MENU

Start

- Best Small Business Loans for 2024

- Businessloans.com Review

- Biz2Credit Review

- SBG Funding Review

- Rapid Finance Review

Our Recommendations

- 26 Great Business Ideas for Entrepreneurs

- Startup Costs: How Much Cash Will You Need?

- How to Get a Bank Loan for Your Small Business

- Articles of Incorporation: What New Business Owners Should Know

- How to Choose the Best Legal Structure for Your Business

Our Guides

- Business Ideas

- Business Plans

- Startup Basics

- Startup Funding

- Franchising

- Success Stories

- Entrepreneurs

Small Business Resources

Grow

- The Best Credit Card Processors of 2024

- Clover Credit Card Processing Review

- Merchant One Review

- Stax Review

Our Recommendations

- How to Conduct a Market Analysis for Your Business

- Local Marketing Strategies for Success

- Tips for Hiring a Marketing Company

- Benefits of CRM Systems

- 10 Employee Recruitment Strategies for Success

Our Guides

- Sales & Marketing

- Finances

- Your Team

- Technology

- Social Media

- Security

Small Business Resources

Lead

- Best Business Phone Systems of 2024

- The Best PEOs of 2024

- RingCentral Review

- Nextiva Review

- Ooma Review

Our Recommendations

- Guide to Developing a Training Program for New Employees

- How Does 401(k) Matching Work for Employers?

- Why You Need to Create a Fantastic Workplace Culture

- 16 Cool Job Perks That Keep Employees Happy

- 7 Project Management Styles

Our Guides

- Leadership

- Women in Business

- Managing

- Strategy

- Personal Growth

Small Business Resources

Find

- Best Accounting Software and Invoice Generators of 2024

- Best Payroll Services for 2024

- Best POS Systems for 2024

- Best CRM Software of 2024

- Best Call Centers and Answering Services for Busineses for 2024

Our Recommendations

Online only.

FreshBooks vs. QuickBooks Online

Table of Contents

Whether you’re a freelancer with a few clients or an established business owner with many customers, you need the best accounting software to help you keep your finances in order. The leading solutions on the market today let you send digital invoices, receive online payments and keep on top of income and expenses effortlessly so you can focus on doing what you do best — running your enterprise.

We’ve compared FreshBooks and QuickBooks Online — two high-quality accounting programs — to help you determine which platform offers the features you need at the best value.

Editor’s note: Looking for the right accounting software for your business? Fill out the below questionnaire to have our vendor partners contact you about your needs.

FreshBooks vs. QuickBooks Online Compared

Criteria | FreshBooks | QuickBooks Online |

|---|---|---|

Starting Price | $19 per month | $30 per month |

Invoicing | Unlimited custom invoices (set number of clients on some plans), automated fees and payment reminders and hours worked, logged and converted to invoices | Unlimited invoices to unlimited clients, automatic billable hours tracking on some plans, progressive invoicing and batch invoicing |

Accounting Features | Double-entry accounting, automatic bank reconciliation, advance payments for recurring payments and accountant access | Automatic expense tracking and categorizing, business bank accounts with 5% annual percentage yield (APY) on savings, inventory management features with top plans and insightful reporting tools |

Integrations | Over 100 integrations, Including international payments via Stripe and FreshBooks Payroll powered by Gusto for an added fee | Over 750 integrations, with payroll and point-of-sale (POS) connections available |

Ease of Use | Colorful and easy-to-use dashboard and mobile app for invoicing and customer communication | Straightforward platform with guided setup support and mobile app for recording receipts |

Customer Service | Phone support Monday through Friday, 8 a.m. to 8 p.m. Eastern time; enhanced premium support and onboarding assistance; online resources and chatbot | Phone support Monday through Friday, 6 a.m. to 6 p.m. Pacific time and Saturday, 6 a.m. to 3 p.m. PT for most plans; 24/7 support for Advanced plan; online resources and chatbot; bookkeeping assistance for monthly fee |

Who Do We Recommend FreshBooks For?

FreshBooks, a popular QuickBooks alternative, is a solid accounting software program with more than 30 million customers worldwide. Thanks to its four cost-effective plans and powerful, time-saving invoicing features, we think FreshBooks is ideal for meeting the needs of freelancers, solopreneurs and service-based small businesses.

