The cryptocurrency market is extremely susceptible to common pump-and-dump scams. Since many rules are unclear and hard for regulators to enforce, thinly traded cryptocurrencies are prime targets for scammers and other nefarious actors.

Understanding how a pump-and-dump scam works, why the cryptocurrency market is especially susceptible, and how to identify a pump-and-dump will help you avoid getting taken by these schemes.

What is a pump-and-dump scam?

What is a pump-and-dump scam?

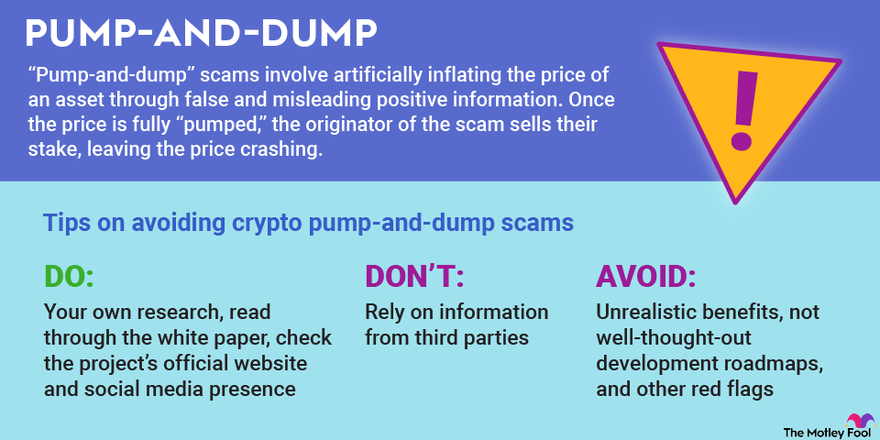

Pump-and-dump scams have been around ever since the conception of a market for securities. The idea is that a person or group of people buy into a thinly traded asset such as a penny stock when its price is low.

They then start disseminating positive news about the asset. More often than not, that positive news is completely contrived.

As more investors pile into the asset, the price continues to climb. Once the price is fully "pumped," the originator of the scam sells their stake to the buyers still coming in. Since they own a substantial percentage of the outstanding shares, it sends the price crashing.

Pump-and-dump schemes are a form of fraud. The originators of the scheme plan to take money from innocent investors by encouraging them to buy an asset based on false information. When those investors buy in, the pumper is selling, which effectively pushes the price lower. The result is big gains for the scammer and losses for all those defrauded.

There are a number of laws that make this illegal in the securities market. The Securities Act of 1933 specifically states that it's criminal "to obtain money or property by means of any untrue statement of a material fact or any omission to state a material fact." You can find similar language in the Securities Exchange Act of 1934. A pump-and-dump may also be considered wire fraud because the fraudsters typically use communication methods such as email, direct messaging, social media platforms, or direct phone calls to pump the stock.

One way to avoid a pump-and-dump scheme in the stock market is to focus on stocks traded on a well-known exchange such as the New York Stock Exchange or the Nasdaq. Those exchanges have strict listing requirements that won't allow stocks most susceptible to pump-and-dump scams. In the cryptocurrency market, sticking with well-known and broadly adopted cryptocurrencies such as Bitcoin (BTC -0.04%) and Ethereum (ETH -0.86%) and well-known exchanges like Coinbase (COIN 7.04%) and Binance should keep you out of trouble when it comes to pump-and-dump scams. (But there is no such thing as total safety in this realm -- you should be cautious with crypto investing regardless of how renowned your crypto or exchange is.)

Stocks traded over the counter are more likely targets for fraudsters. In the film "The Wolf of Wall Street," which is based on the activities of the Stratton Oakmont brokerage house, the brokers focused on stocks traded with pink sheets. Pink sheets have no reporting or registration requirements, making them susceptible to schemes like a pump-and-dump.

