House Dems Want to Vote Wed./Thurs. on BIF; Get Agreement on Build Back Better

Propane prices haven’t been so high in a decade | Wasserman on Signal to Noise

In Today’s Digital Newspaper

Market Focus:

• Yellen expects price increases to remain high through first half of 2022

• Yellen rejects criticism U.S. risks losing control of inflation… ‘temporary pain’

• New definition of ‘transitory’ from the Fed

• No Fed commentary this week as blackout period ahead of FOMC arrived Oct. 23

• U.S. posts $2.77 trillion budget gap

• Supplies dwindling, complaints about “shortages” are surging

• Powell: Probe into trading activity last year by senior policy makers ‘fully independent’

• Covid-19 early retirees top 3 million in U.S.

• Summers: ‘Preposterous’ to argue there is excess labor supply in U.S.

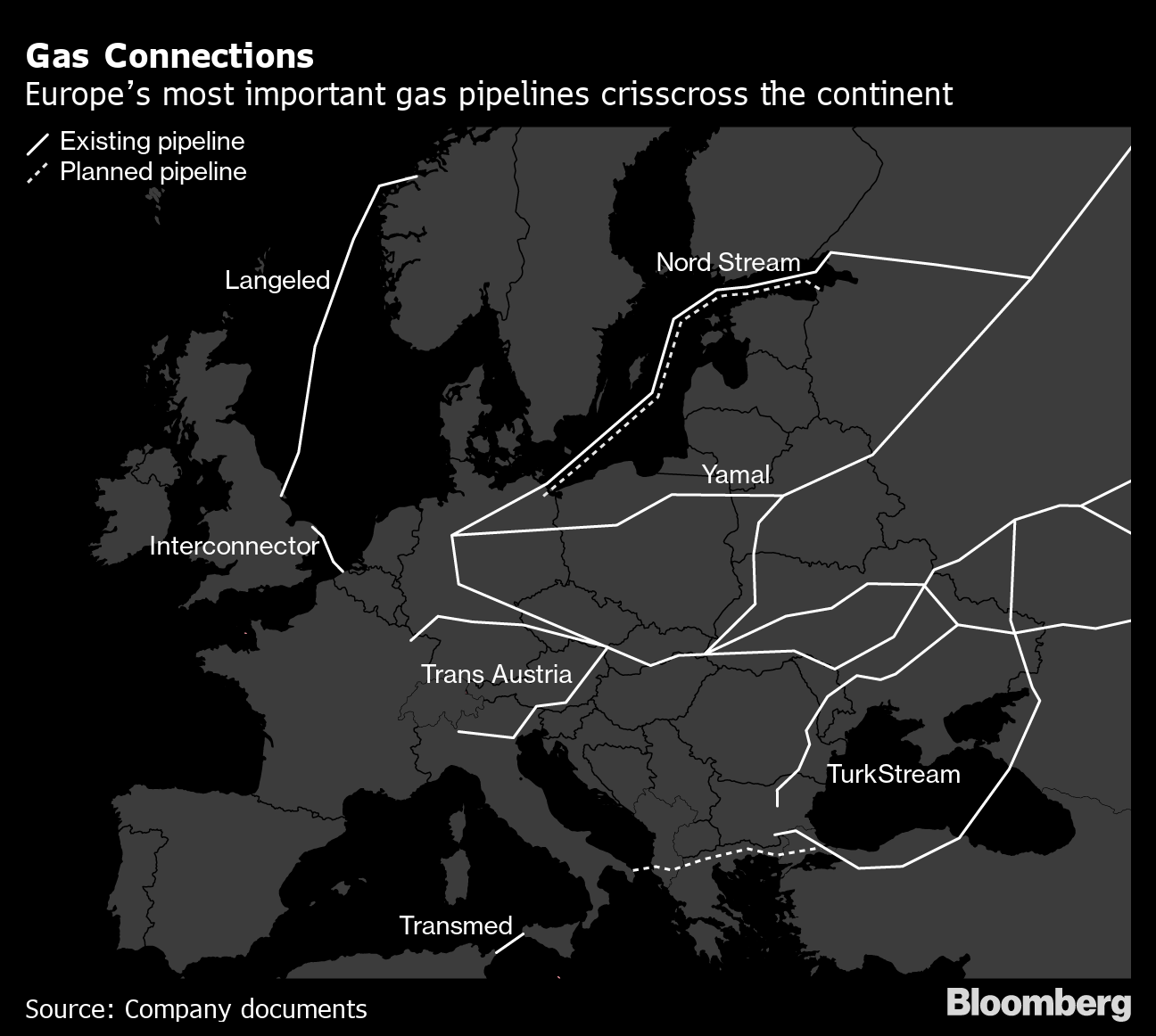

• Putin links help for EU’s energy crunch to reg approval for Nord Stream 2 gas pipeline

• Average cost of shipping continues to rise

• What America's supply-chain backlog looks like up-close

• Shortage of child-care workers holding down female labor-force participation

• Propane prices haven't been so high heading into winter in a decade

• Russian wheat export tax rises again

• Cattle on Feed report showed small placements

Policy Focus:

• Pelosi: ‘We probably will have a wealth tax’

• Pelosi wants BIF vote this week; likely Wed. or Thurs.

• Dems for agreement this week on Build Back Better

Afghanistan:

• Biden admin. launching program to allow veterans with ties to Afghans to sponsor evacuated refugees

Biden Administration Personnel:

• President Biden’s coming trips/meetings

• Former FSA State Director on agency workload

China Update:

• China expects new Covid outbreak to worsen in coming days

• China’s economy risks slowing faster than global investors

• Beijing tells U.S. it won’t yield on status of Taiwan

• Will Biden give Xi what he really wants to get a good headline out of COP26?

Energy & Climate Change:

• Coal is still king in world electricity generation

• Biden’s new climate change approach

• What to see your climate change future?

Coronavirus Update:

• Pfizer: Vaccine 90.7% effective in kids 5 to 11

• FDA advisory panel meets Tuesday to evaluate Pfizer and BioNTech’s application

• Fauci: Vaccines could be available to kids in early November

Politics & Elections:

• David Wasserman to be guest on Signal to Noise podcast this morning

• Chris Sununu will decide whether to run for N.H. Senate seat in next few weeks

Congress:

• Pelosi now open for Democrats to raise debt ceiling without GOP

Other Items of Note:

• Justices to hear abortion case

• Border Patrol made about 1.66 million arrests at southern border in 2021 fiscal year

• EPA seeks nominations to appear at WOTUS regional roundtables

• Whistleblower gets nearly $200 million for informing

MARKET FOCUS

Equities today: Global stock markets were mixed in overnight trading. The U.S. stock indexes are pointed to slightly higher openings. Some 151 S&P 500 companies are scheduled to report this week, plus hundreds of smaller firms. Big tech companies Apple, Amazon, Facebook, Alphabet and Microsoft dominate the huge week of earnings.

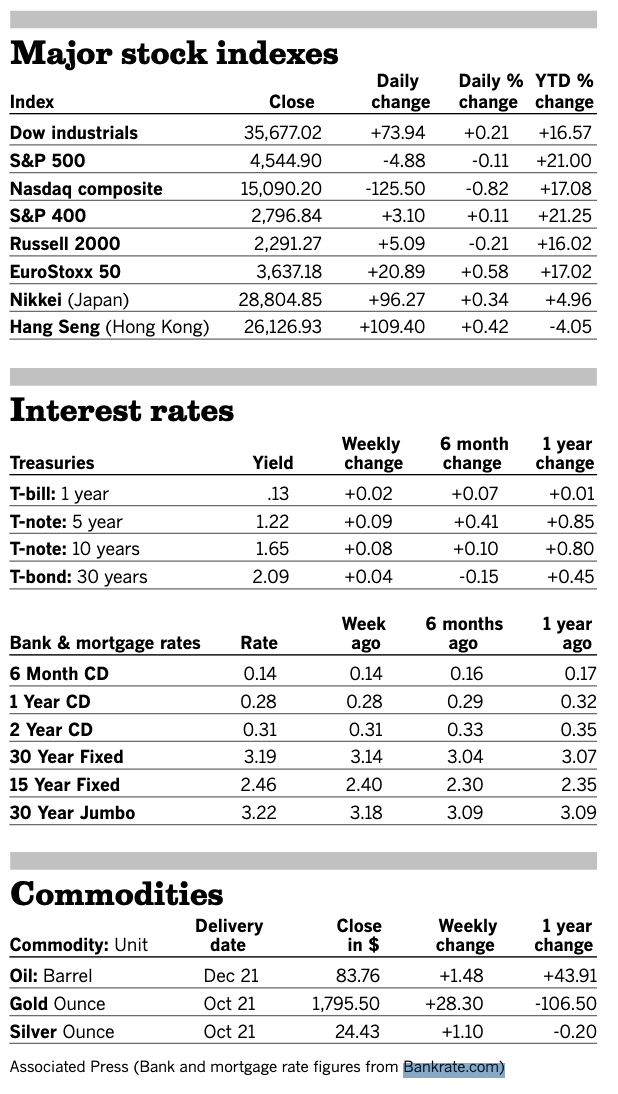

U.S. equities Friday: The Dow ended with a gain of 73.94 points, 0.21%, at 35,677.02, at a record high, its 36th of 2021 and the first since Aug. 16. The Nasdaq declined 125.50 points, 0.82%, at 15,090.20. The S&P 500 was down 4.88 points, 0.11%, at 4,544.90.

For the week, the Dow added 382 points, 1.1%, while the S&P gained 74 points, 1.6%. The Nasdaq closed the week up 193 points, 1.3%.

New definition of ‘transitory’ from the Fed. Even Fed Chair Jerome Powell, who has been calling inflation “transitory,” said high inflation is likely to last “well into next year.’ Still, he says the central bank is on track to start tapering asset purchases with the aim to wrap up the process in mid-2022. The 10-year Treasury yield ended the week at ~1.65%, after breaching 1.7% on Thursday and starting out the week at ~1.58%.

