned and verified for accuracy by a member of our editorial team.

Our in-house research team and on-site financial experts work together to create content that’s accurate, impartial, and up to date. We fact-check every single statistic, quote and fact using trusted primary resources to make sure the information we provide is correct. You can learn more about GOBankingRates’ processes and standards in our editorial policy.

- NBC12. 2022. "Savings Booster: The 52-Week Money Challenge."

- Mint. 2021. "52-Week Money Challenge: How to Save $1378 in a Year."

- FORUM Credit Union. "52-Week Money Challenge."

Written by

Written by  Edited by

Edited by