CLOUD

CLOUD

CLOUD

CLOUD

CLOUD

CLOUD

Despite the posture that Big Tech generally and Amazon.com Inc. specifically should be regulated or broken apart, recent survey research suggests that Amazon faces many disruption challenges, independent of any government intervention.

Specifically, respondents to our survey believe that history will repeat itself in that there’s a 60% probability that Amazon will be disrupted by market forces, including self-inflicted wounds. Amazon faces at least seven significant disruption scenarios of varying likelihood and impact, perhaps leading to the conclusion that the government should let the market adjudicate Amazon’s ultimate destiny.

In this Breaking Analysis, and ahead of Amazon Web Services Inc.’s annual re:Invent cloud computing conference, we share the full results of our survey designed to asses what, if anything, could disrupt Amazon. We’ll also show you some data from Enterprise Technology Research that indicates the strong momentum of AWS is likely to continue, which could be a factor in any government intervention.

Recently, in a collaboration with author David Moschella, SiliconANGLE Media’s video studio theCUBE initiated a community research project to understand: 1) What scenarios could disrupt Amazon and 2) What’s the likelihood that each scenario would occur? We developed the scenarios, tested them in small samples, refined the questions and launched the survey.

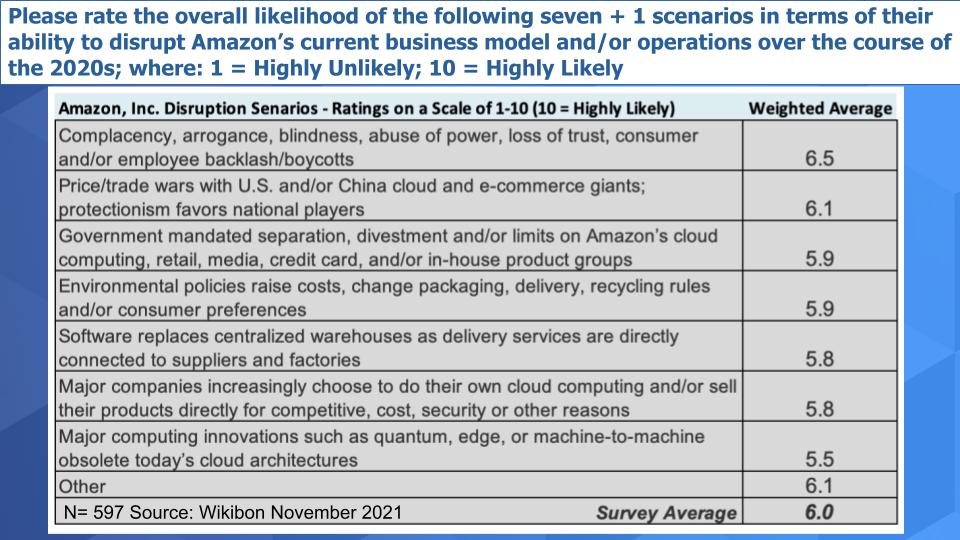

The survey asked respondents to rate the likelihood of each scenario disrupting Amazon, Inc. on a scale of 1 to 10 as shown below.

We have inferred that the ratings are a proxy for probability of disruption. In the interest of simplicity, we chose to not have respondents evaluate the impact of the disruption at this time.

Here are the notable takeaways:

By looking at the distribution of responses you can see further evidence of potential disruption to Amazon. Below are the distribution of results for each scenario in the order the questions were presented:

