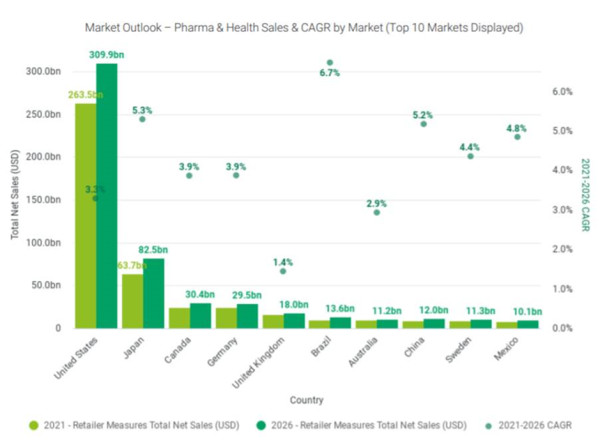

The UK Pharma & Health retail channel is expected to have a CAGR of just 1.4% between 2021 and 2026, representing the slowest five-year growth rate of the world’s top 10 markets, according to analysts at Edge Retail Insight.

The US is the biggest market for this channel, accounting for more than 50% of the world’s total Pharma & Health retail chain sales. It is expected to continue to dominate, but over the next five years, faster growth will come from Brazil (led by RaiaDrogasil), Japan (led by Tsuruha) and China (led by Superdrug owner A.S. Watson).

Forecasts published in Edge Retail Insight’s September Pharma & Health Report, show that the channel in the UK, dominated by Boots, Superdrug, Savers and LloydsPharmacy, will trail Germany and Sweden in terms of growth over the next five years to 2026.

The analysts forecast that the UK Pharma & Health channel will be worth US$18bn by 2026 – the fifth-biggest pharma retail market in the world. Meanwhile, consumers will be spending US$29.5bn at Germany’s chain pharmacy retailers, which will experience a five-year CAGR of almost 4% between 2021 and 2025.

Florence Wright, Senior Analyst at Edge by Ascential and report author, commented: “UK chain pharmacies have been under pressure for some time as a result of the High Street decline and a shift to online sales, which, pre-COVID-19, they were not able to take full advantage of due to their extensive legacy store infrastructures and reliance on in-person healthcare provision.

“Most pharmacy shops stayed open during the pandemic to provide communities with access to essential healthcare and then many became instrumental to the pandemic response becoming COVID-19 vaccination centres. But the collapse of footfall at the height of the lockdowns, closure of beauty and fragrance counters, decline in discretionary category spending, and rising store expenses related to social distancing and incremental cleaning accelerated existing financial struggles. In its third-quarter results in 2020, Walgreens Boots Alliance said its most significant COVID-19 impact was in its UK market and booked a $2bn non-cash impairment charge against Boots UK.

“Digital transformation to drive differentiation and store resets to generate closer online-to-offline interactions are now at the centre of UK pharma retail strategies but this sector has been slower to adapt at scale compared to other markets, such as the US where Amazon has been more of an immediate threat and APAC, where the digital infrastructure offered through platforms like Tencent’s WeChat is more advanced and widely used than anything we have at the moment in the UK.”

As an example, Japan’s largest drugstore chain Tsuruha integrated WeChat Mini Programs to accelerate cross-border e-commerce from its stores last year. Customers in China can now access more than 1,400 Japanese products through the Tsuruha Drug Express Mini Program, with orders picked and packed in Tsuruha stores in Osaka before being directly shipped to China.

Wright added: “Germany’s growth will be led by two of the leading operators – dm and Rossmann, both of which have strong footholds in the market and are investing at pace in stores and digital transformation. dm has been opening distribution centres using robotics technology from Swisslog to improve supply chain efficiency and costs, and Rossmann, which is owned by Superdrug owner A.S. Watson, has been trialling self-scanning payment services integrated with its own app to create a more convenient offer for shoppers. We also expect strong growth from online players like docmorris.de.”

Globally, e-commerce sales through Pharma & Health are expected to outstrip store-based sales, growing at a CAGR of 7% between 2021-2026, compared to store-based growth of 3.7%.

Wright pointed out that the shift to online is challenging for pharmacy retail chains in some European countries because of regulations related to the sale of OTC and prescriptions and pharmacy products limiting the mass expansion of e-commerce.

“In France, tight rules mean OTC is mainly limited to independent pharmacies, but in the UK OTC can be sold across the majority of channels. This allows Boots and LloydsPharmacy to give people almost on-demand access to painkillers and medication for mild ailments like coughs and colds – as well as makeup, nappies, baby formula and snacks – without leaving the house through their partnership with restaurant and grocery delivery app Deliveroo. In the US, same-day prescription delivery is expanding quickly, with Amazon, Walgreens Boots Alliance, CVS Health and Sam’s Club all offering the service. We are not there yet in the UK, but prescription delivery could become one battleground for UK pharmacy retail as they seek shopper loyalty.”

Chris Elliott, Head of Market Insights at Edge by Ascential, added: “To be competitive in a new era of consumer behaviour and retail transformation, the UK Pharma & Health channel will need to focus on three major areas. On the one hand, it should focus on building out healthcare and wellness services to play a bigger role in their community’s mental and physical health in the aftermath of the pandemic and the urgent drive to get people to take better care of themselves.

“It must also embrace technology innovation in-store and online to aid discovery, boost engagement and drive loyalty in its key beauty category, which accounts for more than 80% of the channel’s total sales. Finally, speed to market will also become a key differentiator with the pace of expectation now being raised by rapid grocery delivery apps, like Gorillas, Weezy and Jiffy.

“Health and beauty manufacturers that sell through this channel can support retailers transform their offer, but they should also consider their future route to market. In an age of e-commerce and the profusion of digital touchpoints, the pharmacy retail chain is just one of many channels – including social media and direct-to-consumer (DTC) sites – to grow engagement and sales.”

NAM Implications:

- US = 50% of the world’s total Pharma & Health retail chain sales…

- …but other regions growing fast.

- i.e. Keep an eye on Brazil (led by RaiaDrogasil), Japan (led by Tsuruha) and China (led by Superdrug owner A.S. Watson).

- Meanwhile, traditional UK pharmacy retail tried to shift to online sales, which, pre-COVID-19, they were not able to take full advantage of due to their extensive legacy store infrastructures and reliance on in-person healthcare provision.

- But say Amazon enters the pharmacy healthcare High Street via online…

- Worth reflecting on what Amazon could bring to the party:

- Detailed knowledge/insight of consumer lifestyle and consumption and purchasing habits

- Ongoing tracking of health and fitness via wearables

- Reputation for accurate and timely fulfilment.

- Ability to supply live/online diagnosis

- Scrip fulfilment and an appetite for feedback/consumer centricity