Closing post

Here’s the main stories so far:

Rolling coverage of the latest economic and financial news

Here’s the main stories so far:

Wall Street is pushing higher, as traders continue to digest the likely impact of Omicron on the recovery.

While the new variant may hit growth, and hamper the recovery in the travel sector, it could also deter central bankers from risking raising interest rates soon. That could provide support to the economy, and the markets, for longer.

David Miller, executive director at Quilter Cheviot Investment Management, explains:

What is, however, clear is that our reaction time to this new health challenge has been shortened by past experiences. Even sentimental politicians intent on providing voters with a happy Christmas can’t see the upside of stubborn denial. No one is assuming that the Omicron variant can be kept out however strong border controls are. It has already arrived in Europe and it must be only a matter of time before it crosses the Atlantic. If previous new waves tell us anything it is that markets tend to look forward as soon as the worst is known.

Investment strategists are already reducing growth forecasts for next year, which is bad news, and moderating assumptions about the need for higher interest rates, good news. The latter is likely to be the dominant factor when it comes to making a positive case for 2022.

So, the Dow Jones industrial average is now up 330 points or almost 1%

Big technology stocks, which fared well in the pandemic so far, are leading the charge, lifting the Nasdaq Composite by 2% today.

Investors still nervous about Omicron pile into the safety of megacap tech.

— Rachel (@tolstoybb) November 29, 2021

Amateur virology is all the rage in the City right now, writes our economics editor Larry Elliott.

And while there’s lots we don’t know about the latest Covid-19 variant, investors may have judged things correctly, he writes...

Omicron has arrived at just about the worst possible time for countries in Europe and North America because cold weather means people make themselves more susceptible to catching the virus as they spend more time indoors. If Omicron is as easily transmissible as epidemiologists fear, then that’s a worry.

What we also know is that the big developed countries were slowing down even before news of Omicron surfaced. Some amateur psychology would suggest consumers will spend less in the shops this Christmas and be more reluctant to go out for meals. Businesses will put investment plans on hold. It doesn’t take a full officially mandated lockdown to influence behaviour and some sectors of the economy – hospitality, travel, airlines – will suffer more than others.

The final thing we know is that economies have got used to dealing with the disruption caused by the pandemic. Even if vaccines are less effective against the new strain – and there is no evidence that is the case – the impact on activity will be moderated by working from home and shopping remotely.

In short, the markets have probably got their judgment about right. Omicron currently looks more like an economic setback than a calamity. But that’s only a hunch.

European stock markets ended the day a little higher, after their worst session in over a year on Friday.

The Stoxx 600 gained 0.8%, with gains in Paris (+0.5%), Frankfurt (+0.15%), Milan (+0.7%) and Madrid (+0.6%) as well as London.

The UK’s stock market has posted a modest recovery from Friday’s plunge.

With investors putting their initial alarm about Omicron behind them, the UK’s FTSE 100 index has closed 66 points higher at 7109 points, up almost 1% today.

That’s an improvement on the previous session, which saw 226 points, or £72bn, wiped off the Footsie in a pandemic panic.

BT Group finished the day as the top riser, up 6%, despite India’s Reliance denying reports that it was considering a takeover approach for the telco.

Some companies vulnerable to a new surge in Covid-19 recovered ground, with catering group Compass rising by 4.7%, budget airline Wizz Air up 5.5%, and conference organiser Informa 1.7% higher.

But airline group IAG lost its earlier gains, closing down 0.3%.

Oil majors lifted the UK stock market, with BP gaining 3% and Royal Dutch Shell up 2.4%, as the crude oil price recovered from its 10% plunge on Friday.

Brent crude is up 3% today, at around $75 per barrel, having traded around $83/barrel just last week.

Neil Campling, global TMT analyst at Mirabaud Equity Research, says investors are disappointed that Twitter didn’t appoint an external candidate to replace Jack Dorsey:

“The company had appeared to lose direction, struggling to monetise their network and were under pressure from activist Elliott. The initial reaction, stock +10%, reflects that Jack had probably run his course and it was time for change.

The fact that the stock reversed all the gains to trade lower is likely reflective of disappointment over who is now the CEO. It is the Chief Technology Officer, so it’s not an external hire which many wanted. Instead, it is someone who was in charge of the very process that was becoming antiquated and outdated. Not a good look.”

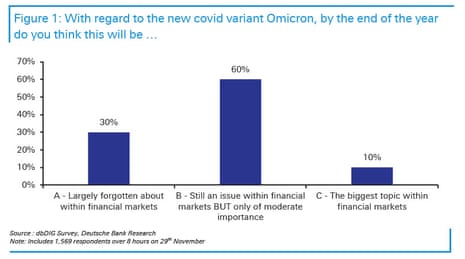

Few financial professionals expect Omicron to be the biggest topic in financial markets by the end of the year.

That’s according to a flash poll of over 1,500 financial professionals, conducted impressively speedily today by Deutsche Bank’s Jim Reid.

It found that only 10% think Omicron will be the biggest topic in financial markets at year-end, while 60% thought it would still be an issue but only of moderate importance.

The remaining 30% think this latest variant will be largely forgotten about.

Reid says this shows that the markets are relatively relaxed, as calm returns following Friday’s wobble. That could be a worry if the news flow becomes negative on the variant, he explains:

As such, it’s probably clear that markets are probably not set up for bad news on this front. So, negative Omicron news is likely to be bad for markets without huge additional stimulus.