On tap today (see detailed list of events and reports below):

• Texas Manufacturing Outlook Survey is due at 10:30 a.m. ET.

• Federal Reserve board of governors begins a closed virtual meeting today.

• Germany's Ifo Business-Climate Index is expected to fall to 98 in October from 98.8 in September.

• USDA Grain Export Inspections report, 11 a.m. ET.

• USDA Crop Progress report, 4 p.m. ET.

There will be no Fed commentary this week as the blackout period ahead of the Federal Open Market Committee (FOMC) arrived Saturday (Oct. 23). Markets will be left to interpret how various data readings that come in might affect the Nov. 2-3 FOMC outcome.

But the attention on the FOMC conclusion will not just be on the state of monetary policy, but also on trading activity by Fed officials and the new rules issued last week by the Fed governing their trading activity.

ING Economics expects “a formal plan to taper asset purchases at the FOMC's next meeting on Nov. 3.” It thinks the Federal Reserve “will begin reducing its Treasury security purchases and mortgage-backed securities by $10 billion and $5 billion a month, respectively, starting in December. This tapering pace would reflect Powell's statement from the September FOMC meeting that "a gradual tapering process that concludes around the middle of next year is likely to be appropriate." However, our forecasts of a lingering pandemic-induced payroll gap and slowing inflation lead us to project that the FOMC will not raise rates until 2023.”

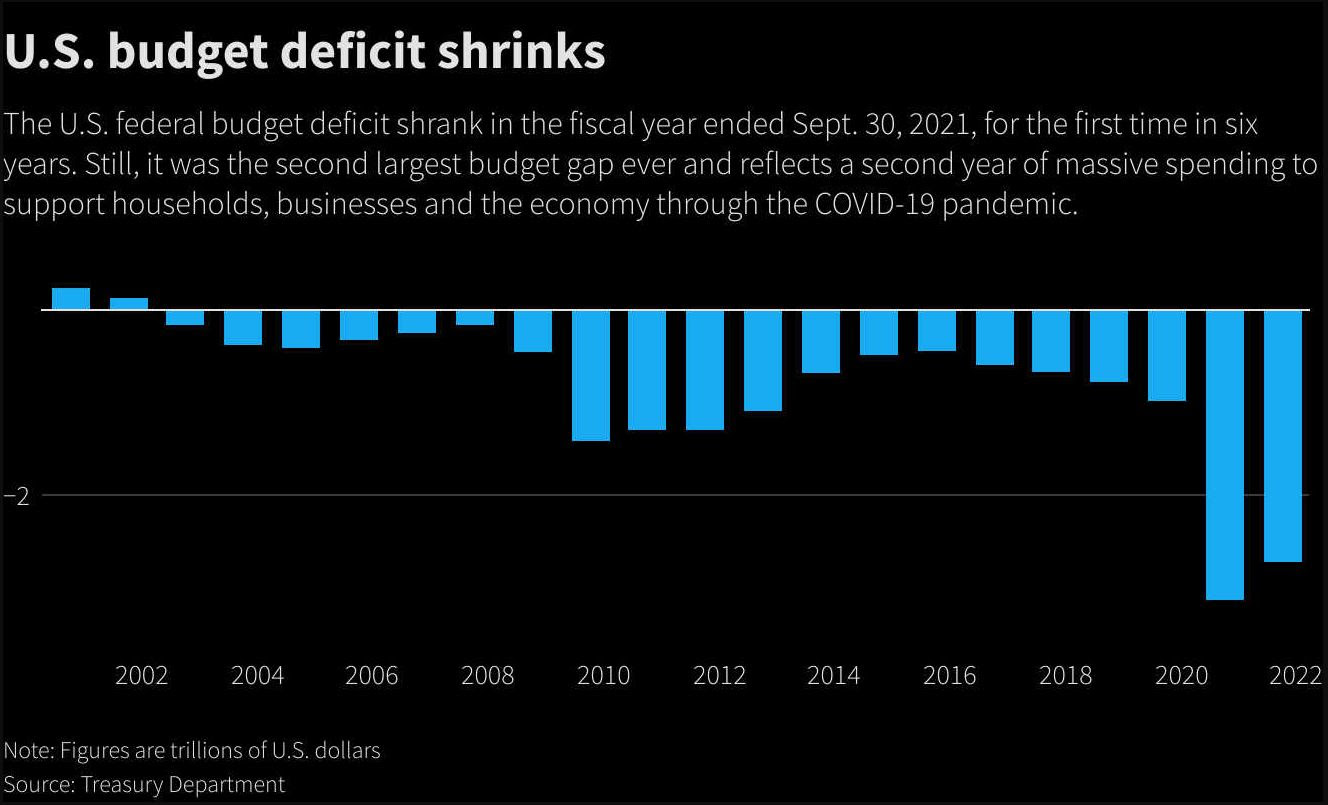

U.S. posts $2.77 trillion budget gap. The U.S. posted its second-largest annual budget deficit on record for 2021 as pandemic-relief spending sustained the federal government’s massive borrowing needs. The deficit for the fiscal year through September was $2.77 trillion, compared with $3.1 trillion zseen in the previous year, a Treasury Department report showed.

The gap was $897 billion less than forecast in the White House’s budget outline earlier this year. Treasury Secretary Janet Yellen and acting administration budget director Shalanda Young said in a statement that the American economic recovery this year helped shrink the deficit from its 2020 trough.

As a share of the economy, the deficit narrowed to 12.4% in the fiscal year, from 15% in 2020 — the biggest since World War II.

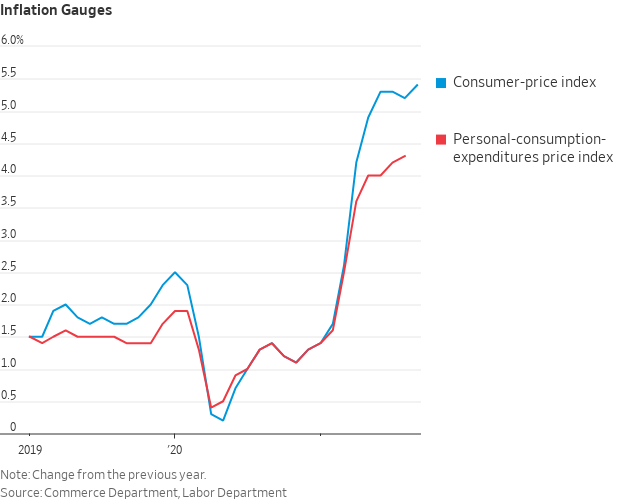

Yellen expects inflation to return to normal levels next year. "Inflation will remain high into next year because of what's already happened, but I expect improvement by the middle to end of next year, second half of next year," Treasury Secretary Janet Yellen said on Sunday. "When do you expect inflation to get back to the 2% range, which is considered normal?" CNN's Jake Tapper asked Yellen on State of the Union. "I expect that to happen next year," Yellen replied. She cited Covid-19-related issues and supply problems as some of the reasons for inflation's recent growth at its fastest pace in 30 years. "The Covid crisis markedly diminished spending on services and caused a reallocation of spending towards goods," Yellen explained. "The supply of goods to Americans has increased substantially, but there's still pressure there."

Yellen noted Sunday that the roughly $2 trillion in spending would roll out over a period of 10 years, rather than being immediately injected into the economy.

