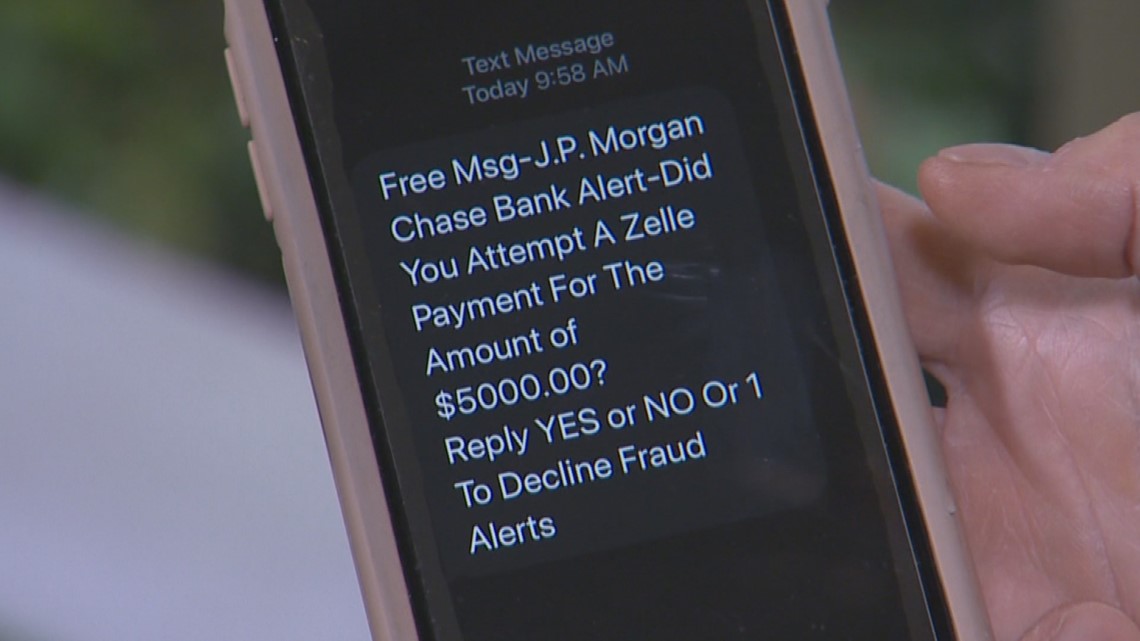

PORTLAND, Ore. — The trouble started when Lisa Mae Osborn got an unexpected text message warning, “J.P. Morgan Chase Bank Alert: Did you attempt a Zelle payment for the amount of $5,000?”

The Portland woman had received similar looking fraud warnings before but then her phone rang and the number showed Chase bank. Osborn answered, thinking someone from the bank was calling to help. What she didn't know at the time is that it wasn’t Chase.

Instead, it was a scammer who claimed to be a bank representative named "Charles." The man on the other end of the line provided Osborn's account information to make his story more believable. It’s not clear where the scammer got all these details.