If sending unlimited invoices quickly and without stress is a top concern, FreshBooks is the solution for you. We especially love that even users without accounting experience will get the hang of the platform in no time. With standard time tracking, features to manage expenses and over 100 integrations, you’ll have virtually all of your financial management needs met without breaking the bank.

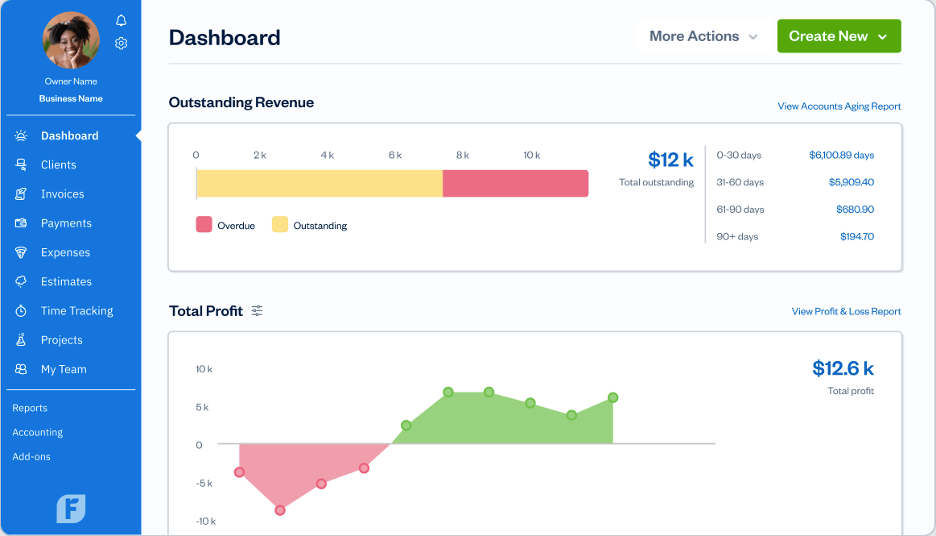

FreshBooks’ simple dashboard lets you visualize valuable data, such as money that you’re owed. Source: FreshBooks.

FreshBooks is our choice for solopreneurs and service-based businesses because of its:

- Intuitive platform to create branded invoices with a few clicks.

- Mobile app that lets you bill clients on the go.

- Native tools for time tracking and project management.

Learn how else this accounting solution excels in our comprehensive FreshBooks review.

Who Do We Recommend QuickBooks Online For?

Intuit QuickBooks Online is our choice for any small or medium-sized business that needs reasonably priced accounting software with potent features that can scale as your company grows. Its four plans are designed to meet the needs of a range of businesses at affordable prices.

From tracking inventory to sending invoices, QuickBooks has everything you need to cover all of your financial bases. That’s why it’s a leader in the accounting software industry. We particularly recommend QuickBooks for businesses that sell products, as the software can help you keep on top of your stock. Plus, the platform integrates with top POS systems and hundreds of other business solutions to streamline operations.

