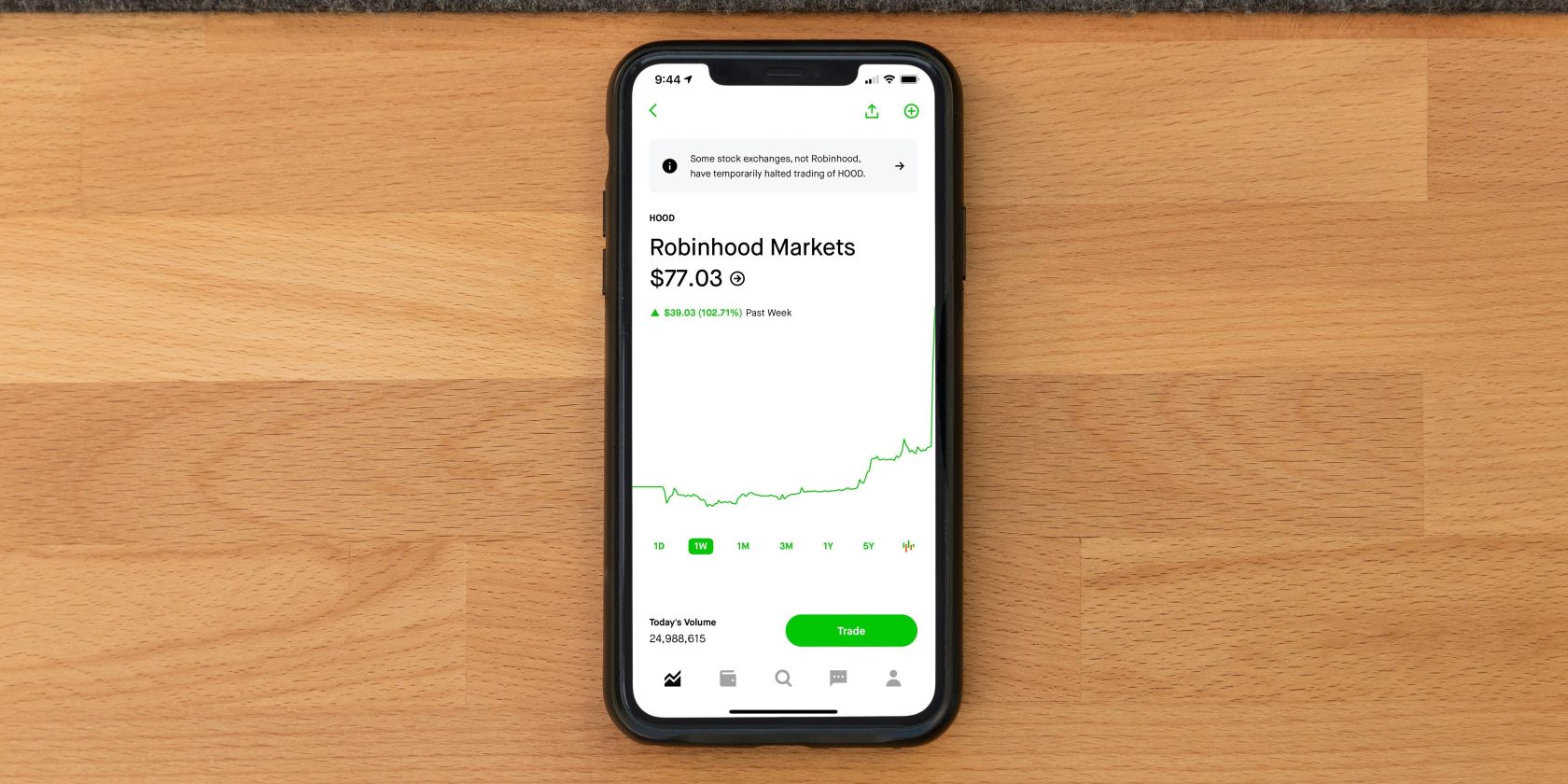

Robinhood is one of the most popular stock trading apps on the market. With commission-free trades and crypto, ETF, and stock options available, you can create a great investment portfolio right from your iOS or Android device. Robinhood also has useful features in the app like reinvesting your dividends into your favorite stocks.

