Asking rents spiked 10%-25% in half the cities. Rents fell in only a few, incl. -25% in San Francisco from 2019 peak.

By Wolf Richter for WOLF STREET.

OK, so these are advertised rents (“asking rents”) for apartments listed for rent at various rental listing services, including Multiple Listing Service, and they’re not the actual rents of currently occupied apartments, and they’re not rents for single-family houses, which dance to a different red-hot drummer. And the Consumer Price Index (CPI) doesn’t look at asking rents; it uses surveys to ask homeowners and tenants about the status of rents. Asking rents discussed here are a measure of where landlords think the current market is. And they’re going wild in lots of places.

First because there are only a few: The cities where rents fell.

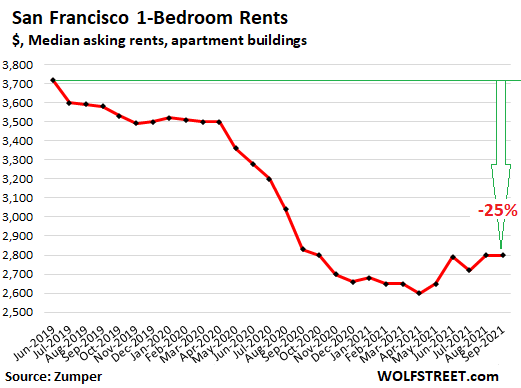

In San Francisco, the median asking rent for one-bedroom apartments for September, at $2,800, was unchanged from August and was down 25% from June 2019:

One-bedroom rents in San Francisco have plunged so far, according to data from Zumper, that the once most expensive rental market has fallen behind New York City.

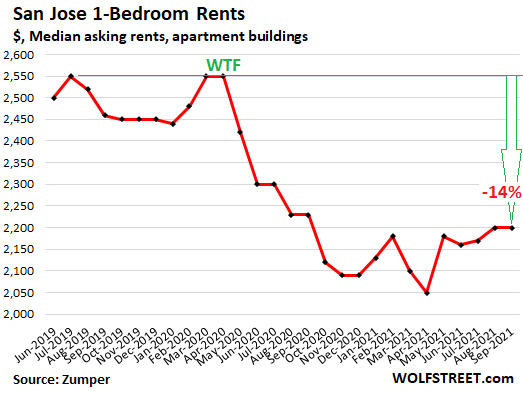

In San Jose, our stand-in for Silicon Valley, rents began falling in the summer of 2019. In March and April 2020, during the lockdown, landlords jacked up advertised rents, knowing that no one was looking for apartments, which produced a silly jump in asking rents, that then dissolved into a plunge when the market re-opened. From July 2019 through September 2021, the median 1-BR asking rent fell 14%, having gone nowhere over the past four months:

But in San Francisco and San Jose, rents started going down in mid-2019, well before the Pandemic, then plunged during the Pandemic, and by September 2020 had done most of their plunging. So compared to September 2020, on a year-over-year basis, 1-BR rents are down only 1.1% in San Francisco and 1.3% in San Jose.

The few rent decliners year-over-year:

There are a few cities where rents have declined sharply on a year-over-year basis. The biggest declines in the median asking rent of 1-BR apartments occurred in Milwaukee, down 17.4% year-over-year, to $900.

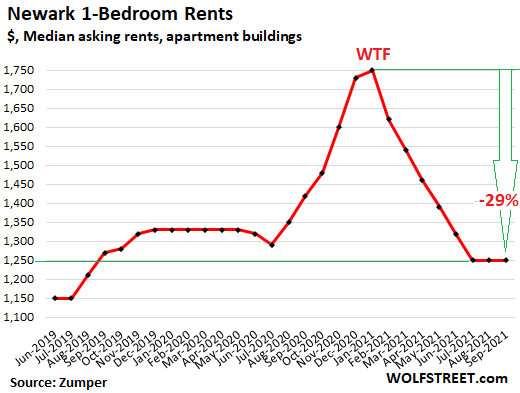

But it’s Newark, NJ, that takes the crown. It shows how asking rents and landlords went crazy on a meme. During the early phases of the Pandemic, apartment dwellers of New York City were said to be fleeing the City, looking for apartments and houses in cheaper pastures. The knee-jerk reaction in Newark, across the Hudson River from Manhattan, was to jack up advertised asking rents, assuming that fleeing New Yorkers had a big appetite for Newark, and lots of money.

The median 1-BR asking rent skyrocketed by 31% from before the Pandemic. But when it became clear to landlords that they couldn’t fill their units at those rents, they brought asking rents back to earth. Year-over-year, the median asking rent is down 12%, and it’s down 29% from the peak in January and below where it had been before the Pandemic:

The table shows the 20 cities where the median 1-BR rent declined year-over-year. This includes Chicago and Honolulu. But in those cities, since their peaks in 2015, rents have plunged by 30% and 28% respectively.

There are only three cities were rents declined 10% or more year-over-year. We’ll get to the significance of that in a moment when we look at the 49 cities where rents surged between 10% and 25%:

| The 20 Cities where 1-BR rents fell YoY | |||

| 1 | Milwaukee, WI | 900 | -17.4% |

| 2 | Newark, NJ | 1,250 | -12.0% |

| 3 | Chesapeake, VA | 1,050 | -11.0% |

| 4 | Minneapolis, MN | 1,190 | -8.5% |

| 5 | Philadelphia, PA | 1,390 | -7.3% |

| 6 | Oakland, CA | 2,000 | -6.1% |

| 7 | St Louis, MO | 920 | -6.1% |

| 7 | Baltimore, MD | 1,260 | -6.0% |

| 9 | Cincinnati, OH | 920 | -5.2% |

| 10 | Kansas City, MO | 940 | -5.1% |

| 11 | Laredo, TX | 760 | -5.0% |

| 11 | Honolulu, HI | 1,530 | -4.4% |

| 13 | Chicago, IL | 1,440 | -4.0% |

| 13 | Richmond, VA | 1,090 | -3.5% |

| 15 | Wichita, KS | 600 | -3.2% |

| 16 | Rochester, NY | 980 | -2.0% |

| 17 | San Jose, CA | 2,200 | -1.3% |

| 18 | San Francisco, CA | 2,800 | -1.1% |

| 19 | Buffalo, NY | 1,050 | -0.9% |

| 20 | New Orleans, LA | 1,440 | -0.7% |

Expensive Markets where rents rose but are still below pre-pandemic levels.