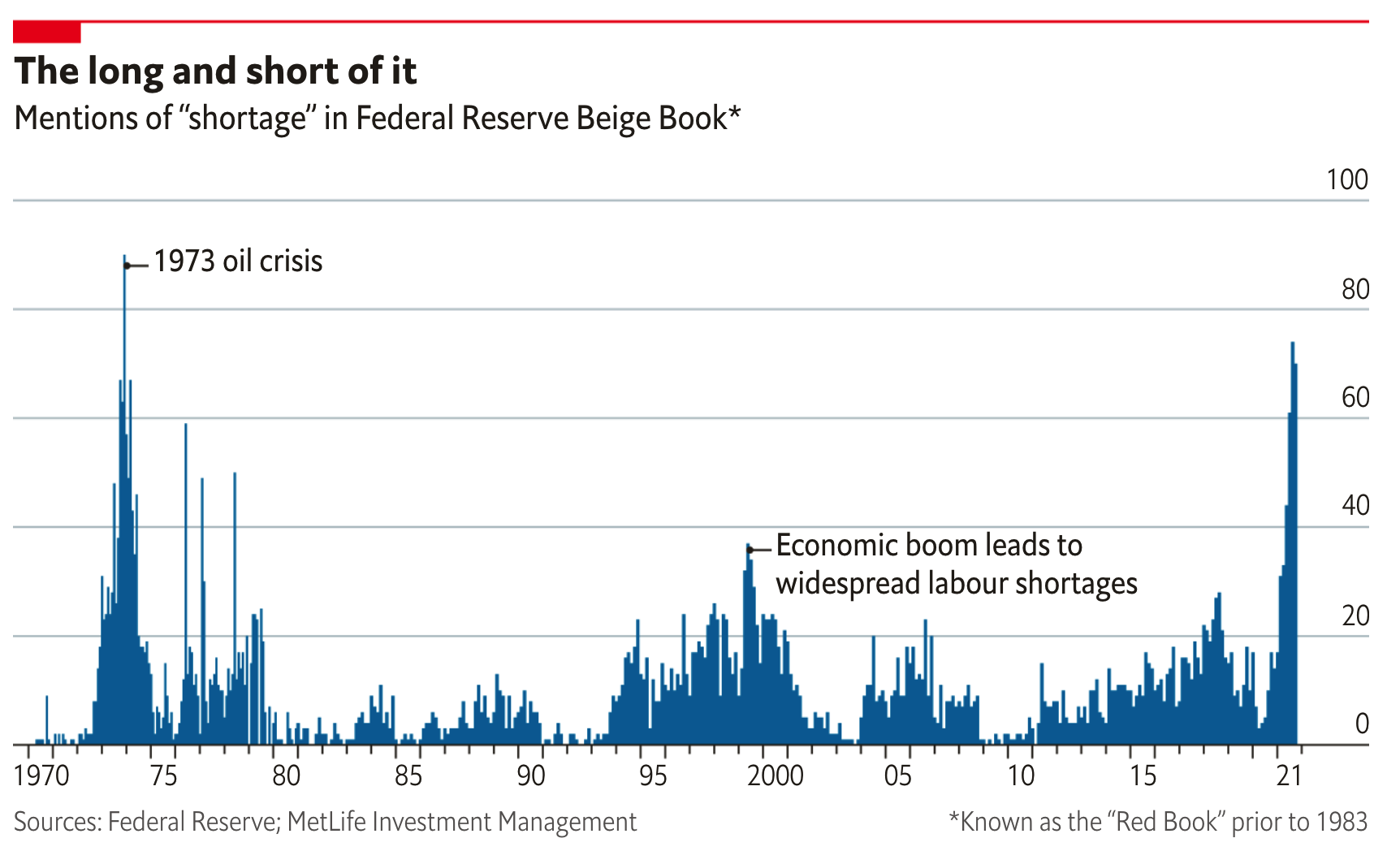

Supplies are dwindling, and complaints about “shortages” are surging. According to estimates by Drew Matus of MetLife Investment Management, an institutional asset manager, mentions of the word “shortages” in the Federal Reserve’s Beige Book have surged. Its latest report, published on October 20, used the word 70 times. Except for the September tally, that is the most since the Arab oil embargo in 1973. Meanwhile, Snap shares tumbled 24% after it warned ad revenue would be lower than expected because companies didn’t have enough products to sell. And port bottlenecks are still getting worse. On Friday, Fed Chairman Jerome Powell said global supply-chain constraints and shortages that have led to elevated inflation “are likely to last longer than previously expected, likely well into next year,” while adding that “it is still the most likely case” that those constraints ease.

Fed Chair Jerome Powell said a probe by the central bank’s internal watchdog into trading activity last year by senior policy makers was “fully independent,” but he offered no update on when it would conclude. “The timing of that investigation is within the control of the inspector general, so I can’t really comment on that,” Powell said in a virtual panel discussion hosted by the South African Reserve Bank.

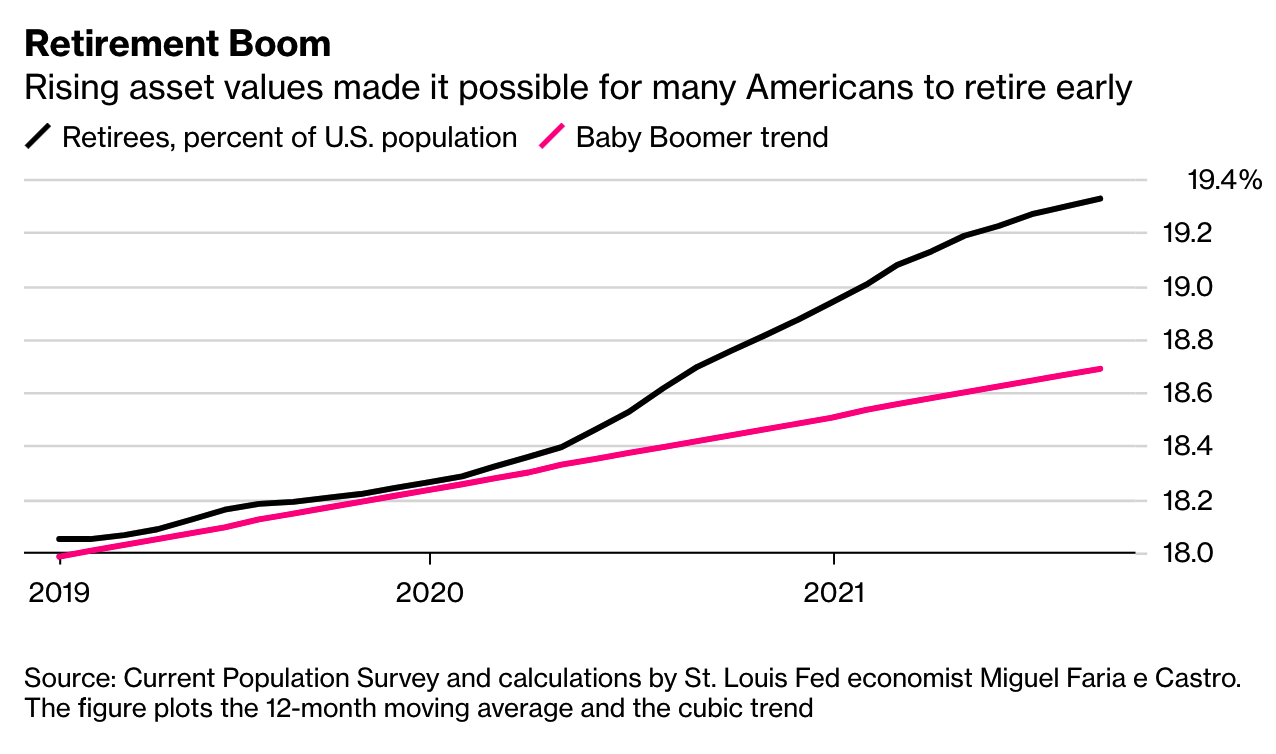

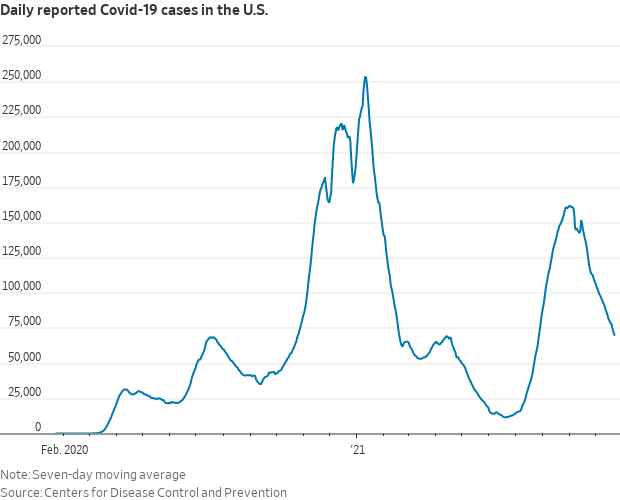

Covid-19 early retirees top 3 million in U.S. More than 3 million Americans retired early because of the Covid-19 crisis, new research found. That equals to more than half of the workers still missing in the labor force from pre-pandemic levels. The estimate, calculated by St. Louis Federal Reserve economist Miguel Faria-e-Castro, suggests that the boom in early retirements shows no sign of abating.

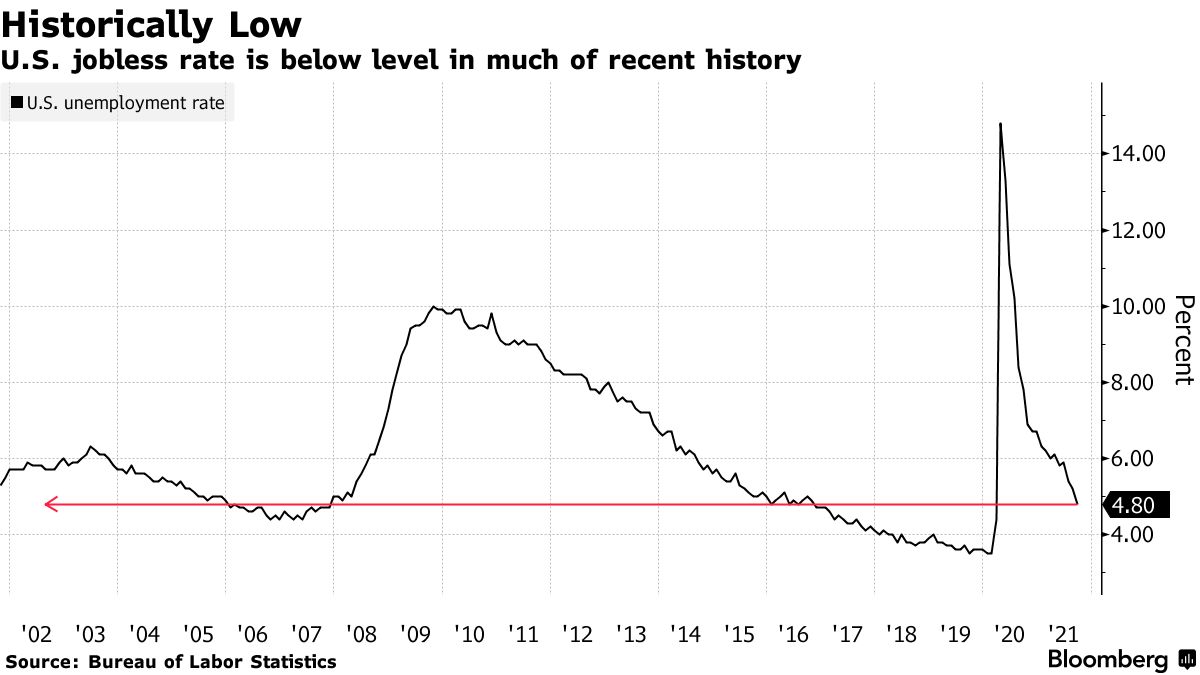

Former U.S. Treasury Secretary Lawrence Summers said that it’s “preposterous” to argue there is excess labor supply in the U.S. and reiterated that the economy is more vulnerable to inflation than many realize. Summers said the current unemployment rate of 4.8% is lower than through much of recent U.S. history. He said many people exited the workforce for reasons including the coronavirus changing how they want to live their lives. He also cited extra savings from pandemic-relief packages and continuing health concerns tied to Covid-19. “The view that there’s a lot of labor market slack is looking preposterous right now,” Summers told Bloomberg Television’s Wall Street Week Friday (link).