If you want to take your financial portfolio to the next level, you might be interested in how to trade options on Robinhood. This tutorial will teach you just that.

Step 1. Download the Robinhood App and Set Up Your Account

The first step to trading options in Robinhood is downloading the app and creating an account. Please note that not all US states support Robinhood.

Currently, you can create an account in every state, including the District of Columbia, except Hawaii, Nevada, New Hampshire, and West Virginia. If you live in one of these states, you will not be able to sign up at all, even if you use a VPN. The reason for this is you will need to verify your identity using your real address and bank account.

The same goes for using Robinhood in a country that doesn’t support it. If you are traveling, an attempted login in a country that isn’t supported could get your account restricted, so be sure to keep this in mind. If you are outside the US, be sure to check with your current country of residence, even if you are a US citizen.

Once you have the app downloaded you can begin setting up your account. Account setup is quick and easy and just includes verifying your identity and adding your bank account for deposits and withdrawals.

Download: Robinhood for iOS | Android (Free)

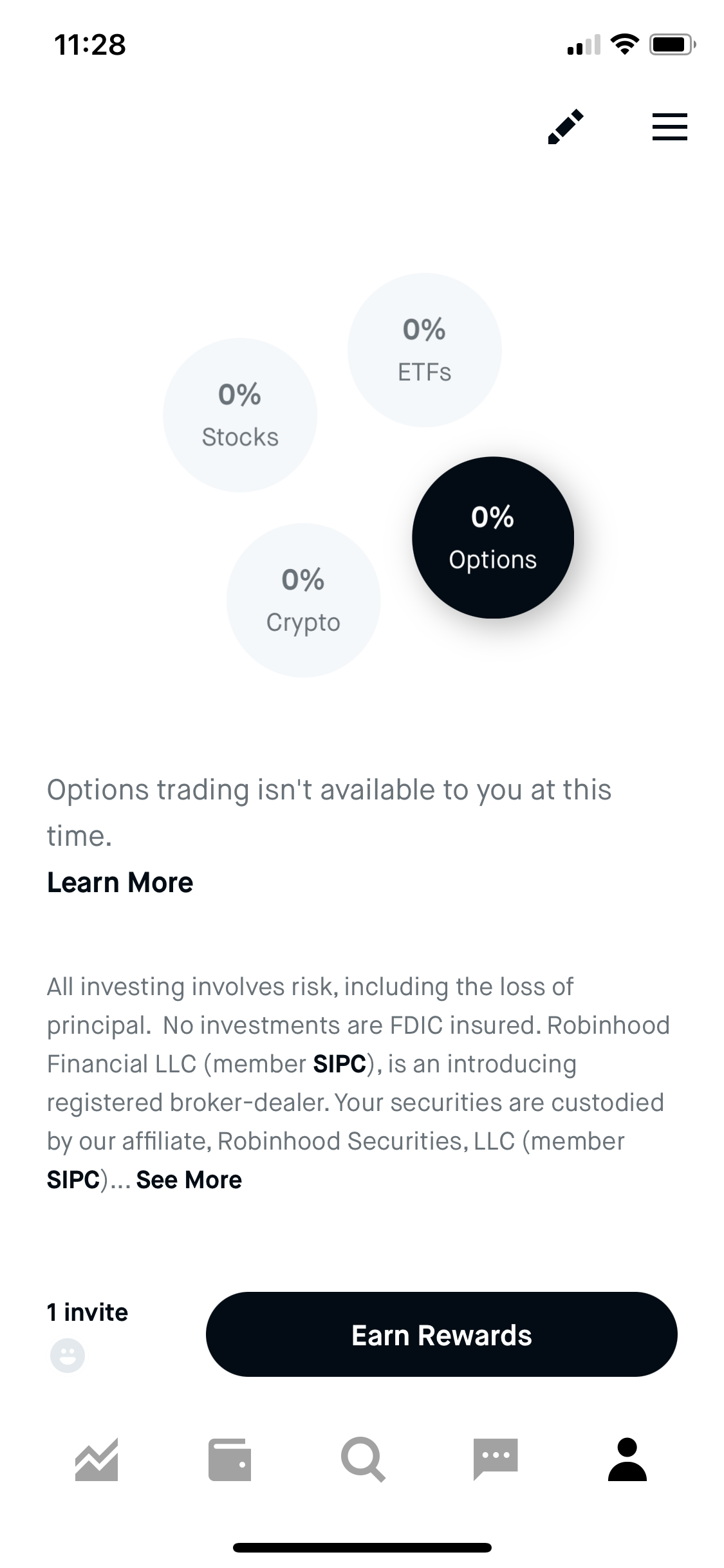

Step 2. Learn How Options Trading Works

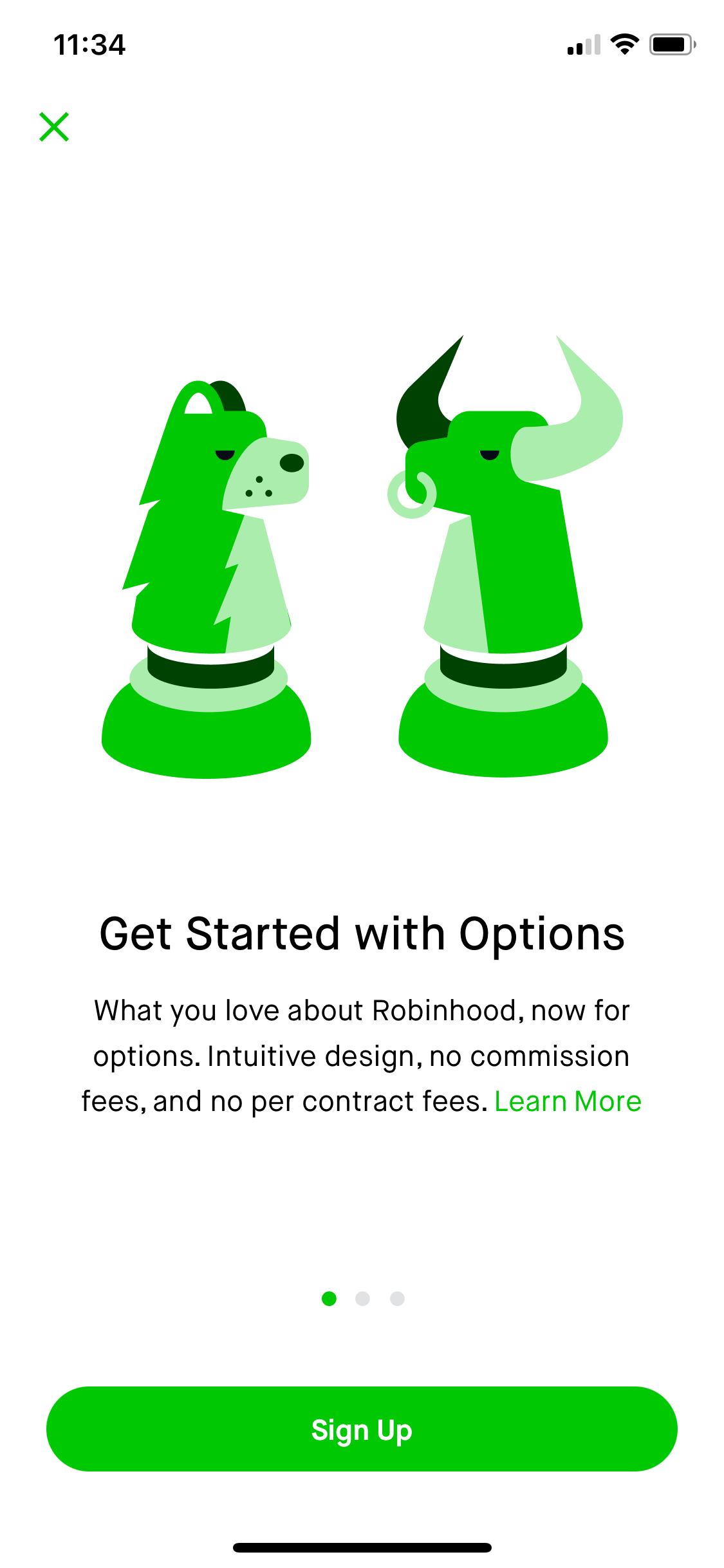

For those new to Robinhood, you might notice that by default you aren’t able to trade options. This is for a good reason, as trading options are risky and Robinhood reserves this option for experienced investors. However, Robinhood is one of the best apps to trade options as its commission-free and you can keep track of the rest of your portfolio without having any of it split up.

