Three-Fourths of Gen Z Has Less Than $10,000 in Debt, Survey Finds

Commitment to Our Readers

GOBankingRates' editorial team is committed to bringing you unbiased reviews and information. We use data-driven methodologies to evaluate financial products and services - our reviews and ratings are not influenced by advertisers. You can read more about our editorial guidelines and our products and services review methodology.

20 Years

Helping You Live Richer

Reviewed

by Experts

Trusted by

Millions of Readers

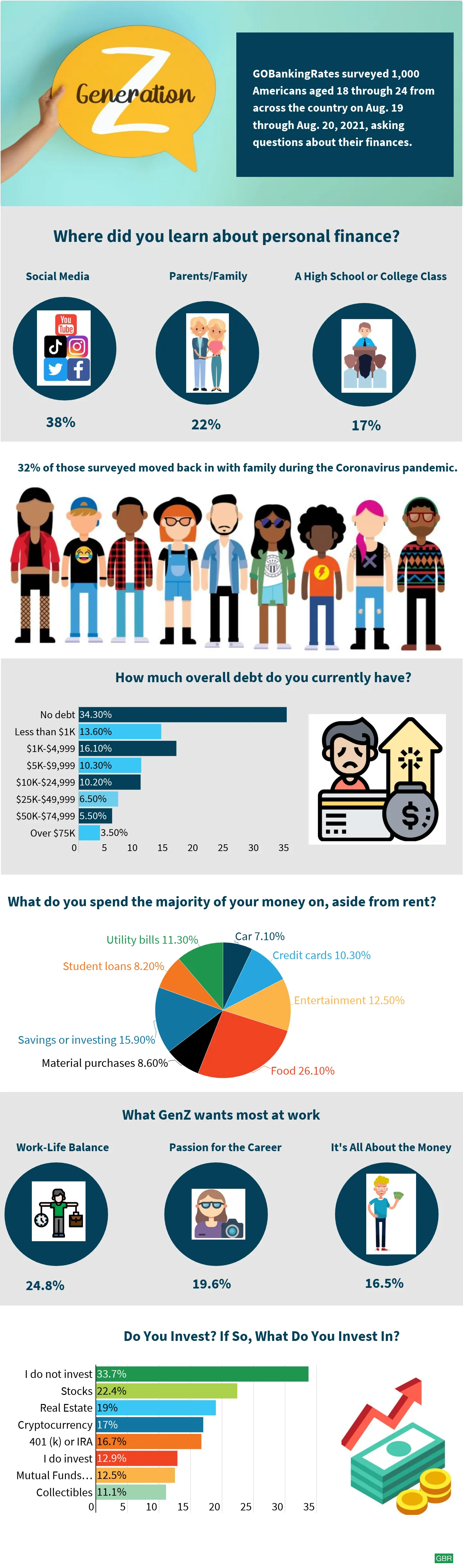

Approximately a third of Gen Z adults — those aged 18 to 24 — don’t have any kind of debt, with three-fourths having less than $10,000 in debt, including student loans, a new survey finds.

A new GOBankingRates survey shows that 34% of Gen Z respondents don’t have any kind of debt. If they do, 13.6% say they have less than $1,000 in debt; 16.1% have between $1,000 and $4,999 in debt; 10.3%, between $5,000 and $9,999; 10.2%, between $10,000 and $24,999; 6.5%, between $25,000 and $49,999; 5.5%, between $50,000 and $74,999; and only 3.5% have more than $75,000 in debt, according to the survey.

See: 7 Moves Gen Z Should Be Making To Protect Themselves FinanciallyRead: 4 Industries Gen Z Might Save — and 4 It Might Destroy

To put these findings in perspective, an earlier GOBankingRates survey found that Gen X — people born between 1965 and 1980 — was the generation both leading for the largest amount of debt and the largest percentage of the generation carrying debt. Indeed, the survey showed that 86% of Gen X respondents had some debt. In addition, Gen X also had the most respondents saying they were $60,000 or more in debt, at 19.3%, and more than 56% had $10,000 or more in debt.