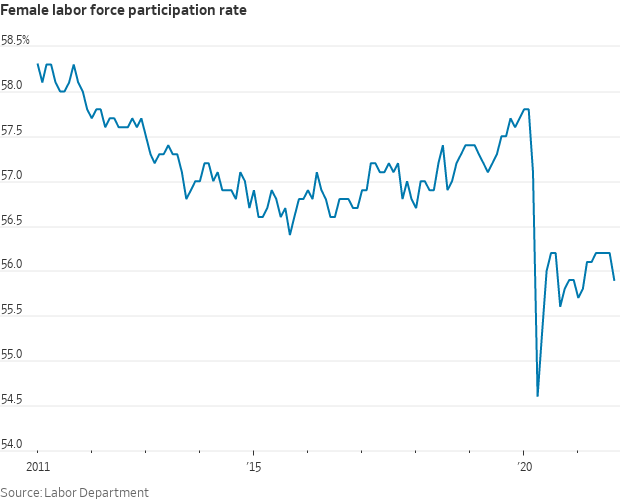

A shortage of child-care workers is holding down female labor-force participation as women stay home to care for their young children, the WSJ reports (link). Many daycare centers closed permanently at the height of the pandemic. Those that survived are turning away families because they don’t have enough staff. In September, more than 300,000 women ages 20 and over dropped out of the workforce, according to the National Women’s Law Center.

Market perspectives:

• Outside markets: The U.S. dollar index firmer. Crude oil prices are higher and trading around $84.50 a barrel after hitting a seven-year high overnight. The 10-year U.S. Treasury note yield is presently fetching 1.656%.

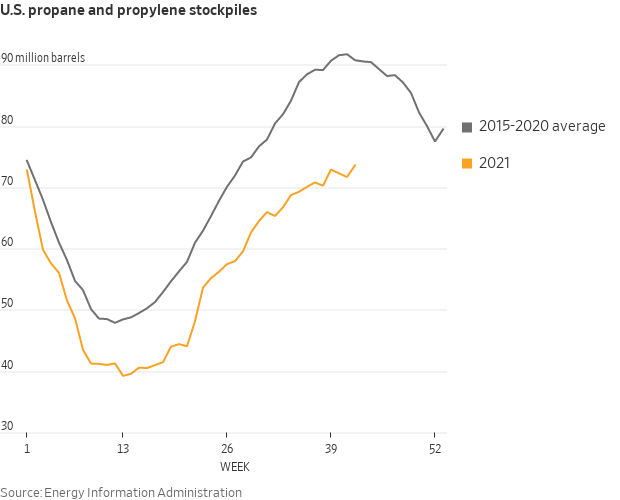

• Propane prices haven't been so high heading into winter in a decade, which is bad news for the millions of Americans who rely on the fuel to stay warm. At $1.41 a gallon at the Mont Belvieu trading hub in Texas, on-the-spot prices are about triple those of the past two Octobers. Of the two main U.S. propane futures contracts, one hit a high earlier this month and the other doesn't have far to climb to eclipse the record it set during the blizzard of 2014. The average residential price tracked by the U.S. Energy Information Administration has jumped by 50% from a year ago, to $2.69 a gallon.

• President Vladimir Putin said Russia can help ease the European Union’s energy crunch as soon as the controversial Nord Stream 2 gas pipeline to Germany gets regulatory approval. Putin said Gazprom, the Kremlin’s gas monopoly, could increase flows significantly via the new pipeline “the day after tomorrow” if regulators approved it “tomorrow.” The amount, equal to roughly 10% of the gas Russia shipped to Europe and Turkey in 2020, would provide significant additional supplies at a time of record prices in Europe, even before the pipe’s second line is fully filled in December. But it is also likely to provoke anger that Russia clearly believes it has gas in reserve but is making its delivery to Europe contingent on Nord Stream 2 being approved.

• Average cost of shipping continues to rise. According to Freightos, an online freight marketplace, the average cost of shipping a 40-foot container from Shanghai to Los Angeles is about $17,400, compared with just $3,700 a year ago.

• What America's supply-chain backlog looks like up-close. California’s Port of Los Angeles is struggling to keep up with the crush of cargo containers arriving at its terminals, creating one of the biggest choke points in the global supply-chain crisis. Waiting times at the Los Angeles and Long Beach ports, which move more than a quarter of all U.S. imports, have stretched to three weeks. This (link) exclusive Wall Street Journal aerial video illustrates the problem’s scope and complexity.

• Russian wheat export tax rises again. Russia’s export tax on wheat shipments will rise to $67 per metric ton for the week of Oct. 27-Nov. 2. That’s up from $61.30 for the week of Oct. 20-26. Russia’s wheat tax is projected to reach $90 by year-end.

• Cattle on Feed report showed small placements — Colorado and Nebraska did not place cattle. The placements create forward tightness. For the nearby, cash markets are expected to garner strength.

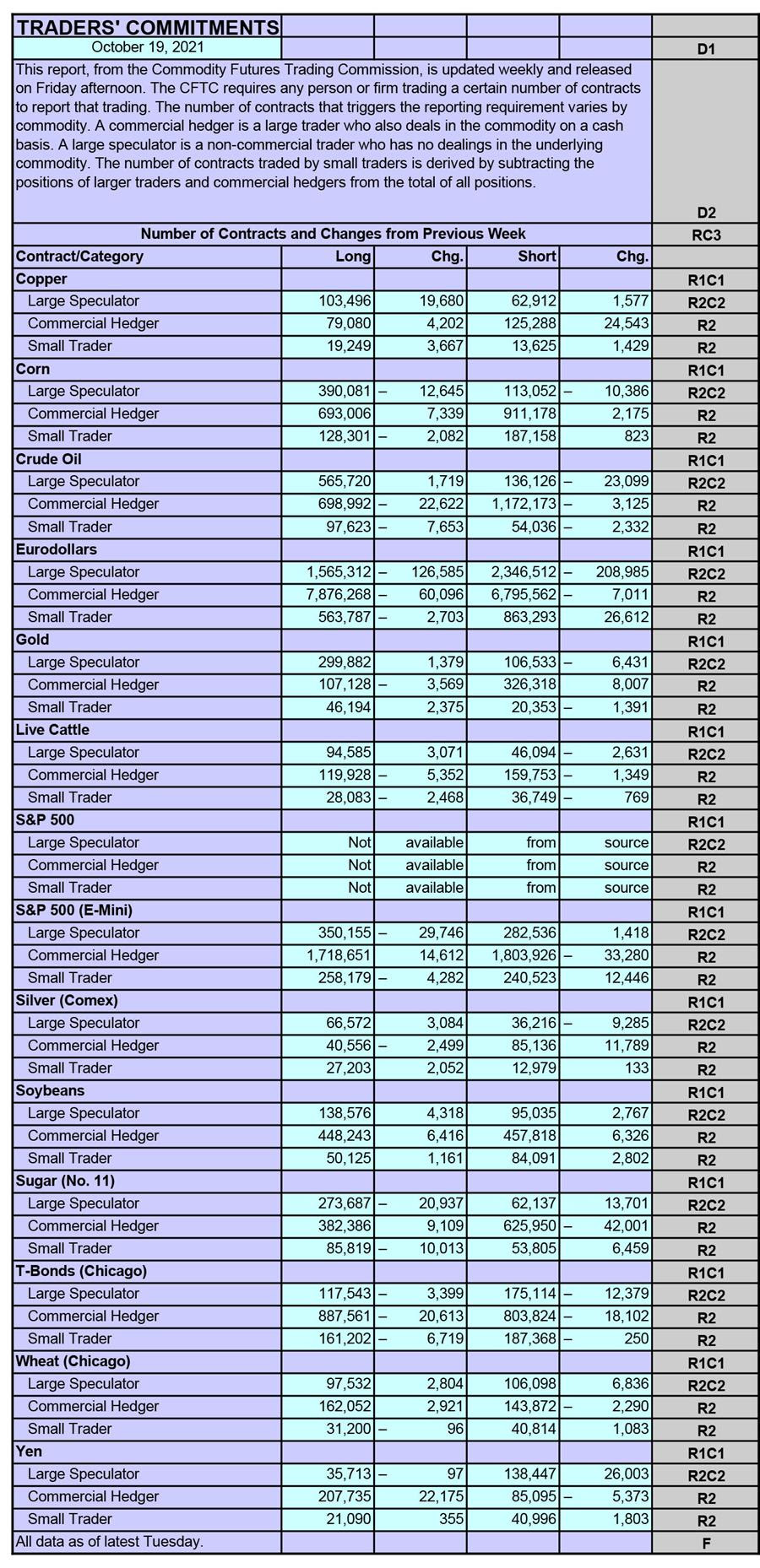

• CFTC Commitments of Traders report (Source: Barron’s):