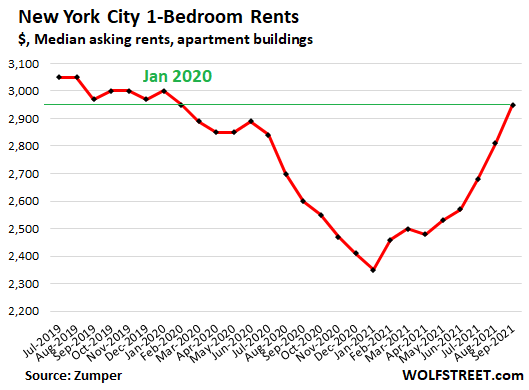

In New York City, the median asking rent for 1-BR apartments has jumped 26% from the low in January 2021, but at $2,950, is now just back where it had been in February 2020 and below where it had been in January 2020 ($3,000) and in 2019:

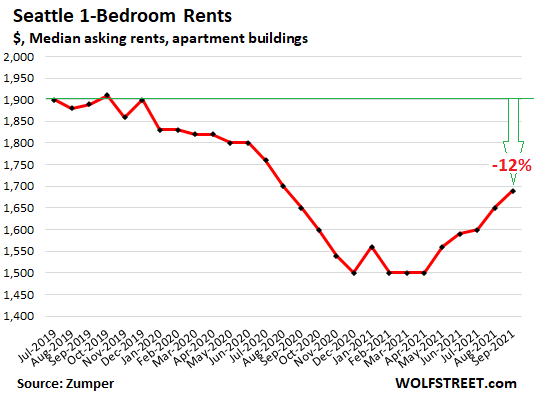

In Seattle, 1-BR asking rents have come up from the lows earlier this year but are still down 12% from before the pandemic and down 15% from the peak in May 2018:

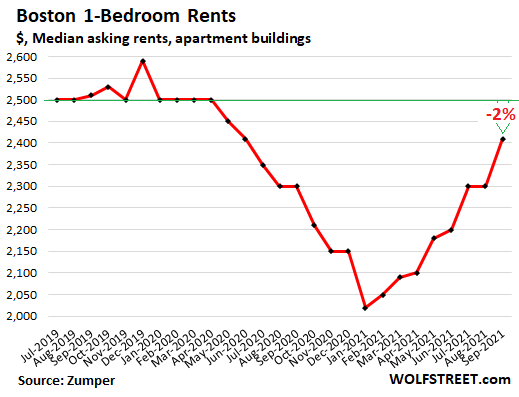

In Boston, 1-BR rents have jumped 19% from the low in January, to $2,410, but remain 2% below pre-pandemic levels:

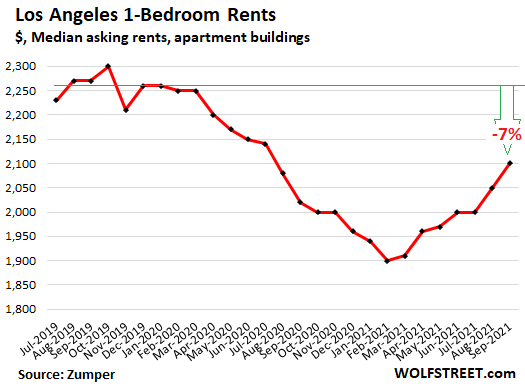

In Los Angeles, 1-BR rents have jumped 11% from the low in January but are down 7% from pre-pandemic levels:

In nearly Half the largest 100 cities, rents surged 10% to 25% year-over-year.

Of the 100 cities where Zumper tracks asking rents, 49 have seen rents jump by 10% to 25% in September, compared to September 2020. These are massive rent increases in nearly half the cities.

In 26 of these cities, asking rents surged by 15% or more. And in 9, rents surged by 20% or more with the top being Gilbert, AZ where rents spiked by nearly 25% year-over-year to $1,660. The top four biggest rent spikes occurred in Arizona. The remainder is spread across the US, from lower cost cities to high cost cities, from coastal cities to inland cities.

| 49 of 100 Cities where 1-BR rents jumped 10% – 25% YoY |

|||

| 1 | Gilbert, AZ | $1,660 | 24.8% |

| 2 | Scottsdale, AZ | $1,850 | 23.3% |

| 3 | Glendale, AZ | $1,130 | 22.8% |

| 4 | Phoenix, AZ | $1,260 | 22.3% |

| 5 | Plano, TX | $1,370 | 21.2% |

| 6 | Anchorage, AK | $1,090 | 21.1% |

| 7 | Mesa, AZ | $1,160 | 20.8% |

| 8 | Boise, ID | $1,380 | 20.0% |

| 9 | Cleveland, OH | $1,320 | 20.0% |

| 10 | Virginia Beach, VA | $1,290 | 19.4% |

| 11 | Henderson, NV | $1,490 | 19.2% |

| 12 | Raleigh, NC | $1,240 | 19.2% |

| 13 | Durham, NC | $1,320 | 18.9% |

| 14 | Tampa, FL | $1,410 | 18.5% |

| 15 | Bakersfield, CA | $950 | 17.3% |

| 16 | Charlotte, NC | $1,440 | 17.1% |

| 17 | San Diego, CA | $2,100 | 16.7% |

| 18 | San Antonio, TX | $1,050 | 16.7% |

| 19 | St Petersburg, FL | $1,470 | 15.7% |

| 20 | Detroit, MI | $890 | 15.6% |

| 21 | Des Moines, IA | $980 | 15.3% |

| 22 | Irving, TX | $1,210 | 15.2% |

| 23 | Chattanooga, TN | $1,140 | 15.2% |

| 24 | Chandler, AZ | $1,450 | 15.1% |

| 25 | Tucson, AZ | $840 | 15.1% |

| 26 | Denver, CO | $1,610 | 15.0% |

| 27 | Salt Lake City, UT | $1,150 | 15.0% |

| 28 | Spokane, WA | $1,000 | 14.9% |

| 29 | Orlando, FL | $1,400 | 14.8% |

| 30 | Atlanta, GA | $1,640 | 14.7% |

| 31 | Reno, NV | $1,250 | 14.7% |

| 32 | El Paso, TX | $780 | 14.7% |

| 33 | Knoxville, TN | $940 | 14.6% |

| 34 | Akron, OH | $640 | 14.3% |

| 35 | Jacksonville, FL | $1,050 | 14.1% |

| 36 | New York, NY | $2,950 | 13.5% |

| 37 | Colorado Springs, CO | $1,090 | 13.5% |

| 38 | Miami, FL | $1,970 | 12.6% |

| 39 | Austin, TX | $1,440 | 12.5% |

| 40 | Las Vegas, NV | $1,170 | 12.5% |

| 41 | Tulsa, OK | $730 | 12.3% |

| 42 | Aurora, CO | $1,200 | 12.1% |

| 43 | Anaheim, CA | $1,820 | 11.7% |

| 44 | Syracuse, NY | $860 | 11.7% |

| 45 | Dallas, TX | $1,390 | 11.2% |

| 46 | Washington, DC | $2,210 | 11.1% |

| 47 | Nashville, TN | $1,410 | 11.0% |

| 48 | Madison, WI | $1,250 | 10.6% |

| 49 | Columbus, OH | $980 | 10.1% |

CPI inflation and these spiking asking rents.

This very large preponderance of cities where 1-BR asking rents increased by 10% or more – nearly half of the 100 largest cities tracked – compared to only 3 cities where rents fell 10% or more, makes clear that, averaged out across the US, massive rental pressures are building up. But it will take a while before they’re making their way into the CPI rent factors.

About one-third of CPI is determined by two indexes that both track a version of rents: Rent of primary residence and Owner’s equivalent of rent. Rent of primary residence rose only 2.1% and owner’s equivalent of rent rose only 2.6% in August. Before the pandemic, they’d been around 3.5%. They’re the biggest CPI categories, and they have effectively pushed down CPI this year.

