Right now is the perfect time to think about stocks to buy during any market environment. Why? Because we've had a recent example of how quickly things can change. Concerns about the economy and the pandemic weighed on the market -- after months of solid gains. The Dow Jones Industrial Average climbed more than 15% from the start of the year through Aug. 31. Then it slipped 4% in the first three weeks of September.

So, what makes an all-around winning stock to hold onto during good times and bad times? I look for companies with a strong sales and/or profit track record. I also like companies that sell essential goods or services. And finally, I'll go for companies that have built a strong brand and relationship with customers. Let's look at three stocks that fit the bill.

Image source: Getty Images.

1. Target

Target (TGT -0.71%) posted an exceptional performance during the worst of the pandemic. The company's recipe for success? First, its array of essential items -- available in store and online. Add to that its options for contactless pickup and delivery. The result? Target's sales last year grew by $15 billion -- that's more than in the previous 11 years combined.

But here's the best part. The company continued to post sales growth -- and growth of its pickup and delivery services -- even after shoppers returned to usual shopping habits. By that, I mean going to physical stores and buying items beyond the essentials. In fact, in the most recent quarter, sales in all product categories climbed. The high-margin category of apparel even posted double-digit sales growth.

Target makes shopping easy for consumers who like to shop in store and those who prefer an online platform. That means the retailer can attract both kinds of customers. Importantly, a lot of guests opt for both -- and Target says these multi-channel guests end up spending four times more than store-only customers and ten times more than online-only shoppers.

The company's plans should keep customers coming back: Target is investing $4 billion annually to remodel stores and strengthen fulfillment and the supply chain.

Target shares are trading at about 18 times forward earnings. That's a steal considering Target's revenue growth -- and potential for more on the horizon.

2. Abbott Labs

I like Abbott Laboratories (ABT -0.20%) for the diversity of its businesses -- and their growth. Abbott's nutrition, diagnostics, medical devices, and pharmaceuticals businesses each posted double-digit revenue gains in the most recent quarter. And Abbott's annual revenue and net income both have been on the rise for the past few years.

Since the early days of the pandemic, diagnostics have led to even more revenue for Abbott. That's because the company sells several coronavirus detection tests -- including the rapid BinaxNOW. These tests generated $2.4 billion in sales in the fourth quarter of last year, for example.

Of course, testing demand may ebb and flow. But that's OK. I look at COVID testing as a plus for the company -- not something that will determine Abbott's overall success. Here's why: Medical devices generally contribute the most to Abbott's revenue. Abbott's star product is the FreeStyle Libre continuous glucose monitoring system. It is the No. 1 such system worldwide. And it's the most prescribed in the U.S. The FreeStyle Libre brought in more than $900 million in the most recent quarter. Total medical device revenue topped $3.6 billion.

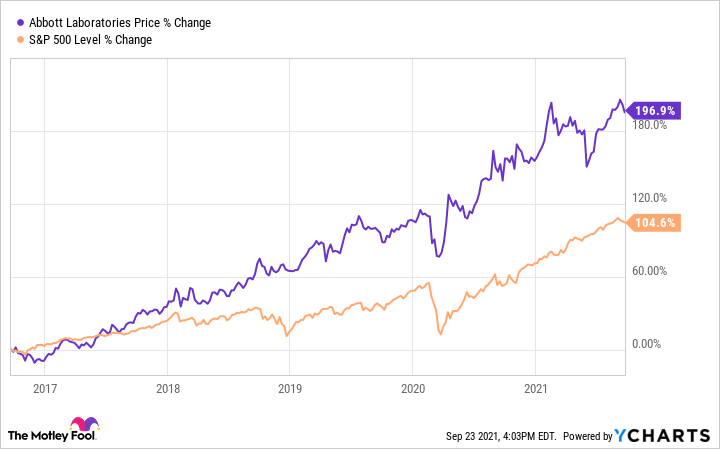

Abbott has already shown it can outperform the market over the long term.

Thanks to the strength and diversity of its product portfolio, I think this performance can continue.

3. Lululemon Athletica

During the worst of the pandemic, most clothing retailers suffered. But Lululemon Athletica (LULU 2.64%) actually managed to grow. The maker of yoga-inspired clothing built a strong brand prior to the health crisis. Lululemon sets itself apart through its innovation. The company uses fabrics that create particular sensations: The clothing feels weightless or comfortably body-hugging, for example.

Lululemon stayed connected with customers through its online community during lockdowns. Customers also flocked to Lululemon online for comfort clothing as they worked from home.

Since then, people have returned to offices. Yet things aren't slowing for Lululemon. The company expects to beat its 2023 revenue target by the end of this year. It's ahead on other 2023 goals too: Last year, Lululemon doubled its e-commerce business. And this year, the company is on track to double its men's business. Lululemon said it also may reach the goal of quadrupling its international business earlier than the 2023 target.

Lululemon shares have gained more than 20% so far this year. I don't expect double-digit gains every year. But overall, the stock has what it takes to head higher over the long term. Lululemon has proven it can grow during even the worst of times. So, it's a stock we can be confident about -- no matter what the market is doing.