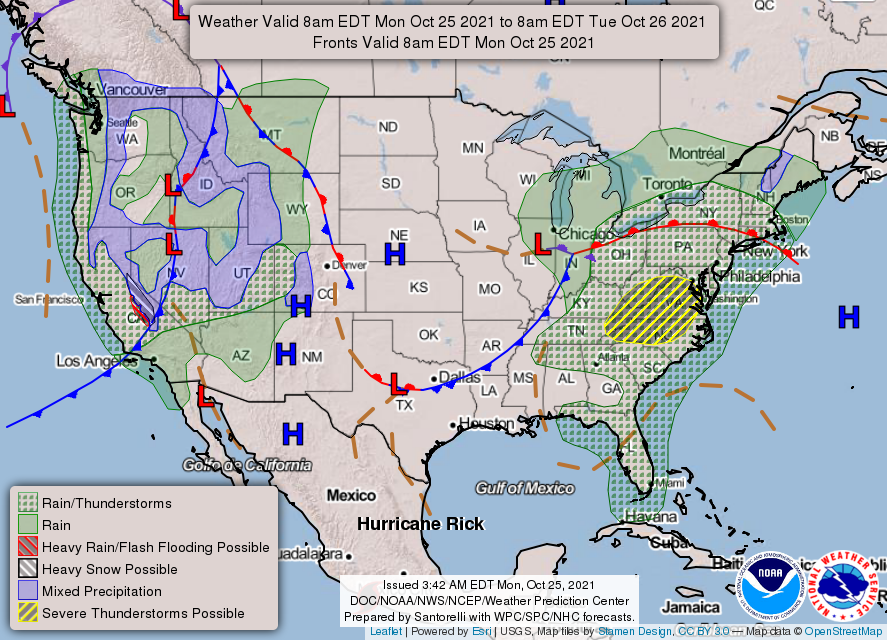

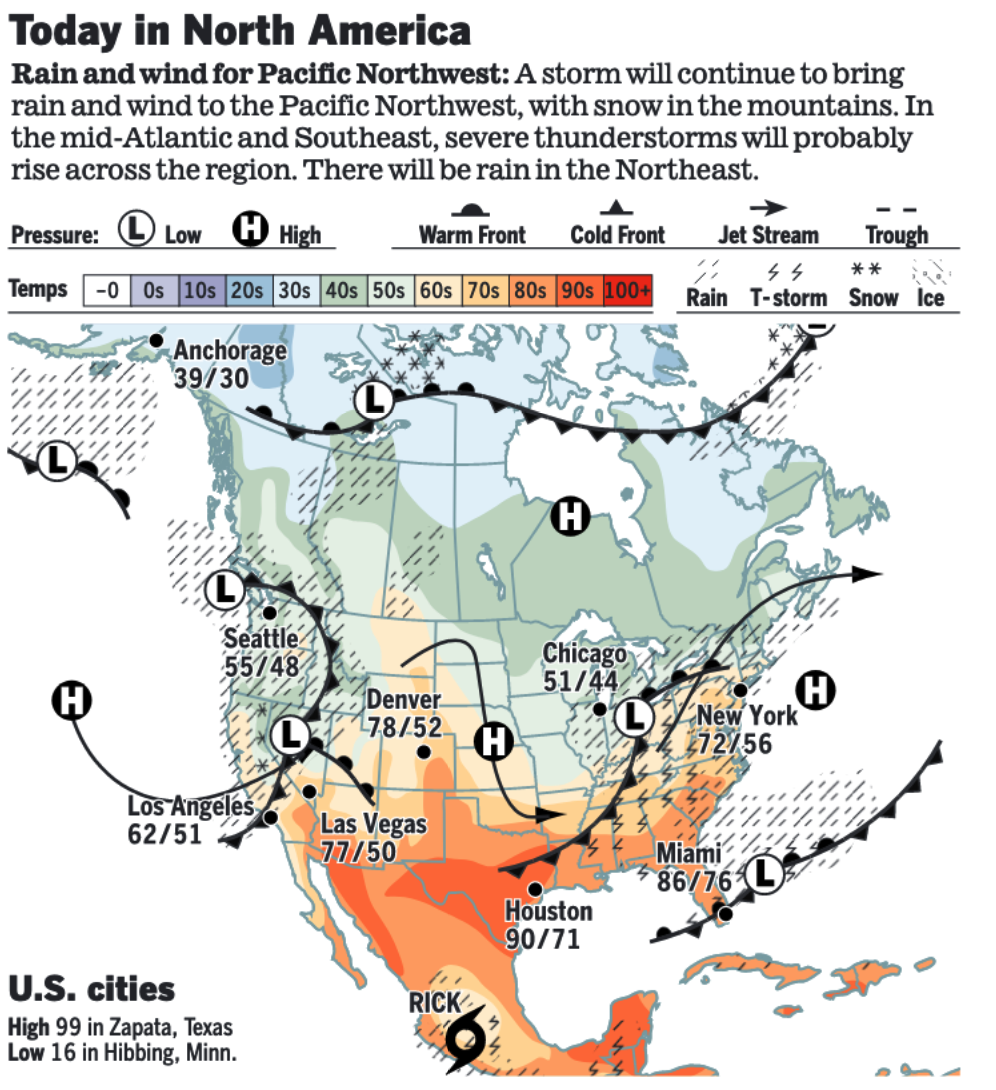

• Bomb cyclone pounds West Coast. A furious storm unleashed from a "bomb cyclone" over the Pacific Ocean slammed Northern California, bringing fierce winds and dangerous flooding. A bomb cyclone is a sudden low-pressure event that intensifies storms. Meanwhile, several feet of snow are forecast for the Sierra Nevada mountain range, creating nearly impossible driving conditions. In the Midwest, tornadoes, large hail and damaging wind have been reported in parts of Arkansas, Missouri, Illinois and Indiana, and the threat will continue today. The East Coast by midweek could also be facing a nor'easter that could bring serious flooding.

• NWS weather: There is a Slight Risk of excessive rainfall over the Sierra Nevada Mountains and coastal New England... ...Heavy snow for the Sierra Nevada Mountains... ...There is an Enhanced Risk of severe thunderstorms over parts of the Central/Southern Plains on Tuesday; there's a Slight Risk of severe thunderstorms for much of the Mid-Atlantic today.

POLICY FOCUS

— Update on BIF and BBB:

- Link to our Sunday update on the topics.

- Bottom line: House Dem leaders this week (Wed. or Thurs.) want to vote on the $1 trillion bipartisan infrastructure bill and reach an agreement on the outlines of the reconciliation bill, the Build Back Better Act.

- “We probably will have a wealth tax,” House Speaker Nancy Pelosi (D-Calif.) said Sunday on CNN, noting that Senate Democrats were still working on their proposal. The proposal would impose an annual tax on unrealized capital gains on liquid assets held by billionaires, Treasury Secretary Janet Yellen said Sunday on CNN. “I wouldn’t call that a wealth tax, but it would help get at capital gains, which are an extraordinarily large part of the incomes of the wealthiest individuals and right now escape taxation until they’re realized,” Yellen said. A spokeswoman for Sen. Kyrsten Sinema (D-Ariz.) said Friday that she was working with Sen. Elizabeth Warren (D-Mass.), who has pushed for an annual tax on the wealthiest Americans’ assets. “I think it’s likely. I’m pushing hard,” Warren said Sunday on MSNBC of raising taxes on billionaires.

- Pelosi said international taxes, a wealth tax and stepped-up IRS tax enforcement could be part of the final package now that tax rates on corporations and wealthy individuals have been nixed over opposition from Sinema.

- Pelosi said the tax on billionaires’ assets would likely only generate somewhere between $200 billion and $250 billion in revenue over 10 years, but that Democrats would be able to find other ways to pay for the bill’s cost.

- Timeline: Pelosi expects an agreement reflecting a consensus of all 50 senators on the tax and revenue portion of the Build Back Better bill to emerge early this week. Asked if they'll have a spending bill deal by the time Biden leaves for Europe later this week, Pelosi said, "I think we're pretty much there now." She expects the House to pass the bipartisan infrastructure plan by week’s end — congressional sources signal a push for a vote Wednesday or Thursday. A formal deal on the around $1.75 trillion social safety net/climate change plan will allow a House vote on the Senate-passed infrastructure bill before surface transportation funding runs out on Oct. 31.

AFGHANISTAN

— Biden administration is launching a program that would allow veterans with ties to Afghans, as well as others, to sponsor recently evacuated refugees and help them settle locally, reports CNN's Priscilla Alvarez. The new initiative allows groups of five adults to apply to become a so-called “sponsor circle,” responsible for helping resettle refugees by supporting them to find housing, access federal benefits like medical services, and enroll kids in school.

BIDEN ADMINISTRATION PERSONNEL

— President Biden’s coming trips/meetings include:

- Oct. 28: President Biden leaves for Italy and Scotland ahead of the G20 leaders' summit in Rome next weekend. Biden will be accompanied by first lady Jill Biden.

- Oct. 29: Meets Pope Francis in Vatican City.

- Oct. 30-31: Group of 20 (G20) meeting. Biden wants to smooth things over with the French amid the worst diplomatic spat between the two nations in years. He plans to meet with French President Emmanuel Macron.

- Nov. 1-2: Glasgow, COP26 climate summit, which lasts until Nov. 12. COP26 is the 26th Conference of the Parties to the United Nations Framework Convention on Climate Change. A COP has taken place every year since 1995, except last year, when it was canceled due to Covid-19. The U.K. is hosting this year’s meeting. The summit is taking place in Glasgow, Scotland, from Oct. 31 to Nov. 12.

— Former FSA State Director on agency workload: “This staff shortage has been unfolding for quite some time. The Trump administration did not cut back but were very slow on back filling vacant positions due to turnover and retirements. Covid guidelines slowed the hiring process. The backlog of work with normal farm records matters etc. is large. Employees cannot do many FSA tasks remotely. Let’s not forget last year they were disbursing a large volume of Covid relief funds. Many other FSA tasks were put to the side to get the relief out.”

CHINA UPDATE

— China expects a new Covid outbreak to worsen in the coming days, and officials are urging areas that have been affected to adopt "emergency mode." The current outbreak has seen infections spread to 11 provinces. The locked down a county in Inner Mongolia, while Beijing has all but banned entry by people arriving from anywhere that’s reported locally transmitted cases.