But given what is happening now in rental land, those measures will pick up the rent increases in the coming months and next year, and push CPI higher (rather than pushing it down). This will happen just as the Fed’s “temporary” inflation spike is supposed to unwind. And these rental measures will give new fuel to overall CPI inflation.

The Largest 100 rental markets.

The table below shows the largest 100 rental markets that Zumper tracks, with 1-BR and 2-BR median asking rents in September, and year-over-year percent changes, in order of the price of 1-BR rents (if your smartphone clips the 6-column table on the right, hold your device in landscape position):

| Rents, Top 100 Cities | 1-BR $ | Y/Y % | 2-BR $ | Y/Y % | |

| 1 | New York, NY | $2,950 | 13.5% | $3,150 | 5.4% |

| 2 | San Francisco, CA | $2,800 | -1.1% | $3,900 | 2.6% |

| 3 | Boston, MA | $2,410 | 4.8% | $2,800 | 0.0% |

| 4 | Washington, DC | $2,210 | 11.1% | $2,950 | 7.7% |

| 5 | San Jose, CA | $2,200 | -1.3% | $2,750 | -0.7% |

| 6 | Los Angeles, CA | $2,100 | 4.0% | $2,900 | 3.2% |

| 7 | San Diego, CA | $2,100 | 16.7% | $2,710 | 14.8% |

| 8 | Oakland, CA | $2,000 | -6.1% | $2,620 | -3.0% |

| 9 | Miami, FL | $1,970 | 12.6% | $2,600 | 10.6% |

| 10 | Scottsdale, AZ | $1,850 | 23.3% | $2,420 | 22.2% |

| 11 | Anaheim, CA | $1,820 | 11.7% | $2,140 | 7.5% |

| 12 | Santa Ana, CA | $1,810 | 9.7% | $2,420 | 11.0% |

| 13 | Fort Lauderdale, FL | $1,740 | 3.6% | $2,480 | 12.7% |

| 14 | Seattle, WA | $1,690 | 2.4% | $2,230 | 1.4% |

| 15 | Gilbert, AZ | $1,660 | 24.8% | $1,980 | 23.8% |

| 16 | Atlanta, GA | $1,640 | 14.7% | $2,190 | 15.3% |

| 17 | Long Beach, CA | $1,630 | 1.9% | $2,100 | 0.0% |

| 18 | Denver, CO | $1,610 | 15.0% | $2,090 | 8.9% |

| 19 | Providence, RI | $1,580 | 2.6% | $1,700 | -5.6% |

| 20 | Honolulu, HI | $1,530 | -4.4% | $2,200 | -1.8% |

| 21 | Henderson, NV | $1,490 | 19.2% | $1,690 | 24.3% |

| 22 | St Petersburg, FL | $1,470 | 15.7% | $2,060 | 20.5% |

| 23 | Chandler, AZ | $1,450 | 15.1% | $1,830 | 20.4% |

| 24 | Austin, TX | $1,440 | 12.5% | $1,820 | 14.5% |

| 25 | Charlotte, NC | $1,440 | 17.1% | $1,660 | 14.5% |

| 26 | Chicago, IL | $1,440 | -4.0% | $1,750 | -2.8% |

| 27 | New Orleans, LA | $1,440 | -0.7% | $1,680 | -4.0% |

| 28 | Sacramento, CA | $1,430 | 1.4% | $1,790 | 8.5% |

| 29 | Nashville, TN | $1,410 | 11.0% | $1,510 | 4.1% |

| 30 | Portland, OR | $1,410 | 0.7% | $1,780 | 4.1% |

| 31 | Tampa, FL | $1,410 | 18.5% | $1,670 | 16.0% |

| 32 | Orlando, FL | $1,400 | 14.8% | $1,690 | 20.7% |

| 33 | Dallas, TX | $1,390 | 11.2% | $1,880 | 8.0% |

| 34 | Philadelphia, PA | $1,390 | -7.3% | $1,700 | -3.4% |

| 35 | Boise, ID | $1,380 | 20.0% | $1,500 | 21.0% |

| 36 | Plano, TX | $1,370 | 21.2% | $1,820 | 19.7% |

| 37 | Cleveland, OH | $1,320 | 20.0% | $1,410 | 24.8% |

| 38 | Durham, NC | $1,320 | 18.9% | $1,420 | 10.9% |

| 39 | Virginia Beach, VA | $1,290 | 19.4% | $1,400 | 9.4% |

| 40 | Baltimore, MD | $1,260 | -6.0% | $1,400 | -13.6% |

| 41 | Phoenix, AZ | $1,260 | 22.3% | $1,450 | 15.1% |

| 42 | Madison, WI | $1,250 | 10.6% | $1,540 | 13.2% |

| 43 | Newark, NJ | $1,250 | -12.0% | $1,580 | -15.1% |

| 44 | Reno, NV | $1,250 | 14.7% | $1,610 | 15.0% |

| 45 | Raleigh, NC | $1,240 | 19.2% | $1,410 | 14.6% |

| 46 | Irving, TX | $1,210 | 15.2% | $1,710 | 20.4% |

| 47 | Aurora, CO | $1,200 | 12.1% | $1,600 | 11.9% |

| 48 | Minneapolis, MN | $1,190 | -8.5% | $1,690 | -11.5% |

| 49 | Pittsburgh, PA | $1,180 | 9.3% | $1,430 | 10.0% |

| 50 | Las Vegas, NV | $1,170 | 12.5% | $1,420 | 13.6% |

| 51 | Fresno, CA | $1,160 | 7.4% | $1,500 | 13.6% |

| 52 | Houston, TX | $1,160 | 5.5% | $1,480 | 9.6% |

| 53 | Mesa, AZ | $1,160 | 20.8% | $1,380 | 15.0% |

| 54 | Salt Lake City, UT | $1,150 | 15.0% | $1,470 | 13.1% |

| 55 | Chattanooga, TN | $1,140 | 15.2% | $1,280 | 14.3% |

| 56 | Glendale, AZ | $1,130 | 22.8% | $1,400 | 19.7% |

| 57 | Anchorage, AK | $1,090 | 21.1% | $1,260 | 5.0% |

| 58 | Colorado Springs, CO | $1,090 | 13.5% | $1,410 | 13.7% |

| 59 | Fort Worth, TX | $1,090 | 2.8% | $1,450 | 9.8% |

| 60 | Richmond, VA | $1,090 | -3.5% | $1,310 | -6.4% |

| 61 | Buffalo, NY | $1,050 | -0.9% | $1,100 | -12.7% |

| 62 | Chesapeake, VA | $1,050 | -11.0% | $1,240 | 0.8% |

| 63 | Jacksonville, FL | $1,050 | 14.1% | $1,290 | 15.2% |

| 64 | Norfolk, VA | $1,050 | 2.9% | $1,270 | 18.7% |

| 65 | San Antonio, TX | $1,050 | 16.7% | $1,300 | 17.1% |

| 66 | Spokane, WA | $1,000 | 14.9% | $1,330 | 19.8% |

| 67 | Columbus, OH | $980 | 10.1% | $1,100 | -0.9% |

| 68 | Des Moines, IA | $980 | 15.3% | $1,030 | 8.4% |

| 69 | Rochester, NY | $980 | -2.0% | $1,210 | 0.0% |

| 70 | Arlington, TX | $950 | 6.7% | $1,320 | 10.9% |

| 71 | Bakersfield, CA | $950 | 17.3% | $1,200 | 14.3% |

| 72 | Indianapolis, IN | $940 | 6.8% | $1,000 | 4.2% |

| 73 | Kansas City, MO | $940 | -5.1% | $1,140 | -0.9% |

| 74 | Knoxville, TN | $940 | 14.6% | $1,120 | 15.5% |

| 75 | Cincinnati, OH | $920 | -5.2% | $1,160 | 5.5% |

| 76 | St Louis, MO | $920 | -6.1% | $1,210 | -4.7% |

| 77 | Louisville, KY | $910 | 7.1% | $1,000 | 4.2% |

| 78 | Memphis, TN | $900 | 5.9% | $950 | 5.6% |

| 79 | Milwaukee, WI | $900 | -17.4% | $1,120 | -9.7% |

| 80 | Detroit, MI | $890 | 15.6% | $1,000 | 14.9% |

| 81 | Lincoln, NE | $880 | 3.5% | $1,010 | 4.1% |

| 82 | Augusta, GA | $870 | 8.7% | $1,000 | 9.9% |

| 83 | Winston Salem, NC | $870 | 8.7% | $970 | 9.0% |

| 84 | Syracuse, NY | $860 | 11.7% | $1,000 | -4.8% |

| 85 | Baton Rouge, LA | $850 | 1.2% | $990 | 5.3% |

| 86 | Omaha, NE | $850 | 0.0% | $1,160 | 6.4% |

| 87 | Corpus Christi, TX | $840 | 1.2% | $1,120 | 6.7% |

| 88 | Tucson, AZ | $840 | 15.1% | $1,080 | 14.9% |