Twitter’s shares have now dropped back from their earlier highs, and are now flat on the day at $47 as the markets digest Jack Dorsey’s departure, and his replacement.

Michael Hewson of CMC Markets says investors will hope the new CEO, Parag Agrawal, can focus fulltime on Twitter.

Twitter shares popped higher after it was reported that Jack Dorsey would be stepping down as CEO of the business. He has previously been accused of being a part time CEO, he also runs Square, which helps explain today’s share price reaction.

The hope is that new CEO Parag Agrawal will be able to devote 100% of his energy to stop the bleeding in the share price, from this year’s peaks at $80.

Investors seem so happy over news reports that @jack is stepping down as Twitter CEO, with Parag Agrawal to replace him, that trading in Twitter Inc. shares had to be halted this morning after they jumped as much as 11%.

— Brahma Chellaney (@Chellaney) November 29, 2021

Victoria Scholar, Interactive Investor’s head of investment, points out that Twitter’s latest financial results missed expectations, giving Agrawal plenty to work on.

Parag Agrawal, Twitter’s CTO has been named as Jack Dorsey’s successor, taking over as chief executive. The change in leadership is being received as a positive by the markets as a way for Twitter to turn over a new leaf. The development comes as no shock to its board members who have reportedly been preparing to say goodbye to Dorsey since last year.

Twitter’s stock has been struggling lately, shedding more than 45% since the February high, with shareholders hoping that Agrawal can restore confidence in the microblogging site. Its latest earnings were a disappointment with revenue guidance and monetizable daily users falling short of Wall Street’s expectations, sending shares down double digits on the day.

Back to the pandemic... and Ryanair’s CEO Michael O’Leary has said he sees no reason to cancel flights because of the Omicron variant.

O’Leary also said his airline’s flights were heavily booked for the next few weeks, Reuters explains:

“We are not cancelling any flights...I don’t see that (Omicron) as a justifiable reason to prevent people who are vaccinated or have negative PCRs” from travelling, O’Leary told a news conference in Lisbon.

“We frankly don’t think there is risk to air travel within Europe from those people,” he said, adding though that Ryanair was worried about some countries potentially shutting air travel, as was the case of Morocco.

Ryanair CEO says Omicron no reason to cancel flights https://t.co/pfoHCoHiF6

— Devdiscourse (@dev_discourse) November 29, 2021

Twitter co-founder Jack Dorsey has stepped down from his executive role at the social media company.

Dorsey will be replaced by chief technology officer Parag Agrawal, the company announced on Monday.

The surprise move ends Dorsey’s much criticized tenure as chief executive officer of both Twitter and Square, his digital payments company which led to Twitter stakeholders Elliott Management and billionaire investor Paul Singer calling on him to step down from one of those roles...

More here:

It’s official, Jack Dorsey is stepping down as Twitter’s chief executive.

The micro-blogging site says that its board of directors has unanimously appointed Parag Agrawal, Twitter’s chief technology officer, to succeed Dorsey as CEO.

In a statement, Dorsey says:

“I’ve decided to leave Twitter because I believe the company is ready to move on from its founders. My trust in Parag as Twitter’s CEO is deep. His work over the past 10 years has been transformational.

I’m deeply grateful for his skill, heart, and soul. It’s his time to lead.

BREAKING: Twitter CTO Parag Agrawal will replace Jack Dorsey as CEO pic.twitter.com/xLapMGEWfw

— Samuel Gould (@iamsamgould) November 29, 2021

Positive momentum has carried forward from the Asian and European sessions to drive a strong rebound out of the gates at the start of trade stateside, writes Victoria Scholar, head of investment at interactive investor.

The S&P 500 and the Nasdaq are both higher by more than 1% with many US traders returning to the markets after the Thanksgiving holiday when light volumes on Friday exacerbated the selling pressure. The Dow is in the green for the first session in four while the Dow and S&P 500 are on track for their best day in over six weeks.

As the world scrambles to digest the threat of Omicron, the sense is that Friday’s panic selling was overdone with many traders using this as an opportunity to buy the dip. Investors have responded well to the speedy imposition of travel restrictions by governments over the weekend and to the mild-to-moderate symptom displays of Omicron patients so far.

However, the fallout for markets and the economy depends on a series of unknowns including the transmissibility of the variant, its resistance to the vaccine and the severity of symptoms.

Shares in Moderna have opened up by more than 7%, extending gains after rallying over 20% in Friday’s session after its chief medical officer said a reformulated vaccine could be ready by early next year. The company is fully focused on the task at hand, already testing three vaccine boosters against the variant and announcing a new variant-specific vaccine candidate against Omicron.

Investors are positively surprised by the speed at which the biotech company has already got to work on the new variant with the response time allowing the share price to restore its upward trendline after a 3-month decline. Although the stock has given back nearly 30% of its gains since the August peak, Moderna shares are still enjoying a 245% gain year-to-date.

-Shares in #Moderna are up by nearly 8%

— Victoria Scholar (@VictoriaS_ii) November 29, 2021

-Extending gains after Friday's 20% rally

-The stock is up ~245% YTD

-But its still 30% below its summer peak

-Investors encouraged by its quick response to Omicron

-The biotech company is testing 3 boosters and a variant-specific vaccine pic.twitter.com/NSNnh1UHnL

Comments (…)

Sign in or create your Guardian account to join the discussion