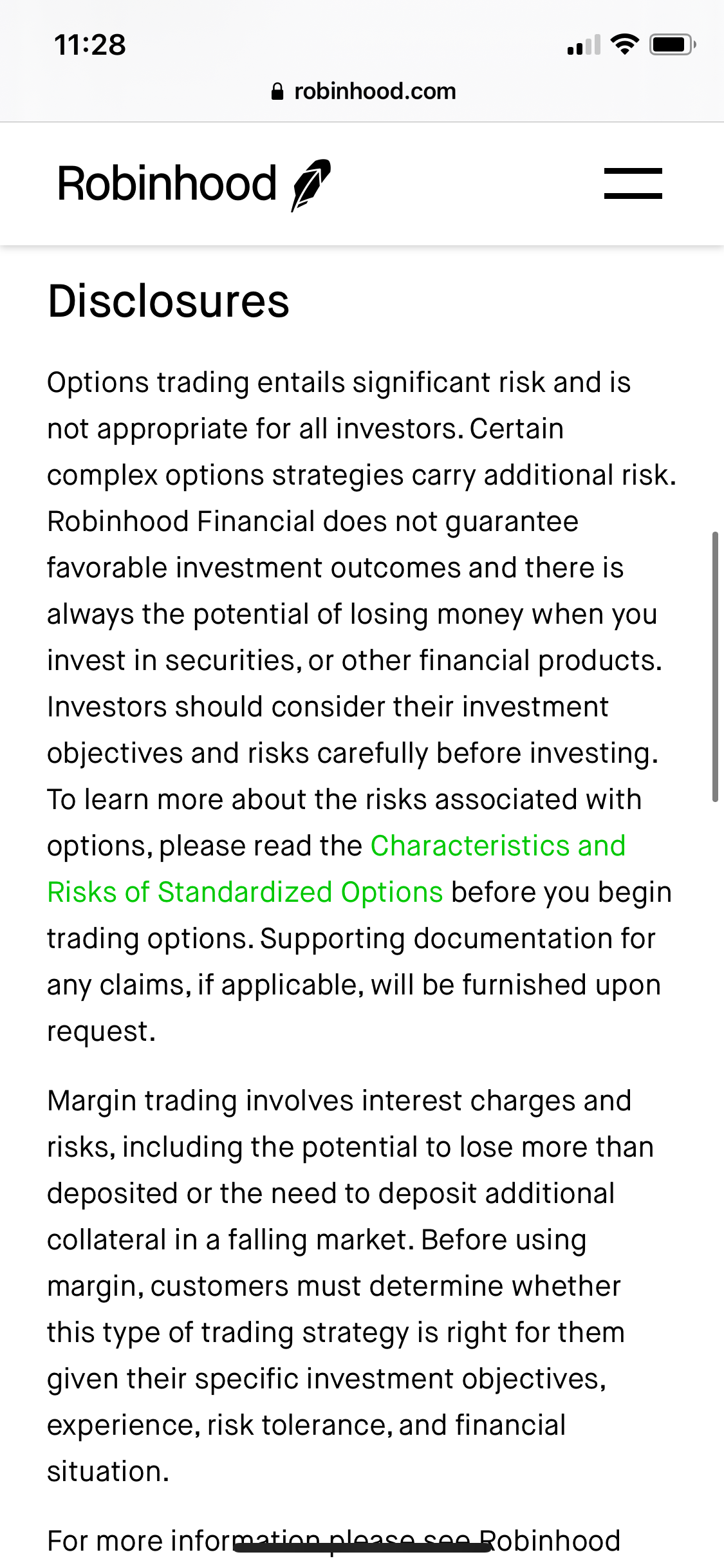

Robinhood recommends reading the Characteristics and Risks of Standardized Options ebook before making your first trades. This PDF goes over the basics of options and how to consider your investment objectives. While it may seem tedious to read through this PDF before enabling your account, there is a reason Robinhood recommends it, and some verification questions require basic options trading knowledge. If you’re a beginner, this will help you get caught up.