| 89 | Tallahassee, FL | $810 | 6.6% | $990 | 7.6% |

| 90 | Albuquerque, NM | $800 | 8.1% | $1,060 | 15.2% |

| 91 | Greensboro, NC | $800 | 5.3% | $900 | 4.7% |

| 92 | Lexington, KY | $800 | 6.7% | $1,050 | 16.7% |

| 93 | Oklahoma City, OK | $800 | 5.3% | $930 | 4.5% |

| 94 | El Paso, TX | $780 | 14.7% | $940 | 14.6% |

| 95 | Laredo, TX | $760 | -5.0% | $970 | 9.0% |

| 96 | Tulsa, OK | $730 | 12.3% | $890 | 8.5% |

| 97 | Shreveport, LA | $680 | 4.6% | $800 | 1.3% |

| 98 | Lubbock, TX | $670 | 3.1% | $830 | 3.8% |

| 99 | Akron, OH | $640 | 14.3% | $780 | 9.9% |

| 100 | Wichita, KS | $600 | -3.2% | $800 | 9.6% |

Enjoy reading WOLF STREET and want to support it? You can donate. I appreciate it immensely. Click on the beer and iced-tea mug to find out how:

Would you like to be notified via email when WOLF STREET publishes a new article? Sign up here.

![]()

Rent is controlled to 9.9% here in Oregon on existing rents. I’m sure that helps keep numbers artificially down.

These are asking rents. I don’t know how the Oregon control laws work, but in California, when a rent-controlled apartment becomes vacant, it goes on the market at whatever market rent may be. So rent control has no impact on asking rents. Landlords can ask for whatever.

Oregon does not have rent control in the way that New York or San Francisco do. But during the pandemic the state legislature passed a law limiting rent increases to no more than 7% a year plus CPI. So it is an across the board rent increase limit and not traditional apartment by apartment rent control.

“limiting rent increases to no more than 7% a year plus CPI. ”

This year the allowed rent increase will be 12%?

Is this really rent control?

If my rent went up 12%, I’d be asking for a 12% increase in wages and if I could get it, CPI would go up 12% next year, and my rent could then go up 19%. This sounds like a possible perpetual inflation machine. Similar to what happened in the 1980’s when I’d get a COLA increase for my job to compensate for CPI which then caused my rent to increase accordingly.

A better form of rent control would be to cap the median rent to 28% of the median wages in an area. Probably too hard to do.

Rent control has many forms – it’s old vinegary wine poured into new bottles. For those who have read the history of rent control in this country and others, it’s easy to see where it’s headed.

If the rent increases are not enough to keep up with the market, that gives landlord a reason to terminate the lease.

If terminating lease is made illegal with a separate law, landlord would then neglect the property so that tenants leave themselves.

If that is met with harsh penalty, less people renting out property. Reducing supply and increasing the rent further.

None of this is speculation, just history.

9.9% is the income tax in OR. Plus 1.5% for free preschool in Multnomah County. Yep, we have an income tax for free finger painting, naptime, and pee pee pants here. Because structural inequity somethin something.

As a Jersey girl, I assure you that nobody wants to live in Newark, and certainly not anyone from the other side of the bridges and tunnels. I drive to Newark Penn Station frequently and it’s a sad passage from the green and leafy suburbs, or even the somewhat edgy Maplewood, to Newark. Cory Booker is hopeful as is Prudential and the New Jersey Symphony, but it’s a tough go, unsafe, and full of drugs.

Still a good place to dump a body, though.

Real estate agent translation – “Welcoming to newcomers!”

Newark, NJ is a total dump.

I technically lived in NY in 2004 (travelled most of the year) and one of my co-workers who lived there recommended it to me. I didn’t say anything.

PS Newark is a hustle. Smoking something to think they could get that for what they got.

One would think the people at the Fed would understand inertial inflation. Is there a cutoff for transitory?

No, they’re too busy trading stonks that they know their fellow members will vote to support.

“The Government printed $4,000,000,000,000 last year and all I got was this lousy Inflation!”

Hmm… could be a T-Shirt idea?

I’d buy it

Me too L, but, as it’s time for my semi-annual contribution to Wolf’s wonder,,, I will wait patiently, with a couple of the older mugs, now certifiably a true collector item, in hand, and don’t need more until and IF Wolf and Kitten figure out how to make the mug fit my preference for ”totally pouring out” the ”brewskies” and thus needing the larger mug,,, Mom gifted me with the ”authenic” ”German” made mug that was a full liter, many many years ago on my 21st,,, and I used it, hopefully correctly, for many decades and passed it to mom’s brewski enjoying grandson, who values it to this day…

C’mon Wolf and Kitten,,, get your act together and present us Wolfers, especially us ”hard core” Wolfers, with at least a 24 ounce mug…

In any case, the semi-annual contribution to this wonderful site goes in the mail this week!!!

And also want to add tons of thanks to all the sincere commentariat on here from whom I learn SO much! Please continue to add your knowledge and wisdom so very clearly denominated recently as the difference between knowing tomato is a fruit and NOT putting tomato in a fruit salad!!!

Choas as long as it doesn’t turn into a collapse, is very profitable for some. It’s called “diaster capitalism”.

#ReplacePowellWithAI

AI is the answer (the magic pixie dust) to all the unsolvable problems.

I say it sarcastically because people bigly overestimate the power of AI and massively underestimate the biases and inaccuracies baked into the model.

I know what AI is better than you. It’s a joke that works in many ways and on many levels.

