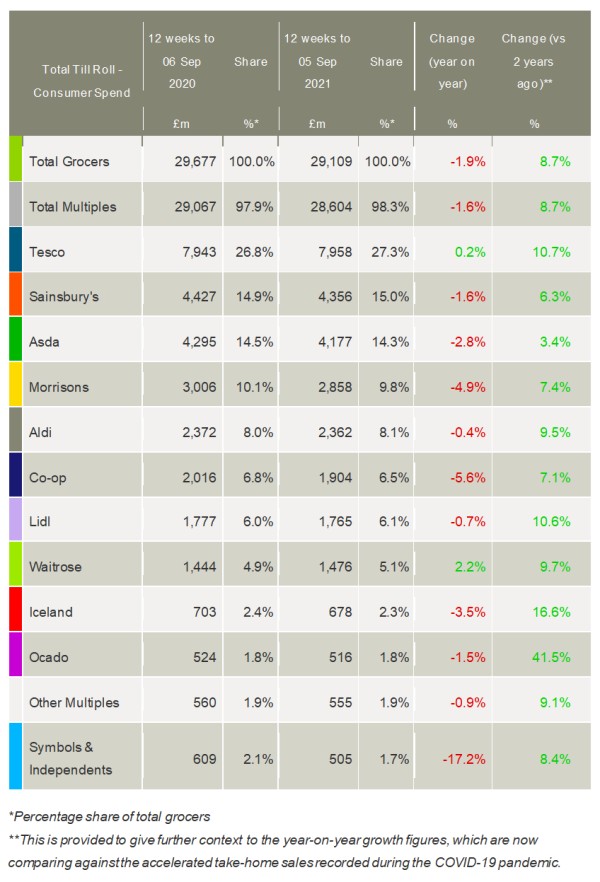

The latest take-home grocery figures from Kantar show sales fell by 1.9% year-on-year during the 12 weeks to 5 September, with all the major chains seeing declines apart from Tesco and Waitrose. The widely reported cost pressures in the industry also appear to be feeding into shelf prices with suppliers reining in promotions.

The data shows that grocery sales still remain 8.7% higher than pre-Covid levels due to some pandemic-related trends. However, with people set to return en masse to offices and schools in September, shopping habits are expected to change.

Fraser McKevitt, head of retail and consumer insight at Kantar, commented: “There are big lifestyle changes on the horizon with commuters heading back to the office and the return to school this autumn, and we’d expect this to impact how people shop.

“In the first week of September, we measured the highest supermarket footfall all year outside of the Easter period with more people out and about picking up items as they go. That suggests a hint of change, and could see shoppers shun the ‘big shop’ in favour of more frequent top-up buying. But we shouldn’t expect to shift from habits learned in lockdown straight back to pre-Covid patterns overnight. It’s most likely that the needle will settle somewhere in between.”

Kantar’s research suggests there are already signs of fatigue when it comes to home cooking. Sales of chilled ready meals, for example, increased by 11% during the month as consumers’ lives got busier again. More people returning to towns and cities is also expected to provide a boost for cafés and coffee shops, where spending last September was £187m lower than in 2019. “We anticipate that a good amount of that lost cash should return to the high street this year but that means it will move away from the grocery sector,” said McKevitt.

The trend away from large shops is already happening on digital platforms, with the average online shop now worth £78.28, nearly £17 less than its peak at the start of the pandemic. The market share of online grocery has also fallen to 12.2% this month from 13% four weeks ago – the lowest level since May 2020 as people continue to move their spend back in-store.

Meanwhile, Kantar’s data shows like-for-like grocery prices rose by 1.3% in the past four weeks compared to last year. For much of 2021 shoppers have been shielded from price increases, with more being sold on promotion this year compared to 2020. However, in the past month only 27.5% of spending was done on deals.

“Other than the early days of lockdown last year, that is the lowest level recorded in the fifteen years which we have tracked this data, with retailers aiming to offer everyday low prices instead,” said McKevitt.

Prices were found to rising fastest in categories such as savoury snacks, cat food and ambient cakes and pastries, while falling in fresh bacon, vegetables and ambient cooking sauces.

Last week, Morrisons warned that industry-wide price rises were coming. It said inflation would be driven by recent sustained commodity price increases and freight costs, and the current shortage of HGV drivers.

Looking at the performance of individual retailers, Waitrose bucked the overall market trend and found growth both online and in-store. With spend up by 2.2% in the past 12 weeks, it was the fastest-growing supermarket for the second month in a row. As a result, Waitrose’s market share increased to 5.1%, a fifth consecutive increase which makes this its best run since September 2015.

Tesco was the only other grocer to increase sales value year-on-year, up 0.2%. Performing better than the overall market meant Tesco also won share, gaining 0.5 percentage points to account for 27.3% of all sales.

Private equity interest in Morrisons has been driven in part because it was the fastest-growing of the four major retailers in 2020. However, its sales fell again, down 4.9% against tough comparisons with the success of last year.

Meanwhile, Asda last week announced a major move into the convenience market with the roll-out of its new ‘On the Move’ stores on EG forecourts. McKevitt commented: “There is a huge opportunity in that sector to tap into the £3.7bn take-home grocery trips of less than £20 made every year.”

Aldi’s share rose by 0.1 percentage points to 8.1%. It attracted more new shoppers through its doors than any other retailer this period, with an extra 612,000 households visiting in the past 12 weeks. Lidl has also made market share gains, up to 6.1%.

Ocado sales followed the online trend, falling by 1.5% compared with a year ago. Its market share remains at 1.8%, the same as it has been since May.

Sales at symbols and independent stores fell by 17.2%, but are still elevated against the same period in 2019.

NAM Implication:

- As expected, Mults: Fine, but for the Discounters and Online…