Commercial Real Estate News

Cloud Services, Social Media Driving U.S. Data Center Demand in 2021

Commercial News » Phoenix Edition | By Michael Gerrity | September 2, 2021 8:55 AM ET

According to CBRE, North America's data-center market made gains in construction and net absorption in the first half of 2021, as cloud service providers like Amazon AWS, Google Cloud, and social media companies like Facebook, Twitter and LinkedIn drove demand.

CBRE's latest North American Data Center Trends Report shows that providers brought 214.3 megawatts (MW) of new wholesale colocation supply online in the seven primary U.S. data center markets in the first half of 2021, an increase of 7 percent from the year-earlier period. However, vacancy remained low across those markets - as scant as 1.6 percent in Silicon Valley - amid persistent demand.

Relief from tight vacancies likely will come from the 527.6 MW of capacity currently under construction in primary markets. That figure marks a 42 percent increase from a year earlier.

"We've seen no indication that the amount of data created and utilized is leveling out, so demand for data centers likely will continue increasing across both primary and secondary markets," said Pat Lynch, CBRE Executive Managing Director, Global Head of Advisory & Transaction Services, Data Center Solutions. "Users are beginning to position themselves closer to end users to support technologies including 5G, artificial intelligence and edge-computing technology. We continue to see a heavier appetite for data centers from investors who are starting to view data centers in the same category as more traditional real estate sectors."

Top North American Data Center Markets

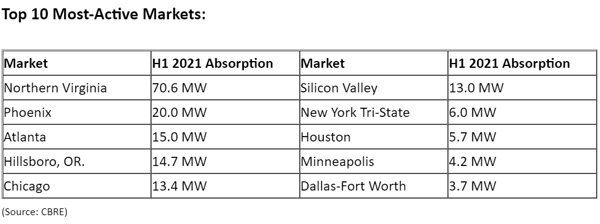

Northern Virginia remained the most active data center market with net absorption of 70.6 MW in H1 2021 - more than triple that of Phoenix, the next highest market.

Net absorption totaled 142.7 MW across the seven primary markets in the first half, an increase of 3.4 percent from the first half of 2020.

Data center users leased more space in the first half of 2021 than in H2 2020 despite fewer deals being signed during this period. Phoenix saw more leasing activity in Q2 2021 than any other quarter in the previous five years. However, several markets, including Northern Virginia and Dallas, saw a drop in absorption year-over-year as some users consolidated their operations.

Of the construction underway in primary markets at second quarter's end, 317 MW (60 percent) has been preleased. Markets with notable pre-leasing activity include Silicon Valley, where 70 MW (82 percent) of the total MW under construction was spoken for, as well as Dallas (17.5 MW), Chicago (17.1 MW), New York Tri-State (13.1 MW), Phoenix (6 MW) and Atlanta (3.5 MW).

Sign Up Free | The WPJ Weekly Newsletter

Relevant real estate news.

Actionable market intelligence.

Right to your inbox every week.

Real Estate Listings Showcase

Related News Stories

Commercial Real Estate Headlines

- Investment in Asia Pacific Multifamily Properties to Double by 2030

- Multi-story Warehouses Are 15 Percent of Sydney's New Industrial Stock

- Manhattan Office Leasing Activity Lags in Q3 as Sentiment Remains Cautious

- Nonresidential Construction Spending Increases in America

- Office Conversions on Pace to Double in U.S.

- Hong Kong Office Vacancy Rates Stabilize After 4 Months of Increases

- Commercial Mortgage Debt Outstanding in U.S. Jumps to $4.60 Trillion in Mid 2023

- Architecture Billings Index in U.S. Remains Flat in July

- Commercial Mortgage Delinquencies Rise in America

- U.S. Data Center Demand Explodes in U.S., Driven by AI Growth in 2023

- Demand for Electric Vehicle Manufacturing Space Jumps Across the U.S.

- Global Cross Border Commercial Property Capital Flows Implode 52 Percent Annually in 2023

- 2023 Financing Constraints Rapidly Drive Down Construction Starts in U.S.

- New York City Named as U.S. Leader in Climate Change Resilience

- Tokyo is the City of Choice for Global Retailers in 2023

- Despite VC Cooldown, Life Sciences Represents 33 Percent of New Office Construction in 2023

- Despite Reduced Credit, U.S. Multifamily Developer Confidence Remained Positive in Q2

- Brisbane Office Market Enjoying Strong Leasing Activity in 2023

- Commercial Lending Dampened in 2023 by U.S. Market Uncertainty

- Asia Pacific's Commercial Investment Market Continues to be Challenged in 2023

- Despite Global Economic Uncertainty, Commercial Investment in Japan Grew in Q2

- U.S. Commercial Lending to Dive 38 Percent to $504 Billion in 2023

- Apartment Markets Across America Continue to Stabilize in 2023

- Cap Rates for Prime Multifamily Assets in U.S. Stabilize in Q2

- Ireland Office Market Making a Comeback in 2023

- U.S. Office Sales Total $15 Billion Halfway Through 2023

- AI and Streaming Drive Global Data Center Growth Despite Power Constraints

- Asia Pacific Logistics Users Plan to Expand Warehouse Portfolio in 2023

- Manhattan Retail Rents Continue to Rise in Q2

- Manhattan Office Leasing Activity Down 29 Percent Annually in Q2

- Commercial Property Investment in Australia Dives 50 Percent in 2023

- U.S. Architecture Billings Uptick in May

- Employees Return to Office Trend Growing in Asia Pacific Markets

- Exponential AI Growth to Drive Asia Pacific's Data Center Market

- Large Opportunity to Transform Australia's Office Market in Play

- Australian Industrial Rent Growth to Continue in 2023

- Corporate Relocations in U.S. at Highest Rate Since 2017

- North American Ports Volume Drops 20 Percent Annually in 2023

- Office Investment in Asia Pacific Remains Strong Despite Weaker Sentiment

- Australia's Build-to-Rent Properties Uptick on Lender's Wish List in 2023