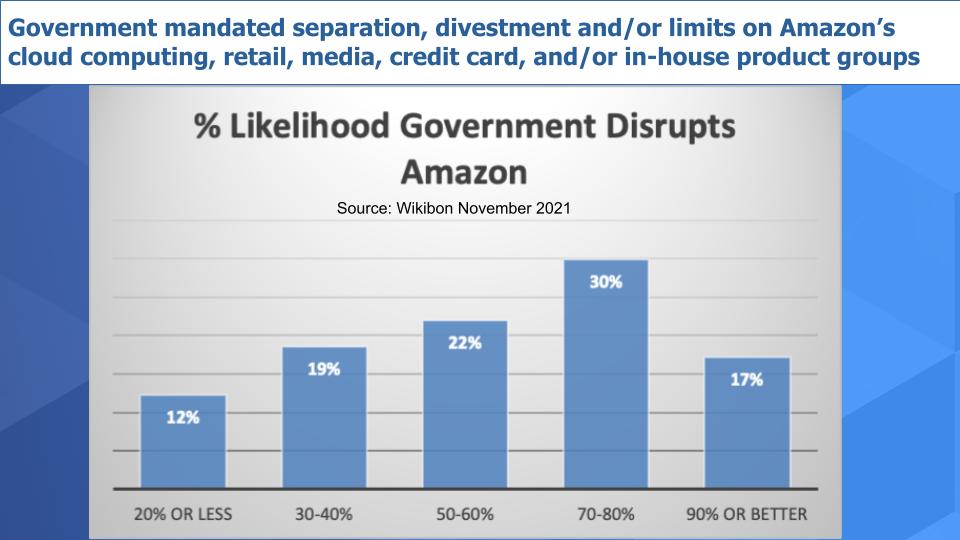

| Q1. Government-mandated separation, divestment and/or limits on Amazon’s cloud computing, retail, media, credit card and/or in-house product groups. |

Forty-seven percent of respondents believe there’s a 70% or better chance of the government disrupting Amazon.

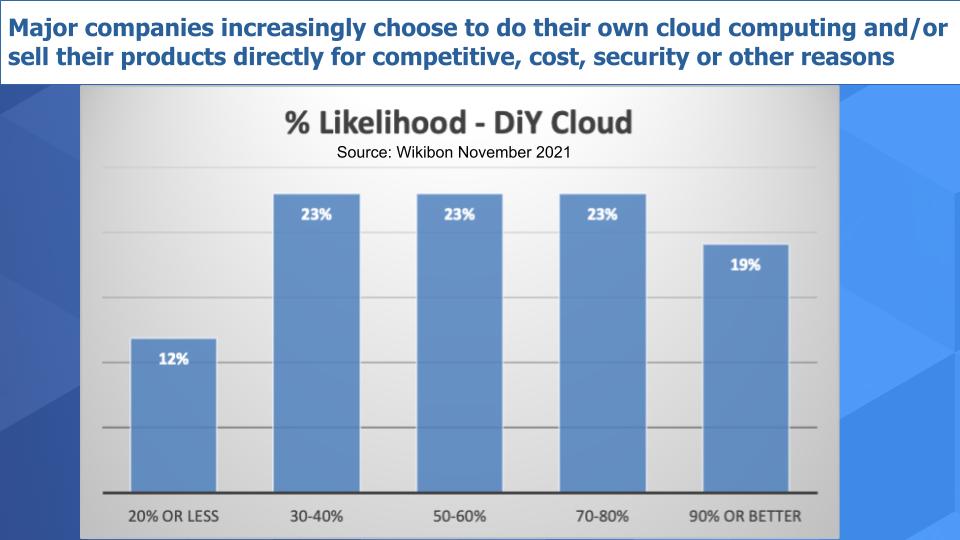

| Q2. Major companies increasingly choose to do their own cloud computing and/or sell their products directly for competitive, cost, security or other reasons. |

Do-it-yourself cloud was not as prominent, but still, 42% of respondents gave this a 70% chance or better. Think the Walmart cloud here.