Understanding crypto pump-and dumps

Understanding crypto pump-and dumps

The crypto industry remains the Wild West. There are dozens of exchanges, and it's relatively easy to issue a new cryptocurrency. Therefore, it's a breeding ground for thinly traded currencies and scammers who can pump and dump those assets.

Typically, a pump-and-dump crypto scheme starts with an organizer gathering influencers in a private group online. They'll coordinate buying the target crypto asset to avoid price spikes. Once they're ready to pump the asset and get the general public to buy in, the influencers will share information about the trade with their followers on social media. The organizers will then coordinate the sale, e.g., the dump, in order to get everyone paid, leaving the public investors holding the bag.

What makes crypto especially susceptible to this ploy is that organizers don't have to search very hard for thinly traded crypto assets. They can just create them. The barrier to entry for creating a new cryptocurrency is just a little bit of research and coding knowledge.

Furthermore, newly formed cryptocurrencies are largely unregulated. A person or group can create a token and make wild claims about its use, and it's unlikely they'll face repercussions when those claims turn out to be nothing but false promises.

For example, several members of FaZe Clan, an esports and influencer group, promoted a new cryptocurrency called SaveTheKids in the summer of 2021. The coin promised to help children around the world, but it turned out to be no more than a scam. The organizers and influencers made off with tens of thousands of dollars, and their followers ended up with a worthless crypto token. Needless to say, no kids were helped.

How to spot a pump-and-dump crypto scam

How to spot a pump-and-dump crypto scam

It's easy to identify a pump-and-dump crypto scam after the fact. But that doesn't do cryptocurrency investors much good when the rug's been pulled and they're left holding the bag. It pays for investors to know the signs of a potential pump-and-dump scam before it actually happens.

The first step in avoiding a pump-and-dump scam is to do your research. If you see a relatively unknown cryptocurrency being touted by internet strangers, don't rush to get in. Look up the token, find its white paper, and read through it. Determine who's behind it and what the objectives are. You should do this for any cryptocurrency to determine if there's long-term potential for it to increase in value.

If the token has been around for a while but development on the project seems to have disappeared, it's best to avoid it. If the project has no clear purpose, it purports benefits that seem unrealistic, its development roadmap isn't well thought out, or it's associated with previous bad actors, those are all red flags, too.

If you don't typically follow influencers in the finance space, specifically cryptocurrency experts, but all of a sudden the people you follow are talking about a cryptocurrency, that's another big red flag. Ask yourself why this fashion influencer you follow is talking about some cryptocurrency.

If you do discover a potential crypto investment on social media, it's best to check out whether the project has its own website and social media presence. Go straight to the source instead of relying on information from third parties.

If you don't find any red flags in the documentation or in how the investment is being promoted, take a look at how the cryptocurrency trades. If it's on a well-regarded exchange, it's more likely to be a safer investment. If you have to dig into some unknown DeFi exchange, you'll want to dig deeper into the order book.

Related Crypto Topics

Most exchanges will show you all the open orders for an asset, as well as the order history. Check the pattern on trading volume. If it's spiked recently and volume appears to be trending higher, be cautious. If you see big walls of the crypto asset on the buy side, there's potential that a big group is making sure the price of the coin doesn't fall below that price. Likewise, you may see big walls of sellers to make sure the price doesn't pump too fast as the organizers pile into the coin.

If you suspect a cryptocurrency is undergoing a pump-and-dump scam, it's best to avoid it. It's impossible to know without inside information when the organizers plan to sell. If you do have inside information, though, you're probably better off contacting the Commodity Futures Trading Commission (CFTC) and providing the information to them.

The CFTC put out an advisory in late 2019 to warn investors about potential pump-and-dump scams. It's offering bounties to any whistleblowers. That means you don't have to do anything illegal, and you might make more money by being an informant.

Once more, remember that there is no such thing as total safety from scams in crypto investing. Be extremely careful how you engage with crypto, regardless of how well-regarded your crypto or exchange is.