Of course, silly me.

Surely then your suggestion to replace Powell with AI was made in jest and not seriously, I assume?

It’s tiring to hear people how AI can replace constitution, doctor, UN, supreme court, tennis coach etc.

Clearly. I know exactly what AI is and is currently capable of. My degree is in Economics and computer science.

Powell intimated as much today. After trotting out that ridiculous inflation dotplot he backed off in front of Congress. Pumping the markets on Wednesdays for the Wall St traders is a ritual. The Fed has the tools you know, and they are using most of them, QE and RRPO. Now amid resignations you can ask yourself can the committee still raise a quorum? The administration can fill these spots and won’t that be interesting? You knew something was up when Liesman, more senior media member, tossed the ethics question to Powell. This isn’t about ethics its about cleaning house. Imagine Fed and PBOC on the same energy plan. Sell oil futures now.

Why oil? It’s not going anywhere.

How might the eviction changes impact rent

Maybe the responsibility for landlord and tenant law, non payment of rent, evictions, etc could be passed from the CDC to the NIMH, or perhaps the Department of the Interior or the Coast Guard.

Failing that, an Executive Order from the president, or make the VP rent czar to determine fair rent. Lots of options.

Just one more justification for higher home prices. If the alternative (Rent) is jumping 10 – 25% in a year, there’s no reason why home prices shouldn’t rise as well.

Keep in mind also, higher rents mean private equity and publicly traded cormpanies (Invitation Homes, American Homes 4 Rent, etc) will now be willing to pay that much more for all the homes they’re buying to rent to end users priced out of the market.

And they’re also limiting the supply of homes coming onto the market by partnering with the big homebuilders like Lennar and DR Horton to build entire single family rental communities.

If that’s the case, the Fed needs to raise interest rates, like yesterday, and get this under control.

Sure…

INTEREST on the national debt in 2020: $522,767,299,265.34

The FED has destroyed the country. Now we have millions of homeless and low income folks who have no prayer of affording even the lowest priced rental housing, and to add insult to injury we have millions of new broke refugees pouring in.

Not to mention middle and even upper middle income younger people with no hope of affording a house.

I don’t know what America is going to look like in 5-10 years, but it ain’t gonna be pretty.

Yeah, what was the PLAN for long term housing for these refugees and the millions now allowed to cross the Texas border?

It’s not like any of these folks have a job waiting for them like my grandparents did in a Pennsylvania coal mine when they immigrated from Lithuania in the early 1900’s.

All the new apartments being built around my parts (Houston area north) are expensive and are reportedly booked up with tenants before completion.

So tell me, what is the PLAN for these new people?

The PLAN is for them to vote Democrat while feeding cheap labor to the globalist grifters.

They can’t vote.

If you want to be scary at least find something trueful.

@josap.. theyd be voting eventually

Democrats are playing the long game and placating the brown population.

You do understand that Democrats and Republicans are functionally the same party, right?

Anthony A.

They will be given subsidies to rent from Air B & B. They are coming to a neigborhood near you. Enjoy.

You know what this really means right? We need another variant to justify further eviction moratoriums. Fauci, where are you, get off your lazy ass and start warning about the Lamda variant , and hurry it up. Otherwise, the CDC won’t have an excuse to extend the eviction moratoriums. Quick, run up another spike. We need to f*** over the landlords in this country some more.

I’d like to say that I’m just being sarcastic, but in reality, we all know that’s what’s being cooked up. No more rent.

Yeah MCH,spot on,thats the right spirit,yay…

I feel like kid again, watching “Seekers” on B&W TV.Where’s that chick with tambourine when we need her ? 😁

We shall not, we shall not be evicted

We shall not, we shall not be evicted

Just like a tree that’s standing by the water side

We shall not be evicted

On the road to financial freedom

We shall not be evicted

On the road to financial freedom

We shall not be evicted

Just like a tree that’s standing by the water side

We shall not be evicted

We’re brothers together

We shall not be evicted

I think you could substitute Congress for the Fed. Congress is the mother of all public policy. If they wanted, they could have limited the Fed to a single mandate of hard money or the equivalent.

Old School. Congress is supposed to be controlling the ship, but cannot seem to do so without being irresponsible. The Treasury could run the ship. But the Fed? The Fed always creates debt. Pretty much it’s only tool. Way to weak.

Depth…

1000 +’s

It’s not the FED, it’s the Democrat Party. BTW, $10.00 says Wolf will censor (I mean “moderate”) this statement.

ALincoln,

Yes, I “censor” drive-by braindead political BS such as this. Post this crap somewhere else.

Now you owe me the $10.00 you promised.

https://wolfstreet.com/how-to-donate-to-wolf-street/

Well done. Touche. ))

Reminds me of the old story about Calvin Coolidge, who was known to be a man of few words. A reporter said “I made a bet I could get more than two words out of you” to which the President responded “You lose.”

Wolf,

Hard to be sure (transaction volumes being harder to come by in residential leasing mkt) but my guess is that the long, long eviction moratoriums have severely distorted the mkt by greatly reducing available supply (creating a big premia for those apts actually avl) and leading rent-deprived landlords to try and recoup 18 months of losses as fast as possible.

But now that evictions are restarting, apt supply is set to rise significantly.

At the end of the day,

1) 600k+ Covid dead have no housing demand (regardless of their prior housing, demand flows across housing types) and

2) 5 to 6 million fewer people are working now vs Feb 2020 (a 3% to 4% decline).

With those demand side hits, it is going to be hard to prop up those goofy two digit yr over yr rent increases.

Of course the G and the landlord lobby could always allow 1.5 million new illegals in…oh, wait…

Cas127,

Do you expect the evicted to just evaporate? Nah. They’re not going to evaporate. The end of the eviction moratorium means largely two things:

1. Churn: people who are evicted find another place to rent. One apartment becomes vacant; another finds a tenant. Just churn.

2. Tenants make a deal with the landlord (who’re now getting paid by the states) and stay in the apartment and start making rent payments again going forward. And nothing changes.

People have to live somewhere, and there is a huge amount cash out there now. So I expect maybe more churn, and that’s it.

Wolf,

Ask yourself this, if you were a landlord, would you make a deal with somebody whose been stiffing you for the last however many months? I think if the renter and landlord tried to work things out, there might be some way to do it. But otherwise, I doubt it, I would guess that landlords would rather find someone or anyone new rather than a known deadbeat.

How about this, if you’re a landlord today, and tenants applied to rent, would you be a lot more careful with the background checks, especially concerning the rental history?

Yep, at some point, a landlord might be desperate enough to take anybody off the street, but I would guess that landlords are going to be a lot more careful about who they rent to.

And BTW, last I heard, states were still late in getting back rent to the landlords. And I would be curious to know if those state payments come with any kind of strings attached.

MCH,

So replace the person that stiffed me with a person that stiffed someone else? What’s the difference? Better the devil you know than the devil you don’t. Look, if I got paid the back rent by the government, and the tenant has a job and can pay the rent going forward, and I can evict them if they don’t, and if I like them otherwise, I’d try to make a deal.

I can see your point, Wolf, but I think that is entirely dependent on the eviction moratorium being over. There are some variations from state to state in this, isn’t there?