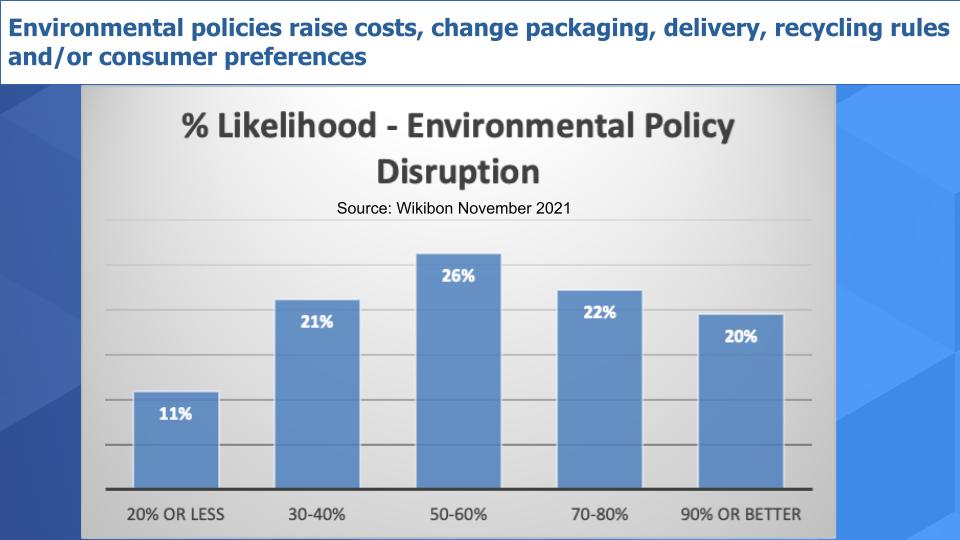

| Q3. Environmental policies raise costs, change packaging, delivery, recycling rules and/or consumer preferences |

Environmental policy intervention showed a similar profile with a somewhat fewer respondents (42%) indicating the likelihood was in the 70%-plus range.

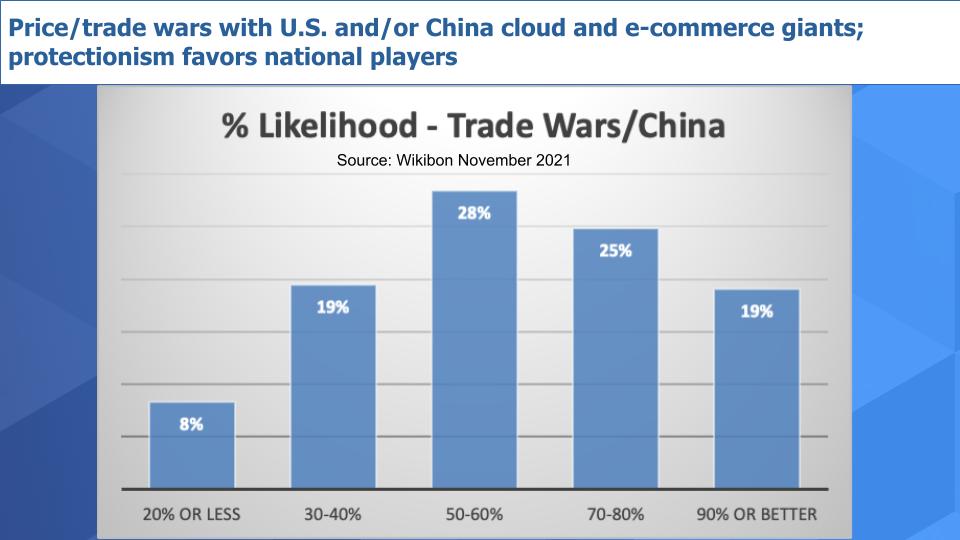

| Q4. Price/trade wars with U.S. and/or China cloud and e-commerce giants; protectionism favors national players |

Pricing wars, trade wars and China had a similar profile for high likelihood, as 43% of respondents gave this scenario a 70% or better chance. We think this scenario could be even more disruptive to Amazon. For instance, what if you go on the web to order an item and Amazon doesn’t have it? But Alibaba does. Maybe not such a huge factor in the U.S. – although it could be – but certainly outside of the U.S., it could be a scenario that disrupts Amazon.

