Commercial Real Estate News

Renter Demand Shifts to Affordable Suburban Apartments in U.S.

Commercial News » Irvine Edition | By David Barley | October 18, 2021 7:55 AM ET

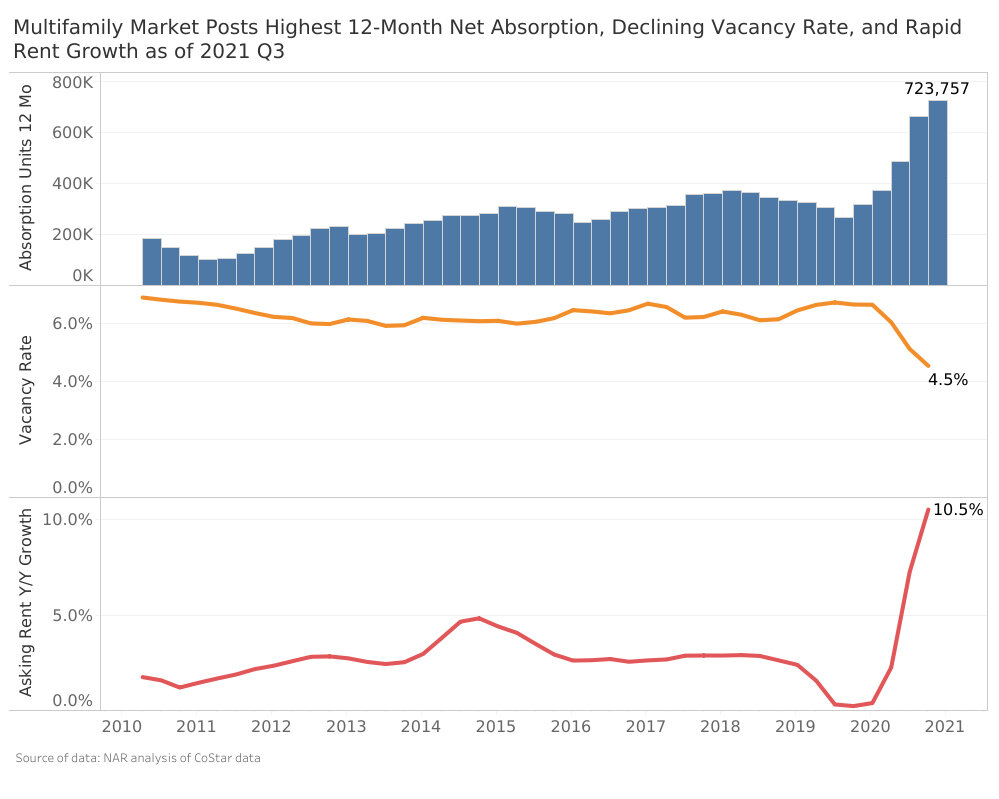

According to new research by the National Association of Realtors, U.S. apartment demand that has surged during the pandemic continued to soar to a decade-high level as of 2021 Q3, with net absorption of nearly a million units (932,910) since 2020 Q2 and nearly a quarter of a million units in the past 12 months as of 2021 Q3. The vacancy rate has fallen to a decade low of 4.5%, and the asking rent has soared to a historic high of 10.5% as well.