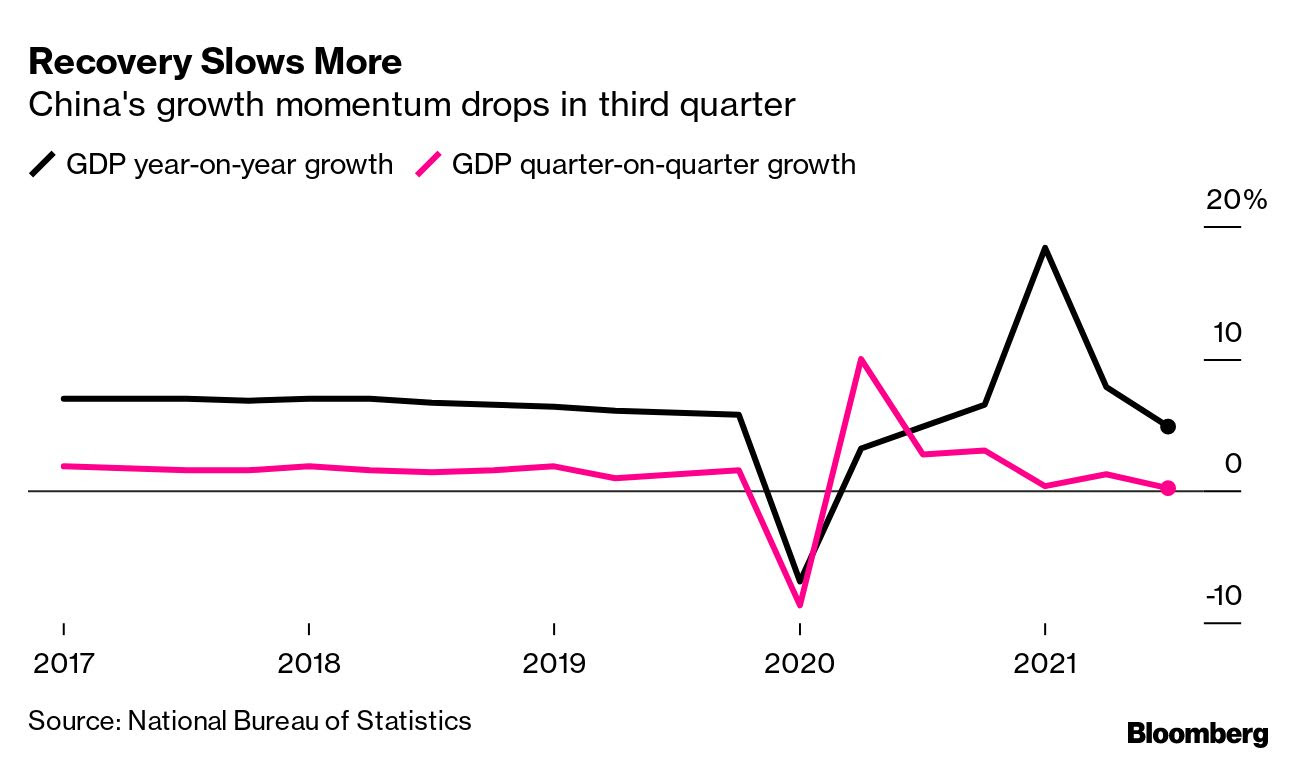

— China’s economy risks slowing faster than global investors realize as President Xi Jinping’s push to cut its reliance on real estate and regulate sectors from education to technology combine with a power shortage and the pandemic. Bank of America and Citigroup are warning that expansion will fall short this year of the 8.2% anticipated by a consensus of economists. The slump could last into next year, forcing growth below 5%, they warn.

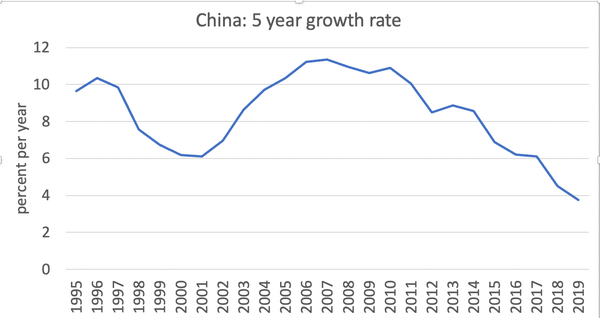

China’s economic growth has been gradually slowing. Here’s a five-year moving average of the country’s growth rate:

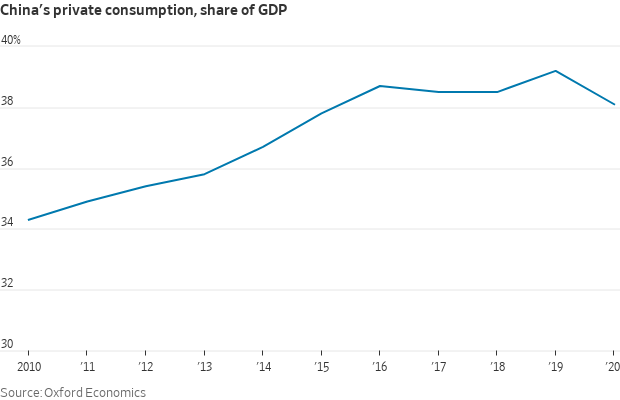

NYT writer and analyst Paul Krugman explains: “Very high investment as a share of GDP is sustainable if the economy is growing at 9% or 10% a year. If growth drops to 3% or 4%, however, the returns on investment drop. That’s why China really needs to change its economic mix — to save less and consume more. But Chinese savings have stayed stubbornly high — and yes, excessive saving is an economic problem.” Krugman recalls an IMF study a few years ago that noted a declining birthrate means that Chinese adults can’t expect their children to support them later in life, so they save a lot to prepare for retirement. “This demographic factor is reinforced by the weakness of China’s social safety net: People can’t count on the government to support them in their later years or to pay for health care, so they feel the need to accumulate assets as a precaution.”

The coronavirus pandemic has complicated China’s efforts to expand its domestic consumer market to allow the country to better navigate the swings in foreign demand. While consumer spending remains subdued in China, it has risen rapidly in Western countries, making exports a larger driver of the country’s growth.

— Beijing tells U.S. it won’t yield on status of Taiwan. Responding to President Biden’s vow to defend Taipei, China says the island is part of its territory. China said Friday that there is “no room” for compromise or concessions over the issue of Taiwan, after a comment by President Biden that the U.S. is committed to defending the self-governing island if it is attacked. Foreign Ministry spokesperson Wang Wenbin reasserted China’s long-standing claim that the island is its territory at a daily briefing after Biden made his comment Thursday at a forum hosted by CNN. China has recently upped its threat to bring Taiwan under its control by force, if necessary, by flying warplanes near the island and rehearsing beach landings. “When it comes to issues related to China’s sovereignty and territorial integrity and other core interests, there is no room for China to compromise or make concessions, and no one should underestimate the strong determination, firm will and strong ability of the Chinese people to defend national sovereignty and territorial integrity,” Wang said. “Taiwan is an inalienable part of China’s territory. The Taiwan issue is purely an internal affair of China that allows no foreign intervention,” Wang said.

Dealing with the rise of China. On Wednesday, Biden’s pick for ambassador to Beijing, Nicholas Burns, told the lawmakers considering his nomination that Americans should “have confidence in our strength” when dealing with the rise of China, a nation he said the U.S. and its allies could manage.

— Will Biden give Xi what he really wants to get a good headline out of COP26? Beijing is playing the climate card by threatening President Biden that if the U.S. wants news out of Glasgow, it must stop criticizing China’s human rights violations and pull back from tariffs and other measures intended to counter China’s economic warfare, according to China observers. John Kerry, Biden’s special envoy for climate, is advocating for subordinating other China policy goals to a Glasgow deal.

ENERGY & CLIMATE CHANGE

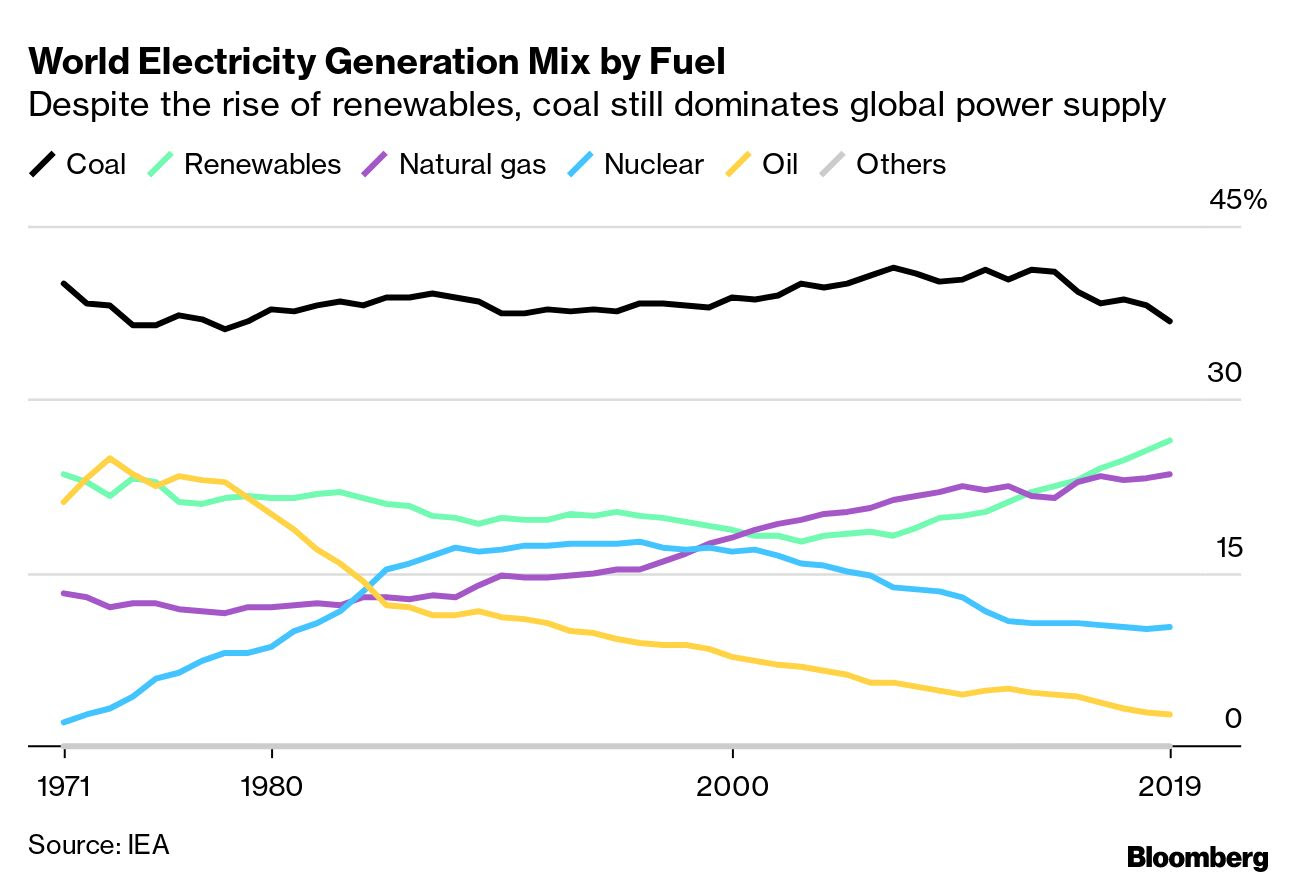

— Coal is still king in world electricity generation.

