Here’s What Will and Will Not Get Taxed From Your Social Security Benefit

Commitment to Our Readers

GOBankingRates' editorial team is committed to bringing you unbiased reviews and information. We use data-driven methodologies to evaluate financial products and services - our reviews and ratings are not influenced by advertisers. You can read more about our editorial guidelines and our products and services review methodology.

20 Years

Helping You Live Richer

Reviewed

by Experts

Trusted by

Millions of Readers

Although tax situations are different for everyone, some individuals will be required to pay taxes on their Social Security income. The Social Security Administration (SSA) states that such benefit taxation usually only occurs if you have other substantial income in addition to your benefits. Examples of other significant income can include regular wages, self-employment income, interest, dividends and other taxable income that must be reported on your tax return.

The SSA reports that you will pay tax on only 85% of your Social Security benefits based on IRS rules. The rules for taxation apply if you:

- file a federal tax return as an “individual” and your combined income is:

- between $25,000 and $34,000 — in this event, you may have to pay income tax on up to 50 percent of your benefits.

- more than $34,000 — in this event, up to 85 percent of your benefits may be taxable.

- file a joint return, and you and your spouse have a combined income that is:

- between $32,000 and $44,000 — if this is true, you may have to pay income tax on up to 50 percent of your benefits.

- more than $44,000 — if this is the case, up to 85 percent of your benefits may be taxable.

- are married and file a separate tax return — in such a circumstance, you probably will pay taxes on your benefits.

Your combined income is calculated by adding nontaxable interest and one-half of your Social Security benefits to your adjusted gross income, for the purposes of the above rules.

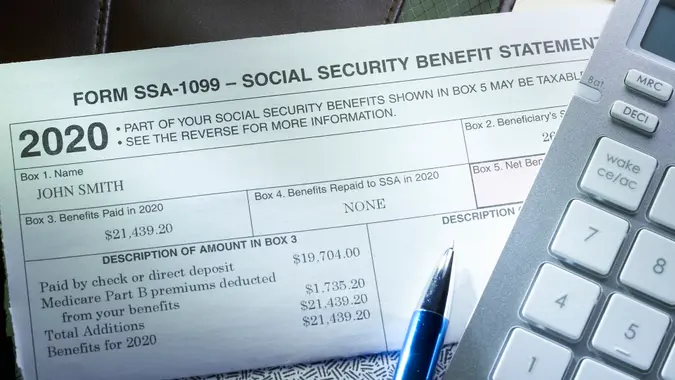

Every January, you will receive your Social Security Benefit Statement, Form SSA-1099, which will show you the amount of benefit you received the year prior. This form will be needed when you file your federal income tax return later in the year to find out if your benefits are subject to tax. This form is now available online through the mySocialSecurity website. By signing up and creating an account, you can view this information online without needing to wait for it to be mailed to your home.

If you already know you will need to pay taxes on your Social Security benefits, it’s possible to have the taxes automatically withheld from your benefits. This can be a smart way to make sure taxes are automatically taken care of, which will make it easier for you come tax return time.

If you do not meet the above requirements, chances are you will not have to worry about your benefits being taxed. However, as always, you can find this out for yourself by logging onto your personal account — or contacting the social security office nearest you.

More From GOBankingRates

Written by

Written by  Edited by

Edited by