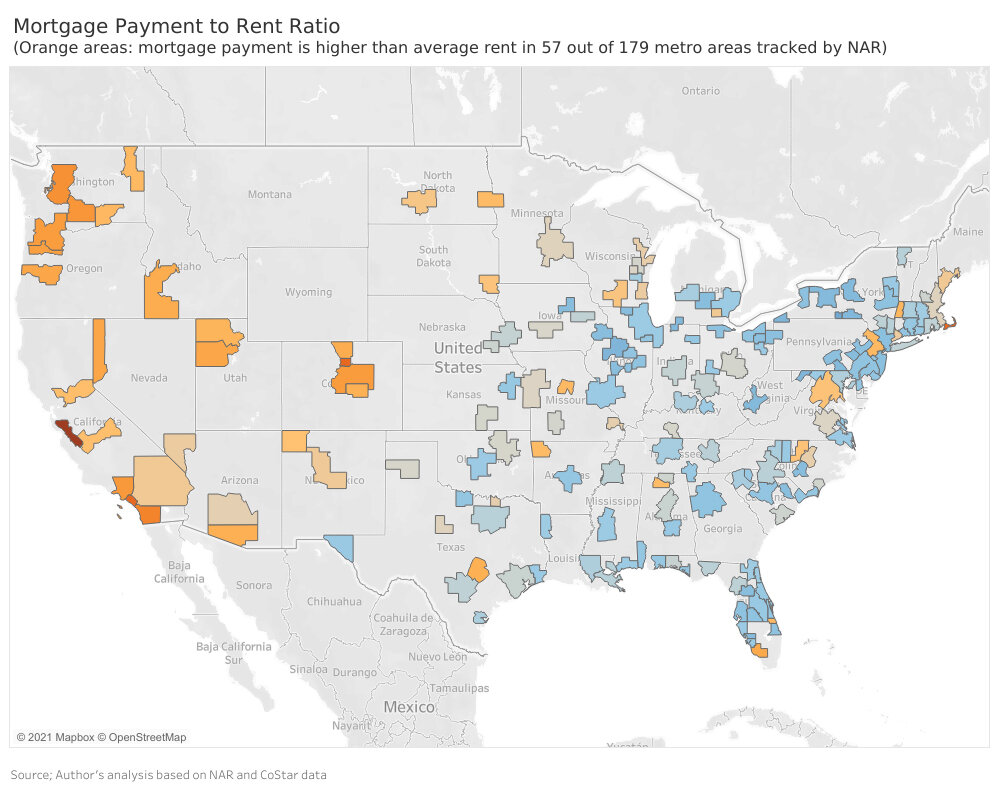

NAR further states that demand for apartments has soared amid strong price growth, with double-digit price growth in the median single-family existing-home sales price in the second quarter in 94% of 183 metro areas. In the western half of the country, owning has become unaffordable compared to renting. For example, in San Jose, the monthly mortgage is $6,400 which is 2.4 times the monthly rent of $2,750. Most of the affordable metro areas for owning a home are in the eastern half of the country (Midwest, South, Northeast regions).

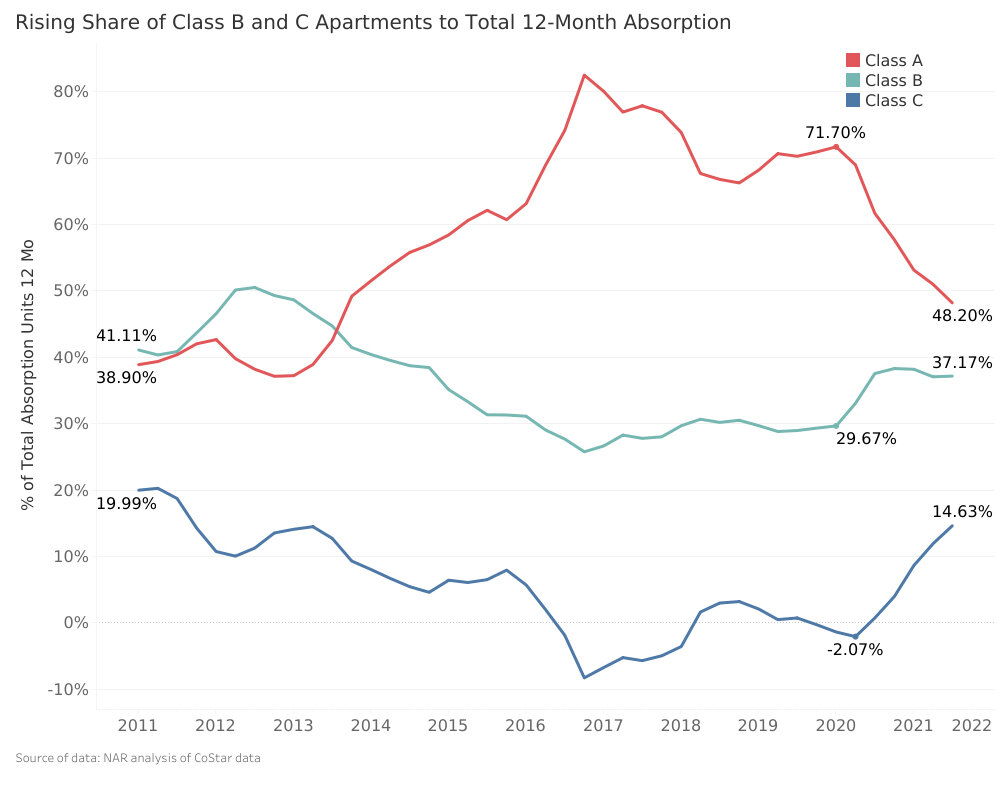

Class A still accounted for the larger share of net new absorptions, but the share of Class A apartments within the total 12-month absorption has drastically declined since the pandemic from 72% in 2020 Q1 to 48% as of 2021 Q3. Meanwhile, the share of Class B rose from 30% to 37% over the same period, as well as the share of Class C going from negative net absorption to positive net absorption of 15%.