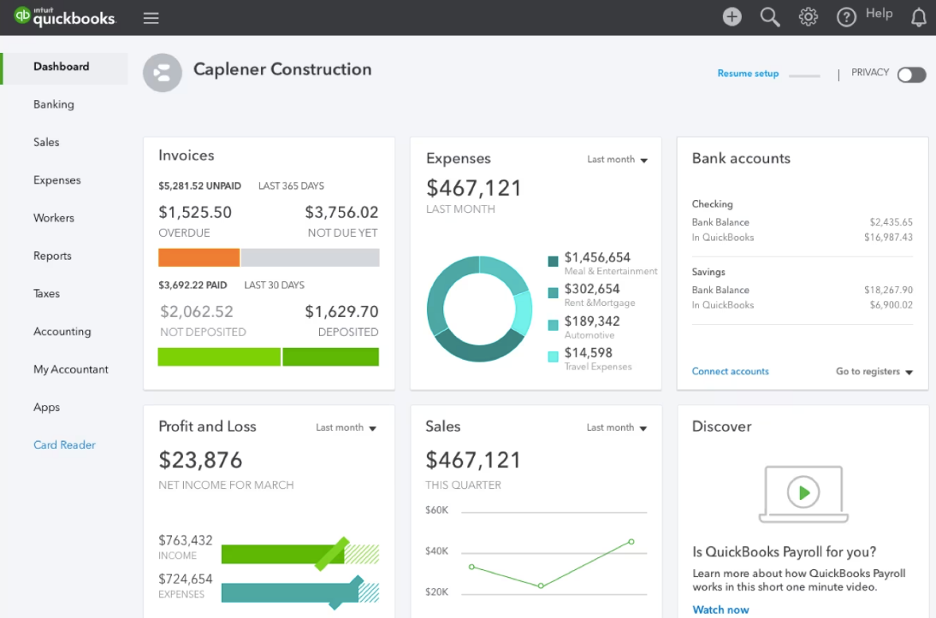

QuickBooks Online lets you easily track the financial data that matters most to your company. Source: QuickBooks.

We love QuickBooks Online for businesses with growth potential because of its:

- Scalable platform with impressive features.

- Easy-to-use interface even for complex functions.

- Powerful reporting tools to help you take your business further.

You can find out what else this accounting software has to offer in our detailed review of QuickBooks Online.

FreshBooks vs. QuickBooks Online Comparison

We’ve compared FreshBooks and QuickBooks Online across key criteria to help you choose the right accounting software for your business.

Price

FreshBooks

- There are four cost-efficient plans that allow unlimited invoicing.

- Only the top two plans allow for unlimited billable clients.

- You can try any plan free for 30 days.

Plan | Price | Features |

|---|---|---|

Lite | $19 per month | 5 billable clients, unlimited invoices, unlimited estimates, unlimited expense tracking, credit card and bank payments through automated clearing house (ACH), tax reports, time tracking |

Plus | $33 per month | Everything in Lite, along with 50 billable clients, recurring invoices, unlimited proposals, e-signatures, accountant access, bank reconciliation, financial and double-entry accounting reports |

Premium | $60 per month | Everything in Plus, along with unlimited billable clients, customized emails, project tracking and bill receipt data capture |

Select | Custom pricing | Everything in Premium, along with 2 users, data migration, lower credit card transaction fees, capped ACH fees, FreshBooks branding removal, dedicated support and advanced payments |

FreshBooks has four affordable plans value-packed with features to help you send invoices, accept payments and keep on top of your finances. Freelancers, startups and other small businesses will love being able to create unlimited invoices, generate estimates and track time for a bargain.

A notable downside is that the entry-level Lite plan only allows you to bill five clients. But for a nominal price increase, you get up to 50 billable clients with the Plus package. Meanwhile, businesses serving many clients can opt for the top-tier plans, Premium and Select, which allow unlimited clients. The highest plan, Select, also includes the “Advanced Payments” feature, which is an add-on costing $20 per month for the other packages.

We love that you also have the option to create a customized plan based on your needs. Even better, FreshBooks offers a 30-day free trial and sometimes the vendor runs special deals, such as 70 percent off for four months. Paying annually will save you an additional 10 percent. If more than one person on your team needs access to the software, you can add more users for $11 per person.

QuickBooks Online

- QuickBooks offers four packages priced for all types of businesses.

- Free business bank accounts add value to all plans.

- You can choose a 30-day free trial or a temporary discounted rate.

Plan | Price | Features |

|---|---|---|

Simple Start | $30 per month | Access for 1 user, automated bookkeeping, importing and organization of transactions, receipt capture, banking with 5% APY, invoicing, payments, basic reports, estimates and 1 connected sales channel |

Essentials | $60 per month | Everything in Simple Start as well as access for 3 users, enhanced reports, 3 connected sales channels, currency conversions, bill management and manual time entry |

Plus | $90 per month | Everything in Essentials, as well as access for 5 users, unlimited sales channel connections, inventory tracking, project tracking and budget planning |

Advanced | $200 per month | Everything in Plus, as well as access for 25 users, fixed asset tracking, employee expense entry, batch invoicing, custom roles and permissions, workflow automation, data restoration and premium support |

QuickBooks Online sells four plans at a range of price points to meet the needs of businesses of all sizes. All plans include stellar automated bookkeeping functionality, unlimited invoicing and useful reporting. However, we think QuickBooks’ business banking, available with every plan, really sets it apart. This is a rare feature among accounting software programs. Meanwhile, the vendor’s higher plans allow you to add more users and expand functionality to make the platform even more comprehensive.

