As seen on the above chart, two of the major indices including the S&P 500 (SPY) and the Dow Jones Industrials (DIA) cleared prior resistance from their 50-Day moving averages (DMA).

On the other hand, the Russell 2000 (IWM) has resistance near $230 and the Nasdaq 100 (QQQ) has overhead resistance from its 50-DMA at $369.39.

With that said, the recent market action has been enforced by strong bank earnings and consumer demand.

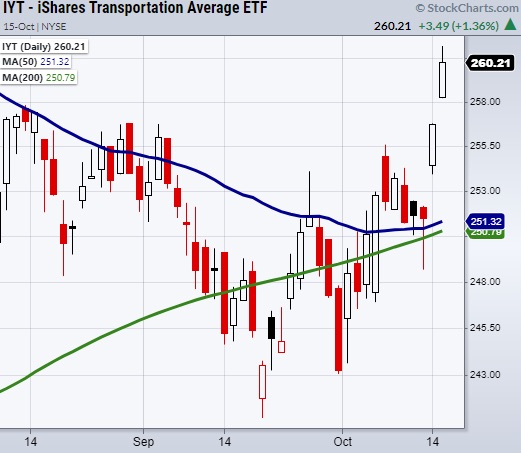

Improving consumer demand can also be reflected in the transportation sector ETF (IYT) which made a second gap up since clearing the 50-DMA at $251.72.

Therefore, if the market is going to continue higher keep an eye on IYT for upwards momentum and for SPY and DIA to hold over their 50-DMAs.

When it comes to trading on Monday, often gap days are met with a digestion day as buyers take profits and money rotates into new buyers.

This rotation is normal and if the market trends higher will show underlying strength.

Nonetheless, the main takeaway for trading on Monday is to watch for IYT, SPY, and DIA to hold their current price areas.

If they do this will help the tech-heavy Nasdaq 100 (QQQ) and the Small-cap Russell 2000 (IWM) look to clear their pivotal resistance areas.

$230 resistance for IWM and $369.39 resistance for QQQ.

Watch Mish on StockCharts give actionable earning season setups!

Stock Market ETFs Trading Analysis Summary:

S&P 500 (SPY) 442 new support.

Russell 2000 (IWM) Needs to stay over 225.

Dow (DIA) 350 new support area.

Nasdaq (QQQ) 370 resistance to clear.

KRE (Regional Banks) 71.75 resistance area.

SMH (Semiconductors) 264.25 resistance from the 50-DMA.

IYT (Transportation) 257 new support area.

IBB (Biotechnology) 160 resistance. 153.38 support.

XRT (Retail) 93.80 resistance from the 50-DMA.

Twitter: @marketminute

The author may have a position in mentioned securities at the time of publication. Any opinions expressed herein are solely those of the author and do not represent the views or opinions of any other person or entity.