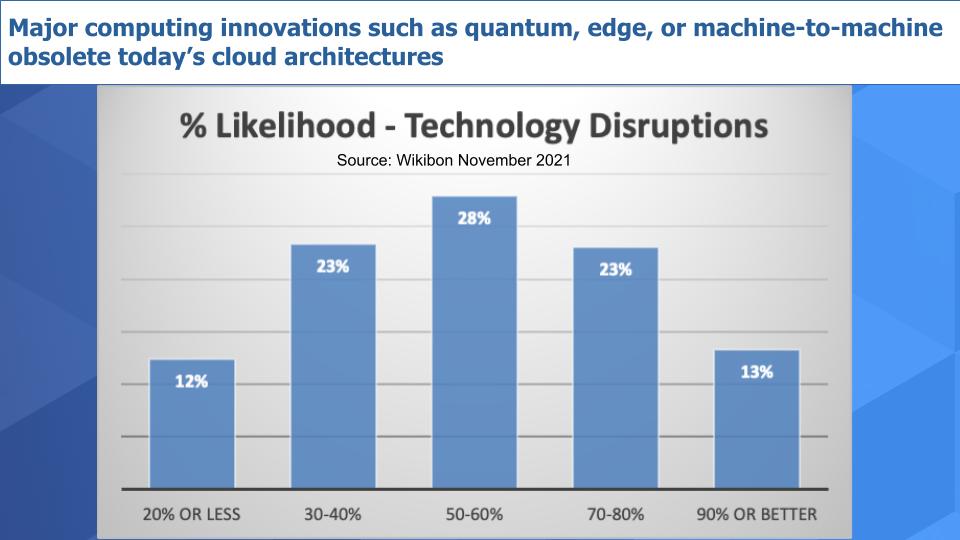

| Q5. Major computing innovations such as quantum, edge or machine-to-machine obsolete today’s cloud architectures |

Tech disruptions ranked the lowest in terms of the distribution of respondents – 36% gave this a 70% or better chance, presumably because AWS is seen as on the cutting edge technically. But as the pendulum swings back to distributed computingm it could pressure AWS’ dominant model.

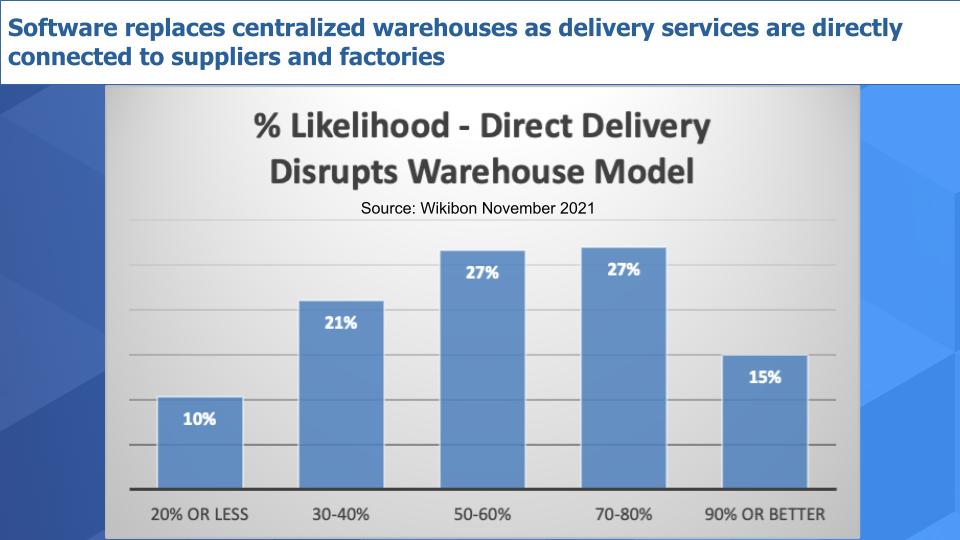

| Q6. Software replaces centralized warehouses as delivery services are directly connected to suppliers and factories |

This is perhaps one of the more interesting scenarios. Imagine if Google LLC creates software that upon a search you can order the item and have it shipped directly to you — like an airline ticket except the concept now applies to physical goods.