When signing up, you have the option of getting a 30-day free trial, but if you skip the trial, QuickBooks will give you a 50 percent discount for the first three months. With any plan, you can add extra help from bookkeeping experts for $50 per month. We appreciate that there are no contracts so that you can cancel at any time.

It’s also worth highlighting that, as of 2024, QuickBooks now offers a Solopreneur Plan for $20 a month, with basic invoicing and accounting features for self-employed businesses. This option arguably rivals FreshBooks’ Lite package. [Find out more about the different versions of QuickBooks.]

Winner: FreshBooks

FreshBooks offers powerful invoicing and competent accounting for a steal. Most freelancers and small businesses that don’t have complex needs or an extensive client list will find FreshBooks saves them money over QuickBooks. While the Lite plan’s billable client restrictions might be too limiting, the next plan expands to 50 clients for almost the same price as QuickBooks’ entry-level offering. However, if you need multiple users and want more robust accounting features, QuickBooks might be a better financial choice.

Invoicing

FreshBooks

- You can easily create unlimited invoices from a FreshBooks template or estimate.

- The program automates payment reminders and recurring invoices.

- The number of billable clients is limited in the lower-level plans.

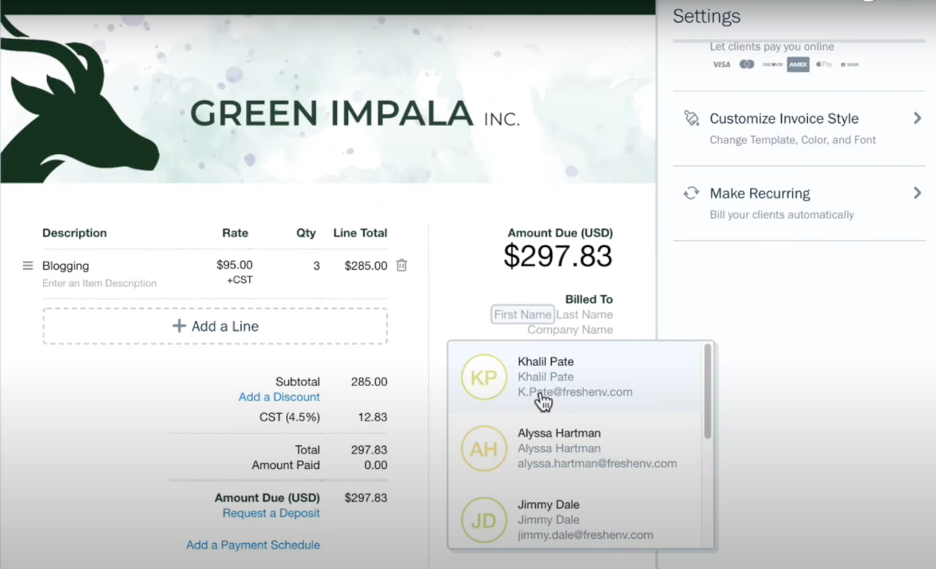

You can create invoices in FreshBooks with your company’s logo in a few clicks. Source: FreshBooks.

We were impressed by how easy it is to create an invoice and accept payments with FreshBooks. From a single screen, you can click and drag to input or rearrange information on customized invoice templates that match your branding. Plus, you can convert estimates or proposals into invoices seamlessly and add tracked time and expenses without a hitch.

FreshBooks takes the hassle out of getting paid by letting clients pay right from their digital invoice. You can accept card or ACH payments, track invoices and automate reminders and late fees when customers don’t pay. We especially like the invoice deposits option, which guarantees cash flow before you start a project.

What also makes FreshBooks’ invoicing so great is that almost all features come standard, including automatic tax calculation and recurring invoices. The only drawback is that billable clients are limited to five clients and 50 clients, respectively, with the Lite and Plus plans.

If your business is running low on cash, invoice factoring can help. A factoring company advances the money you’re owed on outstanding invoices, so your business stays afloat until client payment is received.

QuickBooks Online

- You can easily send unlimited branded invoices to an unlimited number of clients.

