A Staggering Finding: 1 In 10 Adults In LA County Struggle With Medical Debt

The numbers describing the impact of medical debt among Los Angeles County residents are staggering: 1 in 10 adults (around 810,000 people) are in debt for medical care. All together they owe at least $2.6 billion.

That's what analysts found when they examined county-specific data from the annual California Health Interview Survey dating from 2019 to 2021. More than 4,000 adult residents were asked if they had problems paying medical bills for themselves or people in their household in the past 12 months. If they said yes, they were considered to be burdened with medical debt. The responses were then extrapolated to reflect the county’s demographics and population.

This new analysis by the Los Angeles County Department of Public Health suggests this debt can have striking consequences on people’s financial, physical and mental health.

“Medical debt is associated with a huge increase in housing insecurity. It's the largest source of personal bankruptcy and it's just tragic that it's contributing to our homelessness crisis,” said Dr. Naman Shah, a practicing physician and county public health's director of the Division of Medical and Dental Affairs.

-

Data show stark health disparities in L.A. County

-

Photo exhibit portrays workers on the job

-

Listen: USC students join camp-in protest and more

How debt can spiral

High deductibles, copays and out-of-pocket expenses were a significant cause of medical debt for people with health insurance.

Graciela Flores’ high deductible contributed to a snowballing of medical bills that got out of control. The 57-year-old lives in Los Angeles and migrated from Mexico 40 years ago.

“I got the debt because I had to go to the doctor constantly, I had to check my health in general, and eventually the results showed I had to get tested again,” she said.

She says she volunteers part time for an anti-domestic violence prevention initiative through Public Health. Despite having health insurance through her husband’s job at a steel company, she accumulated about $8,000 in medical debt in 2019.

Flores says she was charged $7,000 for one procedure.

“When I got the bill, I couldn’t believe what I was seeing. The deductibles are a big problem,” she said.

She contested the charge and her health insurance company reviewed and decreased the amount. But that was just one bill. A hospitalization put her further behind. Expensive hospital stays also contributed to the problem.

My husband earns very little money, which makes it very hard for us. At some point I had to stop paying.

“My husband earns very little money, which makes it very hard for us. At some point I had to stop paying,” she said. “I became depressed, we couldn’t make it with the expenses.”

They got behind on their rent, and Flores skipped doctors appointments to save money. She started seeing a psychologist through her health insurer Kaiser to treat her depression, which charged her $50 per session and further contributed to her medical debt.

Her husband’s boss eventually paid off their medical bills, but Flores is now scared of accruing more. Each month is a struggle.

She said she has been told multiple times that she does not qualify for Medi-Cal, the state health insurance program for low-income people. After taxes and deductions, Flores husband’s weekly paycheck is just $560 per week. They pay $400 a month in health insurance premiums.

“It was a very difficult situation. It is a very humble sacrifice to pay for this insurance,” she said.

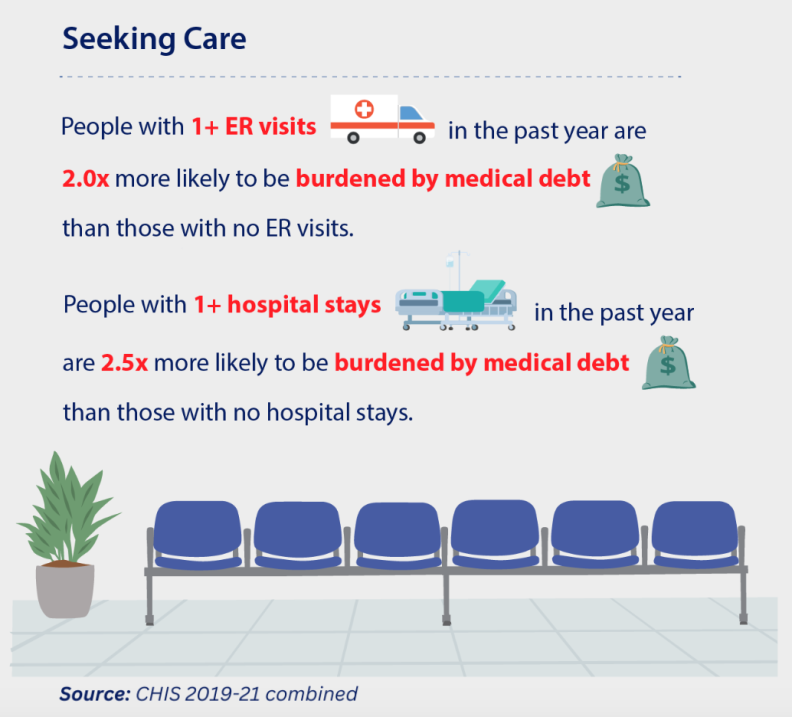

Flores' experience mirrors thousands of others. Adults with at least one in-patient stay in the past year were more than two and half times more likely to be burdened with medical debt than people who weren’t hospitalized. People with at least one emergency room visit in the past year were twice as likely to have medical debt.