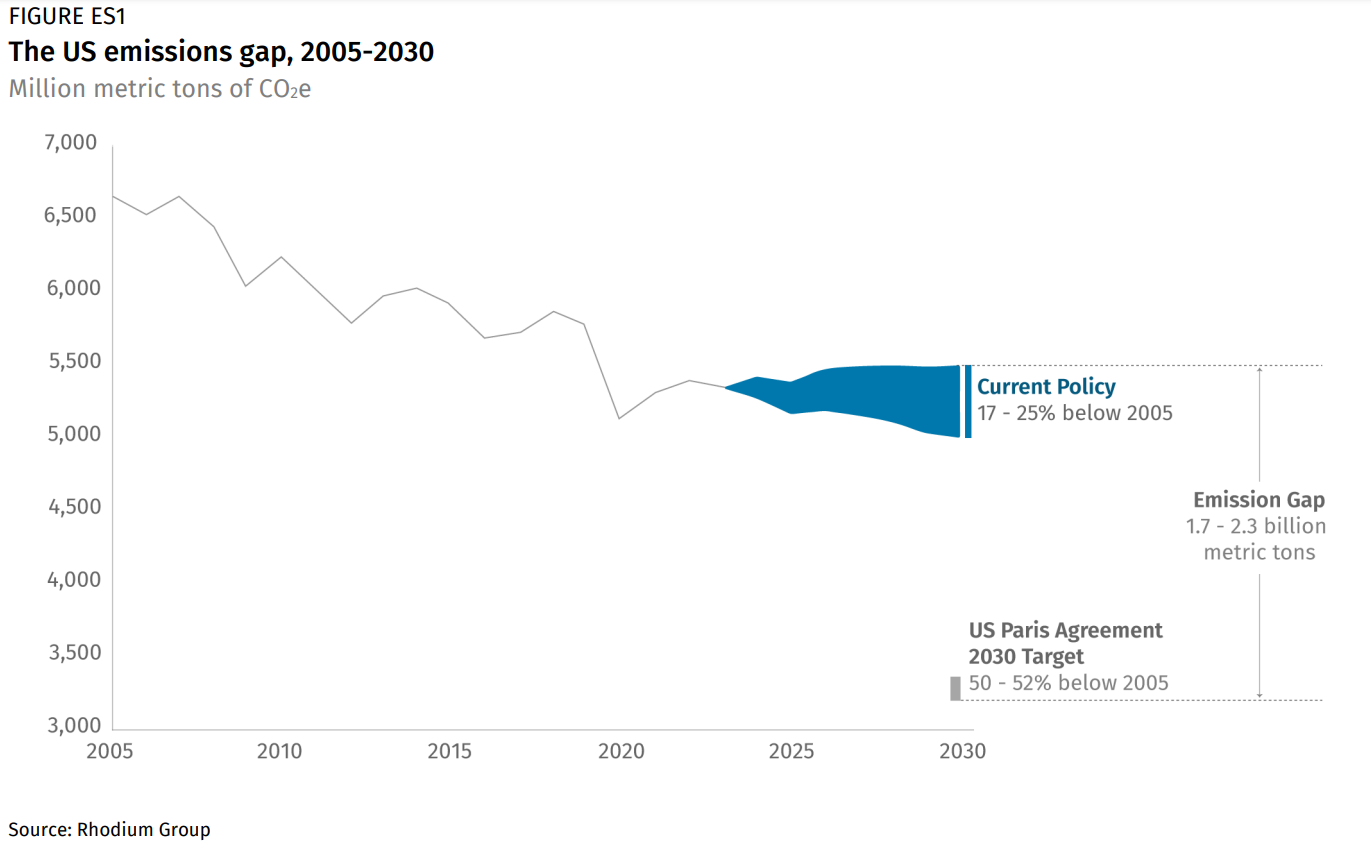

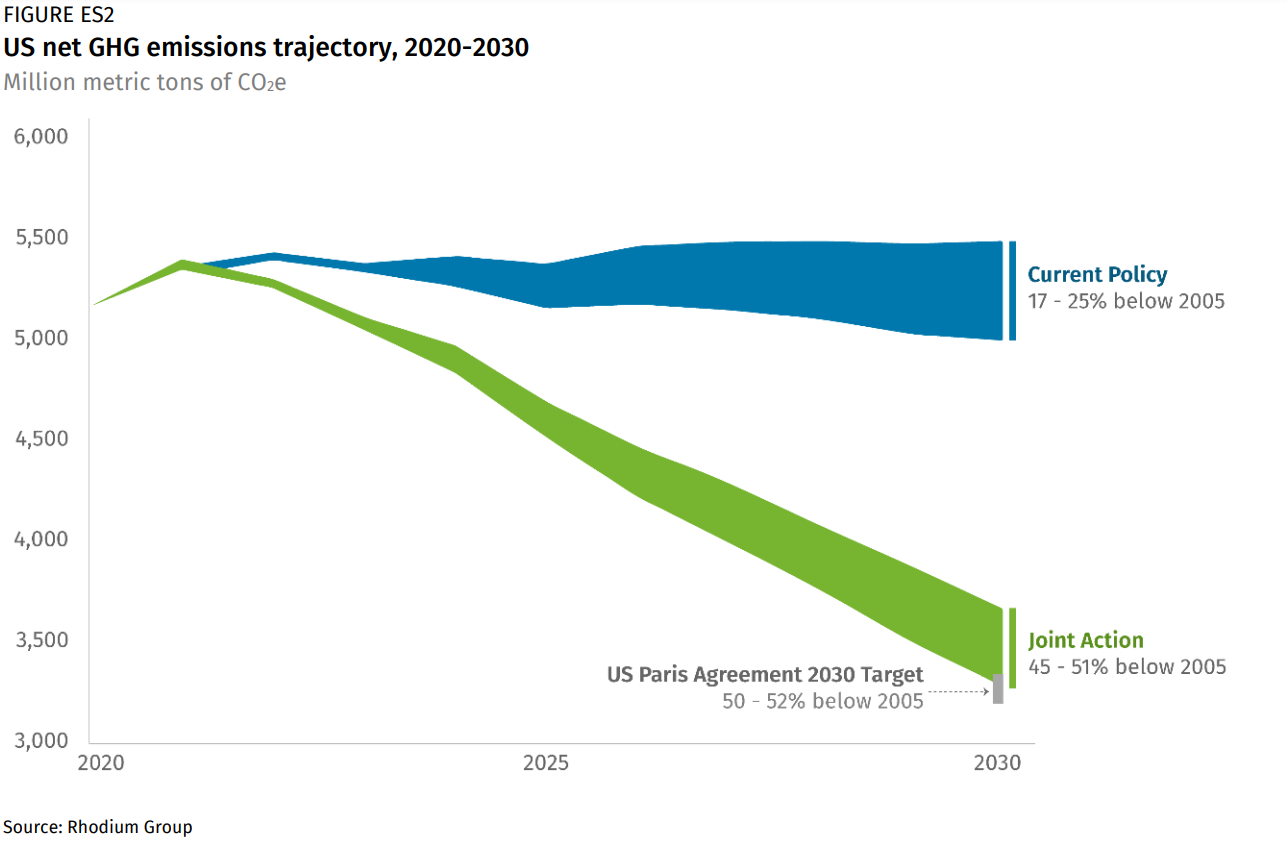

— Biden’s new climate change approach. Sen. Joe Manchin (D-W.Va.) has nixed a key part of the prior Biden climate change plan — Clean Electricity Performance Program (CEPP), which would provide financial incentives for utilities transitioning to renewable energy and financial penalties for those that did not. Manchin opposes any measure that would hurt coal and gas companies. The administration’s strategy now consists of a three-pronged approach: (1) generous tax incentives for wind, solar and other clean energy, (2) tough regulations to restrict pollution coming from power plants and automobile tailpipes, and (3) clean energy laws enacted by states. An analysis (link) released by Rhodium Group, a nonpartisan analysis firm, found that strategy could technically fulfill Biden’s ambitious pledge to cut the country’s emissions 50% from 2005 levels by 2030.