I’d think though that in a situation like that, a landlord would try to find someone with a cleaner record. It’s situational too, right, as I implied in my original comment, it assumes that the deadbeat didn’t even try to work out anything with the landlord. I think in other cases, it becomes a matter of trust but verify.

Churn, right? As Wolf said.

Churn?

It’s not that simple is it? What about members of the landlord class who sellout and move business to more landlord friendly state?

This would inflate property supply in the vacated states probably decreasing rents even further.

This would inflate property demand in the new states probably increasing rents even further.

I think the situation is so complex we’ll have to wait and see what happens.

Many will end up on the street where they will then evaporate into a cloud of meth and become invisible to the rest of society.

“people who are evicted find another place to rent.”

Or they double up.

That seems to make more sense than 1) being in arrears for thousands and thousands and then…2) re-upping for rents that are higher 15% in one yr.

And all this ignores the Covid deceased, no matter where they were living, since current renters will reshuffle the focus of their demand depending upon where prices are least (due to fall in demand due to Covid deceased).

I think it’s too early to know what is what. So much government intervention. Patient is still on life support machine and will have to get weaned off to see if he can live without massive government intervention. The drugs keep you feeling good, but you have got to get off them before they destroy you.

Who’s going to wean him off? Certainly not the government. Anyone else you had in mind?

Channeling my Michael Engel and Georgist simultaneously:

1) Rentier mindset for last 40 years:

2) Okay if house prices go up because equity = wealth.

3) Bonus: dumb-boomers can refi and spend that wealth.

4) But it’s not okay if rents go up. That’s inflation = bad.

5) Only low rates can goose house prices without raising rents.

6) Rates can’t get much lower from here. Game Over!

7) Keynes finally right about “euthanasia of the rentier”?

Two FED officials just “retired” today after they were exposed for essentially trading on their own information. If these guys were in China they’d be put to death, and stripped of all their assets. Here, they will be booked solid with 6 figure speaking gigs.

Yep. Put “china executes snack-shop killer” into Google. This scumbag killed nearly 40 people on September 15 and was tried and executed within 30 days.

Contrast that to the U.S. where you’d have 20 years of trials, appeals, clemency demonstrations, etc.

CCP members are extraordinarily corrupt, the question of whether or not they get punished, depends on whether someone higher than them, wants them gone. All prominent positions in China, are held by CCP members.

As for physical crimes, it’s true that the CCP will get rid of some people quickly. However, it’s also true that if it doesn’t concern the party, police will often just ignore alot of major crime.

This book launched earlier this month and is a major insider account of how the CCP and the Chinese government and business all operate.

Author

Desmond Shum

Title

Red Roulette: An Insider’s Story of Wealth, Power, Corruption, and Vengeance in Today’s China

So who fired them? Who’s calling the shots?

Certainly it wasn’t Powell. It appears he was benefiting from insider information like the rest of them.

Id personally rather see fed officials resign/retire than to try to determine who is guilty of malfesance and implement “punishments” that just create more perverse incentives for the people still trying to run the fed with some semblance of responsibility.

They resigned.

End of story as nothing will happen to them other than a new job with high pay.

Rosengren is also looking at a lifetime of dialysis pending a kidney transplant…

with the money they made, perhaps just retirement?

Heh heh, this is a prelude to Powell getting axed. Or perhaps not.

Let’s see, the J team needs someone to throw under the bus when things really hit the fan. And given Powell has exposed his own conflict of interest, being the head of the Fed that authorized for the first time purchase munis when he held a bunch of munis in the portfolio. He is like a perfect scapegoat for the rest of the Js. If the elected J is lucky, the economy will tank just as JP is up for another appointment on his term again, and he can be pointed to as an architect of a failed policy and a hold over from that horrid previous administration that finally can be let go.

I can see the headline now, “loss of confidence in JP, due to his poor judgement and ethical concerns around assets held that created an inherent conflict of interest.”

And Powell’s replacement will be better? I highly doubt it. At least he’s pretending to taper at some point in the future. And he probably will. What’s the probability that his replacement will do anything other than follow an activist zeitgeist and try and create some weird idea of equality that just burns basically everyone? Powell is making the rich richer and the poor and middle class poorer. His replacement will do the same thing but likely have political motivations behind it. That’s about it. So it’s basically meaningless. None of them will be held responsible. They’ll laugh to the bank.

I hate kids but if I ever somehow was cursed with one, I’d raise them to be a politician. Or at the very minimum a lawyer.

Good morning vietnam Robin Williams comes to mind

Just how is it all Possable anyway ?

I think there is a back story. Maybe a move to virtue signal Jay Powell out of office. If you believe them they followed Fed guidelines which includes disclosing trades. So the the Federal Reserve rules were at fault which look bad on Powell.

“So the the Federal Reserve rules were at fault”

No. The fabric of the people who end up in these positions is the “fault”.

The ” we will look into it”, “we’ll make sure this doesnt happen again”, and might as well through in “at this point, what does it matter”.

There are rules….and the sport is to ignore them. Why would you expect a Fed that ignores its second and third mandate to enforce ethics rules?

“Two FED officials just “retired” today after they were exposed for essentially trading on their own information.”

And to the topic of the article, these guys can pay any rent level that they wish….

The two Fed governors….who now must retire to a life of luxury with all the friends they TIPPED OFF….and hands off lest the Congressmen who got tipped off be dragged in. “Don’t touch me, I’ve got names.”

“The stock market has a floor under it.” Nancy Pelosi.

now Nancy, who told you and when? Did your husband make some shrewd investments?

I like the China option.

Read Michael Hudson on how the Rentier Class has destroyed this country. China told George Soros he’s not letting the Rentier Class in to invest and own China. Good Move.

If anyone wants to learn how China really operates a major new book release just happened this month.

Author

Desmond Shum

Title

Red Roulette: An Insider’s Story of Wealth, Power, Corruption, and Vengeance in Today’s China

Billionaires and politicians fiddling while Rome burns. People are so worried about what China is going to do, when the economic and social fabric of our society is tearing apart right outside our doors (actually, right inside our living rooms, next to our TVs). Haven’t you been reading this site? Get some perspective.

I’m fully aware of the situation in America “fellow American”, many people have heard misinformation on China and if someone brings it up, I’ll have to tell them the real situation, so they can better figure out the whole picture.

Asking rents are anticipatory aspirational rents.

Something other than a free market in rental rates is going on here. Portland is full of new apartment complexes that were completed at the begining or during the pandemic. Most of them are still see-throughs, at least the ones I pass every day. It seems like a racket or a rigged market if rents went up 4% here.

That’s my take as well. So many newly built apartments for rent everywhere and more going up. The rents don’t make sense. Lots of basement parking available at these places. Lots of free month rent and other deals to move in.

Land of illusion. Homeless everywhere. More by the day.

Violent property crime kills property value. St Petersburg, fl in the early 90s is a good example.

The adjunct mindset to NIMBY is “can’t happen here.”

Otis, did you see the homeless encampment over on Kerby ave by the hospital that had its own limo parked out front. An old scruffy one, but drivable. Made me do a double-take.

