Lior Lewensztain started That's It with a simple, but oh-so-bold idea: to "disrupt the fruit snacks category with real fruit."

The natural food brand has grown from simple real fruit bars to probiotics-boosted bars, clean truffles, plant-protein Crunchables and fruit snack packs for kids. Expect more innovation from That's It as Lewensztain seeks to fill gaps in eating occasions with minimal, transparent and clean ingredients.

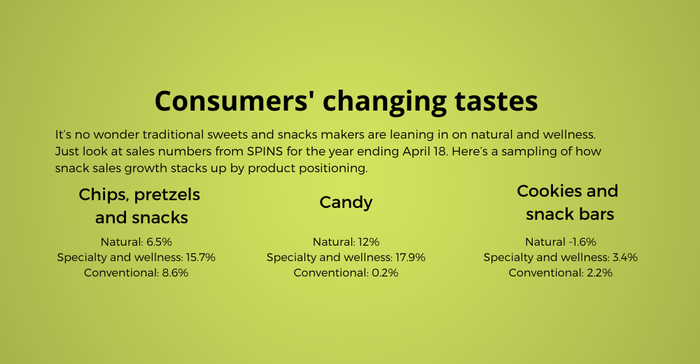

Even at the Sweets and Snacks Expo, a trade show that features the biggest names in candy, fruit-forward products like Lewensztain's stand out and trends natural retailers know so well appear ablazen with front-of-pack callouts such as organic and keto on the likes of Reese's Peanut Butter Cups.

In addition to candy, the SPINS classification of "nuts, trail mix and dried fruits" topped natural product snack categories with 10.7% growth.

It's not just health and better-for-you positioning making a mark on sweets and snacks. Values shopping is making its way into the mainstream, particularly in confectionary and chocolate, where human rights and environmental abuses continue to capture headline attention.

Gen Z and Millennials in particular demand transparency, which matters because they are also the shoppers driving sweets and snacks growth, according to the National Confectioners Association's Sweet Insights: State of Treating 2021 report.

And while the natural channel shows snacking sales growing, the association notes a challenging time for sweets during which COVID-19 had consumers staying home and bypassing convenience stores and even impulse purchases at checkout. Thus, the association said U.S. confectionery sales dipped, down 0.2% in 2020.

Specialty and wellness snacks showed impressive 14% growth in the natural channel for the 12 months ending April 18. In regional and conventional groceries, sales of these products trailed slightly at 13% growth.

Panic buying did not affect snacks like it did other categories, says Jeff Crumpton, SPINS manager of Retail Reporting Solutions.

Yet, the National Confectioners Association, found that 61% of shoppers have changed their shopping behaviors for sweets and snacks. Some of the new habits bode well for the inner aisles of natural stores as consumers:

Buy different pack sizes.

Try different brands.

Grab different items.

Shop different stores.

In addition to those shopping trends, watch for snackers to snap up low- and no-sugar treats, fruit- forward fare and new-style jerkies.

These snacks have come a long way in recent years, with many of today's go-to snacks going above and beyond in terms of functional add-ins, better-for-you options, stunning flavor combinations and plant-based ingredients.

"Customers are looking for their snacking to serve many functions and they want flavor and variety," Jeff Crumpton says.

Low- and no-sugar treats

The sugar backlash is perhaps the biggest disruption in snacking.

It changed Project 7 completely. The organic gourmet gummy company now focuses solely on low-sugar gummies, licorice and lollipops. Founder Tyler Merrick had the line in development for three years when the pandemic hit. But rather than just viewing the products as a line extension, he decided to eliminate the sugar-filled organic candies to remain "in integrity" with himself. How, he thought, could he tout the importance of low and no sugar while also selling the others, even if they were organic?

He braved calling his big-box clients to tell them he was canceling their sugar-filled lines. They all joined him on the journey, so he kept the fought-after shelf space.

The new line has just 1 to 3 grams of sugar per bag, compared with traditional sour worms that have 22 grams. They are plant-based and do not use chicory root fiber or inulin, which many low-carb gummies use. The fiber is soluble corn fiber, and the sweetener is allulose. The gummies are not organic, but the lollipops are.

Allulose continues to grow, but according to SPINS, across all retail channels, monkfruit leads the way with 15.7% growth and stevia at 8.5%. Products containing artificial sweeteners took a dive at -19%.

Fruit-forward snacking

Clean snacks have become reality with one- and two-ingredient options, SPINS data analyst Scott Dicker says.

The innovation isn't in the ingredient, but the processing and combinations. And they fulfill consumers clean label desires.

Innovators in the Natural Products Expo East NEXTY Awards show that well with brands such as Solely wowing judges with its ultra-clean, USDA Organic two- and three-ingredient fruit gummies that contain just fruit and Vitamin C.

And frozen dipped fruit won the 2021 Most Innovative New Product Award in the Sweet Snack category at the Sweets and Snacks Expo. Tru Fru dips real fruit pieces in white chocolate and then dark or milk chocolate and hyper chills the snackable frozen treats and packages them in shareable pouches or grab-and-go cups.

Even the traditional and simple "nuts, trail mix and dried fruits" category won top growth in the 12 months ended April 18 with natural products growth at 10.7%, specialty and wellness foods at 9.5% and conventional at just 4.8%.

In shelf-stable candy, which grew 2%, rolled fruit snacks jumped 29%.

Innovative jerky

Jerky has been a hotbed of innovation as keto and clean meat-eating waves gain force.

Today's products though focus more on the jerk and not the meat. Plants drive innovation and sales growth, even though the beef dominates the category, Dicker says.

Meats such as chicken, turkey and pork, which grew in recent years, however, are not performing as well.

Jerky and meat snacks sales grew 19% in the year ending Aug. 8.

Attributes that stood out include:

Plant-based "beef," up 149%.

Plant-based "meat" snacks, up 66%.

Combination meat snacks, up 24%.

Category stoppers include:

Meat bars, down -24%.

Chicken, down -6%.

Pork-based, down -6%.

About the Author(s)

You May Also Like

.png?width=700&auto=webp&quality=80&disable=upscale)