Gold Up, Dollar Strengthens as Bets of Earlier Interest Rate Hikes Increase -Breaking

[ad_1]

© Reuters

© Reuters By Gina Lee

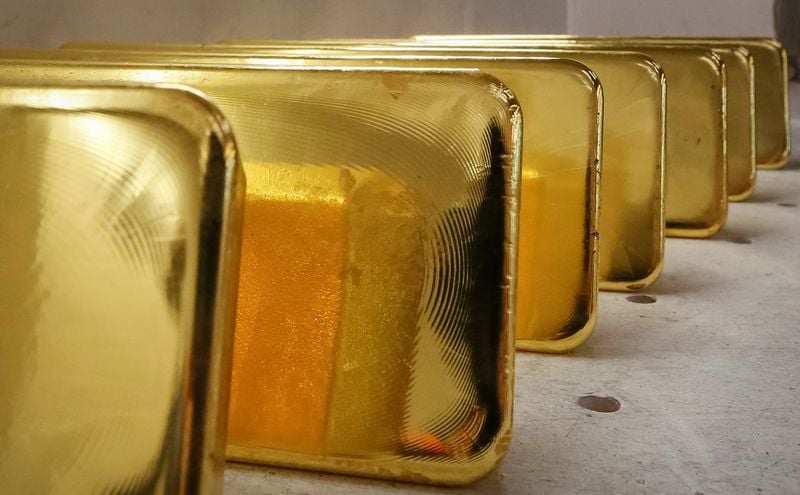

Investing.com – Gold was up on Friday morning in Asia, but was set for its first weekly decline in three as central banks are expected to hike interest rates quicker than expected to curb rising inflation.

The climbed 0.16% to $1864.45 at 11:50 ET (4:50 GMT) The normal movement of the inversely to gold is reflected in Friday’s slight increase in the.

As inflation continues to climb and as COVID-19’s economic recovery continues, the U.S. Federal Reserve may consider earlier interest rate increases. The previous week’s data also showed that October saw inflation rise to the highest point in thirty years.

Chicago Fed President Charles Evans, one of the central bank’s dovish policymakers, said on Thursday that he was “open-minded” to tweak monetary policy in 2022 if inflation continues to remain high. Evans said that a 2022 interest rate increase could be necessary if inflation remains high, in spite of his hopes to the contrary.

Meanwhile, Thursday’s data showed that 268,000 were filed in the U.S. throughout the week. The number of filed in the U.S. was still close to the pre-COVID level, but it was significantly higher than the forecasts by Investing.com which showed a figure of 260,000. The shortage of skilled workers is still a barrier to job growth.

Asia Pacific will unveil an unprecedented $490 billion spending plan that seeks to decrease the economic impacts of COVID-19.

China imported more gold from Switzerland than it did in September, which was the most since June 2018. This is according to Swiss customs data. Also, the data showed that India’s gold shipments had decreased slightly since September.

Other precious metals saw silver rise 0.4% while it looked set for its first weekly drop in three. Platinum was up 0.95% while palladium rose 0.5%.

Fusion MediaFusion Media or any other person involved in the website will not be held responsible for any loss or damage resulting from reliance on this information, including charts, buy/sell signals, and data. Trading the financial markets is one of most risky investment options. Please make sure you are fully aware about the costs and risks involved.

[ad_2]