This direct model would disrupt Amazon’s warehouse approach, but as you can see it didn’t strike the respondents as likely as some of the other scenarios. We think it’s actually one of the more plausible scenarios and is certainly being put to the test by Alibaba, which doesn’t rely on a massive warehouse infrastructure.

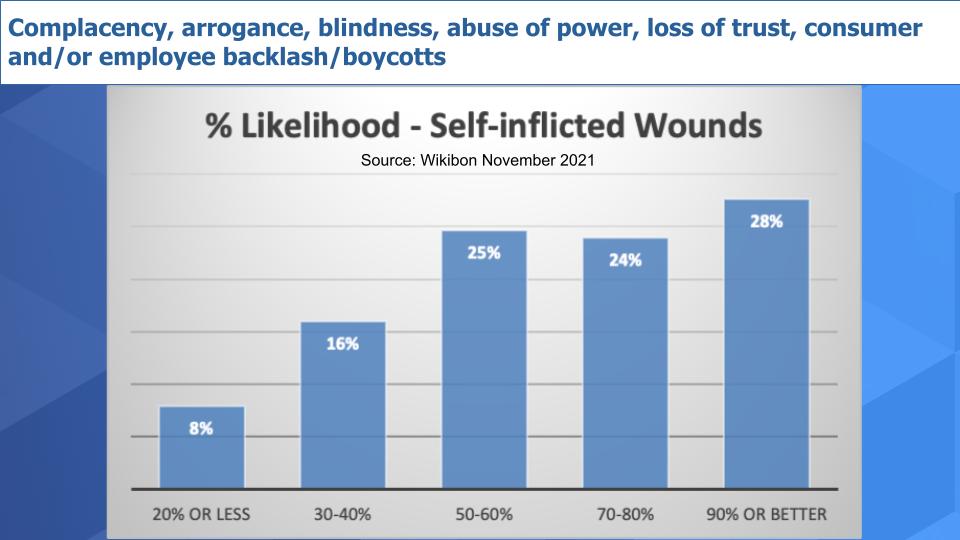

| Q7. Complacency, arrogance, blindness, abuse of power, loss of trust, consumer and/or employee backlash/boycotts |

By far the most likely scenario as rated by the respondents is this one below:

More than half the respondents (52%) indicated that there’s a better than 70% chance that Amazon would shoot itself in the foot over time. Again, history would suggest this is consistent and the most likely pattern, especially when new executives are appointed. You saw this with famous companies at the time, such as Wang Laboratories Inc., Digital Equipment Corp., IBM Corp. eventually, Intel Corp. going through some challenges, Microsoft Corp. under Ballmer. In contrast, you see founder-led companies such as Dell Technologies Inc. and Oracle Corp. continuing to thrive.

But it could be that today’s executives and systems are more tuned to longevity. Former AWS Chief Executive and current Amazon.com CEO Andy Jassy is a longtime Amazonian. Current AWS CEO Adam Selipsky boomeranged back to AWS and has a deep understanding of the company.

So it’s by no means assured that Amazon will trip up.

Taken together, these factors suggest that government intervention may not be necessary. Indeed, the history of government breakups and pressure on big tech has been mixed and arguably futile. AT&T, IBM and Microsoft all came under close government scrutiny and, in the case of AT&T, the company was broken up. Generally these actions led to the U.S. being less competitive – certainly that was the case with AT&T as international telecommunications companies came to dominate the market.

And in the case of IBM and Microsoft, antitrust actions by the government, while a distraction, were less a factor in the challenge to these firms’ leadership than were market disruptions. IBM unwittingly and famously handed its monopoly power to Intel and Microsoft in the personal computer era. And Microsoft under Ballmer hugged onto its Windows past and became much less relevant until Satya Nadella initiated Microsoft’s current hugely successful strategy on top of the Azure cloud.

The point is despite the saber-rattling of governments, history would suggest that market forces will be much more successful in moderating the power of giants like AWS.

We’ll leave you with one last thought.