- Not all QuickBooks plans include automatic calculation of billable hours.

- Progress invoicing and batch invoicing come with higher-level plans.

QuickBooks makes sending invoices and getting paid a breeze. We love that every plan includes unlimited invoicing for unlimited clients. Creating invoices is straightforward even if you choose to customize bills with your corporate logo and branding.

Clients can make online payments directly from their online invoice, letting you get paid quicker. Every user on your plan can automate recurring invoices and track payments. Apart from Simple Start, all packages let you manually enter billable hours or they can be imported from QuickBooks Time or Google Calendar integrations.

We liked the premium features on the higher tiers, such as progress invoicing, which lets you divide projects into multiple invoices according to stages or percentage of work completed. Batch invoicing with the Advanced package is especially useful. If you offer the same product or service to many clients, you can send out hundreds of invoices quickly with minimal effort.

Winner: FreshBooks

While both solutions offer reliable invoicing capabilities, FreshBooks is our choice because you get most of the same features as QuickBooks for a fraction of the price. We especially love that automated time tracking is included with all FreshBooks plans while you’ll either have to manually enter hours or pay for an add-on with QuickBooks. We also found creating invoices simpler with FreshBooks.

Keep in mind that the limited number of billable clients in FreshBooks’ two cheapest plans could be a disadvantage for some businesses. Larger companies that have to invoice many clients might be better served by QuickBooks.

Accounting Features

FreshBooks

- You get competent accounting features with FreshBooks, such as automatic bank reconciliation.

- Time tracking for managing projects and easy billing comes standard.

- There aren’t any tools for inventory management.

With FreshBooks, you can track, import and categorize expenses from most banks easily. Enhanced accounting features, such as receipt capture, start with the Plus tier. Also with that plan and above, double-entry accounting and accountant access ensure your numbers add up. Another standout feature is bank reconciliation. Unlike most competitors, FreshBooks reconciles transactions automatically and continuously. [Learn the difference between an accountant and a bookkeeper.]

Since the platform is geared toward service and project-based businesses, there are no tools for managing inventory or purchasing stock. If your business sells products and needs to keep track of stock, FreshBooks isn’t the best option and you may want to go with QuickBooks instead.

However, FreshBooks does shine at managing projects and keeping track of hours worked seamlessly. Every plan comes with easy time tracking through a timer and hours can be imported directly to an invoice. Visual reports let you see where time is being spent and how employees are performing so you can optimize your team’s productivity.

We also appreciate that the add-on “Advanced Payments” feature turns the platform into a virtual terminal. You can store credit card information for recurring payments or subscriptions. This function costs $20 per month and charges 3.5% plus 30 cents per credit card transaction.

QuickBooks Online

- You can create custom categories to organize expenses automatically.

- The business bank account can help you save money.

- QuickBooks excels with inventory management and reporting.

We found that QuickBooks has an array of excellent features to help any business manage its finances. The software automatically tracks expenses and sorts them into categories. You can even create custom categories, such as deductible and nondeductible expenses, which is especially useful come tax time. While most competitors offer similar tools, QuickBooks’ intuitive classification system makes organization especially easy.

Tax accounting is just one type of accounting. Most software can help you with multiple types, including traditional accrual accounting involving accounts payable.

One of our favorite features that distinguishes QuickBooks from the competition is that it offers business bank accounts to all users. There are no monthly fees or minimums, so businesses of all sizes can benefit. Plus, you get an impressive 5% APY on savings.

The two higher-tier plans, Plus and Advanced, include effective inventory management tools, something FreshBooks lacks. QuickBooks sends alerts when you’re out of something and updates the system when inventory arrives. The software will convert purchases into bills to pay, plus you also get excellent reporting to help you sell better. Beyond inventory analytics, we think QuickBooks outshines its rivals with its excellent variety of accounting reports.

Winner: QuickBooks Online

QuickBooks is the clear winner when it comes to accounting features. While both products boast solid invoicing and expense-tracking functions, QuickBooks has more features that add exponential value. If your business needs to keep track of stock, FreshBooks’ lack of inventory management features means the program isn’t right for you. QuickBooks also offers more extensive reporting than FreshBooks.

