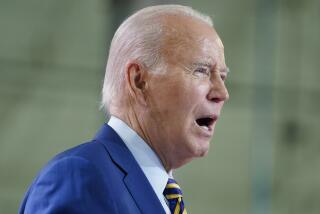

Biden vows to raise taxes on anyone earning more than $400,000

President Biden acknowledges he’s unlikely to get support from Republican lawmakers for any type of tax hike but said he would get Democratic votes.

President Biden promised Wednesday morning that any individual earning more than $400,000 a year would see some type of tax increase under his forthcoming economic plan.

“Anybody making more than $400,000 will see a small to a significant tax increase,” Biden said during an interview on ABC’s “Good Morning America.” “You make less than $400,000, you won’t see one single penny in additional federal tax.”

He acknowledged he was unlikely to receive support from Republican lawmakers for any type of tax hike but said he would get Democratic votes.

“If we just took the tax rate back to what it was when Bush was president — the top rate paid 39.6% in federal taxes. That would raise to $230 billion,” Biden added.

The president’s remarks, taped on Tuesday during a visit to Pennsylvania, show the emerging outlines of his next economic proposal. Buoyed by the passage of the $1.9-trillion COVID-19 relief bill, Democrats are now planning for an even more ambitious legislative package to fund infrastructure, elder care and childcare, and fighting climate change.

Economists and analysts predict the next proposal will cost anywhere from $2 trillion to $4 trillion, with roughly $1 trillion in proposed tax increases to pay for part of the spending. But Congress is unlikely to pass such significant tax increases, which would amount to the first major hike in decades.

Addressing inequality

Some tax increases, such as rolling back tax cuts from the Republicans’ 2017 bill and increasing the rate on capital gains, have already been outlined in Biden’s campaign proposal. The president has long said he wants the tax code to work in a fairer fashion and to tax investments as much as income.

Part of this would involve raising taxes on capital gains, increasing the estate tax and ensuring that companies pay more by raising the corporate tax rate and paring back preferences for so-called pass-through businesses.

Up until this week, the Biden White House had been mum on its tax plans. But now that the pandemic-relief bill has passed Congress, the president and his aides are slowly starting to preview their ideas.

“The president remains committed to his pledge from the campaign that nobody making under $400,000 a year will have their taxes increased,” White House Press Secretary Jen Psaki said Tuesday. “His priority and focus has always been on people paying their fair share, and also focusing on corporations that may not be paying their fair share, either.”

Threshold question

Officials have referred to the $400,000 threshold in differing ways, sometimes saying that the bar is a measure of household rather than individual income. A specific proposal has yet to be announced.

White House aides also are emphasizing that tax increases are necessary to fund critical government programs.

“We need to make sure that we connect the dots between the needs of the American people, making sure that we have fiscal sustainability, and that we have a tax system that is fair and just, but that makes sure that we have the revenue that we need to do the things the government needs to do,” said Heather Boushey, a member of the White House Council of Economic Advisors.

More to Read

Get the L.A. Times Politics newsletter

Deeply reported insights into legislation, politics and policy from Sacramento, Washington and beyond. In your inbox three times per week.

You may occasionally receive promotional content from the Los Angeles Times.