The current mix of apartment units under construction has also shifted towards Class B, with the share increasing to 42% as of 2021 Q3 from 36% in 2020 Q1. A total of 644,690 units are under construction, so Class B units amount to 268,748 units. This shift in construction towards Class B units will lead to a more affordable supply of new units.

Class A apartments tend to be located in the central business districts, so the declining share of Class A apartments is indicative of the shift toward suburban markets and away from the central business district with people working from home. Another reason for the rising share of Class B apartments could be the cost of rent, as Class B units are cheaper than Class A units by about $500. Renters tended to look for more affordable apartments, given the risk of unemployment during the pandemic period.

Sign Up Free | The WPJ Weekly Newsletter

Relevant real estate news.

Actionable market intelligence.

Right to your inbox every week.

Real Estate Listings Showcase

Related News Stories

Commercial Real Estate Headlines

- Nonresidential Construction Spending in the U.S. Falls Sharply in January

- U.S. Multifamily Construction Starts to Decline in 2024

- Commercial Mortgage Lending in U.S. Shows Signs of Stabilization in Late 2023

- Architecture Billings Decline in December as Soft Business Conditions Persist

- Government Sector Claimed Largest Portion of 100 Biggest U.S. Office Leases Signed in 2023

- U.S. Commercial, Multifamily Borrowing Dives 25 Percent Annually in Late 2023

- Record High Multifamily Construction Deliveries Drive Vacancy Rates Higher

- Commercial Property Investment in Japan Implodes 57 Percent Annually in Late 2023

- Green Energy Companies Flocking to New York City Office Space

- Asia Pacific Commercial Property Investment Upticks 3 Percent in Q4

- U.S. Commercial, Multifamily Borrowing to Hit $576 Billion in 2024

- Japan is Top Cross Border Commercial Property Investment Target in 2024

- U.S. Delinquency Rates for Commercial Properties Increased 6 Percent in Q4 of 2023

- Commercial Property Investment in Japan to Weaken in 2024

- Office Landlords Nationwide Increasing Concessions to Lure Tenants in U.S.

- Hong Kong's Commercial Property Market Faces Ongoing Challenges in 2024

- Online Returns in the U.S. Could Total $82 Billion This Holiday Season

- More Pain Expected in 2024 for America's Commercial Property Sector

- Total U.S. Commercial, Multifamily Mortgage Debt Rises to $4.63 Trillion in 2023

- U.S. Apartments Still Enjoy Healthy Demand in Q3

- Commercial Real Estate Lending in U.S. Shows Signs of Stabilizing in Late 2023

- Multifamily Apartment Rent Growth in U.S. Slows in Q3

- Asia Pacific Commercial Investment Dives 22 Percent in Q3

- Global Commercial Investment Implodes 51 Percent Annually in Q3

- Commercial Property Investment in Japan Dips 9 Percent Annually in Q3

- Fast Growing AI Tech Companies Help Drive U.S. Office Leasing Activity in 2023

- Hong Kong's Retail Market Faces Six Challenges to Recover

- Electric Vehicle Public Charging Stations in Asia Pacific Will Reach Ten Million by 2030

- Industrial Market Rebalances as E-commerce Growth Normalizes in U.S.

- U.S. Commercial, Multifamily Mortgage Delinquencies Increase in Q3

- Investment in Asia Pacific Multifamily Properties to Double by 2030

- Multi-story Warehouses Are 15 Percent of Sydney's New Industrial Stock

- Manhattan Office Leasing Activity Lags in Q3 as Sentiment Remains Cautious

- Nonresidential Construction Spending Increases in America

- Office Conversions on Pace to Double in U.S.

- Hong Kong Office Vacancy Rates Stabilize After 4 Months of Increases

- Commercial Mortgage Debt Outstanding in U.S. Jumps to $4.60 Trillion in Mid 2023

- Architecture Billings Index in U.S. Remains Flat in July

- Commercial Mortgage Delinquencies Rise in America

- U.S. Data Center Demand Explodes in U.S., Driven by AI Growth in 2023