That said, FreshBooks has one advantage over QuickBooks thanks to its standard time-tracking feature. QuickBooks does offer a separate product integration (see our QuickBooks Time review), but it will cost you extra every month. However, it provides some tools FreshBooks is missing.

Both QuickBooks and FreshBooks facilitate mileage tracking. If your employees drive their own vehicles for your business, there are mileage reimbursement laws you need to follow.

Integrations

FreshBooks

- There are over 100 integrations in the FreshBooks App Store.

- A partnership with Stripe lets you accept international currency.

- Get an all-in-one payroll solution powered by Gusto.

With over 100 possible integrations, including connections with top business software solutions, we think most small companies will be able to find products in FreshBooks’ App Store to help run their business better. For example, there is software you can sync with FreshBooks to help with scheduling, managing clients and preparing taxes. While time tracking is included with FreshBooks, you also have the option to work with a third-party application. We especially love that you can accept international currencies through Stripe.

Payroll and accounting go hand in hand, so we were pleased to see you can integrate the FreshBooks platform with the best payroll services. FreshBooks also offers its own payroll service powered by Gusto. It costs $40 per month, plus $6 per employee. [Check out our Gusto review to learn more.]

QuickBooks Online

- You can integrate QuickBooks with more than 750 business software solutions.

- There are many options for POS and payroll software integrations.

- QuickBooks Payroll integrates fully with the QuickBooks Online accounting platform.

We were amazed by the amount of integrations available with QuickBooks. With over 750 options in its app marketplace, you’ll be hard-pressed to find a business solution QuickBooks doesn’t work with. As our recommended accounting solution for product-oriented businesses, we were especially happy to see that QuickBooks integrates with the best POS systems.

You can also benefit from native integrations with parent company Intuit’s other solutions — check out our QuickBooks Payroll review for one such example. There are multiple plan options, too, so no matter the size of your business, you’ll be sure to find a bundle that works for your needs.

Winner: QuickBooks Online

QuickBooks offers hundreds more integrations than FreshBooks, so you can rest assured you’ll almost certainly be able to keep working with the business software you already know and love. We also found it especially useful that QuickBooks integrates with multiple POS solutions as well as other products in the Intuit family.

Ease of Use

FreshBooks

- The FreshBooks dashboard is colorful and easy to navigate.

- Create and send invoices on the go with the mobile app.

- You can communicate with clients via the app’s chat feature.

One of the reasons we love FreshBooks is because of how easy it is to create invoices and collect what you’re owed. We found navigating the colorful dashboard to be a piece of cake thanks to its clear organization and simple interface. Even novices can master the platform in no time with little assistance as the learning curve is minimal.

FreshBooks’ mobile app makes invoicing painless no matter where you are. You can just as easily create, send and track invoices from your phone as from your computer. Plus, the in-app chat feature allows you to communicate with clients, so you can stay on top of any issues and keep them in the loop no matter where you are. Beyond that, you can track hours worked and capture receipts right from the palm of your hand. However, we were disappointed the app doesn’t include reporting features or team member management.

QuickBooks Online

- Receive guided help in choosing the right plan and learning the software.

- Even complex tasks feel simple with the QuickBooks platform.

- The mobile app lets you do everything from your phone.

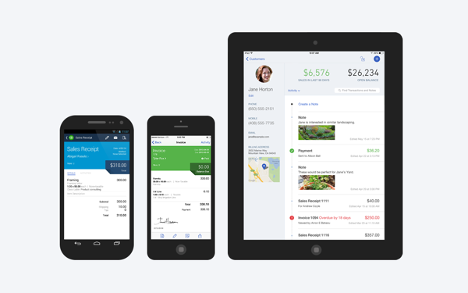

You can log expenses, send invoices and manage customers all from the QuickBooks Online mobile app. Source: QuickBooks

We appreciate that QuickBooks ensures you get all the features you need for your business right from the get-go. By answering a few questions on the vendor’s website, Intuit will recommend a specific package tier or service. Even better, no matter what plan you choose, the platform’s interface is straightforward to understand and navigate.

Admittedly, the dashboard isn’t as simple as FreshBooks, but that’s because it’s designed to support advanced features and complicated accounting tasks for bigger companies. Despite this, we still found that using the program was easy. All plans include guided setup support to help you get the most out of the software.