The pending bill before Congress includes about $300 billion in tax incentives for producers and purchasers of wind, solar and nuclear power, and for consumers who buy electric vehicles. The tax incentives would remain in place for a decade, although they are often renewed. It also includes $13.5 billion to construct charging stations for electric vehicles and promote the electrification of heavy-duty vehicles. It would spend $9 billion to update the electric grid, making it more conducive to transmitting wind and solar power, and $17.5 billion to reduce carbon dioxide emissions from federal buildings and vehicles. The Rhodium analysis found that it could lower pollution enough to meet one-third to one-half of Biden’s emissions reduction goals, cutting carbon dioxide emissions about 25% from 2005 levels by 2030. “This is the first ever tax overhaul that ties cash incentives to actually reducing emissions, and it says, the more you reduce emissions, the bigger your savings.” said Sen. Ron Wyden (D-Ore.), who chairs the Senate Finance Committee and the chief author the clean energy tax credit package. “We think you’ll have an extraordinary increase in renewables and clean transportation.”

Meanwhile, the Canadian government warned that U.S. proposals to create new electric vehicle tax credits for American-built vehicles could harm the North American auto industry and fall foul of trade agreements, according to a letter seen by Reuters. And, Canada's oil producers face new pressure from Prime Minister Justin Trudeau to reduce emissions in just three years, a sudden acceleration of their plans that at least one major company said looks unrealistic.

— What to see your climate change future? For residents who live in Washington, D.C., it’s near Louisburg, N.C. The was made using an interactive online tool, the Analog Atlas (link), developed by a team of researchers to help users contextualize climate change effects. The atlas allows users to pick any location on land on the globe, then identifies the present-day site that best matches the location’s future climate. Users can select two warming scenarios — a global average temperature increase of 2 degrees Celsius, roughly expected to occur around the year 2050, or a more dire late-century increase of 4 degrees Celsius. The climate analog can be explored using maps, satellite images and street views. Link.

CORONAVIRUS UPDATE

— Summary: Global cases of Covid-19 are at 243,751,108 with 4,950,278 deaths, according to data compiled by the Center for Systems Science and Engineering at Johns Hopkins University. The U.S. case count is at 45,444,413 with 735,941 deaths. The Johns Hopkins University Coronavirus Resource Center said that there have been 413,645,478 doses administered, 190,578,704 have been fully vaccinated, or 58.1% of the U.S. population.

— Pfizer: Vaccine 90.7% effective in kids 5 to 11. Pfizer said the Covid-19 shot it developed with BioNTech was 90.7% effective against symptomatic cases in children ages 5 to 11, according to a briefing document posted on the FDA website. Outside experts on the FDA’s Vaccines and Related Biological Products Advisory Committee will meet Tuesday to evaluate Pfizer and BioNTech’s application for federal emergency authorization of their coronavirus vaccine in young children.

Some 28 million children ages 5 to 11 in the U.S. would be eligible for the Covid-19 vaccine. A Kaiser Family Foundation survey in September found that about a third of parents with kids in this age range would want to wait and see before getting their child the Covid-19 vaccine. About a third said they would get their young children vaccinated "right away" once the vaccine is authorized.

— Fauci says vaccines could be available to kids in early November. Dr. Anthony Fauci said on Sunday that Covid-19 vaccines could be available for children in early November, providing a boost of optimism for some parents seeking to get their kids inoculated in time for the holidays. “If all goes well, and we get the regulatory approval, and the recommendation from the [Centers for Disease Control and Prevention (CDC)], it's entirely possible, if not very likely, that vaccines will be available for children from five to 11 within the first week or two of November,” Fauci told This Week host George Stephanopoulos on ABC.

POLITICS & ELECTIONS

— David Wasserman of Cook Political Report to be guest this morning on DC Signal to Noise podcast. Link.

— Chris Sununu will decide whether to run for N.H. Senate seat in the next few weeks. Calling in to WMUR (link), New Hampshire GOP Gov. Chris Sununu said he's nearing a decision on whether to challenge Sen. Maggie Hassan (D-N.H.) in the 2022 Senate race. “I got a job to do — I’ve been focusing on that job — but I’ll probably make a decision in the next few weeks.” Sununu is seen as the strongest possible GOP recruit against Hassan. A Granite State Poll (link) found Sununu would lead Hassan 45% to 42% in a hypothetical matchup.

CONGRESS

— Pelosi now open for Democrats to raise debt ceiling without GOP. House Speaker Nancy Pelosi (D-Calif.) opened the door to Democrats using reconciliation to raise the U.S. debt ceiling without the support of Senate Republicans, whose votes would otherwise be needed to end a filibuster on the increase. Democrats have previously resisted using the budget reconciliation process, which requires just 51 votes to pass fiscal legislation, to extend the debt ceiling. The majority party argued that using that process, which can eat up weeks of Senate floor time, sets a bad precedent given that both parties approved past spending that has led to federal debt. But Pelosi indicated a shift when asked about using reconciliation on CNN’s State of the Union on Sunday. “That’s one path, but we’re still hoping to get bipartisanship,” she said.

OTHER ITEMS OF NOTE

— Supreme Court to hear arguments in Texas abortion case. The U.S. Supreme Court said it will hear arguments over Texas’s sharp restrictions on abortion, leaving the law in place for now. The decision to let the law stay in effect came over the dissent of Justice Sonia Sotomayor. The measure bans abortion, including in cases of incest and rape, after about around six weeks, much earlier than what the Supreme Court had previously allowed. Arguments begin on an expedited basis on Nov. 1. The Justice Department contends that Texas “nullified” the court’s precedents on abortion by designing the law to avoid federal judicial review. A month later, on Dec. 1, the court is set to hear arguments in a separate case, challenging Mississippi’s ban on abortion after the 15th week of a pregnancy.

— Border Patrol made about 1.66 million arrests at the southern border in the 2021 fiscal year. It was the highest annual number ever recorded. The pace of migrants coming has emerged as one of the most difficult issues for the Biden administration.

— EPA seeks nominations to appear at WOTUS regional roundtables. EPA and the US Army Corps of Engineers has published a notice in the Federal Register (Iink) requesting the public submit nomination letters to be selected to appear at one of 10 regional roundtables they are planning regarding the development of a new definition of Waters of the U.S. (WOTUS). The agencies want letters submitted by Nov. 3 so it can select those to appear at the sessions which will be held in December and January. The agency has divvied up the U.S. into five regions — Northeast, Southeast, Midwest, West and Southwest — relative to where the sessions will be held. The agencies said specifically are looking for stakeholders to “organize interested parties and regional participants that comprise up to 15 representatives for these roundtables.” The nomination must include proposed participants that represent perspectives on agriculture; conservation groups; developers; drinking water/wastewater management; environmental organizations; environmental justice communities; industry; and other key interests in that region. The agencies will then pick 10 of the self-nominated groups to participate in a regional roundtable. Meanwhile, the agencies’ proposed rule on revised definition of WOTUS, presumably to remove the Navigable Waters Protection Rule put in place by the Trump administration and put the pre-2015 WOTUS definition back in place, remains at the Office of Management and Budget (OMB) under review; it was sent to OMB Oct. 12.

— Whistleblower gets nearly $200 million for informing. A whistleblower whose information helped U.S. and U.K. regulators with a probe into the manipulation of global interest-rate benchmarks by Deutsche Bank was awarded nearly $200 million. The payout is the largest ever by the Commodity Futures Trading Commission (CFTC), which along with the Justice Department and U.K. Financial Conduct Authority, settled enforcement actions against Deutsche Bank in 2015. CFTC’s announcement didn’t name the bank or the case.

EVENTS AND REPORTS

Monday, Oct. 25

· President Joe Biden travels to Newark, New Jersey, "to continue rallying public support for his Bipartisan Infrastructure Deal and Build Back Better agenda."

· Infrastructure and GOP views on climate change. Washington Post Live holds a virtual discussion focusing on "the Republican party's views on climate change and the ongoing negotiations in Congress over infrastructure and social spending."

· CFTC meeting. Commodity Futures Trading Commission holds a meeting by teleconference of the Global Markets Advisory Committee to discuss various issues related to the US Treasury market.

· Reducing methane emissions. The International Energy Agency (IEA) holds a media briefing on a new report, "Curtailing Methane Emissions from Fossil Fuel Operations," and to discuss "the IEA's broader work on methane tracking and abatement."

· G20, COP26 preview. The Center for Strategic and International Studies (CSIS) holds a media conference call briefing on "Previewing the G20 Rome Summit and COP26."

· Sustainable development in the Amazon. The Woodrow Wilson Center's (WWC) Brazil Institute holds a virtual discussion on "Pathways for Sustainable Development in the Amazon."

· Climate change. Washington Post Live holds a virtual discussion on "the climate crisis and the upcoming United Nations Climate Change Conference," as part of the Protecting Our Planet series.

· Rural health issues. Health Resources and Services Administration holds a meeting by teleconference of the National Advisory Committee on Rural Health and Human Services.

· Nature-centered global economy. The Center for American Progress (CAP) holds a virtual discussion on "Transitioning to a Nature-Centered Global Economy."

· Zero emissions and nuclear energy. Third Way and the University of Michigan's College of Engineering hold a virtual discussion on "Fastest Path to Zero Virtual Series: Advanced Nuclear."

· Energy transition. OurEnergyPolicy and the Grace Richardson Fund hold a virtual discussion on "The Free Market and the Energy Transition."

· EVs. The National Academy of Sciences, Engineering, and Medicine (NAS) holds a virtual workshop on "Navigating an Electric Vehicle Future." Runs through Thursday.

· Climate change causes. The Institute for Policy Studies (IPS) holds a virtual discussion on "What is Fueling Climate Change?"

· Japan issues. The Johns Hopkins University Paul H. Nitze School of Advanced International Studies (SAIS) holds its Reischauer Memorial Lecture with Japanese Ambassador to the United States Koji Tomita.

· Economic reports. Chicago Fed National Activity Index | Dallas Fed Mfg. Survey

· Energy reports. IEA briefing on methane emissions cuts | Singapore Energy Summit (runs through Friday)

· USDA reports. AMS. Export Inspections ERS: Food Price Outlook NASS: Poultry Slaughter | Crop Progress