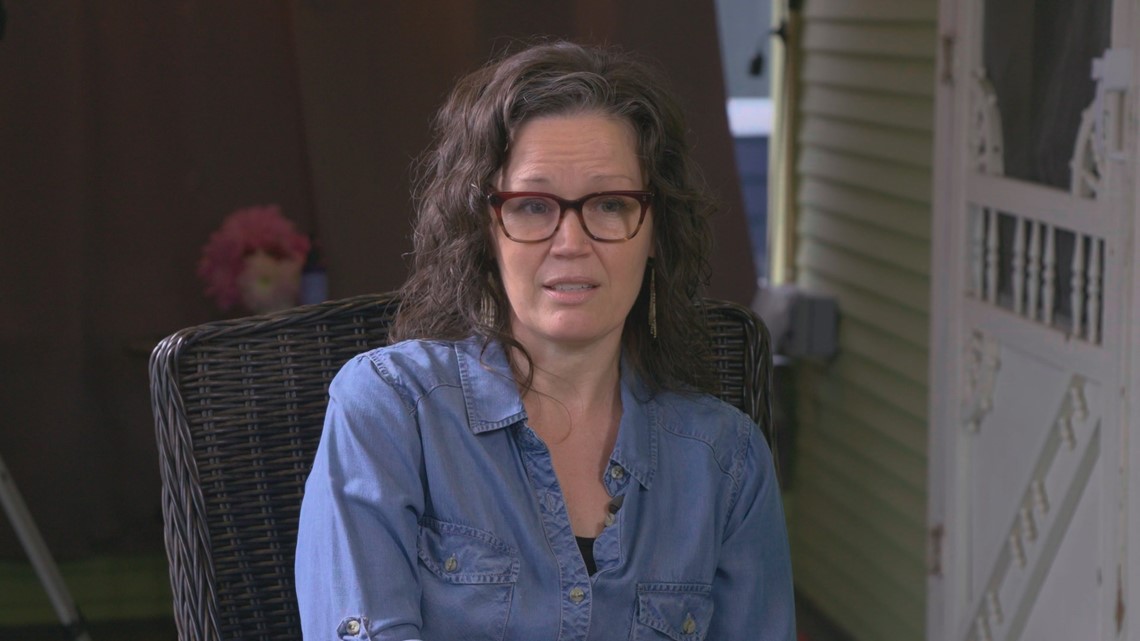

“They asked me if they could verify this was my home address and they read me my home address and they asked me if these were the last four digits of my social security number and they read me those numbers,” explained Osborn.

The crook suggested the bank could reverse the fraudulent charges by using a mobile banking app called Zelle.

Osborn had never transferred money through Zelle before but recognized the name. It’s owned by several banks, including Chase, and is widely promoted as a safe and easy way to send and receive money. In fact, Zelle is built right into the Chase mobile and online banking app.

“It wasn’t a separate app on my phone,” said Osborn. “It was inside the Chase online banking service.”

The crook helped Osborn set up a Zelle account so she could transfer the money back to herself — thinking it was a refund.

Instead, the fraudster likely diverted those payments, although it's not clear how. The money, taken out of Osborn’s three Chase accounts, went to the scammer.

“$23,000!” said Osborn. “That’s a lot of money. It is a very big portion of my earnings in a year.”

Throughout this scam — which played out over a couple days — Osborn tried to alert the real Chase bank several times.

KGW Investigates asked Zelle if it bears any responsibility when customers are defrauded through the platform. A spokesperson for the company said consumers should contact their financial institution and file a claim if they believe they are a victim of fraud.

“Protecting consumers from fraud and scams is a top priority for us,” said a Zelle spokesperson in a statement to KGW.

The Portland woman hoped that her longtime bank, Chase, would help recover her lost money. She called and called, even trying multiple departments.

“Chase’s response to me has been that this is my fault,“ said Osborn.

After weeks of fighting and filing claims, along with a separate inquiry from KGW, Chase changed its mind and agreed to help. Osborn got her money back.

Federal law requires banks to reimburse you for this type of fraud.

RELATED: BBB warns about fake shipping emails

“The important part is you need to act immediately,” said Chuck Harwood, spokesperson for the Federal Trade Commission. “There is a federal law called the Electronic Funds Transfers Act (EFTA) that limits your liability when you are the victim of a scam like this and when you transfer money in an unauthorized way.”

Another federal agency, the Consumer Financial Protection Bureau confirmed to KGW that consumers who suffer unauthorized transactions are entitled to this federal protection and banks are required to refund the stolen money.

Chase wouldn’t respond to our direct questions about Osborn’s case, citing customer privacy.

Instead, a bank spokesperson issued a written statement.

“We urge all consumers never to share their banking password or to send money to someone who says it will prevent fraud on their account. Bank employees won’t call, text or email consumers asking for this, but crooks will,” said Darcy Donahoe-Wilmot, a spokesperson for JP Morgan Chase.

Osborn worries that scammers have found a weakness and are exploiting the system. So, consumers need to protect themselves.

Never trust anyone who calls or texts and wants you to perform a financial transaction, even if the person appears to be from your bank.

Instead, call the bank yourself.

And don’t give out verification codes to anyone because you never know who’s on the other end of the line.