An unequal impact

The burden falls especially hard on certain residents. Black, Latino, Native American and Alaskan Natives and people of multiple races have much more medical debt than white and Asian residents.

People who didn’t finish high school and those with some college or trade school education were significantly more likely to have difficulty paying off medical debt than those who graduated from college. The report found that people with lower incomes were almost twice as likely to have burdensome medical debt than those with higher incomes.

Those who need health care the most are weighed down by the cost. People who reported being in poor health were more than twice as likely to be burdened as those reporting excellent or very good health. Respondents who had burdensome medical debt were less likely to fill their prescriptions and less likely to go for follow-up care.

“It's a terrible situation where the sick get sicker,” Shah said.

“I think the impact of debt from people who sought care, people who were sick and just wanted to get better, and now as a result of their efforts to seek medical care for themselves, is making them even sicker, I think that's just completely unacceptable,” he said.

The report also found that people with children were 37% more likely to be burdened by medical debt than adults without children.

High insurance costs contribute to debt

People without health insurance were significantly more likely to have burdensome medical debt, but having health insurance didn’t protect people from struggling with bills.

Adults with Medi-Cal, the public insurance for people with low-income, or people with private insurance were twice as likely to be burdened with medical debt as those with Medicare, the universal insurance for people 65 and older.

Shah isn’t sure why Medi-Cal recipients have such high medical debt when they are not subjected to balance billing or copays, but he has a couple theories.

“It can be really hard for consumers to understand who is in their network and who isn't. So even though they have Medi-Cal, they may be occurring out of network costs," he said. "Even if they are depending on their networks, many have managed care plans. Certain specialty services may simply just not be practically accessible within their network. And so out of desperation, people might be purposely going out of network just to get the care they need."

People who receive insurance from their employers or other private plans didn’t fare much better. Those with deductibles over $1,000 were twice as likely to have medical debt as those with a deductible below $1,000.

How big is the medical debt problem in the U.S?

-

About 100 million people in the U.S. have health care debt, according to a report by KFF Health News and NPR. The vast scope of the problem is feeding a multibillion-dollar patient financing business, with private equity and big banks looking to cash in when patients and their families can't pay for care, KFF Health News and NPR found.

-

Half of Americans don’t have $500 for an unexpected medical expense, while the cost of care and insurance continues to grow, the report says.

-

Nationwide, the average deductible on a silver-level plan on the Affordable Care Act exchanges rose to $4,500 in 2021. A cheaper, lower level bronze plan had a deductible of more than $6,000. Some subsidies and cost sharing were available for people with lower incomes, but after those the average deductible was more than $3,100 for silver plans.

Would canceling debt help?

“Getting rid of medical debt may help in the short term, but a one time cancellation doesn’t impact the future debts they may incur,” said Wes Yin, a UCLA economist. He’s studied medical debt and has spent years trying to understand its impact.

He’s part of a team that found that patients are much more likely to fill prescriptions and see their doctor when their hospitals wiped out their debts and temporarily reduced how much they had to pay. But within six months, patients who had their debt forgiven were back to getting less care and no better able to afford it than they were before.

Affordable health insurance that has low premiums, deductions and out of pocket maximums would go a long way to preventing more medical debt, he said.

Half of adults with medical debt turned to credit cards to pay their medical bills, which means fewer consumer protections from aggressive debt collectors.

“In California, you can't charge interest on medical bills owed. Not all states have that. California does. But it's not clear what happens when that's then sold off to a financial institution,” Yin said. “There could also just be aggressive collections practices that happen at that point.”

Yin is also concerned about the rise of medical credit cards, and other loans for medical bills.

The Consumer Financial Protection Bureau warned in a recent report that high interest rates can deepen patients' debts and threaten their financial security. The interest payments can inflate medical bills by almost 25%, the agency found by analyzing financial data that lenders submitted to regulators.

“My hunch, from seeing some of the recent trends and alarms, is that the financialization of medical debt is probably a more active space than medical financial assistance,” Yin said.

-

A medical industry challenge to a $25 minimum wage ordinance in one Southern California city suggests health workers statewide could face layoffs and reductions in hours and benefits under a state law set to begin phasing in in June. Some experts are skeptical, however, that it will have such effects.

-

Charlotte Maya's memoir, "Sushi Tuesdays: A Memoir of Love, Loss, and Family Resilience" is an intimate looks at how she continues to navigate her husband's suicide.

-

Fentanyl and other drugs fuel record deaths among people experiencing homelessness in L.A. County. From 2019 to 2021, deaths jumped 70% to more than 2,200 in a single year.

-

Prosecutors say Stephan Gevorkian's patients include people with cancer. He faces five felony counts of practicing medicine without a certification.

-

April Valentine died at Centinela Hospital. Her daughter was born by emergency C-section. She'd gone into the pregnancy with a plan, knowing Black mothers like herself were at higher risk.

-

Before navigating domestic life in the United States, AAPI immigrants often navigated difficult lives in their motherlands, dealing with everything from poverty to war.