Un-housed people are everywhere. It’s worse than ever as I’m sure you know. There’s an epidemic of janky RVs, tents, heaps of trash, crappy graffiti… I’m still shaking my head at the naked “lady” I saw wandering around dazed and confused in the middle of the day a week or two ago, then I saw another one a few days later. I heard six shots pop off at 6:30 last Saturday morning up my street.

It never was particularly safe downtown but at least there was an illusion of safety and the no worries type of attitude. Not any more. The streets are getting meaner. People are angry. 6 years of non stop agitation by the media sowing division are taking their toll. Racial relations are the worst I have seen in 15 years.

“The rents don’t make sense.”

Nothing makes sense anymore.

That’s the most sensical thing I’ve read here.

Seems to me during the 70s there was a hotline to refer landlords who were gouging their tenants. Not all landlords advertise and for good reason. Makes me wonder if there are many cases of landlords lowballing the survey and then raising the rent.

Units that are not listed for rent are not included in this data. This is data scooped up by a computer from the 1 million or so apartment-for-rent listings in the 100 largest markets. Landlords can’t game that. They either list or they don’t list.

But asking rents are a form of price discovery, similar to the prices on cars for sale. Sometimes you can negotiate and make a different deal, and sometimes you cannot.

People have been paying above “asking” to buy a home. This can also happen in hot apartment markets, and then the asking rents would underestimate the effective rents.

The DC Swamp is getting meaner and meaner every day. Murder rates and carjacking are up 30 – 50% from a year ago. I see things I’ve never seen before. Some dude getting a Monica Lewinski from another dude right on the side of a busy street. Another dude eating a fast food meal in his car while driving and then throwing all the trash right out onto the street. I was parked in a nice residential area and was approached by a homeless individual for a donation. On another street a lady came out with an i-Phone and started photographing me in my car, parked legally. No one I know goes into these s$ithole neighborhoods but we have to because they are the only ones with affordable properties.

In some cases, it does. For example, there are many cities that have long been desirable, but the jobs just weren’t there. There are at least some people who moved to those cities and are working remotely. Those people bringing in their high incomes have caused rents to skyrocket. But it remains to be seen whether it will remain that way.

In cities like Syracuse, I’m just not seeing it.

Four years ago I told a friend of mine who went to engineering school at RPI that Troy NY would be a future destination city because of its easy transportation to NYC and cheap and quaint Brownstone neighborhoods. He told me I was crazy ,and that would happen when pigs fly. I would imagine it is on the upswing these days.

I’ve been commenting for years that I expected rent control to happen in America. You can think of the rent moratorium as a form of rent control. But other countries are now on the bandwagon too.

Germany just passed a referendum empowering local govts to force big landlords to sell out to them, to control rents. China’s President has also made it clear that homes should be lived in, not used for speculation, and he has the power to enforce this. America’s endless moratorium extensions are also a form of rent control, which will eventually have to be codified, or we will all land up homeless on the streets. Predators don’t stop, they have to be stopped.

I lived in a rent “stabilized” apartment for a time in new york city- i think by law rent couldnt go up more than 3%per year. That seemed pretty reasonable and functional.

I had an apt like that too, in a nice building. The landlord didn’t look like he was going hungry driving around in his Mercedes.

I thought the German thing was a Berlin only situation.

You don’t need rent control. All you need is the FED to stop buying MBS, and for the government to get out of the house loan biz. In conjunction with that, make Airbnb illegal (it already is when it comes to zoning laws). Once you do that, house prices crater spectacularly. Alas, that’s not what they want. They will do everything in their power to maintain high asset prices, which includes shelter.

The issue for many landlords is the freedom to choose their tenants. They hate that law which says you have to rent to whoever shows up first with the money. What they used to do was tack on a bunch of fees, cleaning deposit first and last month rent. If they really wanted you they would waive the fees. Now landlords may have the right to refuse renting to unvaccinated tenants. If you are in Florida they might fine landlords for doing that, if you are in CA they might fine you for not doing that so Federal rent control will never happen. This is where corporate landlords can put on the pressure, they figure ways to boycott states which offend their shareholders values.

“Rent restriction is habitually one of the first and cheapest of government devices to restrain the cost of living under inflation”

Adam Ferguson “When Money Dies” 1975

Any idea on whether or not a lot of these apartments , I would assume , are corporation owned in multiple cities and increases mandated corporate wide…

Additionally, I would be interested in knowing what cost increases have been levied on these properties, i.e. property taxes, sewer/water, personnel cost, insurances and so on…

Some of the increases are probably just because they can, others maybe not so…

Just wondering…

In most places real estate taxes are higher for investment properties, or second homes. Owner/occupiers pay less in most places.

Not that substantially though, in my experience. Usually you just lose the credit for it being your primary residence.

The difference in taxes though between residential and commercial, however, is usually enormous.

Chesapeake va,

where rents fell 10 percent YoY

is practically next door to Virginia beach, where rents climbed about 20 percent YoY.

I dont understand this economy. What gives?

Any explanations?

The rent jumps are frankly kinda horrifying- the scale of economic pain is outside my realm of experience as a 37 year old. Anyone have any perspective or wisdom on whats happening?

Shells

Have not seen your name much on Wolf Street comments, but to answer your question, just stay connected to Wolf Street and you will be able to form your own conclusion(s) on any number of financial oddities.

My general comment, as a residential real estate investor of about 18 years, is if you look at Wolf’s charts, many markets have normalized to 2018 / 2019 trends and SFH rents up 2% or so (normal or below normal).

The injection of so much $$ into the economy is temporarily increasing rents. The areas with 10-20% increases will stabilize as the bonus $$ in the economy gets spent.

The fed dumped a bunch of money in the market, and we can’t help gorging ourselves on the excess like the Hungry Hungry Hedonists we all know that we are. The greed hedonism cycle.

Oceanfront is attracting a lot of investors right now. FEMA just raised their flood insurance rates by a lot, expect more volatility in waterfront properties going forward.

I am from that area originally. The only thing I can figure is the oceanfront?

Chesapeake is the bedroom community, Virginia Beach is where the money is and the ocean, and Norfolk is the hipster area.

One in eight Americans is foreign born. 25% of immigrants immigrated from Mexico. 40% of immigrants are from Latin America. More immigrants are coming from China and India than before. This is driving housing demand. Rental vacancies are harder to find. New housing inventory is mainly houses that have not been completed.

David here in Australia I used to think along those lines. We shut the borders early last year reducing immigration to a trickle and since then house prices and rents have gone from wtf to WTF. The other argument is that supply has been throttled by the usual red tape etc etc but personally I think it just comes down to jumping on the greed train with the FOMO flag out front.

Brazil has 9.7% inflation. Whether they are open to immigration or not, the price of a home there may rise.

I found a listing for tiny houses under $50k (USD) in Brazil neighborhoods.

For San Francisco, apartments.com lists 5,640 apartments available for rent. This is a huge number for a medium size city such as SF. I have been tracking this number for years. It used to be around 2,200.

So with all the new apartment buildings in the Bay Area, that are all giving out deals with “3-8 weeks free rent”, how long can they go with large numbers of empty units before they have to lower rent?

I guess we will find out. For now, everyone is still hoping the return to the office will bring people back, and some of that is happening, but I don’t know the extent. The Financial District is still very slow.

