Tens of thousands of low-income families who signed up to receive the expanded child tax credit before the November 15 deadline could receive six months of payments next month.

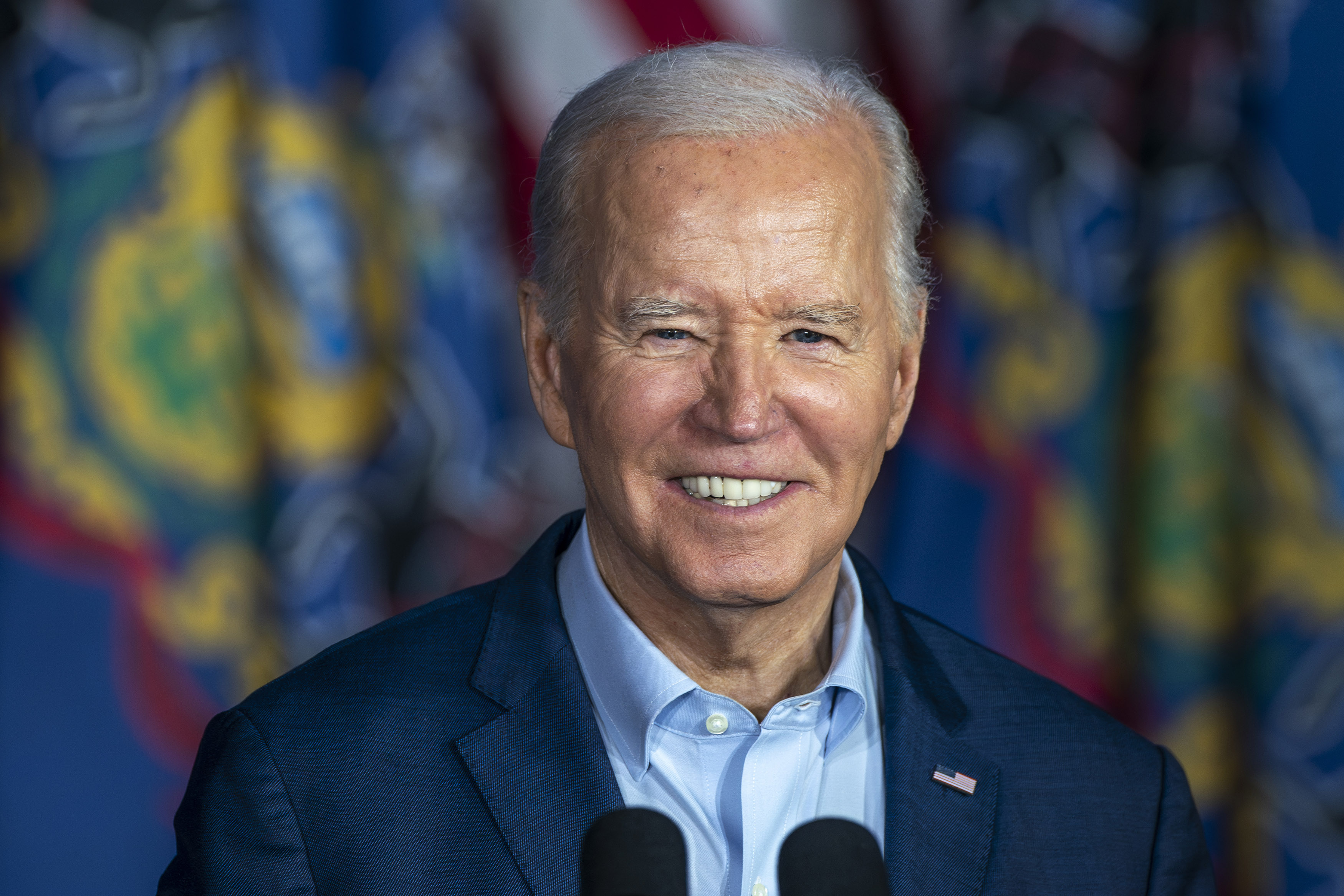

The size of the tax credit was increased as part of President Joe Biden's $1.9 trillion coronavirus relief package earlier this year and made fully available to families without tax obligations.

The credit is now $3,600 annually for children under the age of six and $3,000 for children aged 6 to 17. Six months of payments were advanced on a monthly basis through the end of 2021, meaning eligible families receive $300 monthly for each child under six and $250 per older child.

Eligible families were automatically enrolled, based on their 2020 tax returns, but those who weren't legally obligated to file returns because they don't earn enough had to sign up to receive the payments.

Low-income families who signed up before the November 15 deadline will receive all the money they are owed in the December 15 payout, according to the Internal Revenue Service. That means a payment of up to $1,800 per child under six and up to $1,500 per child over six.

They had to register using GetCTC.org, a non-filer sign-up tool built by the nonprofit Code for America in collaboration with the White House and the Treasury Department.

Registering in Time

David Newville, senior program director for tax benefits at Code for America, estimated that up to 50,000 families may have registered in time to get six months' worth of child tax credit payments next month.

But he clarified that not everyone who filed by the November 15 deadline will get the December 15 payment. "I think for most people, it'll probably go through," he told Newsweek. "But if there's like an issue with the return or the IRS flags it, it may get held up and they may not get that payment in time."

A Treasury spokesperson told Newsweek: "Returns are still being processed and we don't have a final count right now. We want to emphasize that non-filer families that didn't sign up by the deadline can still claim their full Child Tax Credit during next year's tax season."

Newville said Code for America launched the non-filer tool to ensure families eligible for the child tax credit are signed up to receive it.

"Some of the lowest income families, they don't really interact with the tax system at all. They don't earn much money so they're not required to file a tax return," he said.

Describing the credit as "transformational," Newville added: "We've all seen the impact it's had for families in a few short months already, in terms of lowering hunger and improving housing security, and health outcomes for children and for families. All those positive outcomes [have] quickly shown up along with the very rapid drop in poverty."

The Build Back Better legislation that passed the House this month will extend the expanded child tax credit for another year.

"It takes time to build awareness and trust to bring people to the system, so having another year to continue this outreach is really fantastic," Newville said. "I think we can reach many, many more families next year with this extension."

The Treasury spokesperson added: "Over the past few months, Treasury and the White House have partnered with federal agencies, state and local governments, national organizations, and community groups to train thousands of people across the country to serve as navigators. These navigators are trusted messengers within their communities, providing approachable, hands-on expertise to non-filers. The IRS also embarked on an extensive communications and education effort to reach non-filers, with a special focus on reaching underserved and non-English speaking communities."

Uncommon Knowledge

Newsweek is committed to challenging conventional wisdom and finding connections in the search for common ground.

Newsweek is committed to challenging conventional wisdom and finding connections in the search for common ground.

About the writer

Khaleda Rahman is Newsweek's Senior News Reporter based in London, UK. Her focus is reporting on abortion rights, race, education, ... Read more

To read how Newsweek uses AI as a newsroom tool, Click here.