Step 3. Get Approved for Options Trading

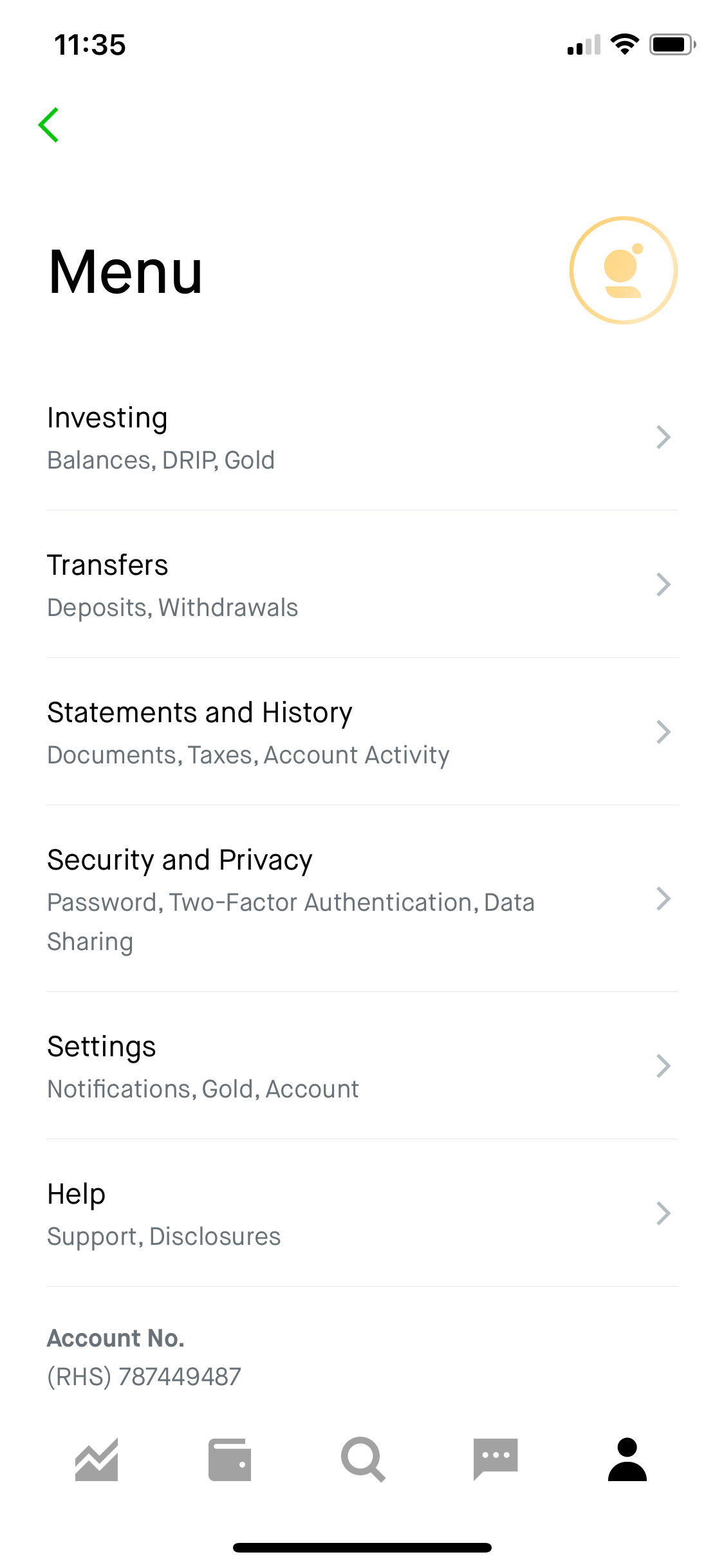

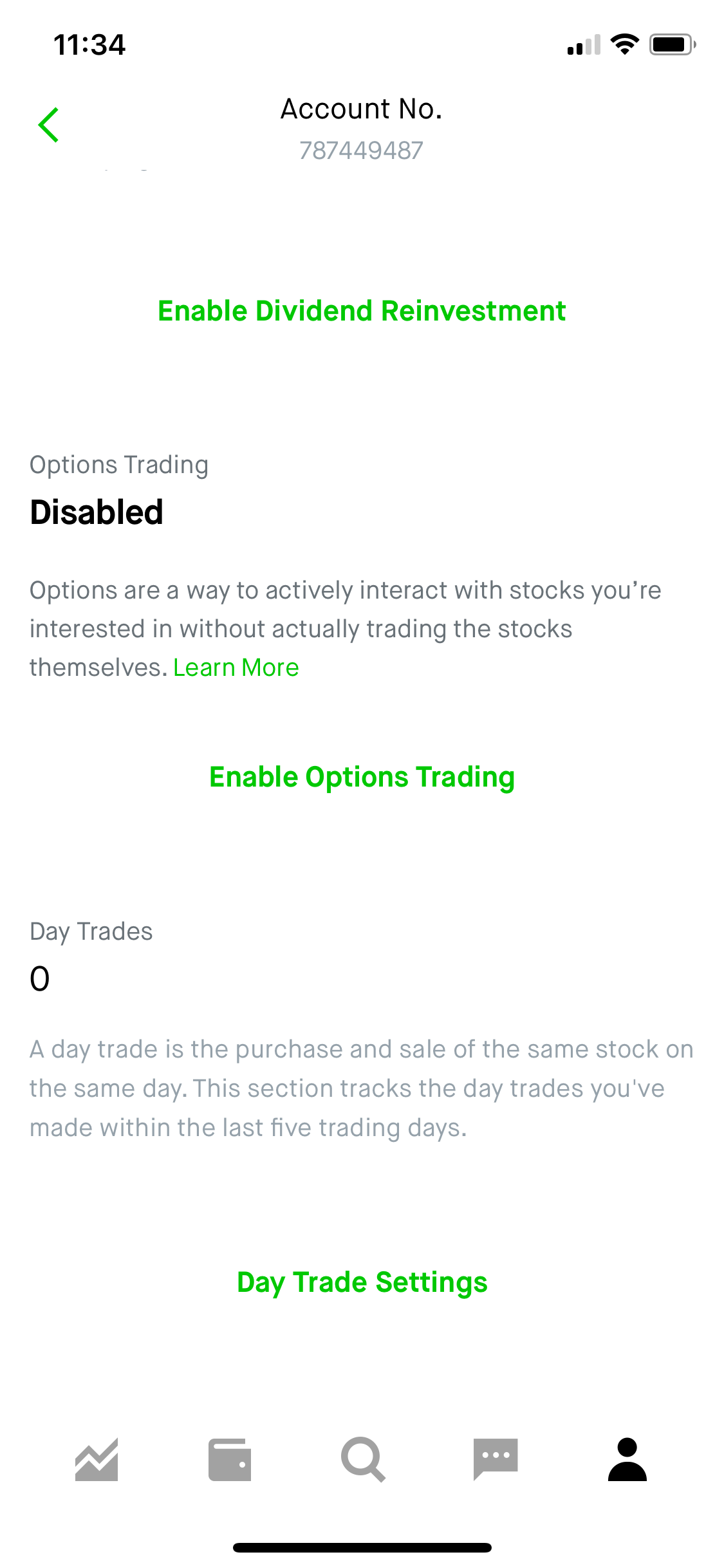

In order to get approved for options trading in Robinhood, you’ll need to enable it in your Robinhood settings. In the app, head over to Settings > Investing, and scroll down to Options. There, you will see an toggle to Enable Options Trading.

In order to enable options, Robinhood will ask you a few verification questions. This will let Robinhood know you’re able to make responsible options trades. These questions include basic knowledge on entering option spreads. Robinhood also needs to legally verify your employment and check if you work in the financial industry.

Once you enter this information, Robinhood will review it and contact you if you’re approved to trade options. Once approved, your account will be upgraded to an instant account instead of a cash account. This means that you can make instant deposits from your bank.

Start Trading Options With Robinhood

Once approved for options trading, you’ll be ready to start trading options! Robinhood makes it easy to trade stocks, ETF’s, and options commission-free. By getting approved to trade options you’ll be on your way to making the most of your Robinhood account.