But even as we speak, they’re completing new units and putting them on the market. So this is a moving target.

Zoning is at least part of the problem. While multi-story multi-family housing would go a long way to fulfilling the needs of the country, many localities simply won’t allow it. It’s single family or nothing. And some more rural communities demand houses only be built on 5 acre parcels. It’s crazy.

2 Fed reserve members just resigned over corruption and insider trading. Actually, the real reason they see the handwriting on the wall. J Powell to testify today. Now he says inflation is not transitory. OOOPS.

He doesn’t even have to give the money back. If I stole a $10 from my job, I’d be canned AND they’d probably file a police report.

Wait till this roaring 20s economy corrects worst hang over ever prepare

The manifest corruption that oozes out of every level and agency of government is exactly why the American people should not, and will not, give up their AR-15s.

Fannie Mae, Freddie Mac Extend COVID-19 Multifamily Protections

The government-sponsored enterprises’ forbearance programs have been extended indefinitely.

Rents are on fire in San Diego. Nobody sees them coming back to earth for a while. California rent control caps are tied to CPI which is the metric by which the state measures the cap. If this formula were put into excel I think it would be called circular and would develop and error. Pretty much the way California is on everything, though…one big error.

Is it becoming evident that the Fed has made a VERY LARGE MISTAKE and they don’t know what to do?

Otishertz: World wide there are tons of expensive rentals that are empty. For the super wealthy it is like buying expensive art, only with a tax deduction thrown in upfront. Why wouldn’t the local wealthy play the same game? It’s not that the Fed necessarily does not know what to do, it’s that the Fed does only debt. It is severely limited in its tools. Treasury is probably the body that should be running the show. Congress has all the tools. Democrats are attempting to use them. Republicans only exist to suppress wages and insure the wealthy savings.

I could have told them back in March that printing $3 trillion in a matter of weeks because of a virus induced shutdown was a mistake.

FED has not made any mistake. They did all these deliberately and made tons of money along with policy maker.

If you want to see your elected representatives trading stock. You can track them here:

http://www.housestockwatcher.com

http://www.senatestockwatcher.com

Now this clown Weimar Boy Powell just came out and said that it’s the “bottlenecks fueling inflation,” and they’ve “worsened.” Last I checked, there was no bottleneck in rental housing. This guy is desperate to try to lie his way out of the disaster he has created. China would put this guy and all his cronies into a grave.

And he blames unemployment on

COVID concerns

Child Care concerns

People looking for better jobs

and generous federal payouts..

NOTICE….keeping rates abnormally low has NO IMPACT on any of these forces he says affecting unemployment.

NOTE: There are record job openings

NOTE: 5% unemployment used to be considered full employment just by people being in between jobs,etc.

This fool thinks that the only things worth mentioning are plastic imports from China.

I think we’re seeing is the beginning of a crack-up boom. It can still be reversed, but only if drastic steps are taken very very soon.

DC,

Saw that…

Reminded me of George Carlin’s hippy dippy weatherman’s forecast for tonight… Dark, with widely scattered light in the morning…

I mean, it’s vague with no substance, but not necessarily wrong…

Come to think of it, they should just play some of Carlin’s skits at these hearings…would be closer to the truth…

Rents in Florida are very high and there’s almost no inventory for sale.

Pd,

You are correct,…

Half my brain says I’m really smart…

The other half says I’m stupid lucky…

Truthfully, I’m not sure of either one…

Not that it matters cause I’m not selling, I’m not buying, and I’m not leaving…

As this administration implodes so does the market. Looks like March 2000 all over again with the NASDAQ leading the way. All the minions that listened to all that bull s$it from the establishment media and the likes of Jim Cramer & CO are now hiding under their chairs waiting for the next shoe to fall. Noticed the 10 year Treasuries rocketed up to nearly 1.6%. Look for the mortgage rates to follow the upward trend. Housing which is unaffordable now will be even more so. Also crude oil is approaching $80/barrel. Gas prices will go to $6/gallon or higher. Natural Gas doubled in price even before the winter heating season. England now has fuel shortages and gas lines. How long before we have the same thing?

Mortgage rate is tied to yield on 10y treasury. If it goes up so does mortgage rate.. then housing would be in trouble and lot of other things as well . It’s gonna be interesting.

Owning two home may not be such a good investment after these interest rates spike. I don’t think the Fed has much control over long term rates. They could buy every Treasury security and MBS and the interest rates would still go up because inflationary expectations would also go up.

House prices did not fall after the 2000 stock market event because there was inflation.

Per CNBC:

Sen. Warren calls Fed Chair Powell a ‘dangerous man,’ says she will oppose his renomination

“Your record gives me grave concerns. Over and over, you have acted to make our banking system less safe, and that makes you a dangerous man to head up the Fed, and it’s why I will oppose your renomination,” Warren said.

Powell did not respond to Warren’s comment that she will oppose him.

Powell could say the same thing about her.

What’s the fuss, when all the homeless can move to a warm and helpful state like Southern California…..The people of California will build houses for them and give them free money. Problem solved……… New rents in private hands will also fall, due to the free state run houses taking the business………….Simples

Many renters to get help when California eviction protections end this week

So how long do renters get free rent going forward? I already know of several people gaming this free rent going forward. And I suspect that is exactly what CA wants. This 5.2 billion is mainly just a liquidity pump for the state in the name of helping the poors. This whole rent eviction BS has been placating most of America to balance the inequality gained by the upper class, Fed and Gov.

If you lost your job due to the crazy govt mandates, I don’t care how much money you get to make up for the losses the govt forced on you. Stop blaming the victims. People were perfectly willing to keep working until the govt forced them to stay home.

That’s not what he’s referring to. He’s referring to people who had their jobs and just refused to pay, because there were no consequences.

I’m actually referring to the point that billions were given to the state. The ‘victims’ numbers were an overshoot. But the state wants that money spent anyway. So the grifters are taking advantage…and the state is counting on them to.

You missed the point completely. Sadly, proving the point actually.

.

The state never intended to help the poor, that’s why the poor are on the streets homeless. The state waited so they could pump the money to their voting constituents. None of this is about need, it’s about buying votes. However, the state miscalculated because most of the recipients will probably use the money to move out of the state. I would take the money and run.

Flooded with Prosperity is what I think It’s all about . What do you think will happen to Home prices /sales /Etc on Basically the economy on and on if everything turns bad ( like where it seems to be heading ) It’s a Printing Pump am I wrong ? Sen Warren seems to have a handle on it

The two Fed bankers, Kaplan and Rosencrast, are releasing a statement that they are both retiring to spend more time with their family and their dogs. Also they said they will use the time to do more insider trading without any conflict of interest.

October 29, 1929. It’s been almost a hundred years so everyone who remembered it is dead, those who lived in the aftermath are in short supply to be able to remind us of history. I work in older homes and always am able to guess when a house was built in the 20’s. It’s easy, teen houses look a little different and 30’s-1945 don’t exist. We’re headed for a depression.

MY uncle worked on Wall Street during the crash in 1929. He once told me they had to work 24/7 for 5 days in a row. There was no electronic trading back then. They ran out of toilet paper, and when they did they started using stock certificates in place of toilet paper. Most of the stock certificates were worthless anyway.