Brad Cummings, principal agent at Insurance Geek, said these Gen Z findings reflect the fact that this generation has been in a unique financial position due to the ongoing pandemic.

“Many are traumatized by witnessing the effect of financial crashes on their parents and grandparents. These previous events have made Gen Z warier of financial burden; their decisions are proving more prudent and suited to their needs,” Cummings said.

“Many in this generation are credit-active with at least one loan but they are showing that they can manage these funds better. Gen Z is taking on debt primarily for investing in emerging industries; otherwise, they are keeping their money out of traditional industries that have proved too unstable and susceptible to change,” he added.

Find Out: Surprising Ways Gen Z and Millennials Are Worlds Apart FinanciallyBudgeting 101: How To Set a Realistic Budget You Can Live With

Experts say another reason so many members of this generation have a low debt burden is fewer of them are taking on massive student loan debt.

Jake Hill, CEO of DebtHammer, told GOBankingRates that the student loan debt has crushed the millennial generation and many millennials have been outspoken about feeling like college was a scam.

“Gen Z is the most resourceful generation yet when it comes to being internet-savvy. They know they can get specialized training online for a fraction of the cost and get a job with the skills they acquire, so many are choosing their own kind of vocational training over a traditional college,” he added.

In terms of investing behavior, it is noteworthy that 34% of them say they don’t invest at all.

In terms of investing behavior, it is noteworthy that 34% of them say they don’t invest at all.

Related: The 10 Best Stocks for the Gen Z Investor

As for Gen Z’s favored investments, this is a generation that can access the stock market more easily than any previous generation, thanks to apps and social media, and the survey reflects this phenomenon. Of those who do, 19% say they invest in real estate. In addition, 17% invest in cryptocurrency.

Jack Caporal, research analyst at The Motley Fool, told GOBankingRates that Gen Z are a unique group of investors.

“They have more tools to invest with, new types of assets to invest in and more information to guide their investing decisions. They are cognizant of risk but still have an appetite for investing — 28% of Gen Z investors trade once a week.”

Caporal added that Gen Z investors are more likely to invest in cryptocurrency than older generations and view crypto as less risky than stocks and options. The survey also notes that 22.4% of them invest in stocks; 16.7% in a 401(k) or IRA; and 12.5% in mutual funds or ETFs.

Finally, 11% of them invest in collectibles, the survey shows.

More: Crypto and 5 Other Groundbreaking Investing Trends for Gen Z

“For investing in collectibles, this seems like a reasonable percentage. Although collectibles constitute an alternative investment, it is harder to predict how much the value of a collectible will increase over time — if at all,” Paris Riha, wealth advisor at Arch Global Advisors, told GOBankingRates. “Furthermore, collectibles also lack popularity due to the general fear of counterfeits and fraud.”

Another key finding of the survey is that a much larger percentage of women compared to men say they don’t invest at all.

“In general, a larger percentage of men invest because statistically women lack confidence in their ability to invest. A lot of women simply don’t have the background knowledge or feel uncomfortable making big life decisions when it comes to finances,” Arch Global Advisors’s Riha said. “However, when women do invest, they earn higher returns compared to men, so it’s important for women to start managing their wealth and actively grow their assets.”

Indeed, the survey shows that 38.1% of women say they don’t invest, versus 25.8% of men.

“Although women are less likely to invest than men, they are more likely to earn better returns, are less impulsive investors and are less likely to have to make changes to their day-to-day finances if their investments turn sour,” The Motley Fool’s Caporal said.

- What Money Topics Do You Want Covered: Ask the Financially Savvy Female

- Can You Afford Education in America at These Prices?

- Nominate Your Favorite Small Business To Be Featured on GOBankingRates

- The Hidden Costs of Education at Every Level

Last updated: Sept. 15, 2021

Written by

Written by  Edited by

Edited by