We love that you can customize the dashboard to meet your needs, so managing invoices, payments, income and expenses is simple. Plus, you can do everything from the mobile app — including view reports, snap photos of receipts and manage client data — so accounting isn’t limited to the office.

Winner: Tie

For an easy-to-use accounting platform, you can’t go wrong with either FreshBooks or QuickBooks. Both offer features that let you save time by creating invoices and tracking expenses with a simple mouse click or camera snap, even from your phone. The simplicity of FreshBooks might make it a better choice for those new to accounting software or those with only basic needs. For larger businesses, QuickBooks makes complicated financial management tasks simpler and you can get more out of the mobile app.

Both FreshBooks and QuickBooks Online make handling most of your accounting needs a snap, but sometimes you might need professional advice. Read our guide on when you should hire a certified public accountant who is well-versed in accounting standards.

Customer Service

FreshBooks

- FreshBooks has online support resources, including a chatbot.

- You can call for assistance during business hours or schedule a callback.

- Users on the Select plan get premium support.

We found FreshBooks’ online customer support resources to be excellent. The vendor offers helpful articles broken down into categories to let you troubleshoot problems or help you better use the software. An automated pop-up chatbot can also answer common questions. But if you need to speak to a representative, you can schedule a callback from the chat window or call yourself Monday through Friday, from 8 a.m. to 8 p.m. ET.

We love that Select plan users get enhanced support with access to a dedicated customer service number, setup assistance, onboarding and employee training. If you expect to need significant help despite FreshBooks’ high usability, spending more money for the support included in this top-tier package may be worth it.

QuickBooks Online

- It’s easy to call support or schedule a callback.

- QuickBooks has superb online resources like blogs and training videos.

- Advanced plan subscribers get 24/7 live support.

We were impressed with QuickBooks’ customer support when we called. Simple Start, Essentials and Plus users can start a chat with a live support rep or schedule a callback Monday to Friday from 6 a.m. to 6 p.m. PT and Saturday from 6 a.m. to 3 p.m. PT. Reaching out was easy, but you can also troubleshoot problems anytime with a live chatbot or use the vendor’s wealth of online resources, such as articles, blogs, videos, training and forums.

The Advanced plan includes expanded customer service, including 24/7 phone and chat support. Plus, you get access to valuable advanced training courses for up to 25 users. But regardless of which package you choose, if you need extra help with bookkeeping, you can add on extra assistance from accounting experts for $50 per month.

Winner: QuickBooks

Although both QuickBooks and FreshBooks offer exceptional customer support and similar resources, we think QuickBooks edges out FreshBooks because of how easy it is to speak with a live support person, either by chat or phone, including on Saturday. Plus, QuickBooks’ top-tier package provides around-the-clock support, something that sets their customer service apart.

FreshBooks vs. QuickBooks Recap

Choose FreshBooks if:

- You need an affordable accounting solution that can send unlimited invoices.

- You want to create automatic invoices based on hours worked without requiring multiple tools.

- You’re looking for uncomplicated software that will save you time.

Choose QuickBooks if:

- You want to integrate your accounting solution with the other business software you already use.

- You need excellent reporting and strong inventory-tracking tools.

- You’re looking for cost-effective software that will grow with your business.

FAQs

QuickBooks Online and FreshBooks are both cloud-based accounting software but they are different in some notable ways. FreshBooks is cheaper and its tools are geared toward freelancers and small businesses, while QuickBooks has plans for all kinds of businesses, especially those that need to track inventory. Both solutions are capable of handling typical accounting tasks but their specific financial management tools vary.

No, QuickBooks Online is not free, but you can try any plan with a 30-day trial.

FreshBooks’ weaknesses include billable client limits, lackluster reporting and a lack of inventory management tools.

Yes, you can convert from using QuickBooks to FreshBooks. For subscribers who sign up for the Select plan, FreshBooks offers an “Easy Switch” service to help with data migration. FreshBooks will import your data from QuickBooks or another accounting software into its platform. Can FreshBooks do payroll?

Yes, FreshBooks can do payroll. You can add its payroll solution powered by Gusto to any FreshBooks accounting plan or connect with a third-party integration available in the vendor’s App Store.