Ahead of a Tuesday Congressional hearing over Jerome Powell's nomination for a fourth term to head the Federal Reserve, prepared testimony from Powell was released Monday in which he acknowledged the challenges facing the U.S. economy.

"We know that high inflation exacts a toll, particularly for those less able to meet the higher costs of essentials like food, housing, and transportation," Powell said in the testimony according to The Associated Press.

Members of the Senate Banking Committee will question Powell in a hearing Tuesday, in which he will likely face harsh questioning about whether the Fed is prepared to meet the needs of the economy in the coming months and take the necessary steps to slow the record rates of inflation of the past several months.

After the likely tough questions, it is still expected that Powell will be confirmed with relative bipartisan support.

In the prepared statements, Powell also said the current American job market is strong and the economy is "expanding at its fastest pace in many years."

However, he acknowledged the long-term economy may look different than what the U.S. is accustomed to after the pandemic subsides.

"We can begin to see that the post-pandemic economy is likely to be different in some respects," Powell said. "The pursuit of our goals will need to take these differences into account."

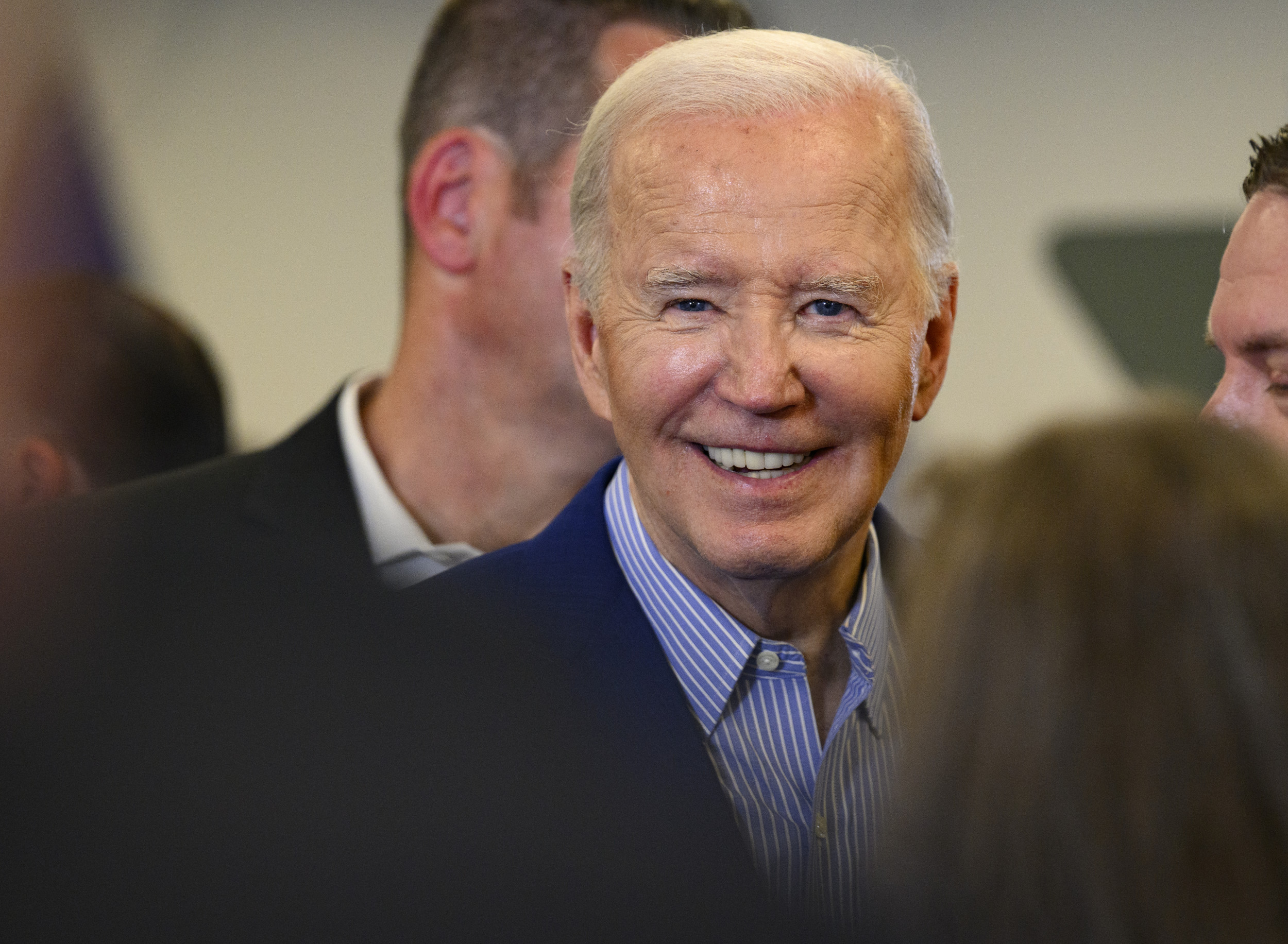

President Joe Biden announced Powell's reappointment in late November.

Inflation has soared to the highest levels in four decades, and on Wednesday the government is expected to report that consumer prices jumped 7.1 percent over the past 12 months, up from November's 6.8 percent annual increase.

Economists and former Fed officials are increasingly raising concerns that the Fed is behind the curve on inflation. Last Friday's jobs report, which showed a sharp drop in the unemployment rate to a healthy 3.9 percent, and an unexpected wage increase, has fanned those worries.

While lower unemployment and higher pay benefit workers, those trends can potentially fuel rising prices.

At its last meeting in December, Powell said the central bank is rapidly accelerating its efforts to tighten credit with the goal of reining in inflation. The Fed will stop buying billions of dollars of bonds in March, ahead of its previously announced goal of doing so in June. Those bond purchases are intended to encourage more borrowing and spending by lowering longer-term rates.

Fed officials now expect to hike short-term interest rates three times this year, a sharp shift from September, when they were split over doing it even once. Economists increasingly expect them to raise rates at least four times in 2022.

Powell has previously said that the Fed's initial goal was to return the economy and job market to pre-pandemic levels, when the unemployment rate had fallen to a 50-year low of 3.5 percent and the proportion of Americans either working or looking for work was higher than it is now.

But more recently, Powell has acknowledged that many of the people who stopped working or seeking jobs in the pandemic are unlikely to return anytime soon. Millions of older Americans retired earlier than they likely would have without COVID, and many people are foregoing jobs to avoid getting infected.

That has left businesses chasing fewer workers to fill more than 10 million open jobs, a near-record, and has forced them to rapidly increase hourly pay. Rising pay could fuel more spending, possibly pushing prices higher.

The Associated Press contributed to this report.

Uncommon Knowledge

Newsweek is committed to challenging conventional wisdom and finding connections in the search for common ground.

Newsweek is committed to challenging conventional wisdom and finding connections in the search for common ground.

About the writer

A 2020 graduate of Kent State University with a Bachelor's degree in Journalism, Aaron has worked as an assigning editor ... Read more

To read how Newsweek uses AI as a newsroom tool, Click here.