At a $64 billion run rate and a 39% growth rate last quarter, AWS is the profit engine of Amazon.com. AWS accounted for more than 100% of Amazon’s overall operating profit in the quarter. So it was surprising to us when the stock dropped after Amazon announced earnings late last month. Its retail business underperformed, but AWS blew away expectations. The stock rebounded and many investors saw it as a buying opportunity, but the point is that AWS is the most critical part of Amazon, in our opinion.

It helps fund Amazon’s massive capital investments and gives Amazon, Inc. a platform in other industries like payments, content, groceries and more.

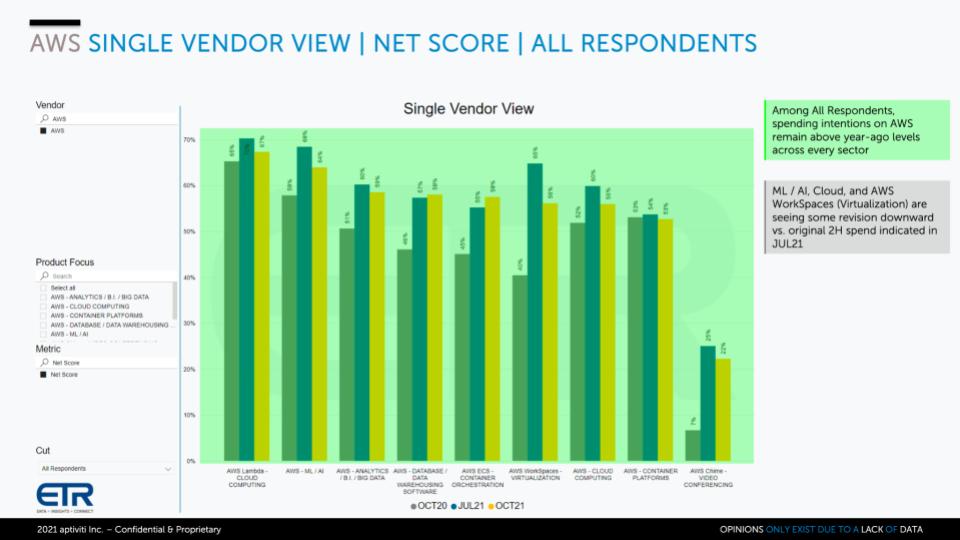

If you look at the ETR data across AWS’ vast portfolio, the picture is very solid:

This chart shows Net Score or spending momentum for AWS in its businesses comparing three survey snapshots – October 2020, July 2021 and October 2021 in the yellow bar. Note the comments from ETR – in every sector – AWS spending velocity is up relative to last year and we’ve certainly seen this trend in AWS’ recent results. Accelerating growth with a much larger revenue base. Across the board in infrastructure, AI, data, analytics, core cloud, everything is up – even Chime, which is just amazing because Chime is horrible compared with other videoconferencing tools. But other than that weak spot, AWS is hitting on all cylinders.

What do you think? Should the government put the shackles on Amazon or should it just let market forces do their thing?

By the way, we asked respondents, “What else could disrupt Amazon other than these seven scenarios and we received some interesting open ended responses that are viewable in this shared Google Sheet. Including one of our favorites: “God.”

Thanks to David Moschella for his excellent work on these scenarios.

Remember we publish each week on Wikibon and SiliconANGLE. These episodes are all available as podcasts wherever you listen.

Email david.vellante@siliconangle.com, DM @dvellante on Twitter and comment on our LinkedIn posts.

Also, check out this ETR Tutorial we created, which explains the spending methodology in more detail. Note: ETR is a separate company from Wikibon and SiliconANGLE. If you would like to cite or republish any of the company’s data, or inquire about its services, please contact ETR at legal@etr.ai.

Here’s the full video analysis:

All statements made regarding companies or securities are strictly beliefs, points of view and opinions held by SiliconANGLE media, Enterprise Technology Research, other guests on theCUBE and guest writers. Such statements are not recommendations by these individuals to buy, sell or hold any security. The content presented does not constitute investment advice and should not be used as the basis for any investment decision. You and only you are responsible for your investment decisions.

THANK YOU